Relying on Baidu and Geely, Jiyue Automobile Still 'Implodes'. Can It Survive Until 2025?

![]() 12/13 2024

12/13 2024

![]() 583

583

Who Will Fall in the Knockout Competition Among New Energy Vehicle Makers in 2025?

Original by Youshu Digital Economy Studio

Author | Youshu

WeChat ID | yds_sh

During a live car sales stream by a female anchor at a Jiyue Automobile dealership, a colleague came over to inform her that they were about to lose their jobs. The live stream did not immediately cease, but instead, the female anchor conveyed her helplessness. Viewers watching the live stream asked, "Can you turn off the background music 'Good Fortune'?" The female anchor tearfully replied, "Yes," and muted the inappropriate song.

As one of the hottest sectors in recent years, auto manufacturing has never lacked participants, but it has also witnessed rounds of magic and reality. In 2024, news of new energy vehicle makers Gaohe Automobile halting production and Weima Automobile's restructuring application being accepted by the court emerged one after another. By the end of the year, it was Jiyue Automobile's turn.

Backed by Two Titans in Tech and Auto Industry, It 'Implodes' Before Reaching Scale

Relying on Baidu and Geely, two titans in the tech and auto industries, Jiyue Automobile can be said to have been 'born with a silver spoon,' but its journey has been fraught with obstacles.

In 2021, Baidu and Geely established 'Jidu Auto Co., Ltd.,' with Baidu holding 55% and Geely holding 45%. In June 2022, the 'Geely Group' withdrew from the shareholder list of Jidu Auto Co., Ltd., and the shareholding ratio of Baidu's affiliated company, Tazhi County Bairuixiang Venture Investment Management Co., Ltd., increased to 100%. In December 2022, Jidu Auto Co., Ltd. underwent another business change, with its corporate name changed to Shanghai Miyahang Automobile Co., Ltd.

Soon, the two sides reconciled. In August 2023, Hangzhou Jiyuyue Automobile Technology Co., Ltd., with Zhejiang Geely Industrial Investment Holding Co., Ltd. and Shanghai Miyahang Automobile Co., Ltd. holding 65% and 35% shares respectively, was established. In the same month, Geely Holding Group launched its new automotive robot brand, 'Jiyue,' marking the birth of Jiyue Automobile. After the change in shareholding structure, the division of labor between Geely and Baidu became clearer. Jidu focused on the research and development of AI intelligent solutions and empowerment, while Jiyue Automobile, led by Geely Holding, focused on vehicle manufacturing.

After a series of adjustments, Jiyue Automobile successively launched Jiyue 01 and Jiyue 07, but sales were not optimistic. Data shows that in the first 11 months of this year, Jiyue Automobile delivered over 14,000 new vehicles, falling short of the monthly sales performance of leading new energy vehicle brands like Li Auto and AITO. To help boost Jiyue's visibility and brand power, CEO Xia Yiping personally led a company-wide marketing campaign. He opened accounts on various social media platforms and used short videos and live streams to convey Jiyue Automobile's product features and advantages to the outside world.

However, Jiyue Automobile 'imploded' before reaching scale. Previously, news spread online that Jiyue Automobile would conduct large-scale layoffs. The Jiyue Automobile Legal Department refuted the rumors, stating that the company's operations were proceeding as usual and that relevant information was released through official channels. Subsequently, it was rumored that Jiyue Automobile would close its vehicle business, with multiple departments being disbanded on the spot, and that Baidu would cease funding. Some netizens even initiated a poll on Weibo: "Which will fall first, NIO Automobile or Jiyue Automobile?"

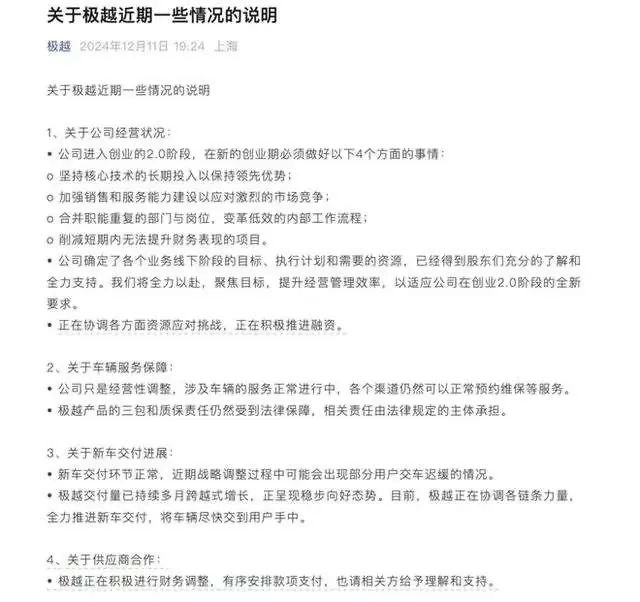

In an internal letter recently released by Jiyue Automobile CEO Xia Yiping, he stated that the company is currently facing difficulties and needs to immediately adjust and enter the 2.0 stage of entrepreneurship. However, for employees, the 2.0 stage of entrepreneurship can also be interpreted as mass layoffs. Some Jiyue employees revealed that the company plans to retain only a handful of employees to maintain operations, while the rest will either leave or work at their own expense.

