Xiaomi, NIO, and Li Auto battle for dominance, the real deal has arrived

![]() 12/09 2024

12/09 2024

![]() 645

645

With rapid advancements in new energy, autonomous driving, AI, and chip technology, the automotive industry is undergoing unprecedented transformation.

To stay updated on the latest developments in the automotive industry, Zero State LT introduces the 'Auto Circle' column, providing in-depth analysis of market trends, focusing on the latest global automotive news, new product launches, technological innovations, and market performance of major automakers. By delving into the automotive industry, we reveal the underlying business logic and market laws, and how they are changing the landscape of the automotive industry and impacting human mobility.

This article is the 11th in the series, focusing on why many new energy vehicle (NEV) makers are aiming to develop their own chips as intelligent driving becomes the 'game-changer' in the NEV industry, and whether they can rise to this immense challenge. Author: Qin Tianyu, Editor: Hu Zhanjia, Operations: Chen Jiahui, Lead Image: Li Auto Official Weibo, Produced by: Zero State LT (ID: LingTai_LT)

At the end of November, a number of emerging automakers released their third-quarter financial reports.

Li Auto remained a top performer in the auto industry, with third-quarter revenue reaching RMB 42.9 billion, a year-on-year increase of 23.6%; adjusted net profit was RMB 3.84 billion, up 11% year on year. XPeng, despite still incurring losses, reported revenue of RMB 10.1 billion, a year-on-year increase of 18.4%; net loss was RMB 1.81 billion, a significant narrowing from the net loss of RMB 3.89 billion in the same period last year. NIO remained committed to its original mission, with total revenue of RMB 18.674 billion, down 2.1% year on year; net loss was RMB 5.06 billion, an increase of 11.0% year on year.

The divergence in performance among emerging automakers indicates that China's NEV market has entered an elimination stage, with the Matthew Effect becoming increasingly prominent. To avoid elimination, automakers must strengthen their core competitiveness.

In previous years, competition in China's NEV market focused on basic user experience. In 2024, with basic configurations converging, the 'game-changer' in China's NEV competition has shifted to intelligent driving.

During an earnings call, He Xiaopeng, Chairman and CEO of XPeng, stated that XPeng aims to transform its intelligent driving capabilities from being among the best to becoming the best.

At the XPeng AI Tech Day held a few days prior, He Xiaopeng revealed that XPeng's self-developed Turing AI chip outperforms three NVIDIA Orin X chips. The latest version of XPeng's intelligent driving functions has been successfully tested with this chip in October. Future AI vehicles will be equipped with at least three Turing chips.

In fact, it's not just XPeng. Recently, NIO, Li Auto, and other emerging automakers have also increased their investments in self-developed chips, aiming to break through the bottleneck of chip computing power and provide consumers with a higher level of intelligent driving experience.

It's important to note that chip development is highly challenging. Automakers aiming to make a mark in this field will need to invest significantly. In the process, automakers that are continuously losing money may face scrutiny from capital markets.

Undoubtedly, the battle for dominance among NEV makers, represented by Xiaomi, NIO, and Li Auto, has reached a critical juncture. Whoever secures the 'pearl on the crown' of chips will emerge victorious in the race against time and survive in the fiercely competitive market.

▲Source: XPeng Motors

Highly Homogenized Industrial Chain

Intelligent Driving as the Key Game-Changer

Once upon a time, competition in the NEV industry revolved around configurations such as the powertrain, interior, and exterior design. However, with the gradual maturation of the upstream industrial chain, basic configurations of NEVs have become highly similar.

Take Li Auto as an example. After 2020, it captured a vast number of family users with its differentiated extended-range technology and unique product definition of 'refrigerator, TV, and large sofa'. Seeing Li Auto's success, in recent years, more and more automakers have followed suit, adopting similar technological routes and product concepts to create their own products, attempting to divert some of Li Auto's influence.

Take the AITO M9 as an example. Equipped with the 4th-generation extended-range platform, it boasts an industry-leading compression ratio of 15:1, as well as comfort features such as a triple-screen cockpit, high-end NAPPA leather seats, and a car refrigerator. It also supports Huawei's ADS 3.0 advanced intelligent driving system, with a price range of RMB 469,800 to RMB 569,800, positioning it as a competitor to the Li Auto L9.

Due to its impressive specifications, sales of the AITO M9 have surged since its launch. On October 10, 2024, Huawei HarmonyOS Intelligent Travel officially announced that cumulative orders for the AITO M9 had exceeded 150,000 units in just over nine months since its launch.

