Li Bin's 200 Minutes of Reflection: NIO's Path to Profitability

![]() 12/16 2024

12/16 2024

![]() 752

752

No Price War, Profitability by 2026

Author|Wang Lei, Liu Yajie

Editor|Qin Zhangyong

Yesterday, Li Bin spoke for over three hours at a media briefing, answering over 200 questions and providing a wealth of insights.

He delved into the nuances of electric cars, joint venture cars, and gasoline-powered cars.

Regarding NIO's performance this year, Li Bin awarded it a score of 60 out of 100, with Ledao being a positive highlight. He acknowledged that NIO's current sales growth rate is somewhat concerning but maintained that achieving the goal of doubling sales in 2025 and turning a profit in 2026 is not entirely unrealistic.

Looking ahead to next year, Li Bin anticipates that the penetration rate of new energy vehicles may exceed 75%, but the automotive market will continue to exhibit a delicate balance of prosperity and survival in narrow margins.

'The next two to three years will witness intense competition, akin to a rainy season where cold and warm air clash, resulting in thunderstorms.'

By pursuing multiple strategies domestically and internationally, NIO is determined to achieve profitability by 2026.

01 From One Brand to Multiple Brands

The most significant change at NIO this year has been the introduction of two sub-brands: Ledao and Firefly.

The first Ledao model has already delivered over 10,000 units, and Firefly models are set to be unveiled next week, targeting the international market. In an increasingly competitive automotive landscape, why is Li Bin expanding NIO's operations so extensively?

Li Bin stated, 'We have long aspired to achieve multiple brands, multiple platforms, and multiple regions. Currently, we can confidently say that we possess this capability.' He also joked, 'In response to the call, the state encourages having three brands.'

These three brands can collaborate in various ways, sharing capabilities such as the three electrics, three intelligences, and other advancements in intelligence and electrification. The Ledao L60 can initially be used nationwide with pure vision technology, as NIO has already laid the groundwork.

Similarly, the fourth-generation battery swap stations can support both NIO and Ledao models, and Ledao will have 1,000 swap stations available this month.

Li Bin believes that with three brands working together, doubling sales next year is not unrealistic, especially since both NIO and Ledao will introduce new models, with sales peaking in the fourth quarter of 2025.

However, in terms of product planning, NIO remains committed to pure electric battery swapping and will not consider extended-range or hybrid options.

NIO: Not Cutting Product Lines

As the premium main brand, everyone is most concerned about sales and new products.

Although NIO has delivered over 20,000 units per month for seven consecutive months, this is partially attributed to the Ledao L60. In terms of individual brands, NIO's sales in October and November fell back to around 15,000 units.

Li Bin responded that this was anticipated. 'Because we reduced promotional discounts by at least 10,000 yuan.' However, as of December 11, NIO's test drive volume and order lock-in volume for the NIO brand were the highest in the past six months, with overall sales remaining stable.

The main brand offers a diverse range of models, and some, like the ES7 and EC7, may not have a strong presence. However, NIO does not plan to discontinue these models.

In Li Bin's words, the NIO brand is positioned to meet the personalized needs of different users in the premium market. Some products, although produced in smaller quantities, play a significant role in specific market segments and thus have no reason to be discontinued.

Regarding upcoming new products, the ET9, the first model based on the new NT3.0 platform, marks NIO's official entry into the premium executive vehicle market, with more models to follow.

Li Bin described the car as follows: 'The ET9 effortlessly demonstrates to users where NIO's over 50 billion yuan in R&D expenses have been allocated.'

This model features at least 17 globally debuted technologies and over 50 class-leading features, such as steer-by-wire, FAS (Fully Active Suspension), a 900V high-voltage platform, and the Tianxing chassis.

The ET9 will be launched on December 21 and deliveries will commence in the first quarter of next year, positioning it to break the ceiling for premium pure electric executive vehicles.

'This model will undoubtedly have a favorable gross margin, and selling one will be equivalent to selling many ET5s.' The ET9 has a pre-sale price of 800,000 yuan, targeting executive flagship users, akin to owners of today's Mercedes-Benz S-Class, Maybach, Audi A8, BMW 7 Series, and Panamera.

