Foxconn's Automotive Dreams Dashed by Japanese Automakers' Alliance

![]() 12/20 2024

12/20 2024

![]() 512

512

Introduction

Faced with the imperative of transformation, Foxconn cannot remain rooted in its traditional role. The company's chronic issues and lack of a solid foundation in automotive manufacturing heighten the risks associated with its ambitions.

Foxconn, the world's largest contract electronics manufacturer and primary assembler of Apple products, may still evoke images of "sweatshops" for many readers, with its leader often remembered from the era of founder Terry Gou.

However, since the succession to Young Liu, Foxconn has striven to forge a more diverse identity beyond being merely an "Apple assembler." In recent years, with the rapid evolution of the new four modernizations and the convergence of automotive and electronics industries, Foxconn has frequently ventured into the automotive sector, aiming to secure a prominent position in the burgeoning electric vehicle market.

Recently, news of Honda and Nissan's business integration swiftly garnered headlines. Faced with fierce external competition, these two Japanese automakers have joined forces to navigate challenges in unison. Meanwhile, Japanese media outlets like The Nikkei have shed light on the rationale behind their decisive action—

Behind this historic large-scale reorganization lies Taiwan's Hon Hai Precision Industry (Foxconn's parent company). It turns out that the perpetually aggressive Hon Hai had long had its sights set on Nissan, which was grappling with cash flow difficulties and poor management, and had been covertly plotting its next move.

Had Hon Hai's plan materialized, Nissan's operational control might no longer have remained in Japanese hands, and a series of cooperation agreements between Honda and Nissan would have been rendered null and void. Upon detecting this ambition, Nissan and Honda promptly convened emergency meetings and resolutely united in the face of adversity.

United to Shatter Hon Hai's Ambitions

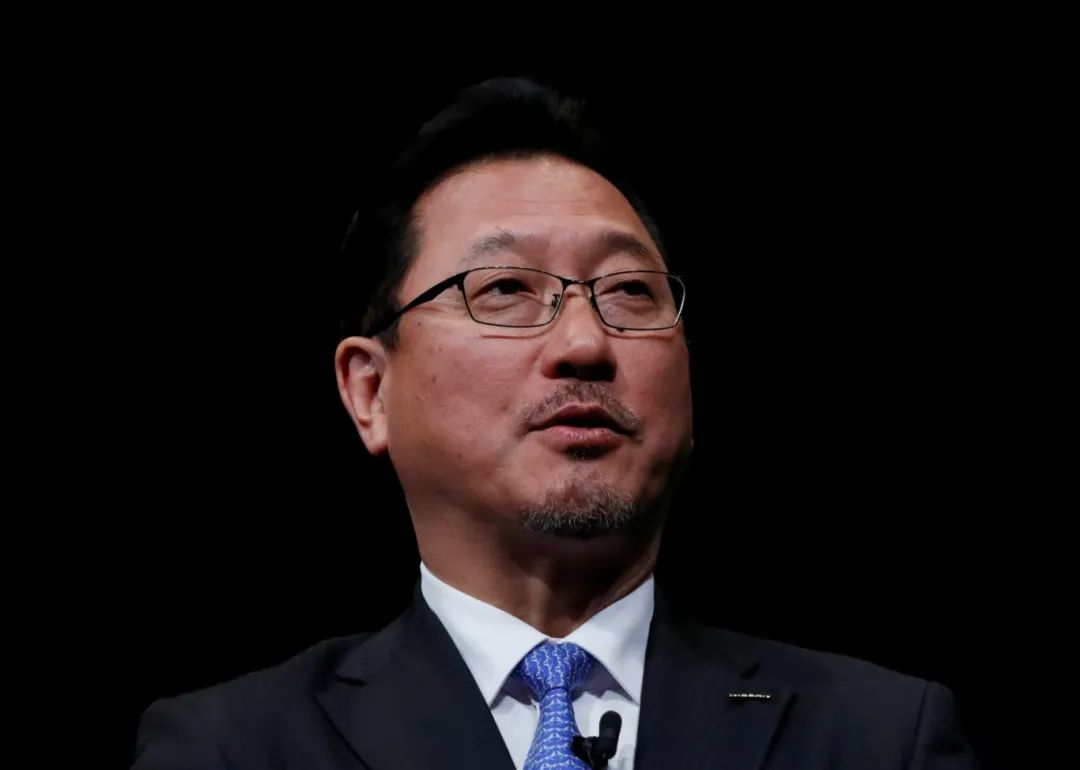

A pivotal figure here is Jun Seki, Chief Strategy Officer for Electric Vehicles at Hon Hai Group.

