Who Hurts the Most as Geyue Faces Extinction

![]() 12/20 2024

12/20 2024

![]() 572

572

"Xia Yiping is under fire; did the factory owner misjudge him? In a scenario where everyone is all-in on AI, it makes sense to selectively abandon auto manufacturing."

@ New technological knowledge original

Overnight, countless straws broke Geyue's back.

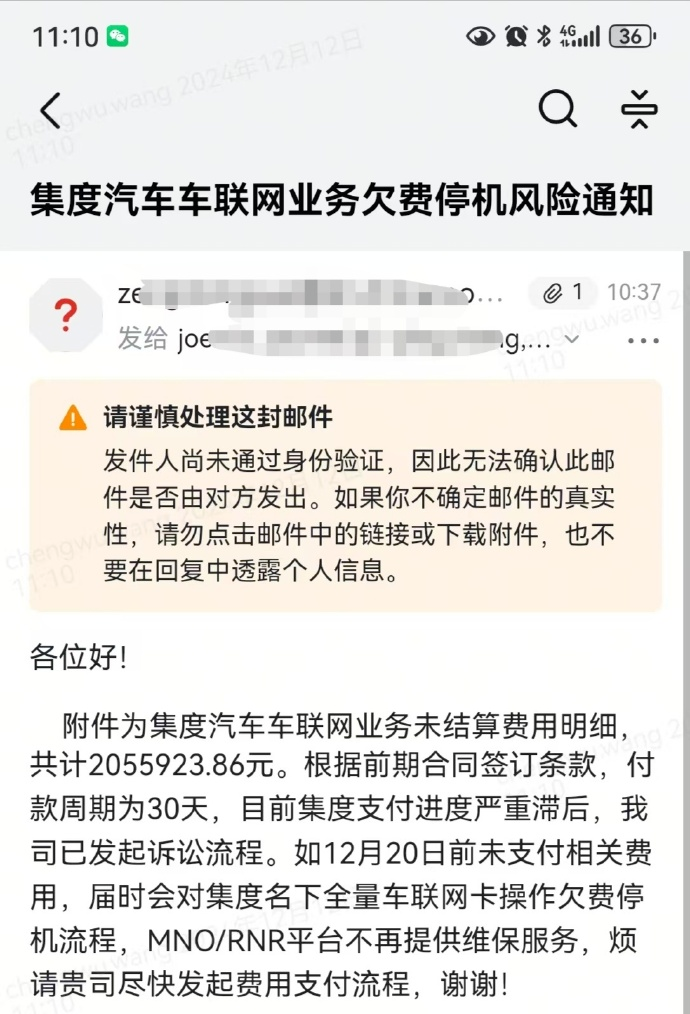

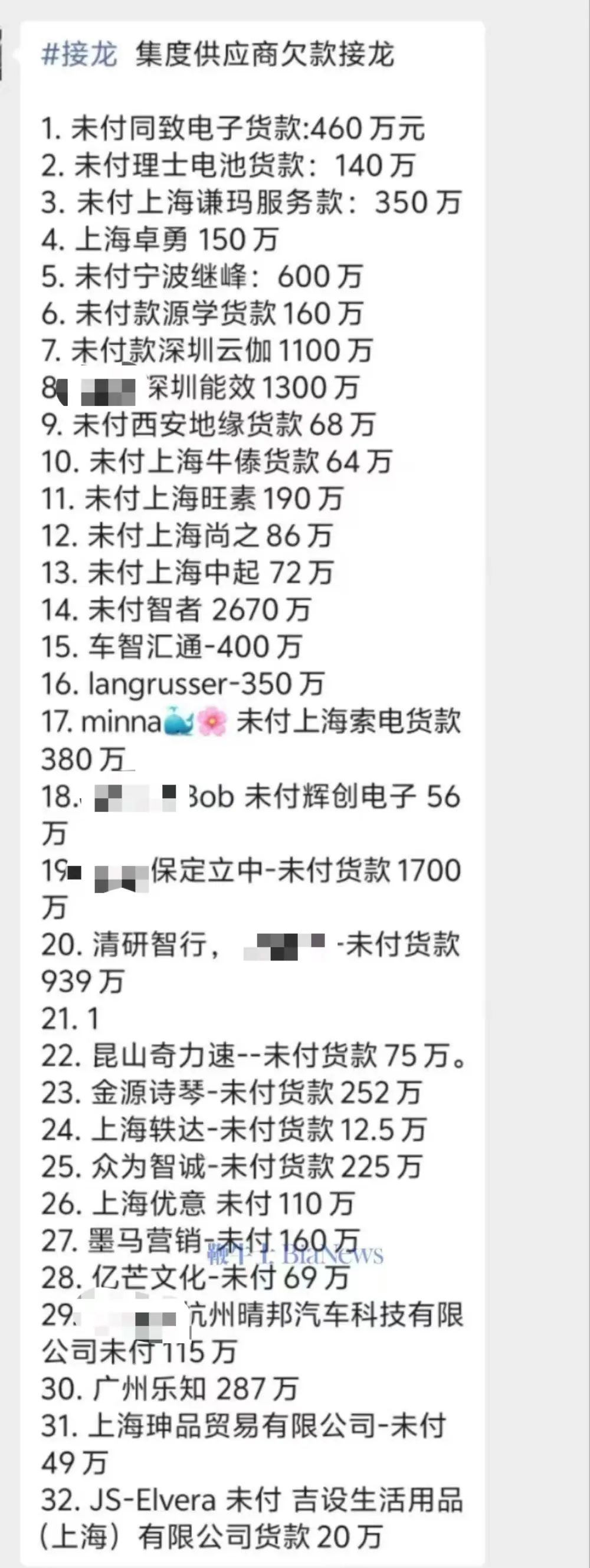

From small media outlets like 'Tech Planet' with debts of hundreds of thousands to larger ones like 'Zhejiang Xingtang' with debts of tens of millions, from partners to suppliers, and even China Mobile demanding unpaid salaries, stating that "overdue payments for the connected vehicle business exceed 2.05 million yuan, and legal proceedings have been initiated. If payment is not made by December 20th, all Geyue models will be unable to connect to the internet."

A video of suppliers demanding payment from Xia, sent to 'Tech News' by a supplier on the evening of the 12th, shows that some suppliers are owed hundreds of millions of yuan. On-site personnel stated that they had inquired about the overdue payments since October this year but had not received a response until now.

Fortunately, the suppliers who blocked the entrance for a night finally received a response!

'Baidu, Geely, and Geyue will form a task force, which will be established by the 15th at the latest. After the task force is formed, a supplier contact window will be provided, and solutions will be discussed with suppliers in batches based on their type and the task force,' the supplier revealed to 'Tech News' in the afternoon of the 13th, 'They have started blocking the entrance to prevent people from entering, and most suppliers cannot enter.' Therefore, it is still uncertain whether they will be able to recover their funds.

Since the injury on Geyue CEO Xia Yiping's face a month ago, rumors about layoffs and dissolution at Geyue have been circulating. Although Geyue has vigorously denied them, the reality is staring us in the face.

In addition to debts owed to related partners, there is also turmoil within Geyue. Market reports indicate that the sales teams in multiple provinces have been completely disbanded. Rumors about Xia Yiping's irregular use of suppliers, alleged corruption, and the immigration of his family to Singapore are also widespread.

