"Is it Crazy to Start Making Cars Now?"

![]() 12/16 2024

12/16 2024

![]() 510

510

Introduction

The adage coined by He Xiaopeng, "If you want to harm someone, let them make cars," continues to resonate more profoundly.

"Isn't it crazy to start making cars in this situation?"

Recently, media outlets reported that Wang Junhao, President of Junyao Group, made this remark during a discussion on the landscape of the new energy vehicle manufacturing industry.

This statement naturally raises questions. Just a year ago, Junyao Group, the parent company of Juneyao Airlines, announced its smart mobility technology brand "Juneyao Auto" and unveiled its product philosophy and promotional images of models at the year-start conference. Now, less than a year later, Junyao Group's attitude towards entering the automotive industry has undergone a significant change, which is indeed surprising.

However, considering the dire situation in the new energy vehicle market this year, Junyao Group's shift in attitude towards car manufacturing becomes more understandable.

From HiPhi at the beginning of the year to NIO, and more recently to Nezha and Geely Auto, news of unpaid wages, work stoppages, and even company bankruptcies has emerged one after another. This has not only caused panic among employees, car owners, and suppliers but has also strained the entire automotive market.

Going back four years, nearly 20 new automakers have gone bankrupt. According to incomplete statistics, since 2020, new automakers including Byton, Thalys, Bojiun, Youxia, Yundu, Leiding, Enovate, and Qiandian have successively exited the market.

It is evident that as the knockout rounds in the new energy vehicle industry intensify, the leading automakers are thriving while the eliminated ones are left disheartened. When these two scenarios intertwine in the tumultuous year of 2024, it makes companies considering entering the industry think twice.

Who will be the last to board the train?

In November of last year, Junyao Group announced its entry into car manufacturing and unveiled its product philosophy and promotional images of models at its first aerial conference on January 16 of this year.

Immediately afterwards, on January 26 of this year, Junyao Group revealed the exterior design of the brand's first model, "Juneyao AIR." The official stated, "The new car's name has a dual meaning: It represents Juneyao Auto extending aviation-grade service standards and quality to ground transportation, starting from user needs, we will connect every link in travel to provide users with diversified, one-stop travel services."

This move confirmed that Junyao Group, which was expected to engage in cross-border car manufacturing, had indeed entered the industry.

In addition to Junyao Group, Xiaomi Auto, which decided to manufacture cars 1000 days ago, also welcomed its first deliveries at the beginning of the year. Moreover, Huawei has expanded its portfolio with the arrival of AITO, AITO Smart Selection, Enjoy AITO, and Respect AITO, among others...

It is evident that in recent years, new energy brands have sprung up like mushrooms after rain, and this is no longer a novelty. Even in 2024, there is still considerable enthusiasm for them.

However, why has Junyao Group's attitude towards car manufacturing changed so drastically in just one year? This must be discussed in the context of what has transpired in the automotive market this year.

The first event was HiPhi's bombshell announcement at the beginning of the year.

On February 18, HiPhi held an internal meeting and announced that it would cease production for six months starting immediately. While HiPhi attributed this to a strategic adjustment in its brand and the relocation of stores, the company eventually filed for bankruptcy, leaving more than 10,000 car owners in despair.

WM Motor soon followed with news of burning through 41 billion yuan and multiple executives under investigation, once again leaving the rights and interests of over 100,000 car owners hanging in the balance. Consumers became wary, with voices like "When buying a car in the future, one must consider the brand; otherwise, they may face issues like no after-sales service or difficulties in reselling the car" becoming more prevalent.

Shortly after, Nezha Auto, celebrating its tenth anniversary, saw its birthday joy overshadowed by unpaid wage scandals. Once the sales champion among new automakers, its current plight is lamentable. Before the market buzz around Nezha Auto had subsided, news of layoffs, salary stops, and brand stagnation in GAC Geely's so-called "Startup 2.0 Phase" exploded online, with the reaction of a female GAC Geely livestream host upon seeing company bankruptcy comments becoming an internet sensation.