In short, the NEV industry is currently following the same path as the PC and smartphone industries, where underlying configurations have become highly homogenized. Against this backdrop, automakers are forced to engage in fierce price wars to attract consumers.

Data disclosed by the China Passenger Car Association shows that in the first five months of 2024, 136 models in the Chinese automotive market experienced price reductions, with the scale of price reductions exceeding 90% of the total for the entire year of 2023 and surpassing the full-year data for 2022.

Fortunately, in recent years, the growing popularity of AI technology has provided a new 'outlet' for NEV competition. At the Sina News Exploration Conference held on October 28, 2024, He Xiaopeng stated that AI will bring significant changes to future automobiles, "Next year, cars without strong AI and autonomous driving capabilities will become difficult to sell."

In fact, as early as 2023, intelligent driving began to demonstrate its potential, becoming a key driver of increasing NEV sales. Take the AITO New M7, launched in September 2023, as an example. It supports Huawei's ADS 2.0 intelligent driving system, with NCA intelligent driving capabilities covering 90% of urban scenarios. It can operate with or without maps, and the AEB maximum braking speed has been increased to 90 km/h.

▲Source: HarmonyOS Intelligent Travel

Due to its outstanding intelligent driving capabilities, cumulative orders for the AITO New M7 exceeded 100,000 units within two and a half months of its launch, with 60% being the intelligent driving version and a 75% option rate for urban NCA.

Since 2024, Li Auto has also intensified its focus on intelligent driving technology. At the Li Auto Summer Intelligent Driving Conference held on July 5, 2023, Li Auto unveiled its end-to-end + VLM intelligent driving solution. On October 23, the full rollout of Li Auto's end-to-end + VLM solution enabled Max and above models to achieve mapless NOA nationwide.

Regarding this, during the third-quarter earnings call in 2024, Li Auto's management stated, "AD Max has had a significant impact on overall sales. Sales of the AD Max version above RMB 300,000 have reached a certain level; the proportion of AD Max in Li Auto L6 sales is also continuously increasing."

Thor's Difficult Birth and Slow Progress of Domestic Chips Leave Automakers Stranded with Orin-X

The rapid advancement in intelligent driving capabilities of NEVs since 2024 is directly related to the increasing flexibility of end-to-end intelligent driving solutions, but it is also inseparable from the underlying support of high-performance chips.

▲Source: Li Auto

Taking Li Auto as an example, its Max and above models are equipped with dual NVIDIA Orin-X chips, offering a computing power of up to 508 TOPS.

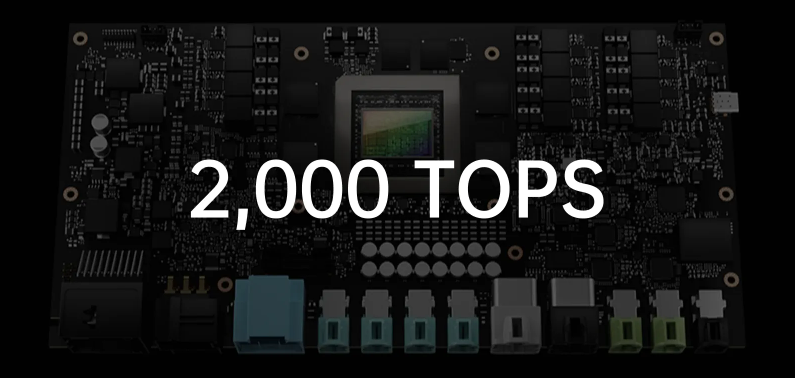

However, it's important to note that end-to-end capabilities are directly proportional to chip computing power. To achieve higher levels of intelligent driving, chip computing power needs to increase exponentially. According to Horizon Robotics, the computing power required for L5 autonomous driving exceeds 2000 TOPS, approximately four times that of dual NVIDIA Orin-X chips.

▲Source: NVIDIA

In fact, as early as September 2022, NVIDIA anticipated the strong demand for computing power in autonomous driving technology and introduced the new automotive-grade SoC chip, Thor, which contains 77 billion transistors and offers AI computing power of up to 2000 TOPS. According to the initial plan, Thor was scheduled for mass production in 2025, with ZEEKR as the first to adopt it.

However, as of late 2024, there is still no sign of Thor entering mass production. In an interview with Wei Jian on November 5, 2024, Nick, the product lead for XPeng's P and G series, revealed that the P7+ was originally considered for the Thor chip. However, due to Thor's difficult birth, the P7+ had to adopt dual NVIDIA Orin-X chips.

