Tariff Increase in First Year Fails to Halt BYD's Export Surge

![]() 12/13 2024

12/13 2024

![]() 696

696

SAIC's exports decline, while Great Wall Motors and BYD's exports show robust growth.

By Lao Xie and Wan Tiannan

In 1978, China's nascent automotive industry, closed off for nearly three decades, extended an invitation to global automakers, hoping they would explore the Chinese market. Later that year, a Chinese machinery industry delegation undertook a comprehensive tour of Europe, including an unplanned visit to Volkswagen Group's headquarters in Wolfsburg, Germany. Subsequently, Volkswagen began negotiations with China for a joint venture.

After arduous six-year negotiations, Volkswagen Group's first joint venture in China, SAIC Volkswagen, was established in Anting, Shanghai, in October 1984. German, Japanese, American, and other joint venture brands subsequently dominated the domestic market. By 2021, these brands accounted for over 60% of domestic auto sales.

Forty years later, in spring 2024, BYD, the world's largest new energy vehicle manufacturer, launched its first auto roll-on/roll-off (Ro-Ro) vessel. The 200-meter-long ship can carry over 7,000 vehicles for export at once. Leveraging technological and cost advantages, China's new energy vehicles have broken into the European market, encroaching on Japanese vehicles' territories in Thailand and Brazil, and impacting local automakers.

In response to the globalization of Chinese automakers, various countries and regions have imposed tariffs. In September this year, the US government hiked electric vehicle tariffs by 100%, and by late October, the EU imposed new tariffs of up to 45.3% on Chinese-made electric vehicles.

Can tariff increases halt the globalization of China's new energy vehicles?

I. Tariff Hikes in the First Year

According to incomplete statistics from "Financial Story Club," since the beginning of this year, multiple countries or regions, including Turkey, Brazil, the United States, and the EU, have raised tariffs on Chinese auto exports. Among them, the EU's tariff hikes have had the most significant impact.

Turkey imposed a 40% tariff on Chinese electric vehicles last year and announced an additional 40% tariff on gasoline and hybrid vehicles in June this year.

Starting from July this year, Brazil imposed additional tariffs of 18%, 20%, and 25% on Chinese-made electric vehicles, plug-in hybrids, and hybrid electric vehicles, respectively, gradually increasing these tariffs to 35% by July 2026.

The most notable tariff increase came from the EU. On October 29, the EU announced tariff hikes of 17%, 18.8%, and 35.3% on BYD, Geely, and SAIC, respectively, and a separate 7.8% tariff on Tesla. For electric vehicle manufacturers not participating in the sampling, an average tariff increase of 20.7% was imposed, including JAC, FAW, Changan, Dongfeng, Great Wall Motors, NIO, XPeng, among others.

It's worth noting that the EU only imposes tariffs on electric vehicles exported from China, leaving export tariffs for plug-in hybrid new energy vehicles unchanged, creating a loophole for automakers like BYD to export plug-in hybrid vehicles.

The United States has taken the toughest stance. In May this year, Biden announced an increase in import tariffs on China, raising the tariff on Chinese electric vehicles from 25% to 100% under Section 301, making it the country with the highest tariff hike on China.

