Zeekr turns around losses, aiming for million-unit sales

![]() 12/09 2024

12/09 2024

![]() 625

625

How much has been achieved, and how much is left?

Editor: Ancient Path

Wind Product: Chen Chen

Source: Rhodium Finance - Rhodium Finance Research Institute

2024 is undoubtedly a big year for Zeekr Motors.

First, it officially listed on the New York Stock Exchange on May 10, setting a new record for the fastest IPO in the history of new energy vehicles just three years after its establishment; on November 14, Geely announced the integration decision of Zeekr and Lynk & Co, with Zeekr ultimately holding a 51% stake in Lynk & Co, and the remaining 49% of Lynk & Co shares continuing to be held by a wholly-owned subsidiary of Geely Automobile.

On December 3, Zeekr and Lynk & Co further announced the name of the new company after integration: Zeekr Technology Group. With its dual brands of Zeekr Motors and Lynk & Co, it strives to build a globally leading high-end luxury new energy vehicle group with annual production and sales of millions of units within two years.

The ambition to grow bigger and stronger is evident, to the extent that public opinion has labeled it as one of the most noteworthy events in the automotive industry in 2024. However, judging from stock price performance, the market does not seem to be very receptive. The stock price even fell by 23.6% on November 14. As of December 5, Eastern Time, the closing price was $25.17, up 5% from $24.26 on December 3, but still down about 13% from $29.14 on November 13 and about 20% from the high of $32.24 on the second day of listing. What is the market hesitating about?

01

Hard-hitting Heatwave: Cold Reflection

LAOCAI

As a high-end luxury brand, product quality is naturally of paramount importance.

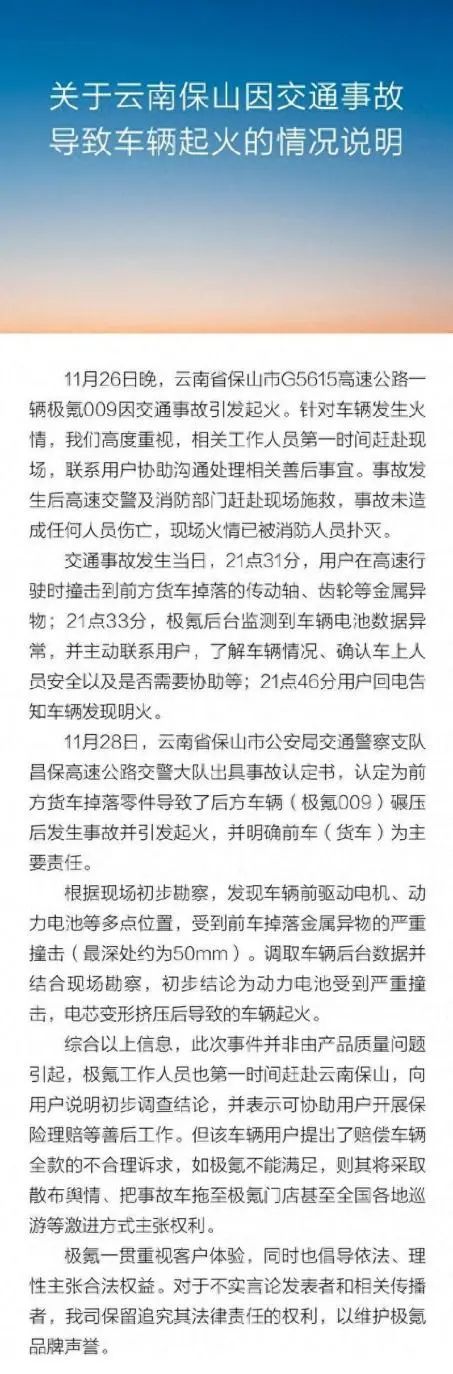

On the evening of November 26, a Zeekr 009 caught fire due to a traffic accident on the G5615 Expressway in Baoshan City, Yunnan Province. On December 5, the Zeekr Legal Department issued a statement that on November 28, the Baoshan Expressway Traffic Police Brigade in Yunnan issued an accident identification, determining that the accident and subsequent fire were caused by a falling part from a truck in front, which was crushed by the following vehicle (Zeekr 009), and clearly stated that the truck was the primary responsibility.

