Jiyue's Downfall: Caught Between Baidu's Indifference and Geely's Neglect

![]() 12/14 2024

12/14 2024

![]() 465

465

Good news: Jiyue is trending! Bad news: It's for all the wrong reasons.

Jiyue has finally achieved its highest spike in public attention. On the morning of December 12, CEO Xia Yiping was confronted by hundreds of agitated employees at Jiyue's headquarters, demanding salaries and social security payments. Fearing that he might flee with company funds, some employees shouted, "Leave your passport here!" and "Use your savings to pay our social security!"

On the back wall, the slogan "In the history of smart cars in China, every Jiyue person's name will surely be remembered" now seems bitterly ironic.

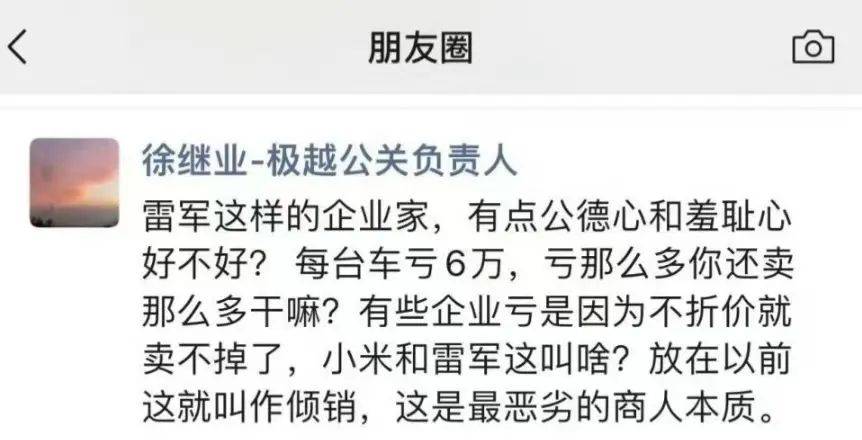

Had it not been for the social media buzz, many would not have even heard of Jiyue. The last time the brand garnered any significant attention was when Jiyue's PR head, Xu Jiye, scathingly criticized Xiaomi's CEO Lei Jun on his WeChat Moments, using the term "dumping" from history textbooks to describe Lei Jun as "the worst kind of businessman."

Clearly, Jiyue was already desperate at that time. Just recently, Xia Yiping had claimed that Jiyue had entered a stable development phase, but now it has imploded.

Many who have recently joined Jiyue or purchased a Jiyue car online now feel a sense of regret – why did they choose Jiyue in the first place?

Whose fault is it?

Jiyue's collapse was sudden.

At the Jiyue 07 launch event in September, Xia Yiping invited Baidu's Li Yanhong, NIO's Li Bin, and CATL's Zeng Yuqun to support Jiyue, while Geely's Li Shufu expressed support through a video message. With new models and endorsements from industry leaders, many believed that Jiyue could catch up.

However, in early December, netizens revealed that Jiyue had initiated large-scale layoffs, with older employees not renewing their contracts and a 40% layoff before the end of the year. Jiyue initially denied these rumors but later changed its tune, with what was expected to be a "startup 2.0" turning into an immediate dissolution.

In addition to employees, suppliers are also demanding payment from Jiyue. On December 11, the self-media outlet "Tech Planet" publicly posted a dunning letter on Weibo, demanding overdue fees of 360,000 yuan from Jiyue Automobile. On December 12, Zhejiang Xingtang Cultural Media issued a public letter demanding 37 million yuan in advance payments for Douyin live streaming advertisements from Jiyue.

Did Xia Yiping know all this beforehand?

According to Huxiu reports, Xia Yiping has recently expressed multiple times internally that Baidu, as the company's major shareholder, would provide support. He also visited Baidu at the end of last month to seek financial support.

But the "lifesaving money" never came, with Xia Yiping attributing the reason to Baidu's reneging on its investment commitment.

Caixin reported that Baidu originally had an investment plan of 3 billion yuan this year but decided not to invest after discovering a 7 billion yuan financial hole hidden by Jiyue during due diligence in October.

