Will We Still Need Internal Competition-Driven Price Wars in 2025?

![]() 12/17 2024

12/17 2024

![]() 500

500

Original content from New Energy Outlook (ID: xinnengyuanqianzhan)

Full text: 3630 words, reading time: 9 minutes

Amidst the rapid growth of the new energy vehicle (NEV) industry, the 2024 price war has become a focal point both within and outside the sector. On the surface, consumers appear to be the main beneficiaries, yet tensions between automakers and suppliers, as well as the risk of declining product quality, loom large.

Reflecting on 2024, a total of 195 NEV models in the domestic market adopted price reduction strategies. Plug-in hybrid models saw an average price drop of ¥15,000, while pure electric models witnessed reductions of up to ¥20,000. This not only underscores market enthusiasm but also reveals the intensity of the price war.

To maintain profit margins, automakers have had to implement various cost-cutting measures, placing significant pressure on the supply chain. More worryingly, product quality issues have begun to surface due to cost compression, such as body rust, leading to consumer dissatisfaction.

Looking ahead to 2025, the price war in the NEV market is anticipated to continue. However, with intensifying market competition and diversifying consumer demand, automakers must find new breakthroughs for sustainable development. Technological innovation and service enhancements will ultimately serve as the key to breaking free from the price war's shackles, balancing consumers' demands for 'reasonable pricing' and 'quality assurance'.

1. Unveiling the NEV Market Yearbook

2024 was marked by fierce competition.

According to data from the China Association of Automobile Manufacturers, NEV production and sales hit a new monthly record in November this year, both exceeding 1.5 million units. Specifically, 1.566 million NEVs were produced and 1.512 million were sold in November, up 45.8% and 47.4% year-on-year, respectively, with NEV sales accounting for 45.6% of total new vehicle sales.

From January to November 2024, NEV production and sales reached 11.345 million and 11.262 million units, respectively, up 34.6% and 35.6% year-on-year. Notably, NEV domestic sales share has exceeded 50% for four consecutive months.

Image/Selected Data on NEVs in November 2024

Source/China Association of Automobile Manufacturers, New Energy Outlook screenshot

Recently, the China Electric Vehicle Charging Infrastructure Promotion Alliance released data indicating that as of November 2024, the cumulative number of charging infrastructure nationwide reached 12.352 million units, a 49.5% year-on-year increase; from January to November, the increment in charging infrastructure was 3.756 million units, up 23% year-on-year.

Behind these impressive achievements lies an intense price war in the domestic NEV consumer market, characterized by fierce competition among automakers.

This year, a total of 195 models in the Chinese market have implemented price reduction strategies. Notably, plug-in hybrid models witnessed significant price drops, averaging ¥15,000, with a reduction rate of 8.5%; pure electric models saw even steeper price reductions of up to ¥20,000, representing a 10% decrease.

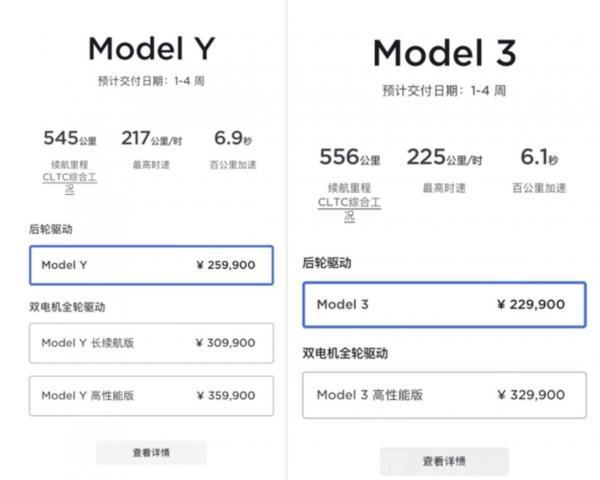

As an industry leader, Tesla sparked a "catfish effect" with substantial price adjustments in the Chinese market earlier this year. On January 1, Tesla announced price reductions for the Model 3 Standard Range to ¥229,900 and the High-Performance version to ¥329,900; the Model Y Long Range was reduced to ¥259,900, and the High-Performance version to ¥288,900.

Image/Adjusted Prices for Model 3 and Model Y

Source/Internet, New Energy Outlook screenshot

This move swiftly ignited market enthusiasm, boosting sales of older models and triggering a chain reaction in the market, with other brands swiftly following suit with price reductions. For instance, XPeng Motors promptly announced price reductions of up to ¥36,000 for the P7i series and up to ¥30,000 for the entire G9 lineup; Li Auto's L7 Pro/L8 Pro models were reduced by ¥20,000 each. Brands like BYD swiftly emulated, introducing multiple cost-effective models and adjusting prices for some existing ones.