Zeekr Motors explained that this incident was not caused by product quality issues, and Zeekr staff immediately traveled to Baoshan to explain the preliminary investigation conclusions to the user. However, the user of the vehicle made unreasonable demands for full compensation, and if Zeekr could not meet them, they would resort to spreading public opinion, towing the accident vehicle to Zeekr stores, or even organizing parades across the country to advocate for their rights. In response, Zeekr emphasized that it always values customer experience and advocates for legally and rationally asserting legitimate rights. It reserves the right to pursue legal responsibility for those who publish false statements and related disseminators.

The wording is polite but also somewhat tough. Regardless of who is right or wrong, the primary attribute of high-end luxury is humanization, and a proper settlement would be best. We will wait and see how the subsequent plot unfolds. Shortly before this, Zeekr also had a "hard-hitting" confrontation with Autohome.

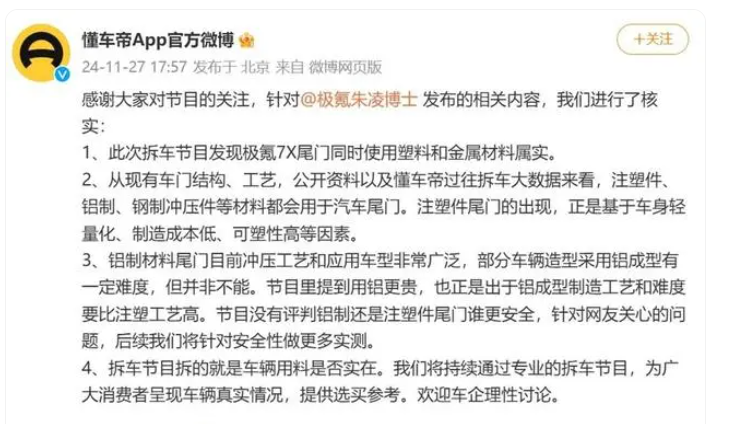

In the latter's "Simple Disassembly" series, a teardown of the Zeekr 7X, which was launched in September 2024, revealed that its tailgate used two materials, plastic on top and metal below. The anchor said in the video, "The reason for using plastic is to reduce weight and cost." Then, at the end of the video, he raised the question, "Why not use aluminum?" sparking widespread attention.

Faced with its product being openly "blackened," Zeekr executives chose to get personally involved. On November 26, Dr. Zhu Ling, Vice President of Zeekr Intelligent Technology, publicly posted on Weibo, angrily confronting Autohome and its anchor: "Confirm if this is your anchor? Confirm if your recruitment threshold is really this low? Have you any common sense in the recent series of videos? Dare to disassemble cars to educate users? Do you understand any basic knowledge about materials? How can aluminum be formed in this position? Dr. Zhu concluded by saying, "It's understandable to want traffic, but if you blatantly spread nonsense in broad daylight without shame, then you are either stupid or bad."

Regardless of who is ultimately right or wrong between the two parties, as a senior executive of a listed company, such wording in public can be understood in terms of emotions, but it is worth examining whether it is somewhat out of line and contrary to the high-end brand image.

In contrast, Autohome's response on November 27 seemed softer yet firm, stating that the teardown program aims to see if the vehicle materials are genuine and that "Autohome will continue to present the true condition of vehicles through professional teardown programs, providing reference for consumers in selecting and purchasing vehicles, and welcoming rational discussions from automakers."" Autohome also said, "Aluminum tailgate materials are currently widely used in stamping processes and applied models. While it is somewhat difficult for some vehicle shapes to use aluminum forming, it is not impossible.""