Li Bin believes that while it may be challenging for the ET9 to sell over 1,000 units per month like the Maybach or Panamera, it will sell more than the BMW 7 Series and Audi A8. 'In the past, it was 7, 8, and S, but in the future, it will be 7, 8, 9, and S.'

Additionally, the 3.0 platform will be fully transitioned next year, but the replacement pace will not be rapid. The 2.0 platform has only been released for a year and remains highly competitive in various aspects.

Ledao: Launching Two Large SUVs Next Year

Compared to other pure electric SUVs launched around the same time, the Ledao L60's performance is not outstanding. However, Li Bin reiterated that Ledao delivered over 10,000 L60s this month and aims to reach a production and delivery capacity of 20,000 units by March next year.

Li Bin believes that although the first month's delivery did not exceed 10,000 units, it was a reasonable ramp-up. If inventory had been accumulated beforehand and deliveries had begun on November 1, the first month's delivery target would have been met.

Moreover, Ledao and NIO do not conflict. Ledao does not occupy NIO's production capacity or steal NIO's customers.

Li Bin revealed that only about 2% of Ledao customers were originally considering buying a NIO. Conversely, some customers who were considering Ledao ended up purchasing a NIO. 'Last month, we sold several hundred cars, some because customers were in a hurry to receive their vehicles, and some because their budgets allowed.'

Furthermore, Ledao has its own sales channels, and its store layout and strategy will differ somewhat. For example, Ledao will not have NIO House Club areas like NIO.

Two new models, a large five-seater and a large six-seater SUV, will be launched next year, with deliveries expected in the third and fourth quarters. The long-range version of the Ledao L60 is anticipated to increase production capacity in January 2025 and be rolled out as soon as possible thereafter.

In terms of battery swapping, Ledao will have about 1,000 available swap stations by the end of this year, growing to 2,000 by April next year.

Firefly: Not Lowering Gross Margin

Unlike NIO and Ledao, Firefly's brand direction is more global, with only one product in China.

However, Firefly will develop models suitable for local markets globally based on local demand. Overseas, Ledao swap stations can be built first, and NIO can then utilize Ledao's swap system, which is the reverse of the domestic approach.

The global small car market exceeds 10 million units, with Europe accounting for 4 million. The market prospects are promising. Additionally, in Li Bin's view, the Chinese small car market, which costs around 100,000 yuan, also lacks a compelling product.

Therefore, Firefly is positioned as a smart electric premium small car: smarter than a MINI and more MINI-like than a Smart. The pricing will be similar to that of a MINI and will not compete with A-segment cars priced at 70,000 to 80,000 yuan.

Firefly's intelligent driving capabilities will be among the best in its class and will not lower NIO's gross margin.

Although there is only one model in China, it will continue to iterate. Firefly models in different global markets will also have their unique distinctions.

For deliveries, lessons will be learned from the Ledao L60 by accumulating inventory before delivery. However, sales expectations for the Chinese market are not as high as 10,000 units.

Firefly will consider NIO's sales and service system but will also have its unique offline service system.

For example, due to its smaller battery, Firefly's swap system is independent, and the deployment cost of swap stations is much cheaper, fitting into a single container.

02 Not Doing Robotaxi, Nor Extended-Range or Plug-In Hybrids

In Li Bin's view, there are only two indicators for intelligent driving: reliability and usability. 'One is reducing accidents, and the other is saving effort.' NIO proposed this standard as early as 2017 and has adhered to it in its product definition and technology roadmap ever since.

Li Bin praised the intelligent driving performance of Xiaopeng and Huawei but also noted that parking-to-parking navigation is not particularly fashionable, with varying opinions. Currently, intelligent driving competition is more about 'verbal sparring,' but Li Bin believes that 'safety comes first in intelligent driving.'

Prioritizing Active Safety in Intelligent Driving

In a recent intelligent driving report, NIO reduced potential safety risks over 190,000 times in November. It will soon roll out multiple active safety features, including two-stage 120 km/h dual-lane continuous avoidance, 80 km/h pedestrian ghost probe avoidance, 130 km/h vehicle lane-change avoidance, and avoidance of rear-end collisions at high speeds from both front and rear.