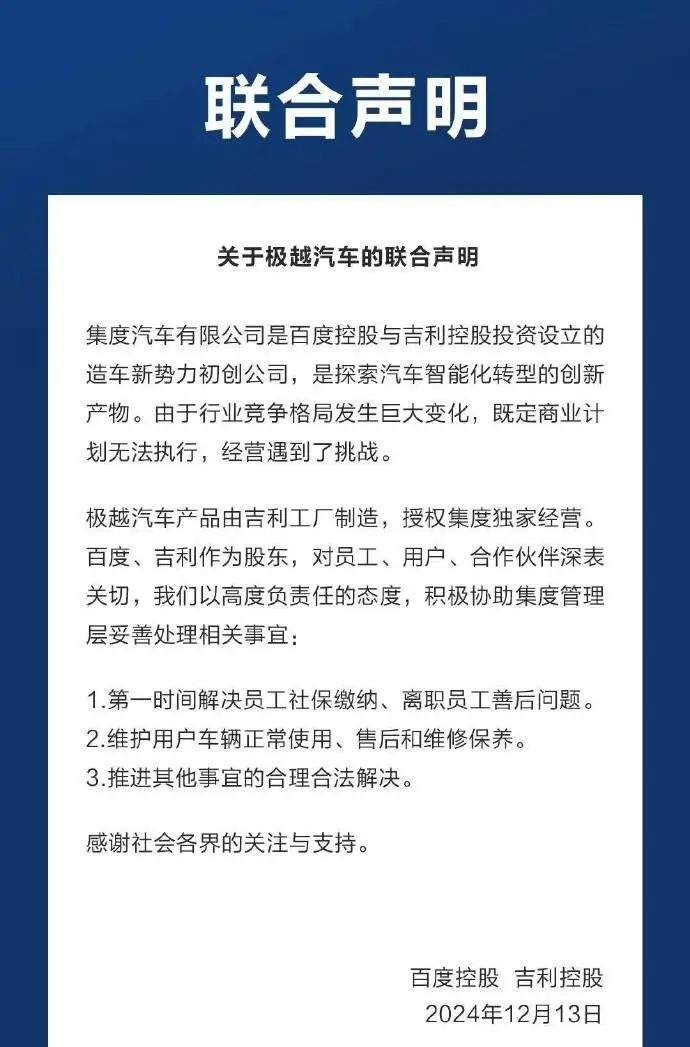

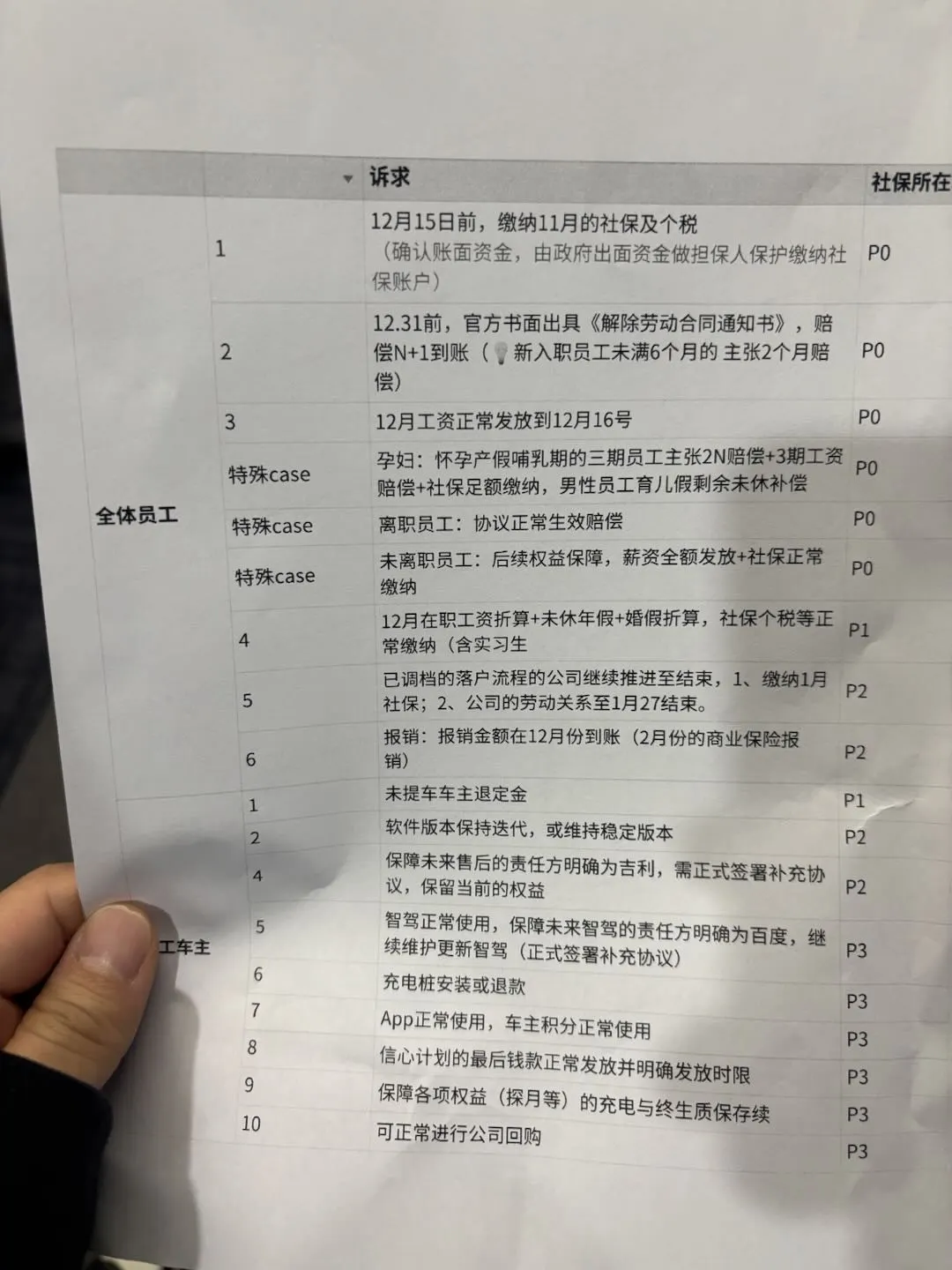

Fortunately, with the mediation of employees, Baidu and Geely are in the process of transferring funds to pay the overdue social security contributions for November. This was confirmed by a joint statement issued by the three parties on the evening of the 13th.

According to a report by 'China Entrepreneur', this fund is jointly contributed by Baidu and Geely, totaling approximately 60 million yuan. In the future, reasonable demands of employees, such as severance payments for those leaving the company, will be gradually addressed.

Image Source/21st Century Business Herald

'As a product of the collaboration between Baidu and Geely in auto manufacturing, Geyue, backed by two powerful entities, should not have experienced such a sudden collapse,' said an industry insider to 'Tech News'. 'This rate of collapse is highly likely due to internal issues within the company.'

If we look at Geyue's predecessor, Jidu, Baidu was the dominant force during the Jidu era. Later, due to issues with auto manufacturing qualifications, Baidu relinquished control, and Jidu was renamed Geyue, becoming an automotive brand under the Geely Group. However, both management and ecological technology are handled by Baidu personnel. Xia Yiping also emphasized in a communication meeting that Baidu holds 80% of the voting rights on the Geyue board. In contrast, Geely often plays the role of a supplier and is even owed money.

This raises a question: How much is Geyue's collapse related to Baidu? Are there issues with Baidu CEO Robin Li's logic in hiring and management? Will this affect Baidu's future development?

01

Another Case of 'Poor Hiring'?

After rumors of collapse circulated for some time, Geyue CEO Xia Yiping finally issued an internal letter on the afternoon of December 11, acknowledging that the company is currently facing difficulties and needs immediate adjustments.

At this point, employees learned that the company had not paid their social security contributions for November, despite regular salary payments. Videos of employees live-streaming their demands for payment frequently trended on social media.