Who is right and who is wrong will ultimately be answered by time. Judging from the comments of netizens on related media reports, some expressed sympathy for Zeekr, while more comments favored Autohome. For example, comments on an article titled "Autohome Responds to Zeekr Executives: Teardowns Reveal if Automaker Materials Are Genuine" on the Extremely News website may be representative.

Objectively speaking, both the Zeekr 009 and Zeekr 7X are highly anticipated by the company. Faced with some criticisms, their eagerness is understandable.

Public information shows that the Zeekr 009 is the second mass-produced model under Zeekr, first launched in November 2022 with a price range of RMB 499,000 to RMB 588,000. On April 1, 2024, the Zeekr 009 Glorious Edition was launched with a price of RMB 789,000. In July, a new model of the Zeekr 009 was launched, priced between RMB 439,000 and RMB 469,000. In the first ten months of 2024, Zeekr Motors sold a total of 167,922 vehicles, exceeding the total sales for the entire year of 2023. Among them, 14,821 were Zeekr 009s, with monthly sales of less than 1,500 vehicles. Although its contribution rate is not high, An Conghui, CEO of Zeekr Technology Group, stated at a press conference that over 75% of Zeekr 009 users come from traditional luxury brands, indicating its important role in expanding the high-end market.

Looking at the Zeekr 7X, as Zeekr's first family SUV, it is expected to drive up sales volumes. Public information shows that, in addition to the first hit model "Zeekr 001," the Zeekr 7X is the second benchmark product of Zeekr to achieve monthly deliveries exceeding 10,000 units, with deliveries exceeding 20,000 units within 50 days of its launch.

Given their significant status, it is not surprising that Zeekr attaches great importance to the above incidents.

Over time, this is not the first time the two sides have harbored grievances. In July 2024, Autohome claimed in a teardown comparison program that the Zeekr 001 did not have a dedicated crumple zone and that the beam's energy absorption capacity was also low, making it easy to damage the rear longitudinal beam during a collision. It also stated that "the cost of repairs will skyrocket."

At that time, Guan Haitao, CMO of Zeekr, responded by saying that "Autohome's conclusion is wrong and highly misleading" and explained that the Zeekr 001 does have a crumple zone but uses a new design where the crumple zone is no longer the size of a milk carton but is integrated with the longitudinal beam structure, with a length equivalent to "the arm length of an adult." He also provided an illustrated guide to universal knowledge.

Without passing judgment on who is right or wrong, it is certain that Zeekr and its senior management have been in the spotlight recently. For example, not long ago, there was a video of having hot pot in a Zeekr MIX: Yang Dacheng, Vice President of Zeekr Intelligent Technology, and his team rotated the front seats 180 degrees to face the back row, placing a hot pot, sliced tripe, crispy pork, a dish of green vegetables, and four dipping sauces on the extendable table. He also said that mahjong could be played in the car.

Some netizens commented that the marketing idea was good, but having hot pot and playing mahjong in a car were pseudo-needs, believing that Zeekr's marketing direction was wrong. "I've driven over 200,000 kilometers, and I've never had the desire to have hot pot or play mahjong in the car," one netizen said. "How do you get rid of the smell of hot pot in the car? What happens if you have to brake suddenly?""

In response, Yang Dacheng said in an interview that the video actually used exaggeration to showcase the interior space of the MIX. He believed that eating in the car does happen in daily life, so there is a genuine need for such a feature.

Industry analyst Wang Yanbo believes that as a new energy vehicle group aiming for annual sales of millions, with a global positioning and a high-end luxury image, it is not a bad thing for Zeekr to maintain a certain level of public attention. However, it should still pay attention to its approach and rhythm and be wary of backlash effects. Especially when it comes to questions about car quality and driving experience, it should handle them rationally and avoid being dominated by emotions, which could damage the authoritative and rigorous image of high-end luxury.