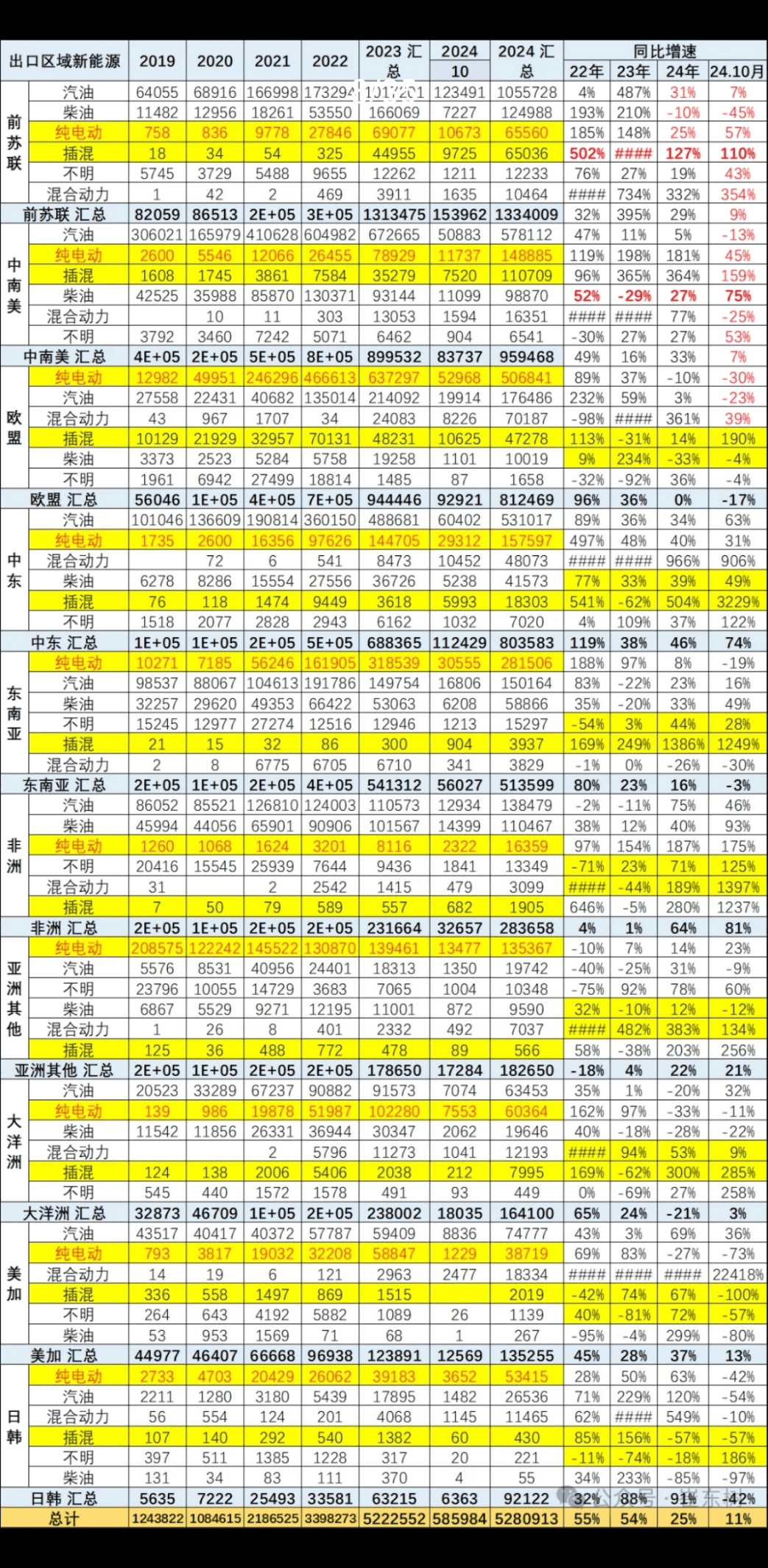

Under the influence of these new tariffs, China's auto exports have been somewhat affected. According to data from the China Association of Automobile Manufacturers, from January to October this year, China's passenger vehicle exports totaled 4.1 million units, a year-on-year increase of 24%, significantly slower than last year's export growth rate of 64%. For new energy vehicles, exports from January to October totaled 1.027 million units, a year-on-year increase of only 6%, a significant slowdown compared to last year's export growth rate of 80%.

Despite the overall export slowdown, there are structural highlights. According to the General Administration of Customs, the export growth rate of pure electric passenger vehicles was 10% from January to October this year, while the export of plug-in hybrids increased by 151%.

Regional export impacts vary. According to statistics from Cui Dongshu, Secretary-General of the China Passenger Car Association, the top five export regions for automobiles from January to October this year include the former Soviet Union (Russia and nine other countries), Central and South America (Mexico, Brazil, Argentina, etc.), the EU, the Middle East, and Southeast Asia. Export volumes were 1.334 million units, 960,000 units, 810,000 units, 804,000 units, and 504,000 units, respectively. Among them, exports to the former Soviet Union region increased by 29%, Central and South America by 33%, the Middle East by 46%, and Southeast Asia by 16%, becoming the main sources of China's export growth, while the EU region's export growth rate was 0%.

In terms of pure electric vehicle exports, major export regions include the EU, Southeast Asia, the Middle East, and Central and South America, with export volumes of 507,000 units, 282,000 units, 157,000 units, and 149,000 units, respectively. Among them, the EU and Southeast Asia are the two largest markets for China's electric vehicle exports, accounting for 37% and 20% of total exports, respectively. From January to October this year, the export growth rate to the EU was 0%, and the export growth rate to Southeast Asia was 8%, both showing significant slowdowns. Although the Middle East and Central and South America achieved growth, the overall new energy export growth rate slowed down significantly.

Overall, due to the EU's tariff hikes, China's auto exports to the EU have declined, particularly for electric vehicles. However, thanks to exports to Russia, Brazil, Mexico, and other regions, overall auto exports have still achieved growth.