After Carlos Ghosn's arrest, Nissan formed a management team comprising CEO Makoto Uchida, COO Ashwani Gupta, and Deputy COO Jun Seki. In late 2019, Seki chose to depart and took up the position of CEO at Nidec Corporation.

However, Seki's tenure at Nidec was not without challenges, and he joined Hon Hai Group in 2022, concurrently serving as CEO of the group's MIH EV Open Alliance this year. Interestingly, Seki also faces pressure at Hon Hai, as the previous leader of the MIH Alliance was Cheng Hsien-Chung, known as the "godfather of the automotive supply chain." Following his departure, Hon Hai's plan to "launch three car models in three years" was temporarily shelved.

Shouldering KPIs, Seki must devise a strategy.

The Nikkei revealed that Seki bears a heavy responsibility, as the group has tasked him with achieving the long-term goal of securing a 40% market share in the global electric vehicle market. To meet his KPIs, Seki has targeted his former employer, Nissan, investing in the company to gain valuable manufacturing experience and global sales access.

How exactly will this be executed?

Back in 1999, Renault acquired a stake in Nissan and became its largest shareholder. For a long time, Renault held a 43.4% stake in Nissan with voting rights, while Nissan held a 15% stake in Renault without voting rights. This imbalance in capital structure has been a source of tension in the Renault-Nissan alliance.

This time, Hon Hai has set its sights on the Nissan shares held in trust by French bank BNP Paribas on behalf of Renault. In 2023, the capital relationship between the two companies was readjusted, with each holding a 15% stake in the other. Simultaneously, Renault temporarily transferred some of its Nissan shares to the trust bank in France in stages for sale.

Japanese media revealed that Renault still holds 22.8% of Nissan's shares in trust, and Hon Hai believes that acquiring these shares could interfere with Nissan's operations.

Nissan has detected Hon Hai's maneuver and is privately discussing countermeasures against the potential takeover. Facing operational challenges, Nissan hopes to avoid Hon Hai's involvement in its management.

If Hon Hai's plan succeeds, it will be a significant loss for the Japanese automotive industry. Both Nissan and Honda are particularly vigilant about Hon Hai's every move. For Honda, which has signed a series of cooperation agreements with Nissan this year as part of its long-term technical collaboration strategy, Hon Hai's interference would set their cooperation plans back to square one.

As mentioned in our article "Nissan and Honda Merge: Good News or a Wake-up Call?", Japanese companies have a history of internal integration. From the "non-aggressive price competition" between Toyota and Nissan in the 1960s to the mutual aid structure of the "six major financial groups" (Mitsubishi, Mitsui, Sumitomo, Fuji, Sanwa, and Dai-Ichi Kangyo), reducing internal friction and uniting to help each other has been a tradition in Japanese business. Nowadays, with intense competition in the automotive industry, Japanese automakers are increasingly turning to mergers as a common strategy for self-protection.

Faced with Hon Hai's covert efforts and Seki, who has served Nissan for over 30 years and is intimately familiar with its operations and management details, Japanese automakers have embarked on the most daring negotiation attempt—a merger between Nissan and Honda to jointly defend against this wave of industry transformation and external threats.

Dream of Making Cars, Repeatedly Thwarted

'Push Taiwan's electric vehicle industry to the world.'

This seemingly motivational slogan was once set by Liu Young-way, Chairman of Hon Hai Group. In 2019, after taking over as leader, he initiated internal reforms, transforming Foxconn's business strategy into a "3+3" model, actively entering the three emerging industries of electric vehicles, healthcare, and robotics, and seizing the emerging technologies of artificial intelligence, 5G, and semiconductors.

