Will GEO Auto Attract a White Knight? | Auto Circle

![]() 12/20 2024

12/20 2024

![]() 630

630

With the rapid evolution of new energy, autonomous driving, artificial intelligence, and chip technology, the automotive industry is undergoing unprecedented transformation.

Zero State LT, focusing on the latest developments in the automotive sector and deeply analyzing market trends, has launched the "Auto Circle" column. Through a professional lens, this column explores the latest advancements in the global automotive industry, new product launches by major automakers, technological innovations, and market performance. By thoroughly interpreting the intricacies of the automotive industry, it uncovers underlying business logic and market laws, shedding light on how these changes are reshaping the landscape and impacting human mobility.

This is the 13th article in the series, focusing on GEO Auto, which is now "besieged" and on the brink of collapse in the new energy sector. Author | Qin Tianyu Editor | Hu Zhanjia Operations | Chen Jiahui Featured Image | GEO Auto Official Weibo Produced by | Zero State LT (ID: LingTai_LT)

Who Can Rescue GEO Auto?

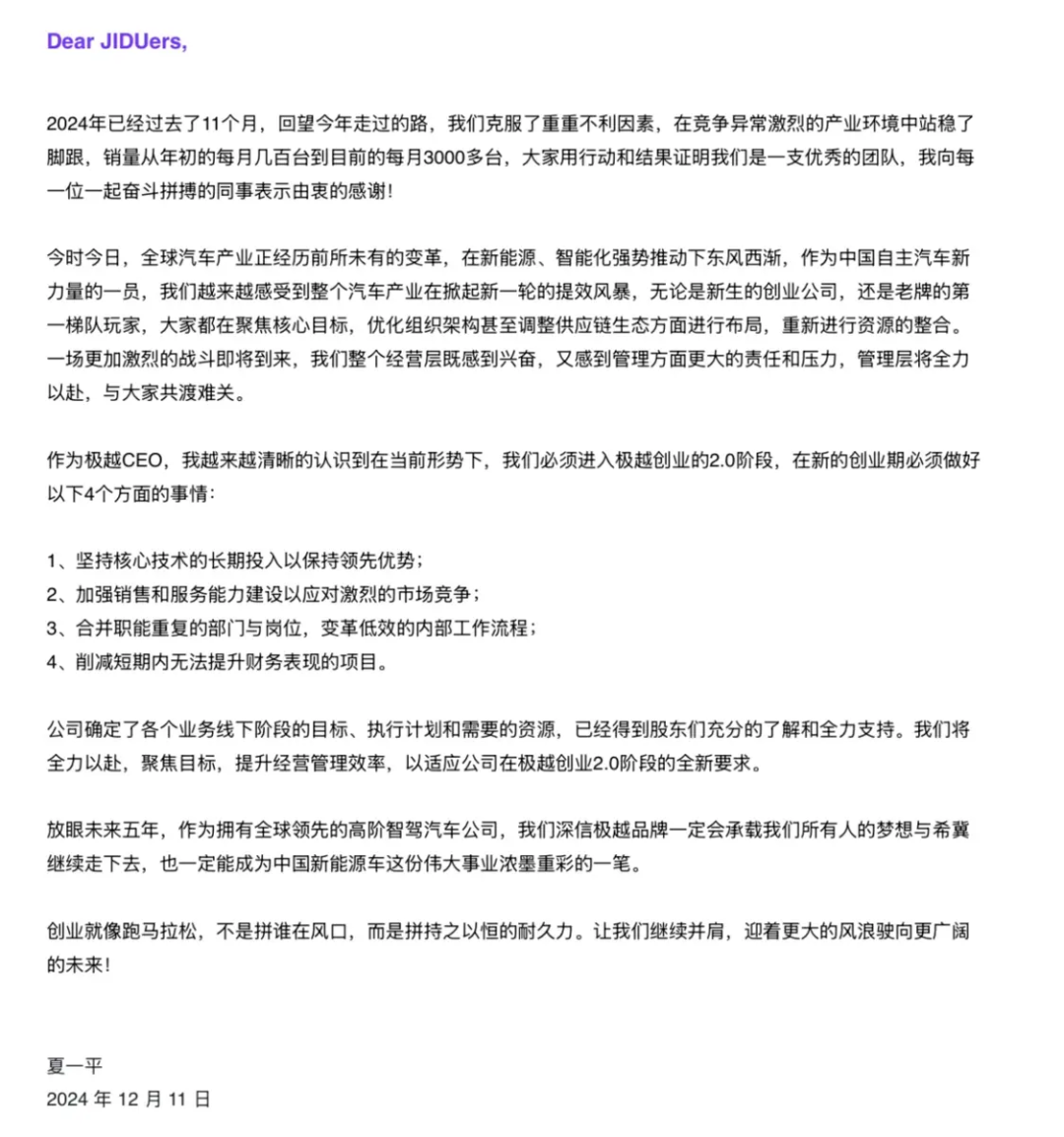

On December 11, 2024, GEO Auto CEO Xia Yiping sent an internal letter stating that GEO Auto had entered the 2.0 phase of its entrepreneurial journey. It would merge departments and positions with overlapping functions and cut projects that do not contribute to short-term financial performance. "The management team will go all in to navigate through these challenging times with everyone."

▲Image source: GEO Auto