02

Too Fast Replacement Cycles, Quality Control Concerns

Beware of "Backstabbing" Old Car Owners

LAOCAI

No matter how high-end or luxurious, or how many years of sales, ultimately, it is the word-of-mouth of users that speaks. Having a good public image is definitely a plus.

According to Jiemian News, the 2024 model of the Zeekr 001, which was previously on sale, was launched in February 2024, and just six months later, in August 2024, Zeekr launched the 2025 model of the Zeekr 001. This move sparked dissatisfaction among some "old" car owners. If the 2023 model, which could be purchased before February of this year, is included, it means that consumers could purchase three models of the Zeekr 001 from 2023 to 2025 this year. The rapid replacement cycle led netizens to complain about this "very magical phenomenon," including the replacement speed of "three updates in a year" and "the car becomes old just three days after purchase"..."

On the night of the launch of the 2025 Zeekr 001, the Zeekr official live stream was unusually lively. According to Zhengguan News, some car owners vented their emotions and demanded refunds, prompting Zeekr to disable the comment function in the live stream. However, some users still expressed their dissatisfaction by modifying their usernames and making donations. Subsequently, Zeekr also temporarily disabled the comment function on its official Weibo account.

Why such a strong reaction? According to Beijing Business Today, the 2025 model is the first to be equipped with Zeekr AIOS and Haohan Intelligent Driving 2.0, while the older models use the Mobileye Intelligent Driving solution. The two use different layout schemes in terms of underlying chips, system deployment, and wiring harness layout, representing two separate systems and hardware layers. Therefore, Zeekr stated that "older models cannot be upgraded." This undoubtedly amplified the dissatisfaction of long-term customers. According to upstream news and Henan Business Daily, on August 14, some car owners went to Zeekr's headquarters and stores to demand their rights, and the incident sparked heated discussions.

Objectively speaking, rapid iteration may not have been the original intention but was more driven by market competition pressure. As Lin Jinwen, Vice President of Zeekr, stated, the current market competition is very intense, and Zeekr needs to provide users with the best technology and products as soon as possible to achieve good market performance. Compared to traditional automakers, new automakers often rely on higher-level intelligent cockpits and intelligent assisted driving chips to strengthen their innovative labels, competing for "first launches" like smartphone companies to enhance their innovative image. Therefore, in the promotion of multiple smart electric vehicles, companies emphasize "first launches.""

Industry analyst Sun Yewen said that introducing new models represents the vitality of automakers and is a lever to boost sales, but attention should also be paid to the rhythm and market balance. After all, both new and old customers are disseminators of the corporate image. With the release of new models, the depreciation of older models will accelerate. If replacements are too frequent, old car owners will face tangible economic losses and naturally will not remain calm. As a high-end luxury brand, maintaining good user word-of-mouth is of utmost importance, and it is necessary to be vigilant about damaging brand value due to overly frequent new product launches. It is better to prevent risks than to deal with them afterwards, so Zeekr needs a systematic plan to minimize the negative impact on old customers, preferably by preemptively addressing potential risks.

Indeed, it is essential to consolidate the foundation before running. Browsing the Black Cat Complaint Platform, as of December 6, 2024, there have been a total of 1,673 complaints related to Zeekr Motors, with 60 in the past 30 days. It is worth noting that the response rate is high, reflecting the company's emphasis, but it should be noted that the complaints mostly focus on sensitive issues such as product quality and service, involving doubts about battery life, design flaws, driving faults, false advertising, and discrimination against old car owners.

(All the above complaints have been reviewed by the platform)

Admittedly, users have diverse needs, and it is unrealistic to satisfy everyone. The above complaints may be biased or one-sided. However, as the saying goes, a weak foundation leads to instability. Product experience and user word-of-mouth are the cornerstones of corporate development. As a shining example of Chinese products, with a high-end luxury positioning and a vision of millions of sales, Zeekr would do well to identify and rectify deficiencies and refine its quality control and risk management capabilities.

