Delving into the Core Competitiveness of Key Components: Japan Analyzes Domestic New Energy Vehicles

![]() 12/13 2024

12/13 2024

![]() 529

529

Preface:

In the era of internal combustion engine vehicles, constrained by technology and experience, Chinese automakers often progressed by studying and dissecting foreign cars.

However, in the new energy era, China's leading position in electrification technology has made Chinese electric vehicles the subject of international research and analysis. From Japan to the United States, from news media to professional automakers, they all dissect and study Chinese electric vehicles.

Author | Fang Wensan

Image Source | Network

Japan Delves Deep into China's New Energy Vehicles

Currently, Japan's focus on Chinese electric vehicles has shifted from "low price and low cost" to the core competitiveness of key components.

At the Electric Vehicle Symposium hosted by Japan's Ministry of Economy, Trade, and Industry this year, as many as 70 Japanese auto parts companies participated, observing displayed electric vehicles to jointly study the body structure and component characteristics of Chinese-made electric vehicles.

During this symposium, participating manufacturers explored the reasons behind the low production costs of Chinese electric vehicles.

Among the displayed electric vehicles were over a dozen Chinese brand models, including BYD ATTO3 (Yuan PLUS in the Chinese market) and NIO ET5, as well as non-Chinese brand models such as Tesla Model Y, involving over 90,000 auto parts in total.

Through in-depth analysis of the BYD ATTO3, it was concluded that part generalization, independent R&D of core components, and large-scale production were key factors.

In the electric drive unit [E-Axle], the BYD ATTO3 not only integrates components such as motors, inverters, and reducers but also includes a total of eight parts such as on-board chargers and DC-DC converters.

This integration not only reduces costs but also lightens the weight.

Furthermore, models like the BYD ATTO3 achieve large-scale mass production through sales advantages, further reducing component costs.

Additionally, BYD implements a sharing strategy for components across different models on the ATTO3 and promotes the self-production of components.

Leveraging its sales advantage in the electric vehicle market, BYD further reduces component costs through economies of scale.

After dissecting and analyzing the Zeekr 007, the Japanese industry expressed high praise for the advanced technology it embodies and adopted a similar approach to the previous analysis of the BYD Seal, compiling the dissection details into a book and publishing it publicly.

They believe that the Zeekr 007, which employs a large number of cutting-edge electrification technologies while priced at approximately 250,000 Chinese yuan, is a fact that many Japanese experts find hard to believe.

By comparing the Zeekr 007 with previously dissected models such as the BYD Seal, Tesla Model 3, and Volkswagen ID.3 in terms of performance parameters, the expert team concluded that Zeekr and BYD have effectively balanced price and performance in their battery design and product concepts.

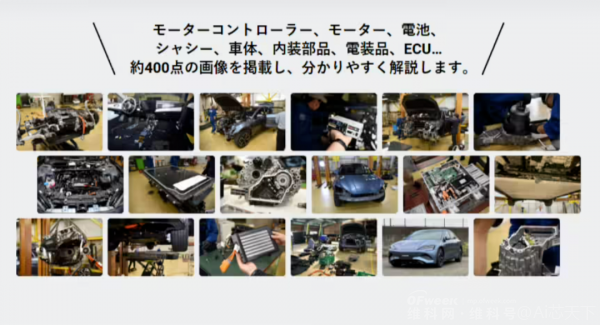

They also published a book titled "Geely Automobile ZEEKR 007 Complete Dissection," which provides a detailed display and comprehensive analysis of components such as inverters, motors, batteries, chassis, body, interior parts, electrical components, and ECUs.

Previous Public Dissections of Domestic Electric Vehicles

The first dissection occurred in 2021, carried out by several professors from Nagoya University in Japan, who dissected the top-of-the-line version of the Wuling Hongguang MINI EV.

These professors estimated the car's cost to be approximately 27,000 Chinese yuan and expressed amazement at its low cost.

The second dissection took place in 2023 and was completed by Nikkei BP, Japan's largest publisher, who comprehensively dissected the BYD Seal, including the body, battery, powertrain, electronic control facilities, and interior components.

After the dissection, they praised BYD's platform configuration and highlighted the high-voltage system, the power unit for electric vehicle driving control functions, and the battery-body integration technology as noteworthy features.

Through comprehensive research, they found that the BYD Seal not only stands out with its blade battery but also leads the industry in many technologies such as on-board electrical components and centralized control.

These achievements of Chinese automakers convinced them to produce a detailed manual.

This 350-page manual elaborates on the BYD Seal's motor, power battery, CTB, mission management system, electronic control system, assisted driving support system, and electronic equipment in great detail.

Additionally, the book they published is not cheap, with a version designed for automotive engineers priced at 880,000 Japanese yen, equivalent to approximately 45,000 Chinese yuan.

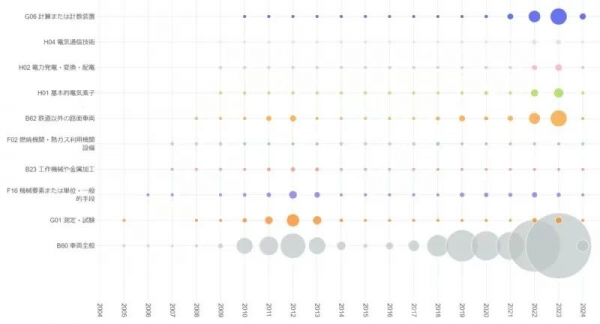

China's Leading Position in New Energy Vehicle Patent Applications

Although European and American countries started earlier in the research and development of new energy vehicles and once dominated patent applications before 2015.