Despite Xia Yiping's optimism for the company's future, numerous clues suggest that GEO Auto has reached a critical juncture. Both company operations and vehicle sales show signs of stagnation.

GEO Auto's plight also underscores that China's new energy vehicle industry has entered an "elimination round." As competition intensifies, more small and micro automakers may face a bleak future.

With only a few employees maintaining operations, what has gone wrong at GEO Auto?

Although GEO Auto garnered attention in mid-December due to "encountering difficulties," signs of poor management emerged half a month earlier. In late November 2024, many netizens reported on the MaiMai platform that GEO Auto would initiate large-scale layoffs, planning to cut 40% of staff before the New Year and failing to pay social security contributions the following month.

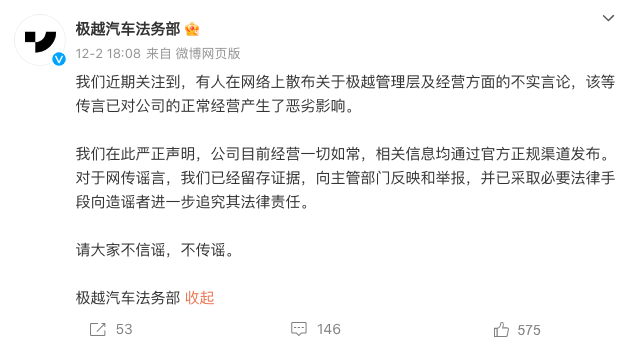

In response, on December 2, the GEO Auto Legal Department posted on social media, "We hereby solemnly declare that the company's current operations are proceeding as usual, and relevant information is released through official channels. For rumors spread on the internet, we have retained evidence, reported it to the competent authorities, and taken necessary legal measures to hold rumor-mongers accountable."

▲Image source: GEO Auto

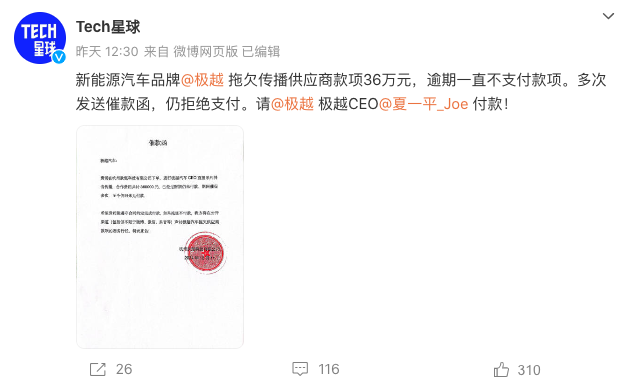

However, GEO Auto didn't "operate as usual" for long. On December 11, the self-media outlet "Tech Planet" published a dunning letter on a social media platform, demanding overdue fees of 360,000 yuan from GEO Auto, claiming that "multiple dunning letters have been sent, but payment is still refused."