In fact, Xia Yiping and Geyue have been regulars on trending topics this year. Most notably, during a mid-year press conference, he tearfully recounted the dismal sales figures from January and February, expressing deep emotion.

After experiencing a sales slump last year, Xia Yiping personally led the marketing team in January this year to strive for a turnaround. Although sales improved from July onwards, exceeding 2,000 units per month and even reaching 3,000 units in some months.

However, over the past 12 months, Geyue has only sold 14,055 vehicles, with an average monthly sales volume of less than 1,200 units. Currently, automotive brands that remain in the market have a stable monthly sales volume of over 10,000 units.

It can be said that it is already too late. For new energy vehicles caught in the vortex of price wars, many industry insiders even believe that a monthly sales volume of 20,000 units is the line between life and death.

To make matters worse, multiple sources familiar with the matter believe that the primary reason for Geyue's sudden collapse is Baidu's withdrawal of investment. An insider from Baidu revealed to 'Caixin' that the company sent a financial team to conduct due diligence at Geyue in October 2024 in preparation for a subsequent investment of 3 billion yuan: 'The results revealed a mess of financial issues, with a financial hole of up to 7 billion yuan, leading to the decision to discontinue further investment.'

Additionally, Geely charges a contract manufacturing fee for producing vehicles for Geyue. Due to overdue payments, Geely has ceased vehicle deliveries.

According to currently leaked information, Geyue owes Geely over 4 billion yuan in manufacturing costs and approximately 1 billion yuan to Baidu for cloud services and other related expenses.

In other words, the essence of this incident is that Geyue is out of money, and neither Baidu nor Geely, the two 'big brothers,' are willing to invest further.

However, when surrounded by hundreds of employees, Xia Yiping appeared wronged, stating, 'No one stepped up during the company's most difficult times, and neither shareholder came forward.'