03

How Close is Zeekr to Turning Around Its Losses?

LAOCAI

Ultimately, it all comes down to sales. As everyone knows, the automotive industry is a typical scale industry. For Zeekr Motors, which has just entered the capital market and undergone a strategic merger, there is an even greater need to prove itself. It is understandable to continuously iterate to improve the overall quality of models and compete for market share.",

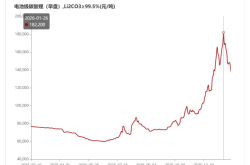

After all, the losses are obvious. According to the prospectus, Zeekr's net losses for 2021-2023 were 4.51 billion yuan, 7.66 billion yuan, and 8.26 billion yuan, respectively, totaling 20.43 billion yuan in net losses over three years. In the first quarter of 2024, the net loss was 2.22 billion yuan. According to the Sci-Tech Innovation Board Daily, Zeekr's net loss in the third quarter of 2024 was 1.139 billion yuan, a year-on-year decrease of 21.7%, but there is still a long way to go before turning a profit.

As of the end of 2023, Zeekr's debt-to-asset ratio reached 132%. According to Aotou Finance, Zeekr conducted three rounds of financing before its IPO, including Pre-A round, equity transfer, and A round. Among them, the disclosed financing amount was only $1.25 billion, equivalent to less than 10 billion yuan in RMB. Its stable development so far cannot be separated from the continuous support of its parent company, Geely Holding Group.

Fortunately, revenue and gross margin growth are encouraging. From 2021 to 2023, Zeekr's revenue was 6.5 billion yuan, 31.9 billion yuan, and 51.7 billion yuan, respectively. It is not difficult to see that with the continuous increase in new vehicle deliveries, Zeekr's scale has grown strongly. According to Daxiang News, Zeekr's cumulative revenue in the first three quarters of 2024 increased by more than 50% year-on-year to 53.13 billion yuan. Unaudited quarterly financial data showed that Zeekr's second-quarter revenue exceeded 20 billion yuan, a year-on-year increase of 58%. Zeekr emphasized that "under Hong Kong Accounting Standards, after excluding the impact of share-based payments, Zeekr's net loss narrowed significantly to 70 million yuan in the first half of the year, achieving profitability in the second quarter."

After the merger with Lynk & Co, An Conghui stated that we are committed to achieving break-even under Hong Kong Accounting Standards this year and will then consider how to achieve profitability.

The ambition and confidence are evident, but whether Zeekr can truly win the battle to turn a profit depends crucially on rapid scale expansion. Upon closer inspection, there are underlying concerns. In terms of product performance, the main concern stems from one of its key products, the frequently updated Zeekr 001 mentioned earlier. According to Aotou Finance, Zeekr's revenue consists of three main segments: vehicle sales, three-electric business (batteries, motors, and electronic control systems), and R&D and other services. However, revenue from vehicle sales is the main support, accounting for an increase from 23% in 2021 to 66% in 2023. A significant portion of vehicle sales revenue comes from the Zeekr 001 model.

This car was the first electric vehicle model launched after Zeekr's establishment. Positioned as a luxury shooting brake, it achieved over 10,000 deliveries within four months of its launch. In 2022 and 2023, Zeekr 001 sold over 70,000 units annually, helping Zeekr establish a firm footing in the competitive new energy vehicle market. It is undoubtedly a stalwart in Zeekr's lineup.

According to Zhongxin Finance, Zeekr disclosed that the 20th Zeekr 001 was officially delivered on June 21st, taking 972 days from launch to the 20th delivery. Since its launch on February 27th, the 2024 Zeekr 001 has delivered over 50,000 units in five months.

The consideration is that Zeekr is not just about this one product; it also includes the Zeekr 009, Zeekr 007, Zeekr X, and others, covering various niche automotive markets. In comparison, although sales have increased significantly, they have yet to replicate the success of the Zeekr 001.