NIO's ET9 is scheduled for delivery in March, and active safety features will definitely be ready. However, intelligent driving features will take some time as they require thorough testing.

NIO will witness a significant improvement in intelligent driving next year: from a safety perspective, when both human and intelligent driving are involved, it is already over six times safer than driving alone. 'By the end of next year, we hope it will be ten times safer, supported by actual data.'

Next year, NIO will update what is claimed to be the industry's first 'AI large model GOA (General Obstacle Alert)'. Currently, GOA has been upgraded to a forward-facing coverage speed of 150 km/h.

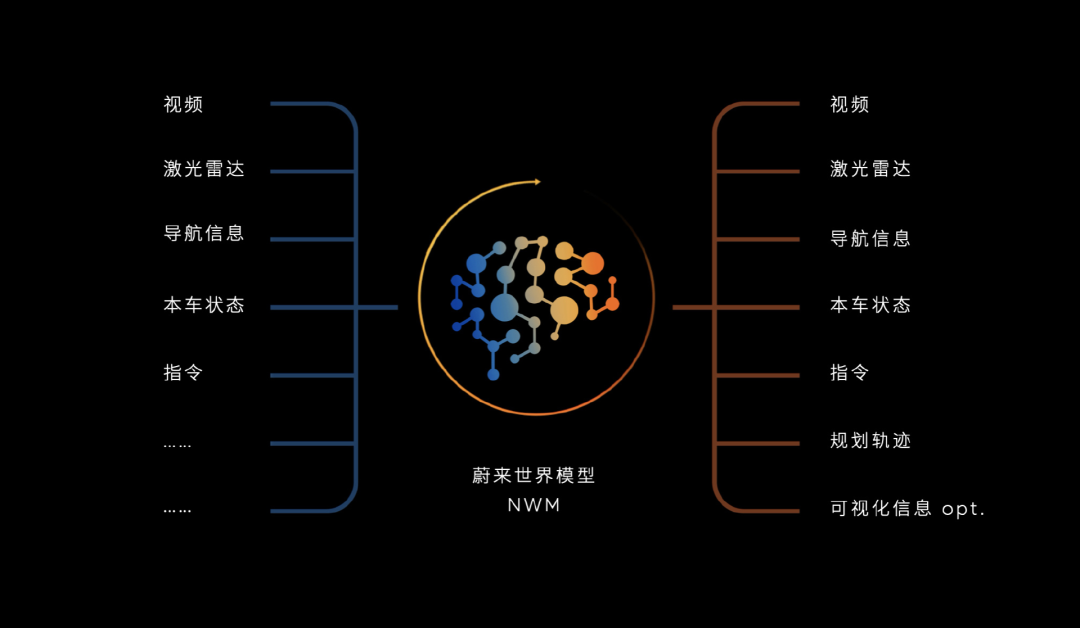

The world model mentioned at this year's NIO Day is essentially an end-to-end active safety function and the foundation for AI-driven intelligent driving. It can generate more relevant training data based on actual data. Currently, the end-to-end functionality of the world model is still in beta testing and will ultimately converge into an end-to-end large model.

Li Bin believes that the dividing line between end-to-end AI capabilities and traditional rule-based capabilities will be active safety.

Besides end-to-end technology, Robotaxi and embodied robots are hot topics this year. Li Bin made his views clear: NIO will not venture into Robotaxi, but he did not reject robots, stating, 'We can explore robots; the technology stacks are similar anyway.'

NIO is also developing its own chips. Domestic substitution is something that every company will arrange reasonably according to its own pace and business rules. Intelligent driving chips are relatively easy to substitute, but basic chips pose more challenges from a commercial viability perspective. If a chip costing 1-2 dollars malfunctions, it may require a recall.

Advised Lei Jun to Do Battery Swapping

Li Bin revealed at the event that he had advised Lei Jun to engage in battery swapping.

In the ten years of NIO, the biggest regret is that battery swap stations should have been built earlier. Starting from 2021, 2,000 stations should have been built annually. If there were 7,000 to 8,000 stations now, they would have greater value and made charging more convenient for car owners.

NIO currently has 2,779 swap stations and expects to exceed 5,000 next year.