A Decade of Turmoil: Auto Manufacturing Is Not a Simple Undertaking

It's not just Jiyue Automobile. Over the past decade, a large number of new energy vehicle makers in China have quickly disappeared, falling into bankruptcy or financial crisis, leaving the market in disarray.

Generally speaking, automobile manufacturing is a monopolistically competitive industry. Factories, dealerships, and delivery operations require substantial capital investment from automakers. For automakers that have not yet reached delivery scale, external funding is needed to maintain normal operations in the early stages of development, necessitating continuous exploration of capital channels.

Due to its heavy asset and investment nature, the automotive industry has a high entry threshold. In developed economies such as Europe and the United States, a stable automotive industry landscape has been formed, with competition primarily among mainstream brands like Volkswagen, Toyota, General Motors, Ford, Hyundai, and Nissan. Rarely do new automakers enter the market, with Tesla being a notable exception.

In 2010, China introduced subsidies for new energy vehicles to strengthen support for the industry. Between 2014 and 2015, China's new energy vehicle sales soared by 300%, and the first batch of new energy vehicle makers, including NIO, XPeng, and Li Auto, were established during this period, turning China's automotive industry into a fully competitive one.

Starting from 2018, the new energy vehicle subsidy phase-out policy came into effect as scheduled and was fully phased out by 2023. 2018 was considered the first knockout point for the new energy vehicle industry. Some sub-standard enterprises that relied on subsidies or existed solely for subsidies were the first to be eliminated. In 2018, there were over 487 new energy vehicle companies in China, but by the end of 2023, according to incomplete statistics, only over 40 new energy vehicle companies were still operating normally.

After a group of low-end new energy vehicle companies 'exited' the market, competition in the new energy vehicle circle entered a new dimension, not just for survival but also to prepare for a 'long war.' However, by 2024, only a few of the early new energy vehicle makers had survived the fierce competition. Most new forces were eliminated, leaving behind only empty boasts. Sixteen companies, including WM Motor, ENN Automotive, Byton, Qidian, Aichi, and Gaohe, had planned production capacities and investments of up to 10.3 million vehicles and 600 billion yuan, respectively, with a total disclosed cumulative funding of over 107 billion yuan.

What does a planned production capacity of 10.3 million vehicles mean? In November this year, China's annual new energy vehicle production capacity reached the historic milestone of 10 million vehicles for the first time. It took China a decade to reach this point, from an annual production capacity of only 78,000 vehicles in 2014 to 10 million this year. The 16 eliminated companies alone had planned annual production capacities exceeding 10 million vehicles, truly embodying the saying, 'The bolder the man, the greater the harvest.'

Those Who Aim to 'Disrupt' the Auto Industry Are Close to Being Eliminated

Successful automakers share similar paths to success, while unsuccessful ones have their unique misfortunes.

Amid the popularity of new energy vehicles, many cross-border companies have tried to get a piece of the pie. Some real estate companies, such as Evergrande and Baoneng, have ventured into auto manufacturing. Others, like Leading and Thalys, have upgraded from producing low-speed electric vehicles to manufacturing full-fledged cars. There is a vast gap between the primary businesses of these companies and auto manufacturing. Even if they can hire technical talent and invest heavily to produce new cars, it is difficult for these companies to successfully transform in the short term. Once their cash flow dries up, they will either be acquired or go bankrupt.

WM Motor, Gaohe, and Byton are all professionally trained teams, but understanding technology does not necessarily mean being able to operate a company well. For example, WM Motor's autonomous driving capabilities are not outstanding, but the company later focused its product selling points on autonomous driving. Coupled with extensive and rough management and aggressive marketing that failed to translate into sales, the company eventually ran out of funds and collapsed.

In particular, a group of internet companies have entered the automotive industry, making car manufacturing a trendy and high-end endeavor. Under the banner of 'disrupting' the automotive industry, they have come in full force, disrupting the original ecosystem of the automotive industry. Some new energy vehicle makers constantly hold press conferences to launch new models to attract attention, with small events every six months and major events throughout the year. However, these are often just minor updates, and in the end, they fail to achieve mass production, leaving behind only the laughingstock of 'PPT car manufacturing'.

The regrettable 'elimination' of these automakers is not due to a single reason but rather a combination of issues related to products, technology, marketing, and capital chains. Especially in the past two years, with significant adjustments in the macroeconomic environment, the number and amount of investments and financing in the new energy vehicle circle have significantly decreased. This has further amplified the automakers' own problems, affecting their survival ability in the market.

In the past few years, the new energy vehicle market has maintained fierce competition, with 'the big fish eating the small fish.' Coupled with continuous price wars in the auto circle, mid-tier automakers that cannot secure continuous financing and cannot compete with their rivals are naturally cleared out by the market. The next stage will be 'the big fish eating the small fish.' The leaders of NIO, XPeng, and Li Auto have all mentioned similar viewpoints, believing that no more than 5-7 new energy vehicle companies will survive in the future.

The current auto circle has entered a white-hot stage of competition, not only in terms of price, technology, and products but also in the battle for consumers' minds. This is also because the overall development time of new energy vehicles is not long, and they need to face the issue of brand precipitation.

For new forces, receiving many orders is a good thing, but limited production capacity that prevents timely delivery becomes a significant problem. Behind this lies a balance between sales, products, and costs, meaning that automakers need more than just hit products; they also need their entire production and profit systems to support delivery and continuously create products that meet production capacity.

The knockout competition has already begun. After Jiyue Automobile, which new force will be next?