"Racing" to Recruit Tesla's China Factory Director

![]() 12/20 2024

12/20 2024

![]() 471

471

Introduction

It's a pity that the factory director will no longer be involved in car manufacturing.

The director of Tesla's China factory, the world's leading automaker, has recently resigned.

On the evening of December 18, media outlets reported that Song Gang, Tesla's former vice president of manufacturing and director of the Shanghai factory, had stepped down. According to two sources familiar with the matter, Song Gang plans to join a local emerging automotive brand currently grappling with production capacity constraints.

Following the news, it's unclear whether new-energy vehicle makers are feeling the pressure, but netizens and media outlets, including Auto Union, are eager to "snatch" this key figure from Tesla China for the automakers.

The current production capacity dilemma faced by new-energy vehicle makers is obvious to all. Song Gang, who once led a team to achieve local production of the Model 3 within a year, is now a "free agent" and will undoubtedly be a hot commodity that new-energy vehicle makers will compete for.

On the evening of the 19th, while discussions about "racing" to recruit Tesla's China factory director were at their peak, another media outlet broke the exclusive news that the company Song Gang was joining was actually Envision AESC.

Upon hearing this news, while congratulating Song Gang and Envision AESC, I couldn't help but sigh for the new-energy vehicle makers. Losing such a talented individual amid production capacity bottlenecks is undoubtedly a great loss.

On one hand, the prophecy that "there will only be 5-10 automakers left globally/in China in the future" is beginning to come true. Whether it's the recent passive move by Japanese automakers to seek mutual support or the accelerated reshuffling of the domestic auto market, both are precursors to the fulfillment of this prophecy.

Once the prophecy comes true, the next obstacle hindering the development of automakers will undoubtedly be production capacity. Whoever breaks through this bottleneck will gain a head start in the next reshuffling of the auto market.

On the other hand, signs of production capacity bottlenecks have already emerged. The dilemma of insufficient production capacity has been played out repeatedly among new-energy vehicle makers. It's no exaggeration to say that new-energy vehicle makers have long suffered from this issue.

"Sometimes what is not real contains more truth than what is real."

Although the news that "Song Gang has joined a local emerging automotive brand facing production capacity bottlenecks" may not be true, the production capacity dilemma faced by new-energy vehicle brands reflected behind it cannot be ignored.

One factory in a year, three million cars in five years

Compared to other automakers, Tesla's production capacity issues are not as painful, largely thanks to its Shanghai Gigafactory.

In terms of commissioning speed and production scale, Tesla's Shanghai Gigafactory truly lives up to its name.

Let's start with commissioning speed. In October 2018, Tesla acquired land in Lingang, Shanghai; in January 2019, Tesla held a groundbreaking ceremony for its Shanghai Gigafactory; in September 2019, the factory passed inspection; and by the end of December of the same year, domestically produced Model 3 vehicles were officially delivered to employees and customers at the Shanghai factory.

From land acquisition to inspection, from groundbreaking to delivery, the Shanghai Gigafactory took less than a year for each phase, showcasing an astonishing speed.

Equally astonishing is the nearly manic ramp-up speed and efficiency of the Shanghai Gigafactory.

On August 15, 2022, Tesla's Shanghai Gigafactory announced that its millionth vehicle had rolled off the production line. It took the factory just 33 months to go from zero to one million vehicles, making it Tesla's most productive Gigafactory ever.

Since then, this timeframe has been significantly shortened.

In September 2023, Tesla's Shanghai Gigafactory produced its two millionth vehicle, taking just 13 months to go from one million to two million vehicles;

In October 2024, less than five years after the factory's commissioning, Tesla's Shanghai Gigafactory produced its three millionth vehicle.

"What makes a company successful is not the product itself, but the ability to manufacture it efficiently." As Elon Musk has repeatedly emphasized, Tesla's Shanghai factory is particularly efficient in production.

Tesla's Shanghai Phase II factory has become the most efficient and highest-quality factory globally in terms of production lines, with a localization rate for components exceeding 95%.

According to Tesla's Q3 2023 financial report, the production capacity of the Shanghai factory increased to 950,000 vehicles per year, meeting nearly half of the global demand and producing a vehicle every 30 seconds on average.