According to the China Association of Automobile Manufacturers, sales of Tesla's Model 3 and Model Y in the Chinese market surged 40% year-on-year in the first month following the price reductions. Tesla's price cuts not only attracted a surge of previously hesitant consumers but also compelled competitors to adjust their strategies, driving industry-wide change.

For consumers, the direct benefit of this price war is reduced vehicle purchase costs. Many potential buyers advanced or accelerated their car-buying plans due to the price adjustments. However, some voices caution that frequent price fluctuations may undermine brand stability and evoke negative consumer sentiment.

For example, incidents where owners of older models protested significant price reductions on newly launched models by hanging banners and blocking entrances became commonplace in the NEV market in 2024.

Some car owners mentioned in interviews that while prices have dropped significantly, they are concerned about the potential impact on future vehicle quality, particularly whether parts related to driving safety have been compromised or even substituted with inferior materials to reduce costs. In fact, such concerns are well-founded and have been substantiated by real-life purchasing and usage experiences.

2. When the Nest is Overturned, No Egg Remains Unbroken

The Double-Edged Sword Behind Automakers' Price Wars

As the price war intensifies, the pressure on the supply chain gradually emerges. To maintain profit margins, automakers have had to implement various cost-cutting measures, primarily renegotiating with suppliers to lower parts procurement costs and optimizing production processes to reduce expenses.

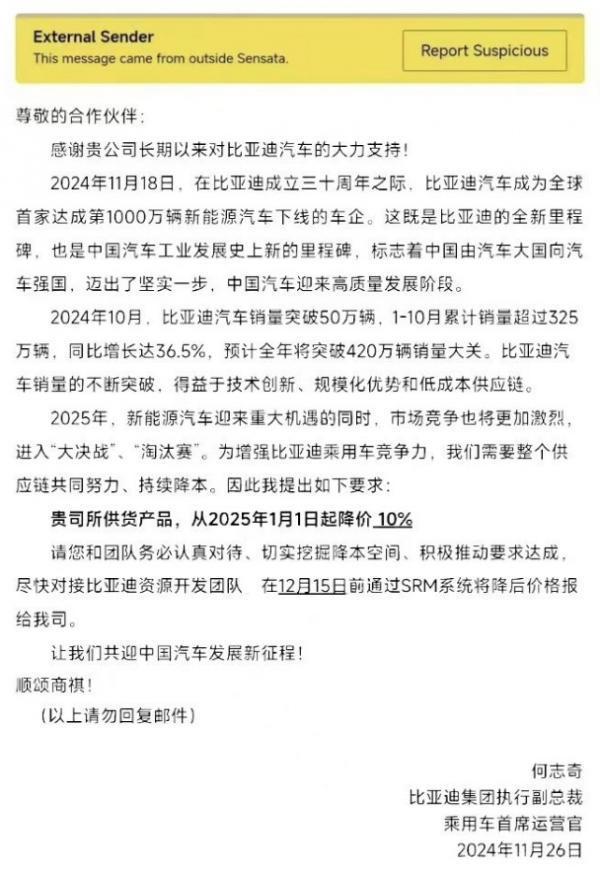

Not all suppliers remain unscathed in the price war. For instance, the recent BYD cost reduction email incident caused quite a stir.

The email, dated November 26, was sent by He Zhiqi, Executive Vice President and Chief Operating Officer of BYD's Passenger Vehicle Business Unit. It stated: "To enhance the competitiveness of BYD's passenger vehicles, we need the entire supply chain to collaborate for continuous cost reduction. Therefore, I propose the following requirement: Your company's supplied products must be reduced by 10% starting from January 1, 2025."

Image/Email Content

Source/Internet, New Energy Outlook screenshot

Industry insiders noted that BYD's payment cycle to suppliers is at least six months, with payment made via commercial bills, adding another six-month cycle. This places significant cash flow pressure on suppliers, and further supply price reductions in 2025 could jeopardize their business viability.

In fact, small and medium-sized suppliers have borne tremendous pressure in this price war, facing issues such as tight cash flow and unstable orders, with some enterprises already experiencing financial crises.

More concerningly, product quality issues have begun to surface due to cost compression. Some consumers have reported issues such as body rust on NEVs purchased within a few months, which not only detracts from the user experience but also raises questions about brand trustworthiness.

Mr. Liu, the head of a radiator manufacturer in Jiangsu, said, "We are constantly being pressed to lower prices, yet raw material costs remain unchanged. Now the company is losing money every month, and I'm unsure how long we can hold on."

Besides supply chain pressure, product quality issues have also begun to emerge.