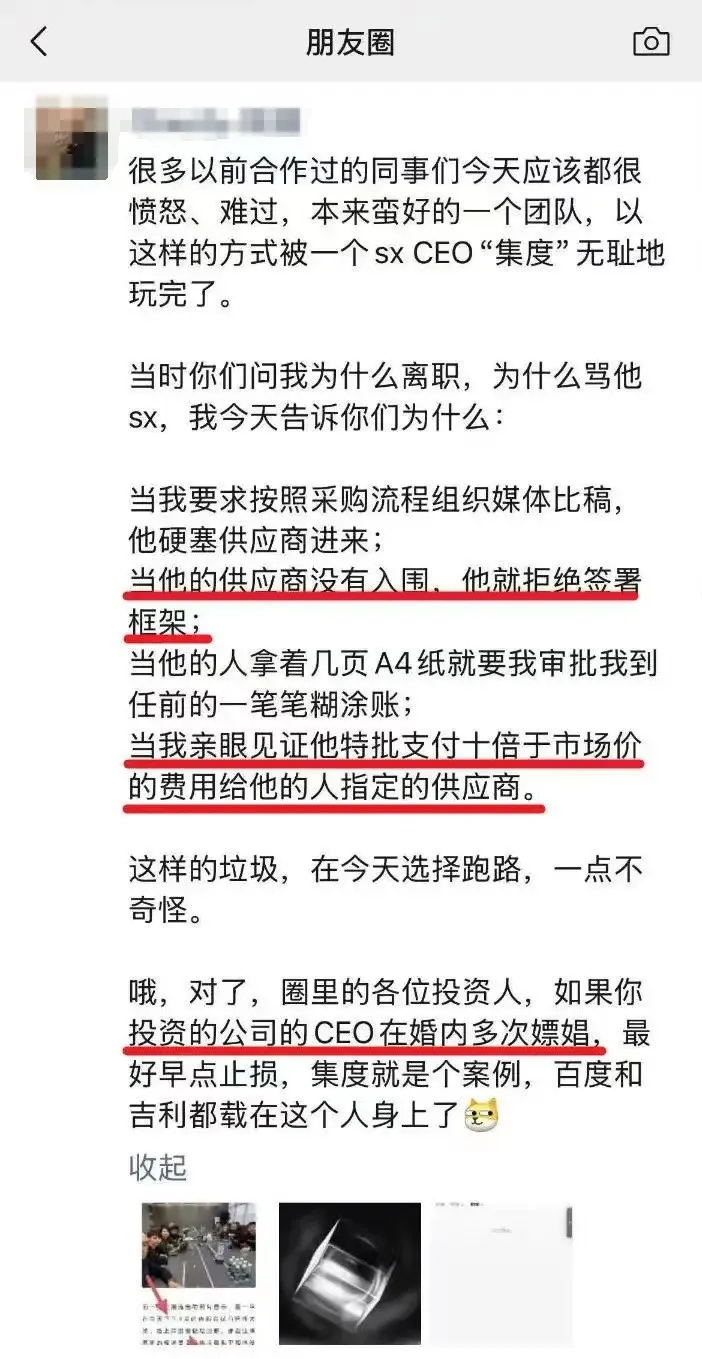

The root cause is inseparable from the management of Geyue. It is reported that some Geyue employees have accused Xia Yiping of corruption on their social media platforms.

Screenshots from their social media posts reveal, 'When I requested a media bidding process according to procurement procedures, he forcibly inserted a supplier; when his supplier was not selected, he refused to sign the framework; when his people presented a few pages of A4 paper for me to approve a mess of unclear accounts from before I took office; when I witnessed him personally approve payments ten times the market rate to suppliers designated by his people.'

An employee also stated, 'After Baidu sent a new financial director to audit the company in October, various acts of corruption and self-enrichment by Xia Yiping were discovered, including the procurement of designated suppliers for personal gain. Therefore, Xia Yiping was asked to resign voluntarily.' However, these claims have not been confirmed by Geyue.

In fact, most employees of Geyue Auto believe that Xia Yiping is responsible for 90% of the company's current situation. There have also been rumors within the company that Baidu is actually willing to continue investing, but only if Xia Yiping steps down as CEO, which he is unwilling to do.

In fact, judging from Baidu's management changes in recent years, there has been a tendency to reuse old employees, such as Shen Dou and others. According to a previous analysis by 'Tencent Shenwang', earlier on, Baidu's strategy was to recruit external talent extensively. When key executive positions became vacant, Robin Li's first reaction was not to promote internally but to select candidates globally, 'whoever is the best candidate should fill the position.' Executives and experts from well-known domestic and international companies, such as Li Yinan, Zhang Yaqin, and Andrew Ng, were all parachuted into Baidu, culminating in the arrival of Lu Qi.