In the first three quarters of 2024, Tesla delivered approximately 1.3 million vehicles in total, with the Shanghai Gigafactory delivering 675,000 vehicles, accounting for more than half. In March of this year, Tesla surpassed the milestone of producing 6 million electric vehicles, with the Shanghai Gigafactory contributing nearly half of this production capacity.

Man makes his own destiny, and the astonishing production speed of the Shanghai Gigafactory is largely attributable to Song Gang, its first employee and director.

The position of director of the Shanghai factory is the most crucial role in Tesla China after Zhu Xiaotong, overseeing both phases of the Shanghai factory, as well as the battery and motor plants. According to sources familiar with the matter, Song Gang's resignation signifies that those who initially helped Tesla establish the Shanghai factory have completed their historical mission.

Now, Song Gang has parted ways with Tesla on good terms and may join Envision AESC. Although the rumor of him joining an automaker facing bottlenecks has been debunked, the production capacity bottleneck faced by automakers cannot be ignored.

Will those who gain production capacity rule the world once the prophecy comes true?

The competition in the global auto market is undoubtedly fierce. In the future, only a handful of players are likely to remain at the table.

Once this happens, the focus of future competition will inevitably shift to production capacity.

In an auto market where consumers are increasingly dominant, few car owners are willing to wait several months for a specific vehicle, except for those from a few companies with strong brand charm and loyalty.

In an era where "speed" is increasingly valued, patience is a scarce commodity. When automakers' production capabilities fail to meet users' immediate needs, they may only be left with the sight of consumers turning their backs and leaving.

NIO, on the brink of collapse, once had a glimmer of hope.

Within 35 days of its launch on April 22, the NIO L had secured 30,000 orders. However, in the full sales month of May, only 3,732 NIO L vehicles were delivered.

With conservative sales forecasts, unsustainable cash flow, and a fraught supply chain, even with a large number of orders in hand, NIO could only sigh in frustration.

"If the L had been launched first, would the outcome have been different?" The unresolved question from NIO employees will never be answered.

Amid the intense price war, the sales volume corresponding to automakers' break-even points is bound to rise.

In 2018, Shen Hui, chairman of WM Motor, also made a similar judgment, stating that new carmakers couldn't survive if their annual sales volume didn't reach 100,000 units.

In 2023, Zhu Jiangming, chairman of Leap Motor, predicted that when the company's sales volume reached 500,000 units, it could achieve positive net profit margins through economies of scale; Li Bin, chairman of NIO, believed that "in the long run, an annual sales volume of 2 million units is the lifeline, and it will be difficult to survive if this threshold is not met." He Xiaopeng, CEO of XPeng Motors, set the threshold for advancement in the next decade at 3-5 million units.

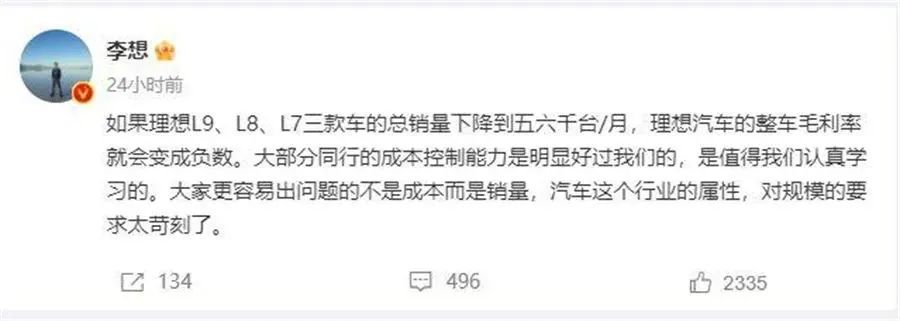

In May 2023, Li Xiang, CEO of Lixiang One, posted on social media, expressing his sentiments: "The auto industry's requirements for scale are too demanding."

Success hinges on scale, and so does failure.

The pressure from supply-side costs and the market's low-price orientation put tremendous pressure on automakers. A good solution to this dilemma is the economies of scale adopted by BYD and Tesla: winning by volume.

Undoubtedly, the battle for scale has already begun, and sales volume and production capacity will undoubtedly become the next decisive factors at the next turning point in the reshuffling of the auto market.