Mr. Sun (pseudonym), an NEV owner in Zhanjiang, Guangdong, shared his recent experience. His car, purchased less than a year and a half ago, exhibited extensive rust on the body, with four doors rusting and paint peeling. He contacted the 4S store, which proposed leaving the car for grinding to ascertain if the rust had penetrated the metal. If so, they would replace the doors; otherwise, they would repaint them. As an owner, Mr. Sun found this solution unacceptable.

Image/Rust on a Car Door

Source/Internet, New Energy Outlook screenshot

Mr. Liu (pseudonym) also encountered rust issues. He purchased a popular model slightly over a year ago and discovered extensive rust across the entire vehicle, including holes in multiple body structure coverings. After consulting the 4S store, the manufacturer, and undergoing an assessment over half a month, the final solution offered was rust prevention treatment.

According to China Automobile News, complaints about quality issues in NEVs nationwide increased by 20% in 2024. Issues such as body rust, reduced battery range, and charging faults were most prevalent.

Faced with these challenges, industry experts advocate for a focus on long-term healthy development, cautioning against sacrificing product quality and service levels for short-term gains. Professor Zhao Fuquan, Dean of the Institute for Automotive Industries at Tsinghua University, believes, "Price wars can stimulate sales in the short term but are detrimental to the industry's healthy development in the long run. Enterprises should prioritize technological innovation and service enhancement to earn consumers' trust and support."

3. Looking Ahead to the 2025 Price War

Diversified and Differentiated Competition Will Dominate

Looking ahead to 2025, the price war in the NEV market is expected to continue. However, with increasing market competition and diversifying consumer demand, automakers must find new breakthroughs for sustainable development.

Regarding policy guidance, government subsidies may gradually phase out, replaced by non-financial incentives such as charging infrastructure development and the promotion of intelligent driving technology. According to UBS and other institutions, Chinese government subsidies for NEVs may weaken in 2025, and stimulus policies like "trade-ins" and "scrappage replacements" are anticipated to decline, directly impacting automakers' cost structures and compelling them to explore new profit models.

Simultaneously, the government may support the NEV industry through other means, such as optimizing charging infrastructure and promoting intelligent driving technology. These initiatives help reduce consumer usage costs, indirectly boosting sales growth.

In line with the recent Central Economic Work Conference, comprehensive rectification of malicious internal competition will soon be implemented, and the NEV industry is bound to undergo adjustments. The intention is clear: enterprises should prioritize improving product quality over cost and price competition. This prevents profit margins from shrinking and hinders investment in new products or industrial quality upgrades.

Targeting malicious internal competition aims to optimize the market environment, promote high-quality development, and prevent enterprises from falling into vicious competition due to short-term interests, leading to issues like resource misallocation, overcapacity, and inefficient and repetitive construction. The focus is on encouraging enterprises to gain a competitive edge through innovation and technological progress.

Technological innovation is the key to development and will ultimately enable automakers to break free from the price war's shackles.

New battery technologies such as solid-state batteries and hydrogen fuel cells are making rapid progress in research and development, with potential commercial application in the coming years. These advanced technologies can not only enhance driving range but also significantly reduce production costs, providing automakers with greater pricing flexibility. The development of intelligence and connectivity will also be a crucial trend, with the popularization of high-level autonomous driving features adding substantial value to products.

Service enhancements cannot be overlooked. Beyond hardware-level competition, the quality of software and services is becoming increasingly important. A high-quality after-sales service network and convenient, efficient charging solutions will be vital for attracting customers.

For example, Tesla's FSD V12 system showcases the immense potential of autonomous driving; XPeng has released the AI Tianji operating system and plans to achieve L3 and L4-level intelligent driving capabilities in the coming years; NIO has introduced the NIO Power charging service system, offering users free battery swapping services, greatly enhancing user convenience. Many automakers are also considering introducing a "subscription" service model, allowing consumers to flexibly choose configurations and services based on actual needs.

Image/Tesla FSD Autonomous Driving System

Source/Internet, New Energy Outlook screenshot

After the intense 2024 price war, consumers hope for a more transparent and reasonable pricing mechanism, eschewing frequent price fluctuations. Simultaneously, they aspire for enterprises to maintain product quality amidst price reductions, avoiding issues stemming from cost compression. Ultimately, consumers seek reasonable pricing and quality assurance.

It is foreseeable that the new energy vehicle industry will continue to evolve in 2025, driven by the confluence of policy guidance, technological innovation, and market competition. While pricing remains a crucial consideration, sole reliance on low prices is no longer sufficient to sustain long-term competitive advantage. Conversely, enterprises capable of persistent innovation in technology and user experience are poised to excel in this challenging era. By leveraging diversified and differentiated competitive strategies, these enterprises can generate reasonable profits for both upstream and downstream businesses while delivering genuine value to consumers.