Reorganizing Dealerships: Porsche's Strategic Adaptation

![]() 12/13 2024

12/13 2024

![]() 662

662

Recently, Oliver Blume, President and CEO of Porsche China, disclosed to the media that Porsche intends to gradually optimize its dealership network over the next two years. According to the plan, approximately 100 dealerships will remain operational by the end of 2026.

"Currently, customer demand is waning, and sales are contracting, necessitating an urgent optimization of our dealership network. We aim to secure the profitability of our partners in the local market," he said. Based on the current size of the Chinese market and future prospects, Porsche must make strategic adjustments to its distribution channels to maintain the health of its entire sales network.

Prior to May Day this year, a collective protest and boycott by three Porsche dealerships in China garnered significant attention, aimed at pressuring the German headquarters. Reports indicate that during an earlier Porsche China dealership conference, three dealers—Xinfengtai, Baideli, and Meidong Group—objected to the year's sales targets but failed to receive a satisfactory resolution. Consequently, some Porsche dealers halted vehicle deliveries as a means to 'pressure' headquarters, demanding subsidies and executive replacements. Though Porsche and the dealers eventually reached an agreement, this incident exposed Porsche's challenging situation.

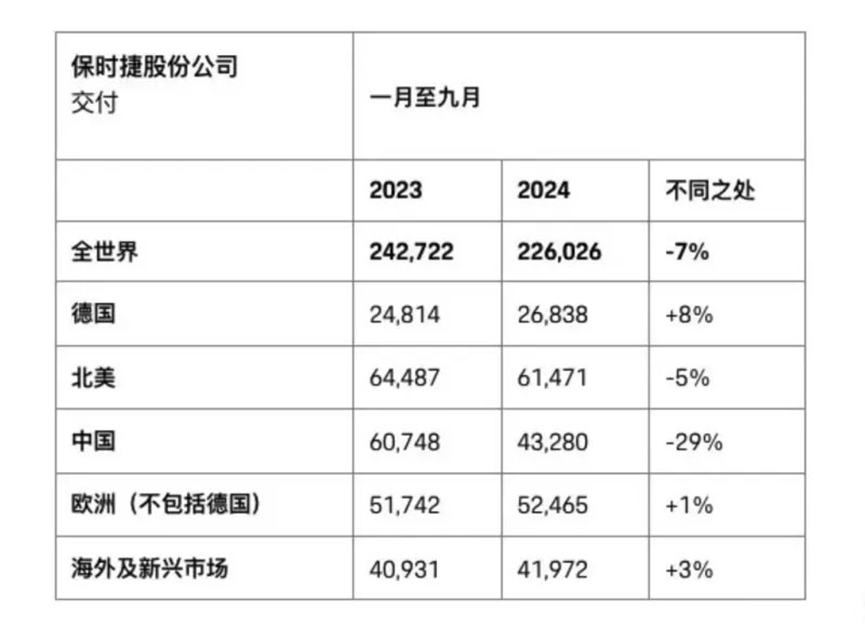

Porsche, which has long dominated the Chinese market, has shown signs of fatigue in its performance over the past two years. In 2022, Porsche experienced its first sales decline in China, delivering 93,000 new vehicles, a 2.5% year-on-year drop. In 2023, the decline widened, with 79,300 new vehicles sold, a 15% year-on-year decrease. During the first three quarters of 2024, Porsche sold only 43,280 vehicles in China, a 29% year-on-year drop.

Due to declining sales, Porsche China began 'pressuring' dealers to take on more inventory to meet sales targets. However, amid weakening demand and price wars, dealers had to sell cars at a loss. In October this year, a Shenzhen dealer offered a base price of RMB 358,000 for a Porsche Macan, equivalent to a 40% discount. Additionally, models like the Taycan and Panamera also saw significant price drops. The Taycan's starting price fell to RMB 588,200, and the Panamera's to RMB 630,000. Publicly disclosed data shows that in 2023, the Meidong Group's new car sales business gross profit margin dropped to -0.6%, while Baideli's passenger car sales gross profit margin fell from 4.1% in 2022 to 0.2% in 2023. Under immense operating pressure, some Porsche dealers have exited the network. In March this year, the Jebsen Group-owned Porsche store in Guangzhou Tianhuan Plaza closed.

Notably, following the dealer 'pressure' incident, Porsche's Global Sales Director Detlev von Platen led a delegation to China to understand the situation. Subsequently, Porsche China initiated adjustments. In July this year, Porsche announced that Oliver Blume would replace Klaus Zellmer as CEO of Porsche's Mainland China, Hong Kong, and Macau operations, effective from September 1 at the earliest. During Porsche's third-quarter investor conference call in late October, Chief Financial Officer Lutz Meschke first revealed that Porsche would 'significantly reduce its dealership network in China.' This time, Oliver Blume provided a detailed response regarding the dealership network adjustment plan. He stated that the sales network adjustment wasn't merely a reduction in dealership numbers but a flexible adjustment based on city consumption capacity and store profitability. Porsche will streamline unprofitable stores and increase investment in first-tier cities like Beijing, Shanghai, Guangzhou, and Shenzhen.

In fact, dealership network cuts are just one aspect of Porsche's business adjustments in China. Almost simultaneously, industry insiders confirmed that Porsche China had recently begun staff optimization, laying off 10% of regular employees and 30% of outsourced staff. Prior to this, Porsche announced that Li Nan would assume the role of Vice President of Porsche China's Technology Department. The newly established Technology Department encompasses local procurement and quality assurance functions, overseeing Porsche's R&D work in China. Oliver Blume said, "Li Nan's market insight and professional abilities will accelerate Porsche's product upgrades in areas such as vehicle connectivity and intelligent driving." Oliver Blume added, "We believe that by optimizing the dealership network, strengthening local R&D, and enhancing online service capabilities, Porsche will usher in new development opportunities in the Chinese market."

Industry analysts suggest that layoffs and channel reductions are Porsche's tactical response to the current Chinese market situation, buying time and development space for the brand. It's undeniable that the Chinese automotive market has undergone significant changes, and the era of 'easy wins' for brands like Porsche is over. While 'stalling,' Porsche must swiftly adapt to changes in the Chinese automotive market. We eagerly await its future endeavors.

(Images sourced from the internet. Please remove if infringing upon copyright)