According to data released by the China Association of Automobile Manufacturers, from 1995 to 2015, the total number of global patent applications for new energy vehicles approached 200,000.

During this period, Japan stood out in patent applications for new energy vehicles, with its application volume accounting for 46% of the global total, demonstrating its leading position in this field.

In contrast, China's global share of patent applications for new energy vehicles was approximately 18%.

However, China has now established a global leading position in patent applications for new energy vehicles, with its application volume accounting for over 40% of the global total.

Furthermore, China also ranks first globally in patent applications for core technologies such as electric motors and electric drives.

In recent years, the gradually increasing number of patent applications has focused on basic electrical components and related fields of the three-electric system. From the latest dissection technology analysis, the commercial application of these technologies has begun to achieve phased results.

Meanwhile, Japan, once in second place, has seen its share of global patent applications for new energy vehicles drop to less than 20%.

Faced with this situation, there is widespread concern within the Japanese automotive industry.

They are gradually realizing that their once-proud technological advantages in the new energy field are gradually weakening.

At the same time, Chinese automakers have become a formidable competitor that cannot be ignored due to their remarkable innovation strength and cost control capabilities.

Knowing the Secret is Not Enough; Replicating the Industrial Chain is Key

Although Japan has conducted in-depth dissections and research on domestic electric vehicles, some netizens believe that even if Japan has a thorough understanding of the cost control secrets of domestic electric vehicles, it will still be difficult for them to replicate China's success.

Some IT Home users pointed out that the completeness of China's electric vehicle industrial chain is crucial, as almost the entire supply chain can be found domestically, providing a comprehensive cost advantage.

The reason why Chinese automakers can produce low-priced electric vehicles is mainly due to the standardization and independent R&D and production of components.

Globally, China is unique in the comprehensiveness of its electric vehicle industrial chain, and the fierce competition in upstream and downstream industries naturally leads to effective cost reduction.

Therefore, even if Japanese institutions conduct thorough dissections and research on Chinese electric vehicles, at least in the short term, it will be difficult for the Japanese electric vehicle industry to replicate China's development path.

This is mainly due to China's well-developed supply chain system, as there are only a handful of countries with such a complete automotive supply chain globally.

After a detailed analysis of numerous Chinese brand electric vehicles, in addition to differences at the technical level, the cost control capabilities of Chinese brands have actually posed a significant challenge to the Japanese.

Against the backdrop of widespread wariness towards Chinese brands in overseas markets, the overwhelming cost-effectiveness advantage of Chinese automakers in the international market remains their primary competitive weapon.

As China's domestic new energy industrial chain becomes increasingly complete and mature, this advantage is expected to persist for some time in the future.

It is not that foreign enterprises cannot manufacture electric vehicles similar to BYD's; rather, it is difficult for them to replicate the Chinese automotive industry model from the perspectives of scale and the industrial chain.

In the past, the cost of automobiles was difficult to reduce because many core technologies were held by foreign enterprises.

In the traditional fuel vehicle sector, Chinese automakers did not dominate pricing power.

However, the industrial chain of new energy vehicles differs from that of traditional vehicles, with core technologies such as batteries and motors independently developed by China, providing opportunities for Chinese enterprises to reduce costs.

Of course, cost reduction is also closely related to economies of scale, and costs can be effectively controlled after a large-scale market is formed.

Japan's Focus on Hydrogen Fuel Cell Vehicles

Japan has adopted a diversified technological approach in the field of new energy vehicles, including the parallel development of various technologies such as hybrid vehicles (HV), pure electric vehicles (EV), and hydrogen fuel cell vehicles (FCV).

Japan has given special attention and support to the development of hydrogen fuel cell vehicles.

However, the current market share of hydrogen fuel cell vehicles in Japan is relatively small, mainly due to their high prices and the insufficient number of hydrogen stations.

Toyota's introduction of portable hydrogen tanks demonstrates Japan's emphasis on hydrogen fuel cell vehicles, but reducing costs to attract consumers and thereby activate the entire hydrogen fuel cell vehicle industry remains a significant challenge for Japan.

Conclusion:

The in-depth analysis of China's new energy vehicles by the Japanese industry is both an affirmation and an incentive for Chinese automakers.

Japan's meticulous dissection of Chinese manufacturing recalls the saying in "Huainanzi: Sayings of the Forest": "The height of Mount Tai cannot be seen from its back; the tip of an autumn hair can be seen with the naked eye."

However, we will not be arrogant and believe that China's new energy vehicles and smartphone industry have reached the heights of Mount Tai.

Some reference materials: Auto Commune: "From BYD to Geely Zeekr, Japan is Addicted to Dissecting Chinese Cars", Toxic Tongue Zhang Zufu: "Japan Dissects Chinese New Energy Vehicles Again", IT Home: "Japan Violently Dissects BYD and NIO, This Time to Fully Understand the Unique Secrets of Chinese Electric Vehicles", Huanqiu Times Finance: "Foreigners Cannot Replicate the Chinese Automotive Model", Dianju: "Japanese Automakers Violently Dissect BYD", Qin Shuo's Circle of Friends: "Japan is Addicted to Dissecting Chinese Manufacturing", BT Technology Business: "Is Japan Addicted to Dissecting Chinese New Energy Vehicles? This Time, It's Geely Zeekr 007", Car Owner's Guide: "The Japanese Have Dissected Another Chinese Electric Vehicle? This Time, It's Zeekr 007's Turn", Automotive Business Review: "The Japanese Dissect Chinese Cars and Sell the Book for 880,000 Yen