II. Similar Directions, Different Paths: Mixed Fortunes

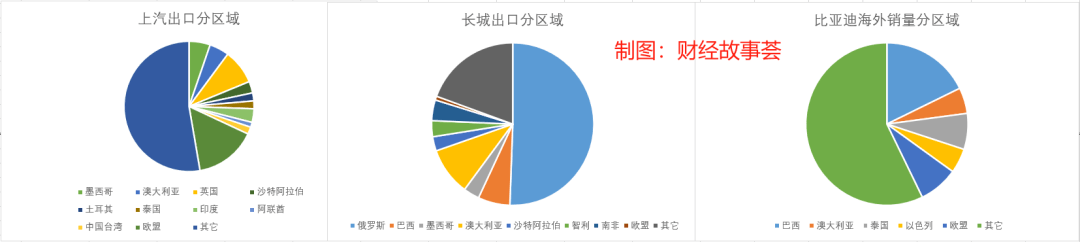

Regional variations in exports impact automakers differently. We compared export data from BYD, SAIC, and Great Wall Motors, representing leaders in new energy vehicles, joint venture brands, and independent brands with substantial export volumes, respectively.

Great Wall Motors has continued to see export growth, benefiting from the Russian market. SAIC's export focus on Europe has been significantly affected by tariff hikes, resulting in a decline in exports. In contrast, BYD has continued to experience high export growth, fueled by surging demand in emerging markets like Brazil and Thailand.

According to data disclosed by Cui Dongshu, from January to October this year, Great Wall Motors achieved exports of 368,600 units. Regionally, exports to Russia, Australia, Brazil, South Africa, and Mexico were 186,000 units, 35,000 units, 24,000 units, and 15,000 units, respectively, accounting for 51%, 10%, 6%, and 4% of total exports. Russia is Great Wall Motors' largest export market, accounting for over half of its exports.

After the Russia-Ukraine war in 2022, foreign brands like Japanese and Korean withdrew, and Chinese automakers quickly filled the gap. In 2023, 1.53 million vehicles were exported to the former Soviet Union region, a year-on-year increase of four times. This year, on a high base, it still achieved a growth rate of 29%. Great Wall Motors, which embraced the Russian market, saw an 82% increase in exports last year and a 49% increase in the first 10 months of this year.

From January to October this year, SAIC's overseas sales volume was 843,000 units, a year-on-year decrease of 11%, affected by the EU's tariff hikes. Regionally, the EU, the UK, Mexico, and Australia were the main export destinations, with export volumes of 129,000 units, 73,000 units, 44,000 units, and 41,000 units, respectively, accounting for 15%, 9%, 5%, and 5% of total exports. Exports from European regions (EU + UK) accounted for a quarter of the total.

BYD's overseas expansion is more diversified, focusing on emerging markets like Brazil and Thailand, with less impact from the EU's tariff hikes. Additionally, the EU only imposes tariffs on electric vehicles and not on plug-in hybrid and hybrid electric vehicles, which somewhat mitigates the impact on BYD's exports.

From January to October this year, BYD's overseas sales volume was 329,000 units, a year-on-year increase of 87%, continuing its high growth trajectory.

BYD's overseas expansion began in 2010, initially focusing on electric buses and other commercial vehicles. Since 2013, the company has pursued a strategy of "electrifying urban public transportation" to penetrate overseas markets with new energy commercial vehicles. Brazil, its largest overseas market this year, was one of the first commercial vehicle breakthroughs. In 2021, BYD's new energy passenger vehicles officially entered the international market, and its sales channels have now spread to six continents and 83 countries and regions worldwide.

With improved sales channels, the models sold overseas have also evolved. In terms of exported models, the Yuan Plus (ATTO 3) had an overseas registration volume of 63,000 units in 2023, making it BYD's best-selling model overseas. As the first "strategic overseas" global model, the Yuan Plus has topped the sales charts for single new energy vehicle models in Thailand, Brazil, Israel, and other places for consecutive months since its delivery.

The Seal and Song Plus follow closely behind. The Seal had a terminal registration volume of 19,000 units last year, while the Song Plus, launched overseas in 2023, had a terminal registration volume of 8,000 units last year. Both are key export models. Overall, BYD has launched a total of nine models overseas, including the Han, Tang, Yuan Plus, Haiou, Dolphin, Seal, Song Plus EV/DM-i, and Haishi 07EV, creating a rich product matrix.