However, with Lu Qi's abrupt departure, Baidu entered a strategic transformation towards internal talent selection. Xia Yiping's arrival once again disrupted Baidu's calm. From his resume, Xia Yiping can be considered a veteran in the automotive industry and was personally selected by Robin Li from among dozens of candidates, without even informing his wife. However, this external hire has failed to deliver for Baidu.

When officially announced, Robin Li used a series of adjectives to describe Xia Yiping, one of which was 'passionate.' This is similar to Robin Li's hiring principles. 'Actually, for every executive promotion before, Robin used the same words: dare to fight hard battles, win battles, and adhere to the same principles when speaking with executives internally,' said a Baidu HR personnel close to Robin Li.

As for Xia Yiping, he faced some external doubts from the beginning of his tenure: Why him? Is he capable of auto manufacturing? However, Xia Yiping did show passion at the time. To keep up with the schedule, it was common for Xia Yiping to hold meetings with middle management on weekends, and programmers joked about frequently attending 'nightclubs,' meaning 'nightly meetings.'

Later, whether it was through a matrix of over a hundred blue-check verified sales accounts or personally generating buzz, Xia Yiping did make efforts. Unfortunately, these blue-check verified accounts have now become the main battlefield for 'condemning' Geyue.

Whether Xia Yiping is truly corrupt and self-enriching remains unknown. However, it cannot be denied that Xia Yiping bears responsibility in this farce. For Robin Li, following the departure of PR Vice President Qu Jing and now Xia Yiping, he needs to carefully review his hiring standards and levels.

02

The Outcome of Auto Manufacturing was Predetermined

In fact, the outcome could already be seen from Robin Li's attitude towards Geyue and auto manufacturing.

According to Robin Li's early plans, Baidu would not engage in auto manufacturing directly but would collaborate with traditional automakers, with Baidu responsible for its areas of expertise such as autonomous driving and smart cockpits. Robin Li, who does not engage in auto manufacturing directly, focuses mainly on the AI field, leading to Xia Yiping taking charge of Geyue.

However, there are concerns that even if the boss leads the team personally, auto manufacturing may not necessarily succeed, and Robin Li has chosen to be a 'hands-off' leader. Previously, Lei Jun and Zhou Hongyi had a classic exchange. After the failure of the 360 Special Edition phone, Zhou Hongyi asked Lei Jun why it failed. Lei Jun said at the time, 'If you want to make phones, think about whether you can go all in and lead the team. If you can lead the team personally, we might still have a chance. You can't just set up a department and think a director can compete with me.'

This is very similar to Baidu's situation in auto manufacturing. Robin Li's attitude towards Geyue is somewhat ambiguous.

During an interview with CCTV's 'Dialogue' program in March this year, the host directly asked Robin Li, 'Don't you want to get involved in auto manufacturing yourself?' Robin Li responded, 'The threshold is a bit high, and it's quite troublesome.' Faced with the host's follow-up question, 'But many people are doing it themselves now,' Robin Li was vague in his response.

Robin Li rarely expresses public support for Geyue. Even during a live broadcast with Xia Yiping in April this year, he was sparing with his words, and the few questions he asked raised doubts about how much he really understands about Geyue 01.

The same was true at Baidu World Conference in November this year. According to insiders, Geyue paid 3 million yuan, but the benefits it enjoyed at the Baidu World Conference were limited to a single announcement at the main forum and the playback of a warm-up video, which had already been played before the audience entered the venue.

In the press release issued by Baidu for the Baidu World Conference, Baidu did not mention Geyue. Although the Baidu World Conference is a commercial event for Baidu, when Jidu was first established, Robin Li once said to Jidu employees, 'Jidu carries Baidu's dream of auto manufacturing.'

Therefore, Robin Li and Baidu's ambivalent attitude towards Geyue is even more puzzling.

However, judging from investment data, Robin Li's disappointment with Geyue is understandable.

So far, Baidu has invested a cumulative total of approximately 8.8 billion yuan in Jidu, with 4.1 billion yuan invested in 2022 and increasing to 4.7 billion yuan in 2023. In the end, nearly 10 billion yuan of investment only resulted in sales of less than 15,000 vehicles.