Meanwhile, when communicating with netizens on forums, Thor helplessly stated, "Thor's production has been delayed so far, and there is no definite SOP timeline. It would be great if we can see it by 2026."

What's even more despairing for automakers is that not only is NVIDIA's Thor chip experiencing difficulties, but domestic automotive-grade SoC chips are also progressing slowly. In April 2024, Horizon Robotics launched the Journey 6 series of chips, with the Journey 6P, as the flagship product, offering a computing power of only 560 TOPS, similar to the dual NVIDIA Orin-X chips that have been available for two years.

Considering that outstanding intelligent driving capabilities have become a key driver of surging NEV sales, the difficult birth of high-performance upstream chips determines that automakers' intelligent driving capabilities are about to reach a bottleneck, making it difficult for them to continue expanding NEV sales.

Against this backdrop, automakers must take action.

Intensifying Investments in Self-Developed Chips as Automakers Prepare for Battle

To break through the upstream computing power bottleneck and take control of their destiny, in recent years, not only XPeng but also Tesla, NIO, Li Auto, and other emerging automakers have intensified their investments in self-developed chips.

As early as March 2019, Tesla mass-produced its self-developed FSD chip. Currently, the cumulative shipment of FSD chips has exceeded 12 million units.

At NIO's Innovation Day in September 2023, the company publicly unveiled its self-developed lidar main control chip, Yang Jian NX6031, for the first time. A year later, NIO's Chairman and CEO, Li Bin, announced the successful tape-out of NIO's self-developed intelligent driving chip, Shen Ji NX9031, which is based on a 5nm automotive-grade process and contains over 50 billion transistors. It is expected to be first launched in NIO's flagship sedan, the ET9, in Q1 2025.

▲Source: NIO Motors

Meanwhile, in early October 2024, 'LatePost Auto' reported that Li Auto plans to establish a chip R&D office in Hong Kong. Prior to this, Li Auto had already set up chip R&D offices in Beijing, Shanghai, and Silicon Valley, USA, with a total of about 200 employees. It is expected that Li Auto's intelligent driving inference chip for vehicles will have tape-out results in Q4 2024 and will be mass-produced and installed in vehicles by 2026.

Regarding this, during the third-quarter earnings call in 2024, Li Auto's management stated, "Li Auto will continue to increase its investment in intelligent driving infrastructure and maintain its leadership in training computing power and intelligent training mileage."

Although most automakers' self-developed chips have not yet been mass-produced, based on Tesla's precedent, self-developed chips are expected to bring many benefits to automakers.

▲Source: NIO Motors

Firstly, vertical integration leads to a significant reduction in costs. Currently, the industry estimates the R&D and production cost of the FSD chip to be approximately USD 240 per chip, while the procurement cost of the NVIDIA Orin-X exceeds USD 300 per chip. Li Bin also stated that after mass production of the Yang Jian NX6031, the cost of a single lidar for NIO can be reduced by several hundred yuan, and the R&D costs can be recovered within about a year.

On the other hand, due to full-chain self-development, customized self-developed chips can more efficiently match automakers' unique intelligent driving solutions, avoiding the waste of substantial general-purpose computing power in off-the-shelf chips. This is the core reason why XPeng's Turing AI chip can outperform three chips.

However, it's important to note that although self-developed chips hold immense commercial potential, their technical difficulty requires significant R&D investments. For example, in early 2024, Tesla CEO Elon Musk revealed on social media platforms that Tesla's cumulative investment in autonomous driving would exceed USD 10 billion this year.

It's worth noting that, apart from Li Auto, which has already achieved profitability, XPeng, NIO, and other emerging automakers are still incurring losses. Investing heavily in R&D for self-developed chips every year may plunge these automakers deeper into losses and weaken investor confidence.

In fact, OPPO, a leader in the smartphone industry, has already served as a cautionary tale for automakers. In 2019, OPPO established Zeeku Technology to intensify its investments in self-developed chips. According to ICwise, OPPO invested nearly RMB 10 billion in chip development over three years, which could not be monetized. Due to the enormous disparity between input and output, OPPO announced the termination of Zeeku Technology's business in mid-2023.

However, unlike self-developed chips in the smartphone sector, which may not immediately improve consumer experience, intelligent driving has now become a key factor in convincing consumers to purchase NEVs. If automakers can develop competitive self-developed chips and continuously enhance their intelligent driving capabilities, they can immediately close the business loop.

Therefore, self-developed chips are expected to become the most notable technical trend in the NEV industry. However, due to the high development difficulty, only a few automakers may reach success.