In terms of export countries, BYD's destinations are relatively dispersed. From January to October this year, export volumes to Brazil, the EU, Thailand, Australia, and Israel were 58,000 units, 26,000 units, 24,000 units, 17,000 units, and 16,000 units, respectively, accounting for 18%, 8%, 7%, 5%, and 5% of total exports.

As BYD's largest export market, Brazil received 58,000 exports this year, almost double the number exported to the EU. BYD has been deeply engaged in the Brazilian market for ten years, starting with electric buses and electric coaches. Its sales network in Brazil now includes 39 dealer groups and 100 operating stores, with plans to expand to 250 dealer stores by the end of 2024.

Relatively speaking, BYD entered the European market later, adopting a dual model of self-operated stores and dealer cooperation. The company has partnered with Hedin Mobility, Europe's largest dealer group, which owns over 330 dealer stores and operates in 14 countries, including Germany.

Additionally, BYD has accelerated the construction of self-operated stores in Europe. As of the first half of this year, it has entered 20 European countries, including Germany, the UK, Spain, Italy, France, and the Netherlands, and opened 260 stores.

In summary, Chinese automakers focusing on different markets are willing to experiment and adapt in the trend of going abroad rather than miss out on opportunities.

III. Increasing Overseas Expansion: An Unstoppable Trend

Next year, the auto export industry will face another challenge. On November 25, Trump posted on the social media platform Truth Social that he would impose an additional 10% tariff on all products imported from China on his first day in office and a 25% tariff on products from Canada and Mexico.

Although Biden has already imposed a 100% tariff on Chinese electric vehicle exports, electric vehicles exported from China account for less than 3% of total exports. However, if Trump imposes tariffs on Mexican electric vehicles, it may have a greater impact on Chinese companies. The reason is that a significant portion of China's auto exports involves entrepot trade through Southeast Asia, Mexico, and other regions. In 2023, China exported 415,000 vehicles to Mexico, while local sales in Mexico were 132,000 units, with the remaining 283,000 units being re-exported to nearby markets like the United States. Therefore, if Trump imposes tariffs on Mexican products, it will undoubtedly indirectly affect China's electric vehicle exports.

However, with the highly competitive Chinese market, exports have become essential for leading automakers. Currently, the penetration rate of new energy vehicles in the domestic market has exceeded 50%. After four years of high growth, the new energy vehicle market's growth rate has slowed, and domestic automakers' price competition has intensified. The sudden collapse of Jiyue, the realistic difficulties faced by Nezha, and the high losses incurred by automakers like NIO all demonstrate the harshness of China's new energy market.

In contrast, according to data from the China Passenger Car Association, the global penetration rate of new energy vehicles (excluding China) is only 7%, equivalent to the level before the outbreak of new energy vehicles in China three or four years ago, leaving ample room for growth.

Moreover, profit margins in foreign markets are significantly higher than those in China. Taking BYD's flagship models as examples, their prices abroad are typically much steeper than in China. For instance, the domestic price of the Seal ranges from 149,800 to 249,800 yuan, whereas in the Netherlands, the same configuration starts at 48,000 euros (approximately 370,000 yuan). Similarly, the domestic price of the Yuan Plus ranges from 116,800 to 147,800 yuan, while in Europe, it begins at 35,000 euros (approximately 270,000 yuan). In Australia and Brazil, models like the Yuan Plus are priced 30% to 50% higher than their domestic equivalents.

However, with numerous countries imposing tariffs, the globalization path for Chinese automakers has begun to shift, emphasizing increased localization of overseas production.

Currently, BYD has plans to establish factories in Thailand, Brazil, Indonesia, Uzbekistan, Hungary, and other locations. Earlier this year, a 50,000-unit capacity factory in Uzbekistan commenced operations. In July, a 150,000-unit pure electric and hybrid vehicle production facility in Thailand was completed. Next year, an electric bus, new energy passenger vehicle, and lithium iron phosphate battery factory in Brazil will be finished and commence production. Construction of factories in Indonesia and Hungary is also progressing at full speed.

Great Wall Motors currently has a capacity of 80,000 units in the Russian market, with plans to expand to 150,000 units next year. In Brazil, Great Wall's 50,000-unit capacity will also commence production next year, and plans for local production in European and North American markets are under development, with site selection ongoing.

SAIC was the first to establish a joint venture with Charoen Pokphand Group in Thailand, with a capacity of 100,000 units. Additionally, it operates a 60,000-unit capacity at SAIC-GM-Wuling in Indonesia and recently announced plans to expand factories in Mexico and Europe.

Automakers such as Geely and Chery have also intensified their overseas expansion efforts.