However, in contrast, Xiaomi Auto, which is gaining momentum, has invested 70 billion yuan right off the bat. Lei Jun believes that 10 billion dollars is the threshold for entering the automotive industry.

Over the past decade, Baidu has ventured into various cross-border businesses, encompassing takeout delivery, group buying, e-commerce, live streaming, and short videos, yet none have proven successful.

In the current era of rapid AI development, for companies like Baidu that have invested early in AI, the "AI dream" and "large model dream" hold paramount importance. It appears that Robin Li indeed lacks the bandwidth to tackle the "troublesome" endeavor of automobile manufacturing. Especially with Luobo Kuaipao already operational, compared to Lei Jun's decisive "All in on auto manufacturing" strategy, Baidu's efforts seem more rhetorical than substantive.

A tangible example is the relative comfort enjoyed by businesses like DuerOS, which directly reports to Robin Li.

Robin Li previously stated, while discussing corporate governance, that Baidu cannot engage in too many battles due to limited resources. He emphasized focusing resources on areas genuinely related to core businesses to avoid overextension. Therefore, within the company's all-in approach to AI, the selective abandonment of vehicle manufacturing appears reasonable.

03

Will There Be Another "JiYue"?

Following JiYue's collapse, a reassessment of Baidu's business lines reveals that some operations might also be on the brink.

Robin Li is well aware of some of Baidu's challenges. During an internal director meeting this year, he rarely admitted that Baidu's growth rate had slowed, describing it as "a relatively difficult time."

Indeed, Baidu's revenue growth has been volatile in recent years. From 2019 to 2023, revenue growth rates were 5.02%, -0.32%, 16.27%, -0.66%, and 8.83%, respectively. In the first three quarters of 2024, only the first quarter recorded growth, with declines in the subsequent two quarters; the third quarter even saw a year-on-year decrease of 2.58%.

Robin Li noted that the current mobile internet has transformed into a zero-sum game, indicating that the market share has entered a competitive stage.

A simple example is Baidu's core search business. With the rise of short video platforms like Douyin and Kuaishou, as well as social apps like WeChat and Xiaohongshu, users now have increasingly diverse ways to access information, no longer limited to traditional search engines. Users' time and attention are further fragmented.

Within Baidu, unprofitable businesses are also starting to shrink. On June 30 this year, the Baidu Baike App was officially discontinued, with related functions migrated to the "Baidu Baike" mini-program within the Baidu App. As a typical tool-type application, the Baidu Baike App could not effectively integrate with profitable businesses such as e-commerce, gaming, and advertising, requiring more financial support from Baidu.

In July this year, Baidu launched Wen Xiaoyan, an AI digital human social APP. Initially seen as Baidu's foray into the social media sphere, this attempt was merged with Wenxin Yiyan after two months, becoming the current Wen Xiaoyan.

Looking at other businesses, in the third quarter, Baidu merged its Healthcare Business Group (HCG) into the Mobile Ecosystem Group (MEG) and also included Baidu Netdisk in MEG. This adjustment led to a 13% year-on-year decrease in R&D expenses. However, despite this decrease, the operating profit margin increased by only 0.5 percentage points quarter-on-quarter.

In addition to continuous investment in AI and intelligent driving businesses, financial constraints also make Baidu's internal traditional businesses cautious. In the third quarter, Baidu Core's free cash flow was only 2.4 billion yuan, a year-on-year decrease of 59%, a scale only higher than that of the first quarter of 2022.

The primary reason for such poor cash flow is the decline in operating cash flow. The advertising business has traditionally generated robust cash flow. Therefore, when Baidu's advertising business comes under pressure, the cash flow is naturally affected. Simultaneously, while intelligent driving and intelligent hardware appear to have good revenue growth rates, they may not necessarily generate immediate cash inflows. Consequently, Baidu can only reduce costs and increase efficiency by downsizing underperforming business departments or cutting budgets for external investments.

Currently, although there is no clear business priority within Baidu, in Robin Li's mind, he seems to be gradually identifying which businesses are essential and which can be abandoned. Robin Li has often been described as a gentleman, rarely seen losing his temper. Even when water was poured on him in public, he elegantly diffused the situation. However, Baidu has reached a crossroads, and as the group's top leader, Robin Li needs to infuse more energy and determination into himself and the company.