Layoffs and Winter Chill: Why Haven't Home Appliance Giants' 'Car Dreams' Yet Faded?

![]() 12/19 2024

12/19 2024

![]() 473

473

The sharp decline in lithium battery prices has paradoxically emerged as a new catalyst for the growth of the new energy vehicle (NEV) industry.

As the year draws to a close, market fluctuations are keenly observed by all.

Recently, the "cliff-like liquidation" of the new car manufacturing company JiYue stirred up considerable online buzz. Consequently, when Dong Mingzhu recently "announced" her renewed intention to manufacture cars, the "car dreams" of home appliance giants have once again come under the spotlight.

However, the journey isn't easy for home appliance giants either.

As a result, "trade-ins" have become a key growth term for the home appliance market in 2024. According to Ministry of Commerce data, as of 00:00 on December 13, 2024, the overall policy of trading in old consumer goods for new ones has driven sales of related products to exceed RMB 1 trillion. Among these, trade-ins of home appliances have spurred sales of over 49 million units across eight major categories.

However, the driving effect doesn't seem as robust as anticipated.

According to AVC Cloud Data, China's home appliance market recorded a retail sales volume of 614.4 billion yuan in the first three quarters of 2024, marking a year-on-year decline of 0.2%. On a quarterly basis, it stood at 176.7 billion yuan in the first quarter, up 4.3% year-on-year; 239.8 billion yuan in the second quarter, down 8.5% year-on-year; and 197.9 billion yuan in the third quarter, up 7.5% year-on-year.

Midea's CEO Fang Hongbo recently spoke about the "intensity of competition" in the home appliance industry. He said, "We have an internal slogan, 'actively participate in competition, bravely jump out of competition.'" Regarding "competition," Fang Hongbo emphasized, "Don't compete on the floor, break through the ceiling."

In response, netizens joked that the best way to break through the ceiling and actively engage in competition seems to be "car manufacturing." Despite the challenges in the automotive industry, traditional home appliance giants have identified substantial business opportunities and have successively entered the market. They either venture into core components like batteries or start with air conditioning compressors, or collaborate with automakers to develop smart cockpits.

Perhaps, as Lei Jun once remarked, the automotive industry is a century-old race track, and it's never too late to bet on it.

Eight Immortals Crossing the Sea to Forge a 'Second Curve'

Previously, due to significant losses in Silverlon New Energy, Dong Mingzhu didn't reap the rewards of car manufacturing. Consequently, Gree's approach to car manufacturing has shifted, focusing on the field of core components for NEVs.

In 2022, Gree Electric invested 3 billion yuan to acquire DunAn Environment, a leading enterprise in the refrigeration component industry. The company's primary business is divided into two major segments: refrigeration component business, refrigeration equipment business, and new energy vehicle thermal management business. This move signifies the company's intention to venture into the realm of NEV thermal management.

Last December, Gree Electric increased its investment in new energy by acquiring additional shares in Gree Titan. The announcement stated that the company had signed a "Share Transfer Agreement" with 12 transaction counterparties on December 19, 2023, intending to acquire a total of 271 million shares of Gree Titan held by them, accounting for 24.54% of Gree Titan's total share capital. The transaction value was 1.015 billion yuan.

However, as of now, Gree Titan hasn't yet achieved profitability. As of the first half of this year, Gree Titan New Energy's total liabilities amounted to 24.786 billion yuan. Investments from Wang Jianlin and others have essentially gone down the drain.

Recently, Shanghai Gree Automotive Technology Co., Ltd. was quietly established. Its business scope includes technology promotion and application services, such as industrial internet data services, intelligent robot research and development, software development, technology intermediary services, as well as refrigeration and air conditioning equipment sales and manufacturing, and automotive parts research and development.

Some believe that Dong Mingzhu has realized that manufacturing cars isn't necessary to make money. Judging from the business scope of Shanghai Gree Automotive Technology Co., Ltd., it doesn't include automobile manufacturing but rather automobile parts research and development, as well as automobile parts and accessories manufacturing. "By becoming a supply chain enterprise for automakers, providing products like car air conditioners and refrigerators, and earning money from automakers."

However, from an external perspective, Dong Mingzhu's aspiration to manufacture cars stems from the urgent need to develop a "second curve" to expand revenue space amidst the "competition" in the home appliance industry.