Perhaps it was the bankruptcies of the aforementioned new automakers that made Junyao Group realize the difficulties of entering the car manufacturing industry, leading to this change.

Therefore, when Wang Junhao, President of Junyao Group, was interviewed at the beginning of this article, he said, "Isn't it crazy to start making cars in this situation?" At the same time, Wang Junhao stated, "Junyao provides marketing and research and development for asset-light operations, designs products with aviation elements, and then commissions automakers for production."

Junyao Group, which had confirmed its entry into car manufacturing, has once again returned to cross-border car manufacturing.

Obviously, initially, many companies saw the market demand and policy support for new energy vehicles and chose to engage in cross-border car manufacturing. Especially for companies facing difficulties in traditional industries, switching to the new energy vehicle industry was seen as an "exit" option.

However, competition in the car manufacturing industry is fiercely intense, and new entrants must face numerous challenges. Many new entrants have limited funds and technical capabilities, putting them at a disadvantage in the market. Additionally, the rapid development of the new energy sector and intense market competition require new automakers to invest heavily in research and development, further increasing the difficulty of car manufacturing.

At this point, Junyao Group's decisive withdrawal from its ambitions in car manufacturing was a wise move.

Meanwhile, companies still intent on breaking into the car manufacturing industry will also reconsider their plans after witnessing the many scandals involving new automakers. After all, the knockout rounds are intense, with few winners and many losers. The value of He Xiaopeng's joke, "If you want to harm someone, let them make cars," continues to rise.

Who will be next?

If you are not in the industry, you may find the current state of the new energy vehicle market quite perplexing. Alongside the disheartened losers are the leading automakers enjoying immense success.

Just how successful are they?

Data shows that from January to November this year, new energy vehicle production and sales reached 11.345 million and 11.262 million units, respectively, representing year-on-year increases of 34.6% and 35.6%. Furthermore, in November, both new energy vehicle production and sales exceeded 1.5 million units for the first time, with a new energy vehicle penetration rate of 52.3% for the month, an increase of 12 percentage points from the same period last year, and exceeding 50% for five consecutive months.

Based on performance in the first eleven months, industry insiders have even stated that if the new energy vehicle market can maintain its momentum in December, annual new energy vehicle production and sales are expected to approach 13 million units, exceeding initial projections... These positive data indicate that China's automotive industry transformation is still accelerating, and the development speed of new energy vehicles continues to increase.

These positive data and optimistic trends, excluding the "negative effects" of the eliminated players, are supported by leading companies.

First and foremost, sales of companies like BYD have soared.

Data shows that as of the end of November, BYD's cumulative sales for the year exceeded 3.74 million units, a year-on-year increase of 67%. BYD thus completed its 2024 sales target of a 20% increase one month ahead of schedule. Moreover, based on the current growth trend, BYD is highly likely to become the world's first new energy vehicle manufacturer with annual sales exceeding 4 million units.

Companies like NIO, XPeng, and Li Auto have established unique brand identities and achieved brand expansion. NIO has incubated a second brand, LeDao, and will incubate a third brand, Firefly; XPeng has incubated MONA; and Li Auto is rumored to be incubating a second brand.