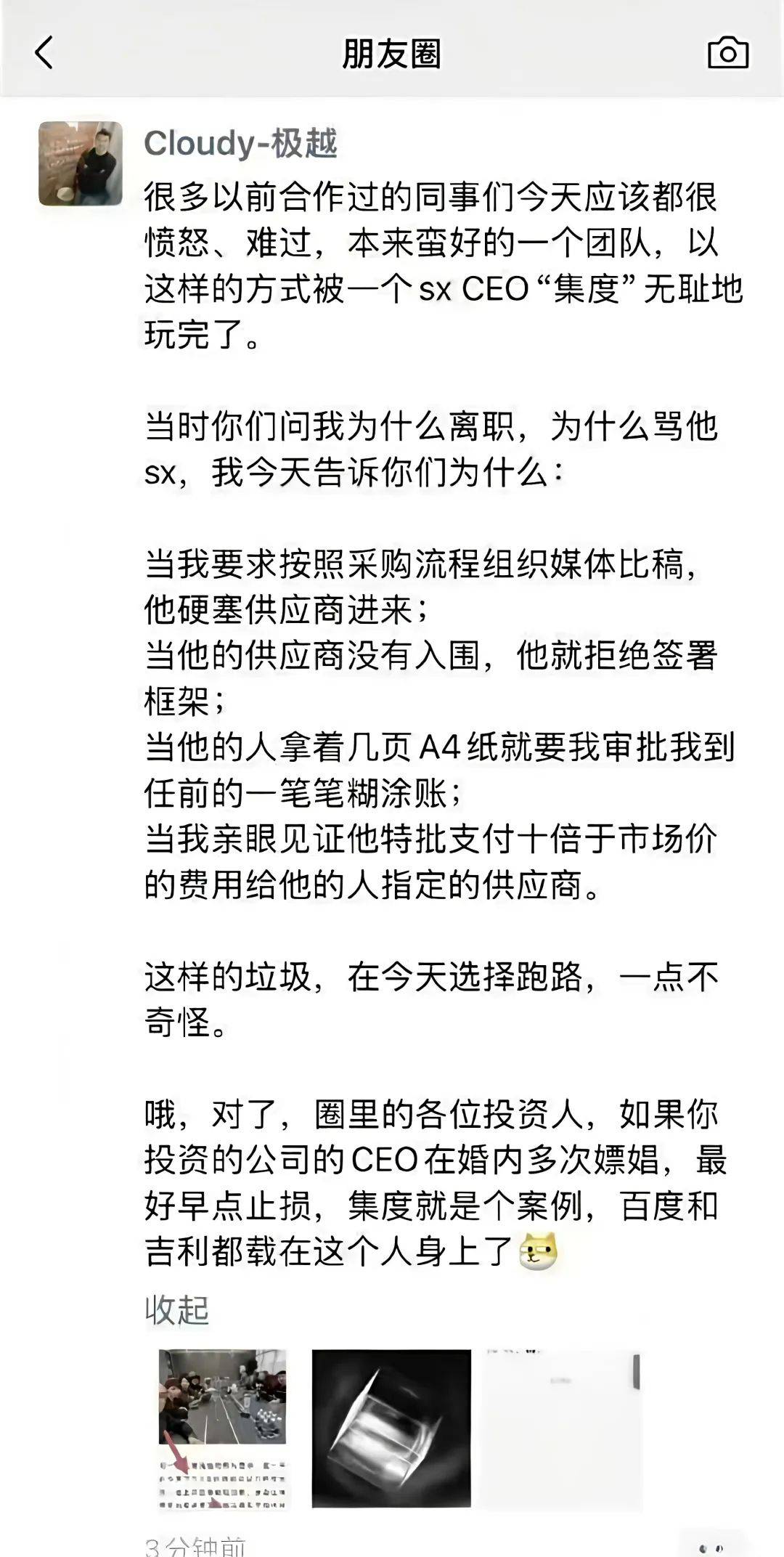

Employees and suppliers have reported on social media that Xia Yiping, the CEO of Jiyue, has immigrated his family overseas, is suspected of corruption, has used the supply chain for personal gain, and that the entire management team spends money too quickly.