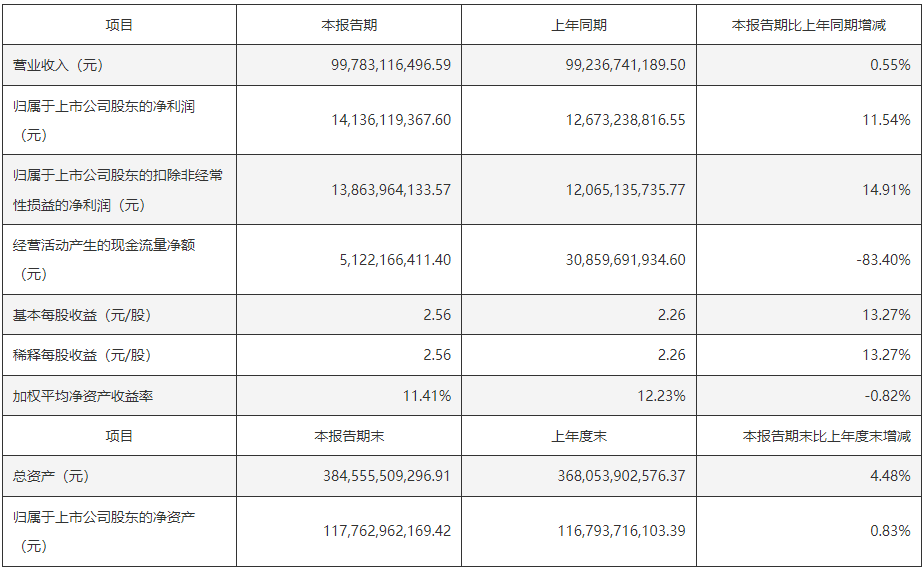

According to Gree Electric's third-quarter report for 2024 released at the end of October, Gree's revenue was 47.13 billion yuan, marking a year-on-year decline of 15.87%; net profit attributable to shareholders was 7.825 billion yuan, an increase of 5.47% year-on-year. In the first three quarters, Gree's revenue was 147.4 billion yuan, a year-on-year decline of 5.39%; net profit attributable to shareholders was 21.96 billion yuan, an increase of 9.30% year-on-year. Gree experienced the second-largest quarterly performance decline in nearly a decade, second only to the 16.40% revenue decline in the third quarter of 2021.

In the industry's view, for all industries related to consumption, revenue growth rate often ranks first, determining a company's dominance and growth space in the market. The decline in revenue further underscores that Gree Electric, which has struggled with growth for over 30 years, is still grappling to develop a "second curve" to expand its revenue space.

It's noteworthy that Gree's performance and market value are both at the bottom among the three major home appliance giants, which is one of the critical reasons why Dong Mingzhu must propel Gree into the ranks of traditional home appliance car manufacturing newcomers.

Another leading home appliance company, Midea, also ventured into the automotive industry early on.

As early as 2003, Midea attempted to acquire multiple commercial vehicle companies and established bus production bases in Kunming and Changsha, but ultimately withdrew from vehicle manufacturing in 2009 due to poor management, instead investing in the production and research of components like motors and automotive air conditioning compressors.

In 2017, Midea acquired a majority stake in KUKA, a leading industrial robot supplier; the following year, Midea established Welling Auto Parts Company, primarily producing components such as drive motors, electronic water pumps, electronic oil pumps, electric compressors, and power steering motors.

In December 2020, Midea restructured its overall business framework from the original four segments into five, with the electromechanical business group involved in automotive parts products becoming one of the newly established business segments for the first time.

Midea is currently focusing on three areas: electric drive, thermal management, and chassis execution systems. It has become a supplier to new car manufacturing forces such as NIO, Xpeng Motors, and Li Auto, and traditional automakers like JAC have also partnered with Midea.

Fu Yongjun, Vice President of Midea Group and President of the Industrial Technology Business Group, also said in an interview, "From home appliance parts to automotive parts, the products and markets differ significantly, posing indeed great challenges. We have chosen incremental components produced during the electrification of automobiles. These are novel products for the automotive industry suppliers, but we are technically more adept at these components than they are."