According to the plan, NIO will enter a new infrastructure cycle in 2025. With the commissioning of the fourth-generation stations, all 27 provincial regions will have county-level charging and battery swapping coverage by the end of 2025. 'We are very confident.'

Additionally, NIO will achieve county-level battery swapping coverage in Jiangsu before New Year's Day 2025. Currently, NIO is constructing a fourth-generation station in Peixian County, Jiangsu, which will be the last station needed to achieve county-level battery swapping coverage in Jiangsu. The 9 vertical and 9 horizontal expressway battery swapping network will also be completed.

In terms of profitability, 20% of swap stations currently meet the

Li Bin once again emphasized that NIO will not develop range-extended or plug-in hybrid vehicles in China.

"Currently, Tesla and NIO are the only two companies globally producing pure electric vehicles. Indeed, both range-extended and plug-in hybrid vehicles have their merits, and many people still prefer gasoline vehicles today. Different users have varying needs, but each company must make its own choices when selecting a technological path. We have opted for the route of rechargeability, swappability, and upgradability."

03 Lowering Expectations for Overseas Markets

In an internal letter marking NIO's 10th anniversary, Li Bin acknowledged that the most intense and competitive phase of the smart electric vehicle industry has arrived, with only a few outstanding enterprises expected to survive the next two to three years. The subsequent challenge will be a high-dimensional competition. Doubling sales next year and achieving corporate profitability by 2026 are critical, non-negotiable tasks.

He stated at the communication meeting that the current competition is multi-dimensional and comprehensive, extending beyond products, technology, and services.

"Compared to BYD, our growth is too slow."

"Honestly, I'm not entirely satisfied with our current performance." Even after the successful launch of the Ledo, Li Bin gave NIO a score of 60 for this year's performance.

Although NIO's annual growth doubled from 2018 to 2021, its business objectives for the past three years fell short of expectations, lagging behind the initial plan by approximately two years.

"Our annual sales volume reached 160,000 units in 2023, and we anticipate achieving 220,000 units this year. However, compared to companies like BYD, this growth appears sluggish."

Regarding areas for improvement, Li Bin hopes to enhance efficiency and system capabilities, aiming to further boost gross margins.

Next year, NIO will offer models from three brands. Doubling sales would mean achieving at least 440,000 units, with a priority on improving growth quality and gross margins.

"Current NIO is undoubtedly more resilient than it was in 2019," with a healthy operating cash flow. The third-quarter financial report reveals that NIO holds 42.2 billion Chinese yuan in cash, and sales are on the rise.

Based on annual R&D expenditures exceeding 10 billion Chinese yuan, combined with increased sales, revenue is projected to surge by approximately 60% to 70% next year. If gross margins grow steadily and expenses are well-managed, the transition from loss to profit is imminent, as profit and loss often hinge on a delicate balance.

Li Bin noted that losses stem from investments. If NIO ceased investing and deposited most funds in the bank, it could earn interest. "You certainly wouldn't want to see such a NIO."

The primary competitors for Chinese automakers are Japanese and Korean brands.

"I once predicted that by 2030, new energy vehicles would capture 90% of the passenger vehicle market share. Now, I believe it won't take until 2030. It might happen in the next two to three years, or at the latest, by 2027, they will exceed 90%. Next year, the penetration rate of new energy vehicles may surpass three-quarters, marking a significant milestone."

All but a few traditional joint venture automakers will be marginalized, which Li Bin considers unsurprising.

The main competitors for Chinese automakers will be Japanese and Korean brands, but ultimately, "they won't be able to sustain their position." Additionally, he believes China's new vehicle exports may reach 15 million units, accounting for over 40% of the global market share.

Regarding overseas markets, NIO plans to enter at least 25 global markets next year, facing significant challenges like localized deployment and operation. Smart electric vehicles differ from gasoline vehicles, with higher costs and technical difficulties than anticipated, as exemplified by Tesla's FSD. Therefore, "take it one step at a time and cherish every opportunity. Lowering expectations is crucial."

In Li Bin's view, intelligent and connected vehicles are not dominated by a single new technology; instead, operational capability becomes paramount. In this process, Chinese companies will encounter immense opportunities. By 2035, five of the world's top ten automakers should be Chinese, with BYD already among the top five.