Industry analyst Wang Tingyan stated that the new energy vehicle market is evolving rapidly. For example, NIO has launched new models like the Ledao and Firefly, continuously enriching its product portfolio. Zeekr's continuous introduction of new models follows a logical path. Currently, models like the Zeekr 009 and Zeekr 7X are performing well, but whether this momentum can be sustained remains to be seen over time. After all, competitors are not idle, and as the market advances, competition in the high-end luxury segment will become increasingly fierce. It is crucial for Zeekr to quickly incubate more new best-selling products and implement multiple rounds of parallel development, which is significant for the company's self-verification of value, improving its chances of turning a profit, and striving for sales of one million units.

04

A Grand Integration Play

No Room for Error

LAOCAI

Certainly, after years of market baptism , Zeekr has honed a strong foundation of capabilities. The strategic merger with Lynk & Co brings unlimited possibilities for the company's future development.

Geely stated that the group has always valued the development of its global luxury electric vehicle technology brand, Zeekr, and the acquisition of Zeekr will further demonstrate the group's support for the brand. Increasing its stake in Zeekr through the acquisition will simplify Zeekr's shareholder structure and enhance the group's influence over Zeekr's strategic direction, helping the group allocate strategic resources and drive future plans.

Additionally, the Zeekr acquisition will strengthen the group's equity control over Zeekr and help mitigate potential future equity dilution.

On the product side, Zeekr will introduce hybrid models in 2025 to continue boosting sales. On August 21st, at Geely Auto's mid-year earnings conference, An Conghui revealed that Zeekr's large flagship SUV model will be equipped with two powertrain options: pure electric and super hybrid, with an expected release in the fourth quarter of 2025.

On November 14th, Zeekr announced its third-quarter results for 2024, delivering nearly 170,000 new vehicles in the first ten months, a year-on-year increase of 82%. Cumulative deliveries exceeded 360,000 units by the end of October. Among them, the Zeekr 001 remained the sales champion for pure electric vehicles priced above 250,000 yuan; the Zeekr 009 was the sales champion for pure electric vehicles priced above 400,000 yuan for four consecutive months; and the Zeekr 7X delivered over 20,000 units within 50 days of its launch, becoming the sales champion for Chinese pure electric SUVs priced above 200,000 yuan.

Regarding the full-year delivery target of 230,000 units, Lin Jinwen, Vice President of Zeekr Intelligent Technology, stated, "Although we need to complete sales of 29,000 units per month until the end of the year, which is indeed challenging, Zeekr is confident in achieving this goal."

Regarding the integration and collaboration between Zeekr and Lynk & Co, An Conghui revealed during the third-quarter earnings call that they would operate relatively independently and be mutually distinct to maximize market coverage. At the product level, conflicts will be avoided to form a synergistic force. At the technical level, there will be deep integration in areas such as vehicle architecture, electronic architecture, three-electric systems, cabins, and intelligent driving, with integration and focus over the next two to three years. In terms of manufacturing and supply chain, the company will leverage economies of scale, expected to increase factory capacity utilization by 3%-5%. R&D investment will be reduced by 10%-20%, BOM costs by 5%-8%, and support and service department expenses by 10%-20%.

Obviously, the upcoming integration between Zeekr and Lynk & Co will be a grand play, presenting both opportunities and challenges. Whether the result will be 1+1>2 or internal conflict and waste depends on the integration efficiency and collaboration accuracy. Being both large and strong, fast and stable, and excellent is crucial for Zeekr's future transformation from loss to profit and achieving breakthroughs at the million-unit level. From this perspective, the importance of solidifying product quality control, risk control, building a solid user reputation, and managing public perception becomes self-evident.

'This year, we cannot afford any mistakes. If we make a mistake, everything will be lost,' An Conghui, CEO of Zeekr Intelligent Technology, reminded at the beginning of the year. As the year draws to a close, how much has been accomplished, and how much remains to be done?

This article is original content from Rhodium Wealth. For reprints, please leave a message.