While Midea doesn't manufacture cars, it has essentially joined the automotive supply chain. With "refrigerators, color TVs, and big sofas" becoming standard equipment in NEVs, coupled with the energy storage business, Midea doesn't manufacture cars but can still generate considerable revenue from the automotive sector.

Home Appliance Giants Decide to Make a Comeback

Unlike Gree and Midea, Haier, despite denying the launch of its own branded cars, has long been involved in the automotive field, focusing more on the automotive supply chain and rapidly expanding its presence in the used car market.

Currently, Haier has deeply invested in the used car market through its automotive industrial internet ecosystem platform brand, CarTimes. It has established an automotive ecological network in over 30 cities such as Zhengzhou, Shanghai, Wuhan, and Qingdao.

But why did Haier Group choose to enter the used car market?

Jiang Han, a senior researcher at the RDIC, said, "The used car market is a vast market with enormous growth potential. Through multi-dimensional deployment, Haier Group can fully leverage its advantages in brand, technology, capital, etc., swiftly enter the market, and realize resource sharing and complementary advantages. Additionally, Haier Group also hopes to further broaden its business scope, enhance brand influence, and achieve diversified development by venturing into the used car sector."

Some industry insiders also believe that the used car business might just be a stalling tactic for Haier to enter the booming automotive industry. Haier also possesses certain advantages. For instance, Haier has robust capabilities and resources in branding, service, and standardization, which can mitigate the chaos in the used car market.

However, Haier's ultimate goal lies in the intelligent ecosystem of automobiles.

Compared to Haier, Gree, and Midea, another home appliance giant, Skyworth, pays more attention to the layout of vehicle manufacturing.

As early as 2010, Skyworth's founder Huang Hongsheng established King Long New Energy Automobile in Nanjing, acquiring and reorganizing Nanjing Golden Dragon Bus, quickly entering the commercial vehicle sector, expanding from minibuses to logistics vehicles, special vehicles, trucks, batteries, parts, and other fields.

In 2017, King Long obtained production qualifications for passenger vehicles and later launched the Skywell auto brand in 2019; the first model, the Skywell ET5, was introduced in October of the following year.

In April 2021, Skywell Auto was renamed Skyworth Auto, and the Skywell ET5 was subsequently renamed Skyworth ET5 and Skyworth EV6 for launch. However, Skyworth Auto's market performance has been unsatisfactory. In 2023, Skyworth Auto sold only 18,600 vehicles throughout the year, achieving only 46% of its annual target.

The outlook for Skyworth Auto isn't promising. In the view of most people, the primary reason is that its products lack core competitiveness. For instance, in terms of core technologies like the three-electric system, autonomous driving, and smart cockpits, Skyworth Auto has little to offer, with neither self-developed results nor promotional highlights. Moreover, Skyworth Auto's marketing strategy of promoting "health care" as a selling point has been widely questioned.

In summary, the traditional home appliance market is becoming saturated and fiercely competitive. Without exploring new business boundaries and growth points, it will be challenging to maintain stable operations. With the advent of the era of smart NEVs, there's significant interaction and integration between cars and mobile phones. Home appliance giants believe that the time has come to re-enter the automotive industry.

Particularly after the launch of Xiaomi's first model, the Xiaomi SU7, which leverages the same group's ecosystem to interact with Mijia smart home appliances, enabling functions like remote control of home appliances, traditional home appliance manufacturers have glimpsed the prospects for cross-industry collaboration between smart cars and home appliances.

However, despite the commonalities between home appliances and automobiles, they are ultimately two entirely different industries.

Automobile manufacturing is a highly complex and capital-intensive industry, vastly different from the realm of electronic consumer goods familiar to traditional home appliance giants. From research and development, production, to sales and after-sales service, the automotive industry chain is extensive and has many links, requiring substantial investment in capital, technology, and talent.

Furthermore, the requirements for safety, reliability, and durability of automobiles are much higher than those for electronic products. Traditional home appliance giants need to establish a robust research and development and quality control system in these areas.

Twenty years ago, there was a wave of "car manufacturing fever" in the home appliance industry. Companies like Midea, Chunlan, Xinfei, and Green Cool all participated, but most of them ultimately failed. Now, a new batch of home appliance giants has decided to make a comeback, and their determination is even fiercer than in the previous round.

Note: Some images are sourced from the internet. In case of infringement, please contact us for removal.