So where did Jiyue's money go?

The lack of funds ultimately stems from bleak sales and a lack of self-sustaining capabilities.

Jiyue currently has two models, the discontinued Jiyue 01 and the mid-to-large-sized Jiyue 07 launched in September. The cumulative deliveries of both in the first 11 months exceeded 14,000 units, a nearly bottom-ranking performance that lags behind some new-energy vehicle companies' monthly sales.

Jiyue's November delivery volume reached 2,485 units, which is only a slight improvement. As a new-energy brand also under Geely, Zeekr delivered 27,000 units that month, significantly outpacing Jiyue, while Li Auto delivered 49,000 units at the top.

Regarding the low delivery volume, Xia Yiping previously believed it was due to poor marketing. Starting from January this year, Xia Yiping personally led the marketing team. After the launch of Jiyue 07, he first conducted an 18-hour endurance live streaming test and then a 24-hour intelligent driving live stream over 2,000 kilometers.

This was also questioned by Jiyue employees: "At the beginning of the year, we should not have taken over the sales system and emulated Xiaomi's Lei Jun in live streaming car sales. Instead, we should have found money to keep the company alive."

Xia Yiping also felt wronged: "No one stepped up during the company's toughest times, and neither shareholder (Baidu and Geely) came forward."

Xia Yiping emphasized to people that he is both an angel investor and CEO of Jiyue, but the decision to disband multiple departments was not made by him personally. "I am a minor shareholder, and 80% of the voting rights of this company are held by Baidu. I have decision-making power in business, but not in the company's direction."

So, the question arises: Is it appropriate to blame Xia Yiping alone for a company that has sunk to this level – where are Baidu and Geely?

Who will save it?

On the surface, Jiyue seems to be a brand born with a silver spoon, but the glory only stays on the surface.

When Jiyue Automobile was established in early 2021, it was named Jidu. Baidu, as the leading partner, held a 55% stake, while Geely, as the strategic partner, held a 45% stake.

At that time, Baidu was highly enthusiastic and proposed the concept of an "automotive robot," with Li Yanhong personally promoting it on multiple occasions. Last year, due to issues such as vehicle production qualifications, Baidu retreated behind the scenes, and Geely took control of 65% of Jiyue Automobile's shares, renaming Jidu to Jiyue.

If everything had gone smoothly, Jiyue would have been the pride of being backed by two giants in hardware and software. But one never knows which will come first, the accident or tomorrow.

Now that Jiyue is facing a major collapse, will the two giants step in to save it? From various clues, we find that Baidu is unwilling to continue investing, and Geely is unwilling to take over. Jiyue, born with a silver spoon, has suddenly become an outcast.

For Baidu, Jiyue, although a big hole, is one of the few options.

From the beginning, Baidu positioned itself as a supplier of intelligent driving technology: "Baidu has been conducting autonomous driving research since 2013, and many of its technologies are cutting-edge. When we approach others and say, 'You should take this,' the feedback we often get is to wait for someone else to try it first. Without manufacturing cars, it is difficult to bring our technology to the market."

According to a report by LatePost Auto, a Baidu source said that Baidu's original client automakers, Dongfeng and BYD, have been poached by companies like Huawei and Momenta. The benchmark automaker Weimar, which Baidu once heavily supported, was on the brink of bankruptcy by the end of 2023. Therefore, for Baidu, which urgently hopes to scale up its intelligent driving capabilities, the best option is still to support Jiyue.

This is indeed the case. Yidian Finance has participated in several test ride events invited by Baidu and experienced models equipped with Baidu's intelligent driving technology, such as the Weimar W6, ARCFOX, and Hongqi. When driving in circles on a fixed route with clear traffic signs, occasional misjudgments and unexpected hard braking occurred.

The relevant person in charge of Baidu explained that not all car manufacturers are willing to share their underlying code, which hinders Baidu's ability to deeply empower cooperative vehicles.