Given that payments in the automotive industry often involve millions or even tens of millions of yuan, GEO Auto's inability to pay even 360,000 yuan largely indicates its deteriorating financial health.

▲Image source: Tech Planet

Finally, on December 11 afternoon, Xia Yiping addressed all employees via video conference, stating that the company was facing difficulties and needed immediate adjustments to enter the 2.0 phase of entrepreneurship. In his open letter, Xia Yiping announced that GEO Auto would "merge departments and positions with overlapping functions, reform inefficient internal workflows, and cut projects that do not contribute to short-term financial performance."

Despite the challenges, Xia Yiping remained optimistic about GEO Auto's future. "Looking ahead to the next five years, as a globally leading high-end intelligent driving car company, we firmly believe that the GEO brand will carry on our dreams and hopes, continuing to move forward. It will surely leave an indelible mark on China's new energy vehicle industry."

However, based on various sources, it appears GEO Auto is struggling to maintain even basic operations. Interface News learned from multiple GEO Auto employees that the company's R&D department had been completely laid off, with only a handful of employees left to maintain operations. GEO Auto employees had two options: resign and receive N+1 compensation by February 2025 or stay without pay from December, essentially "working for free."

China Business News reported that on December 12 morning, GEO Auto employees "besieged" Xia Yiping, demanding that the company make up social security, medical insurance, and provident fund contributions from October to November, pay December salaries, social security, and individual income tax, provide "N+1" compensation upon resignation, and complete the employee settlement process. Xia Yiping assured employees, "I won't run away. Why would I come to the company if I were going to run away? I'm here to solve problems for everyone." He promised to pay social security and medical insurance contributions.

By 8 pm on December 12, GEO Auto employees on-site revealed that investors were willing to settle November social security contributions for GEO Auto employees.

▲Image source: China Business News

Currently, GEO Auto is in disarray both internally and externally. Frontline channels have also stopped selling cars. Auto blogger "Panghu Shawn" revealed that GEO Auto stores had ceased operations, stopped selling cars, and halted test drives. Zero State LT (ID: LingTai_LT) found that on platforms like Xiaohongshu and Douyin, many GEO Auto store anchors were seeking jobs online, with some even "giving up" and sarcastically live-streaming about GEO Auto.

It is evident that GEO Auto urgently needs capital infusion.

Born with a golden key, why has GEO Auto sunk to this level?

Unlike most emerging automakers that grew independently, GEO Auto was born with significant advantages.

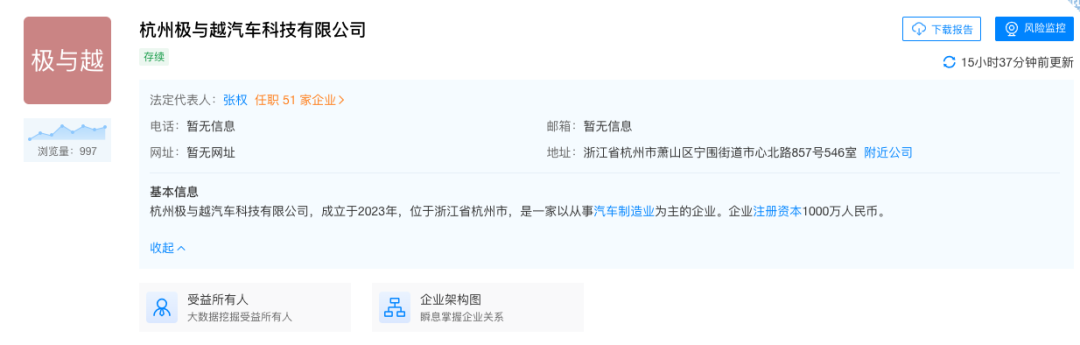

▲Image source: Tianyancha, GEO Auto shareholding structure

On its official website, GEO Auto proudly states, "Leveraging Baidu's leading AI capabilities and Geely's extensive SEA architecture ecosystem, the company is committed to creating intelligent, leading automotive robots."