However, Hon Hai Group's decade-long dream of manufacturing cars has either been superficial, half-hearted, or derailed by unreliable partners, or has made much noise but accomplished little on the integration path of "vertical and horizontal alliances."

Faced with the pressure of transformation, Foxconn cannot remain static and must expand into the automotive industry; however, its existing chronic issues and lack of a solid foundation in automotive manufacturing increase the risk of failure.

Hon Hai's ventures into the electric vehicle field can be traced back to its early partnerships with Beijing Automotive Group to explore car rental and its acquisition of Antai Electric to nibble away at the automotive electronics market. Industry rumors have frequently circulated that the company has been in contact with automakers like Geely and Yulon to discuss potential car manufacturing collaborations.

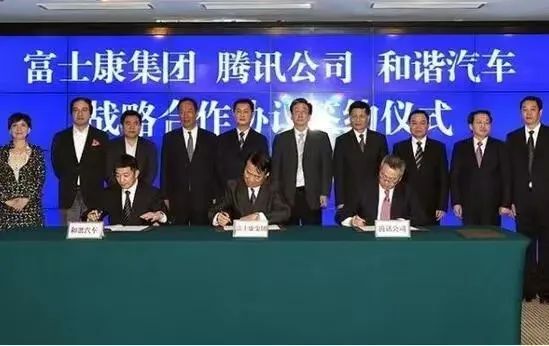

Foxconn once teamed up with Tencent and Hexie Auto to create "Hexie Futeng," attracting individuals like Dai Lei, the former general manager of Infiniti; Fu Qiang, the former CEO of Volvo China Sales Company; and Carsten Breitfeld, the group vice president who led the BMW i8 project. However, halfway through the project, Foxconn backed out, realizing the difficulties and withdrawing from subsequent investments.

Later, Foxconn's Hon Hai Precision once injected 300 million Chinese yuan through its subsidiary to participate in Xiaopeng Motors' Series B funding round. However, a year later, due to Xiaopeng Motors' overseas restructuring, after multiple consultations and accountant audits, it was decided that the related party IDG would receive Foxconn's equity to support Xiaopeng's restructuring.

In 2021, Hon Hai Group and Stellantis, the world's fourth-largest automotive group, officially signed a memorandum of understanding to jointly establish a new joint venture with a 50:50 voting rights ratio. Liu Young-way revealed at the time that Foxconn would handle design, components, and supply chain management in the new joint venture. However, this collaboration also ultimately came to nothing.

Looking back at the company's development trajectory of "dabbling in automobiles" in recent years, although most of Foxconn's projects have ended in failure, it has remained almost "open" to collaboration partners. Most importantly, Foxconn's "car manufacturing" ambition remains undeterred; it is getting braver and more resilient in the face of setbacks, with numerous failures but an increasing determination to keep trying.

Hon Hai has been anxious in recent years.

According to Liu Young-way, Foxconn does not produce complete vehicles and will not create its electric vehicle brand. However, between 2025 and 2027, it aims to provide components or services for 10% of the world's electric vehicles. He estimates that the global electric vehicle market will reach 30 million units by 2027, meaning that at least 3 million new vehicles will bear the mark of Foxconn each year.

However, the Sino-US dispute is affecting Apple, which in turn affects Foxconn. As the US government vigorously suppresses Huawei, its interests have led this hegemonic country to vigorously block China's technological upgrading strategy, revealing the fatigue of American companies led by Apple in innovation and their fear of losing to emerging Chinese companies.

Furthermore, China's countermeasures against the US and its ongoing technological catch-up are bound to impact Apple's performance in the medium to long term. How can Foxconn, which relies heavily on Apple, realize its grand ambitions?

Moreover, as electric vehicles increasingly transition from policy support to a normal market, the previous explosive growth rates are no longer sustainable, and global sales in 2030 may be lower than previously high estimates. If Foxconn is to achieve its previously set industrial goals, it must attain a level of technological supply that rivals Tesla or at least capture an automaker camp comparable to SAIC.

However, with more and more powerful players emerging in both new energy suppliers and vehicle manufacturers, and with domestic substitution in the Chinese market springing up like mushrooms after rain in recent years, the tight embrace between Nissan and Honda makes Foxconn's ambitions increasingly elusive.