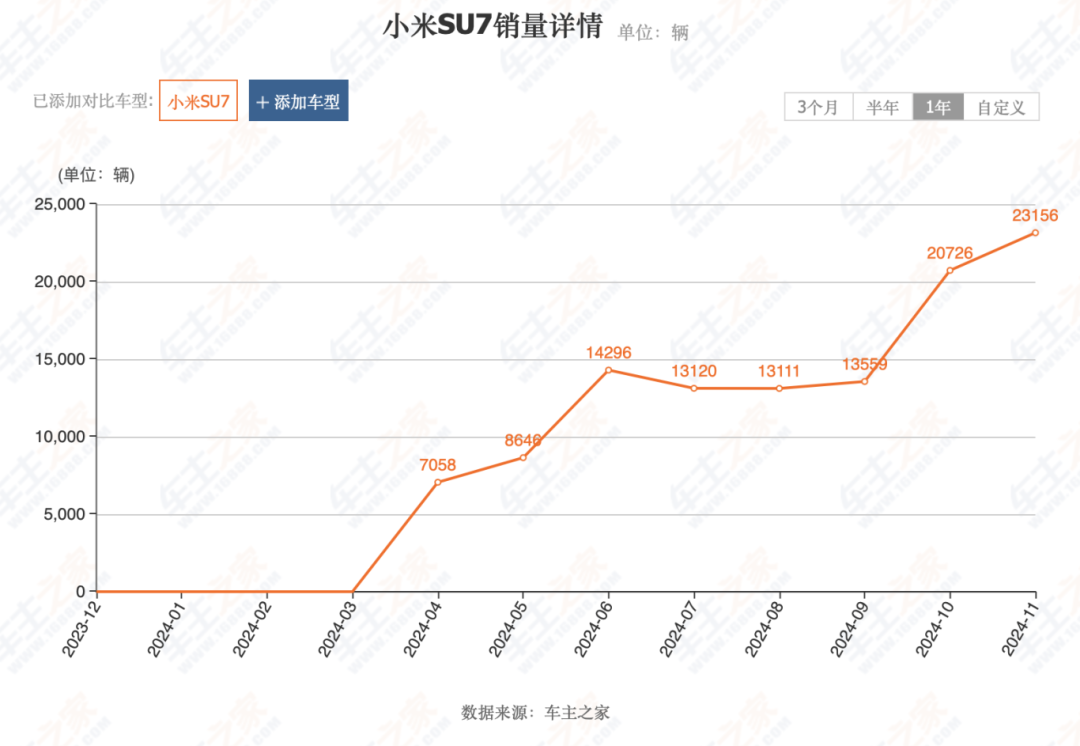

Furthermore, Xiaomi Auto, which adopted a latecomer strategy, has also achieved phased success.

Leveraging Lei Jun's personal charm and the product highlights of Xiaomi SU7, Xiaomi SU7 has sold over 110,000 units since its delivery in April. In November, with sales of 23,000 units, Xiaomi SU7 topped the list of new automakers' sedans for the month and pulled ahead of the second-place finisher by over 10,000 units.

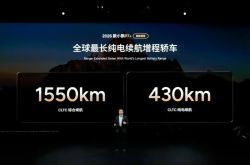

This phenomenal performance has led many industry insiders to comment that only production capacity can limit Xiaomi SU7. It is worth mentioning that Xiaomi's second model has officially been registered with the Ministry of Industry and Information Technology. Named Xiaomi YU7, it is positioned as a mid-to-large SUV and is expected to be officially launched next June, potentially causing another industry shock at that time.

In addition, Huawei has also completed its "Four Realms" deployment with AITO, AITO Smart Selection, Enjoy AITO, and Respect AITO. Among them, AITO has gained fame and become a focus of industry discussion, with highly competitive models under its brand.

Among them, AITO's new M7 has sold over 170,000 units, securing the 2024 sales championship; since its launch in December last year, AITO M9 has received over 180,000 orders, becoming the sales champion among luxury cars in China. In November, it sold 16,000 units, surpassing all BBA models to become the sales champion for vehicles priced above 300,000 yuan.

From product sales to public opinion and traffic, there is no sign of the intense knockout rounds in the new energy vehicle market affecting them.

However, the success of one comes at the expense of many. They are standing on the ruins of HiPhi, WM Motor, and GAC Geely. Meanwhile, no one can predict which company will be the next to collapse, and most companies outside of the leading automakers cannot guarantee their safety. Therefore, not only has Junyao Group shelved its ambitions in car manufacturing, but even Apple has directly abandoned its car manufacturing business.

Back in 2018, that year was recognized as the first year of new energy vehicle manufacturing in the market. Driven by policy subsidies, the number of domestic new energy vehicle brands exceeded 50. Fast forward to 2024, with the market knockout rounds underway, there are only around 20 new automakers left. So, who will be the next batch of eliminations this time next year?