▲Image source: GEO Auto

With the deep support of Baidu and Geely, GEO Auto bypassed the long incubation period typical of most emerging automakers. In August 2023, just two and a half years after its establishment, GEO Auto launched its first product, the GEO 01, positioned as a mid-to-large pure electric SUV priced between 249,900 and 339,900 yuan.

GEO Auto's senior management had high hopes for the GEO 01. When the model was launched in October 2023, Xia Yiping stated that it would achieve monthly sales of over 10,000 units in 2024.

However, GEO Auto's sales performance has been lackluster since 2024. Official data shows that from January to November 2024, GEO Auto's cumulative sales were only 13,300 units. Notably, in September 2024, GEO Auto also launched its second product, the GEO 07. Since then, GEO Auto's monthly sales have hovered around 2,000 units.

In contrast, emerging automakers like NIO, Xpeng, and Li Auto currently sell tens of thousands of units monthly, with Li Auto's November sales reaching as high as 48,700 units.

GEO Auto's struggle to penetrate the market is partly due to missing the optimal window for emerging automakers' development. Although GEO Auto launched its first product just two and a half years after its establishment, in 2023, competition in China's new energy vehicle market intensified, and an oligopoly effect emerged. With limited brand strength, GEO Auto struggled to convince consumers to buy its products.

▲Image source: GEO Auto

From a product perspective, although GEO Auto's intelligent driving and chassis quality are impressive, some features are too unconventional, aiming to compete with Tesla. For example, the GEO 01 lacks a gearshift or steering column, which goes against consumer usage habits. Moreover, as a 2024 pure electric vehicle, the GEO 01 only supports 400V charging and lacks an AC port, notable shortcomings.

GEO Auto was also aware of the GEO 01's limited competitiveness. In late November 2023, just one month after its launch, it announced a price reduction. Specifically, the GEO 01 Max and GEO 01 Max Performance were reduced by 30,000 yuan, and the 100kWh battery option package was also reduced by 10,000 yuan, bringing the price range down to 219,900 to 309,900 yuan.

Unfortunately, the price reduction failed to reverse GEO Auto's sluggish sales. Due to the delay in achieving economies of scale, just one year after launching its first vehicle, GEO Auto faced challenging times.

The Auto Circle Elimination Round Officially Begins

GEO Auto's plight is a microcosm of the sudden changes in China's new energy vehicle market environment. In recent years, as downstream demand has gradually saturated, China's new energy vehicle sector has become increasingly competitive, leaving little incremental value for small and micro enterprises.

Data from the China Passenger Car Association shows that from 2022 to the first half of 2024, China's new energy vehicle sales were 2.6 million, 3.747 million, and 4.111 million units, respectively, with year-on-year growth rates of 120%, 44.1%, and 33.1%, indicating a gradual decline in growth rates.

Against this backdrop, traditional automakers and established emerging automakers have aggressively seized remaining market dividends, leaving small and micro automakers destined for elimination. In recent years, brands like WM Motor, HiPhi, and AITO have vanished.

Xiaopeng Motors CEO He Xiaopeng stated that "China's new energy vehicle market has begun to enter an elimination round." Zhu Huarong, Party Secretary and Chairman of Changan Automobile, believes that in 2024, the top ten automakers in sales will account for approximately 85% of the market share. In the coming years, 80% of brands will cease operations.

The Paper quoted sources as saying that Xia Yiping is actively seeking investor assistance. However, shareholders will only continue "infusing blood" into subsidiaries if they see a path to victory and the potential for growth.

Currently, Geely has invested billions in building the Zeekr brand in the pure electric field. In the first ten months of 2024, Zeekr's cumulative sales reached 167,900 units, a year-on-year increase of 82%. Given this success, Geely has no incentive to take significant risks with GEO Auto.

Considering the recent bankruptcies of new energy automakers, consumers are now wary of automakers with poor operating conditions. After this ordeal, if GEO Auto can find an investment institution to take over, it may turn its fate around.

But who will play the role of the white knight?