In addition, Xia Yiping claimed that Baidu holds 80% of the voting rights on Jiyue's board of directors (the interpretation of this statement needs to refer to the internal agreement possibly reached between Baidu and Geely). Moreover, Jiyue was originally waiting for additional investment from Baidu. It can be seen that Baidu has not completely "abandoned" Jiyue but has ceded control to Geely after encountering obstacles in obtaining vehicle production qualifications, while continuing to empower it in intelligent driving.

However, how to fill the rumored 7 billion yuan financial hole is a problem. During a live streaming event in April this year, Li Yanhong joked while announcing a preferential policy with Xia Yiping, "Don't lose me too much money."

Now, after investing 8.8 billion yuan, Baidu has received low sales volume and significant losses. The key to Jiyue's future lies in Baidu's attitude.

For Geely, an "adopted son" is not as dear as a "biological son."

Geely Automobile has many sub-brands, including Zeekr, Lynk & Co, Geometry, Polestar, Lotus, and smart, covering a wide range of models, energy forms, and high-end to low-end markets. If Jiyue fails to effectively complement Geely's portfolio, Geely will not continue to have high expectations for it.

Moreover, Geely recently released the "Taizhou Declaration," integrating its Zeekr and Lynk & Co brands. The main purpose is to reduce competition and consumption among brands, improve operational efficiency, and concentrate efforts on major tasks.

Geely has clearly realized that having many sons does not necessarily mean more fighting power; it is more likely to lead to internal conflicts. It is not necessary to continue investing too many resources in Jiyue, which has struggled for years and is now deeply in debt.

