Geyue's Explosion Sparks Major Upheaval; The Evolution of New Auto Firms Is a Process of Winnowing

![]() 12/17 2024

12/17 2024

![]() 535

535

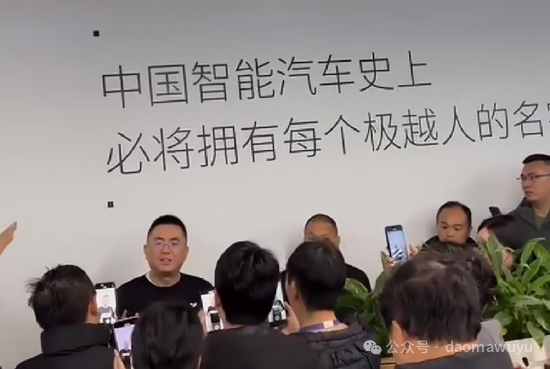

Geyue has erupted in controversy, with numerous live streaming platforms reporting that CEO Xia Yiping was surrounded by employees at the company's headquarters. Relevant live streams from internal staff have circulated online, prompting widespread discussions about the root causes of Geyue's troubles, the technical issues at play, the real crux of the matter, and the industry pressures, including the ultimate trajectory of its development. The discourse has been both eloquent and comprehensive, uncovering all facets of the challenges faced.

Some suggest that Baidu and Geely should "rescue" Geyue. However, from their initial collaboration to Baidu's gradual withdrawal, this was a process of experimentation, and it's impractical to continue funding indefinitely. After all, it would be a bottomless pit. We observe that whether it's Xiaomi, NIO, Li Auto, XPeng Motors, or Nezha, none have attained their current status without the persistent efforts of their founders. Without a core technology of their own and relying solely on external suppliers, service providers, and content creators, even superior technology cannot be implemented without financial backing. Geyue is currently grappling with capital chain issues.

In response, Baidu has shifted its strategy. For heavy asset investments, especially auto manufacturing, the cycle has come full circle. Nowadays, Baidu mirrors Huawei's approach, acting as a content and technology provider rather than an automaker. Although Luobo Kuaipao represents an attempt, it is merely a veiled form of assistance during the early stages of autonomous driving implementation and will not venture into automobile manufacturing in the long run. Baidu's abandonment of Geyue was evident from the initial name change. Rather than heavily investing in total asset businesses, Baidu will continue to fund R&D in autonomous and intelligent driving, a sound development strategy.

For Geely, managing numerous sub-brands has become overwhelming. Early in smart car development, they hoped a "scattershot" strategy might yield promising sub-brands. However, as market competition evolved, especially with rapid changes in pricing wars in the smart car and new energy vehicle markets, the competitive landscape and market structure significantly shifted. Already stretched thin in its primary markets, Geely cannot support numerous sub-brands. This is a common practice of sacrificing less critical aspects to preserve the essential. Geely's internal integration reflects the dramatic shift in the market's competitive environment. Success now demands real investment and sustained effort. In this regard, NIO's Li Bin offers a keen perspective: the industry is in a cutthroat competition.

For many new auto firms, survival is paramount. It cannot be achieved through slogans, concepts, or dreams alone. Geyue's automotive robot concept initially garnered attention, but users prioritize technology, strength, price, and market fit when making purchases. Mass production and sales capabilities are crucial. Tesla initially struggled with mass production but ultimately relied on the Shanghai Gigafactory to resolve these issues. Amidst domestic new energy vehicle market price wars and competition among major manufacturers, new brands find it challenging to secure a foothold. Geyue's issues are not unique.

As Geyue spiraled into "on-site dissolution" chaos, other new auto firms likely felt a chill. Fundraising is difficult for anyone in the current environment. Geyue's three-year development without fully navigating market opportunities suggests it was unprepared to build a competitive moat.

Geely is also accelerating internal integration, merging Lynk & Co. into Zeekr. Geyue's market influence is not a key priority. Leading the smart car 3.0 era is easier said than done. Many new auto firms rush into the market after securing initial funding, lacking sustained capabilities and technical support, especially a robust development trajectory to carve out market space. When capital chains tighten, survival becomes paramount. The market environment is evident: each manufacturer seeks a foundation for growth. Firms lacking solid technology, hardware, and asset support will falter.

In a viral video, Geyue CEO Xia Yiping was surrounded by employees. One staff member shouted, "Use your savings to pay employees' social security." Employees have received November salaries but must self-fund November and December contributions. Geyue plans to retain a skeleton staff; others can resign with N+1 compensation by February or stay unpaid from December, effectively "working for free."

Some believe that if auto firms endure 2024, 2025 will be a pivotal year. The "trade-in" policy has stimulated the market but intensified competition. After investing heavily in intelligent driving and AI, firms must swiftly boost sales and turn profits. This applies to traditional, joint venture, and new auto brands alike.

Recently, Baidu Group Vice President and Intelligent Driving Business Group President Wang Yunpeng posted on WeChat Moments, "We've taken action. Intelligent driving and map navigation are guaranteed. Geyue car owners, rest assured." Geely Holding Group Senior Vice President Yang Xueliang tweeted that Geely will ensure vehicle usability and after-sales service. Both issued a joint statement, pledging as shareholders to assist Geyue's management in handling related matters.