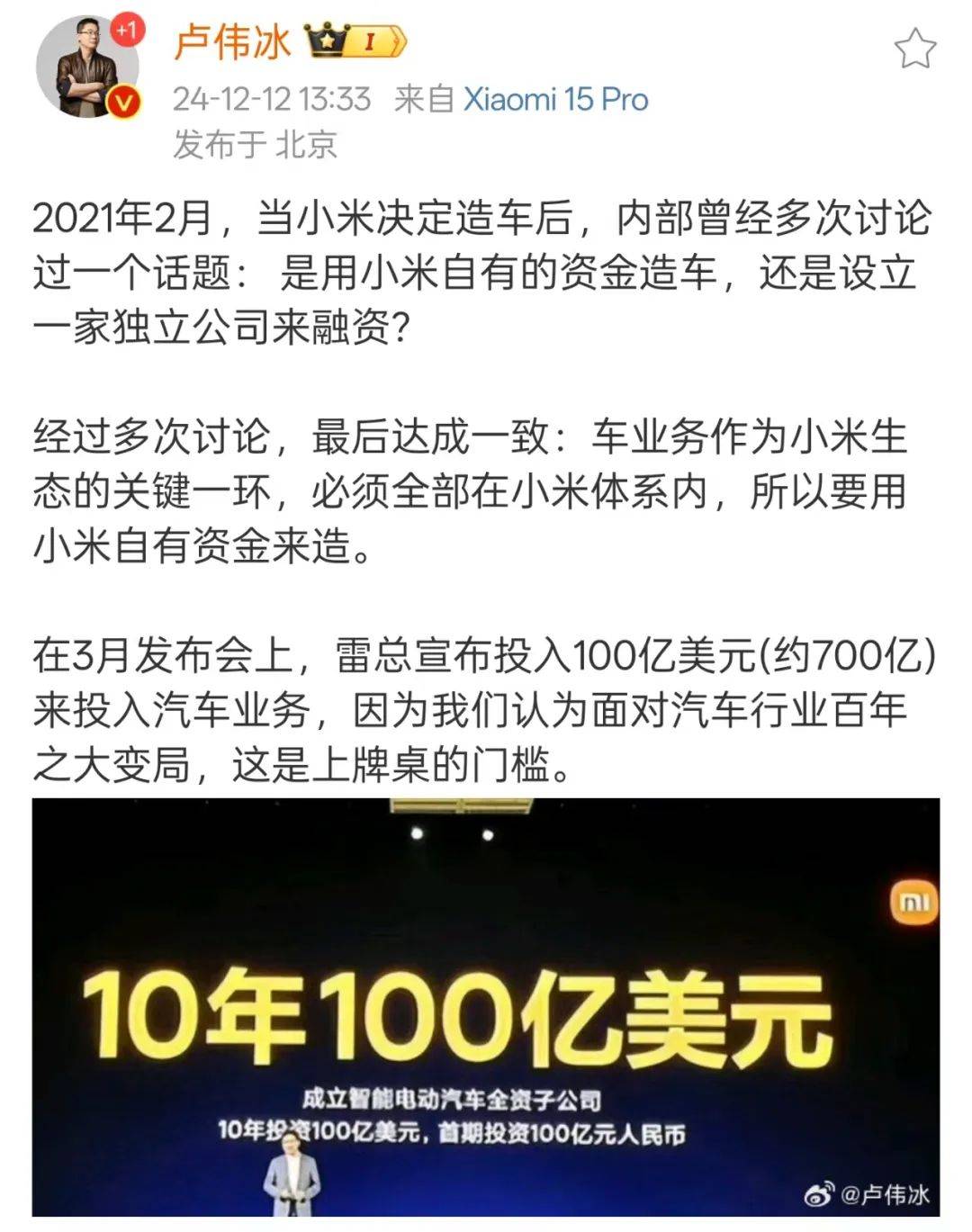

This incident shows that although Jiyue has two decision-makers behind it, when disagreements arise, they cannot be efficiently resolved. Lei Jun avoided this pitfall from the beginning of his car manufacturing journey.

The rise of Xiaomi Automobile is not only supported by substantial investments but also has firm control over the discourse. Lu Weibing, Xiaomi Group partner and president, commented on December 12, "The automotive business, as a crucial part of Xiaomi's ecosystem, must be entirely within the Xiaomi system." "Mr. Lei announced an investment of 10 billion US dollars (approximately 70 billion yuan) in the automotive business."

Jiyue is not Xiaomi. Whether it will have nowhere to go or see a ray of hope in the future depends on how Baidu and Geely negotiate and compete.

Conclusion: The elimination round continues

This year has clearly intensified the elimination round among automakers.

At a critical juncture when the automotive industry is accelerating its transition to electrification and intelligence, new-energy vehicle companies are facing increasingly intense competition, accelerating industry shuffling. The list of candidates for "the next Weimar" is growing.

Li Bin, the founder of NIO, previously predicted, "The most intense and brutal phase of the qualification round for the smart electric vehicle industry has arrived, and only a few outstanding companies will survive in two or three years."

Neta Auto did not announce its sales figures for October and November, accompanied by various negative news such as layoffs, salary reductions, supplier lawsuits, and the departure of CEO Zhang Yong. Now Jiyue is in the same difficult situation. Some bloggers have also revealed that some new-energy vehicle brands have already used inventory vehicles to settle debts, indicating a severe industry situation.

Ironically, both Zhang Yong of Neta Auto and Xia Yiping of Jiyue have unanimously believed that their weak sales are due to poor marketing and have sneered at Lei Jun's strategy of promoting his entrepreneurial IP, failing to see Xiaomi Automobile's insight and investment in user needs.

When Zhang Yong had not yet launched the Neta L, a family SUV model, and the company had not yet gained a firm foothold in the market, he wanted to invest resources in the niche model, the Neta GT coupe. Xia Yiping, whose vehicles have good exterior design and intelligence, insists on "anti-human design" such as button door handles, half-steering wheels, button turn signals, and screen gear shifts, ignoring users' objections.

On October 16, Xia Yiping even boasted in an interview, "If we compare comprehensive intelligence, Jiyue dares to claim first in the industry, surpassing Huawei and Tesla."

This may be a kind of arrogance and stubbornness, but the market is relentless. Once the opportunity to catch one's breath is missed, there will only be regret.

Just like XPeng Automobile, which launched the XPeng MONA M03 when sales were sluggish, precisely targeting user needs with "ultimate cost-effectiveness + intelligence" and making a comeback against the trend.

For Jiyue, cost reduction and efficiency enhancement to seek rescue is a top priority. In the longer term, launching a model widely recognized by the market is the only way to save itself.