Top 30 Sales Rankings for Passenger Cars and New Energy Vehicles in November: Independent Brands Dominate, Tesla Faces Tough Competition

![]() 12/20 2024

12/20 2024

![]() 686

686

IPSO · Auto Industry Chain Data Service Platform

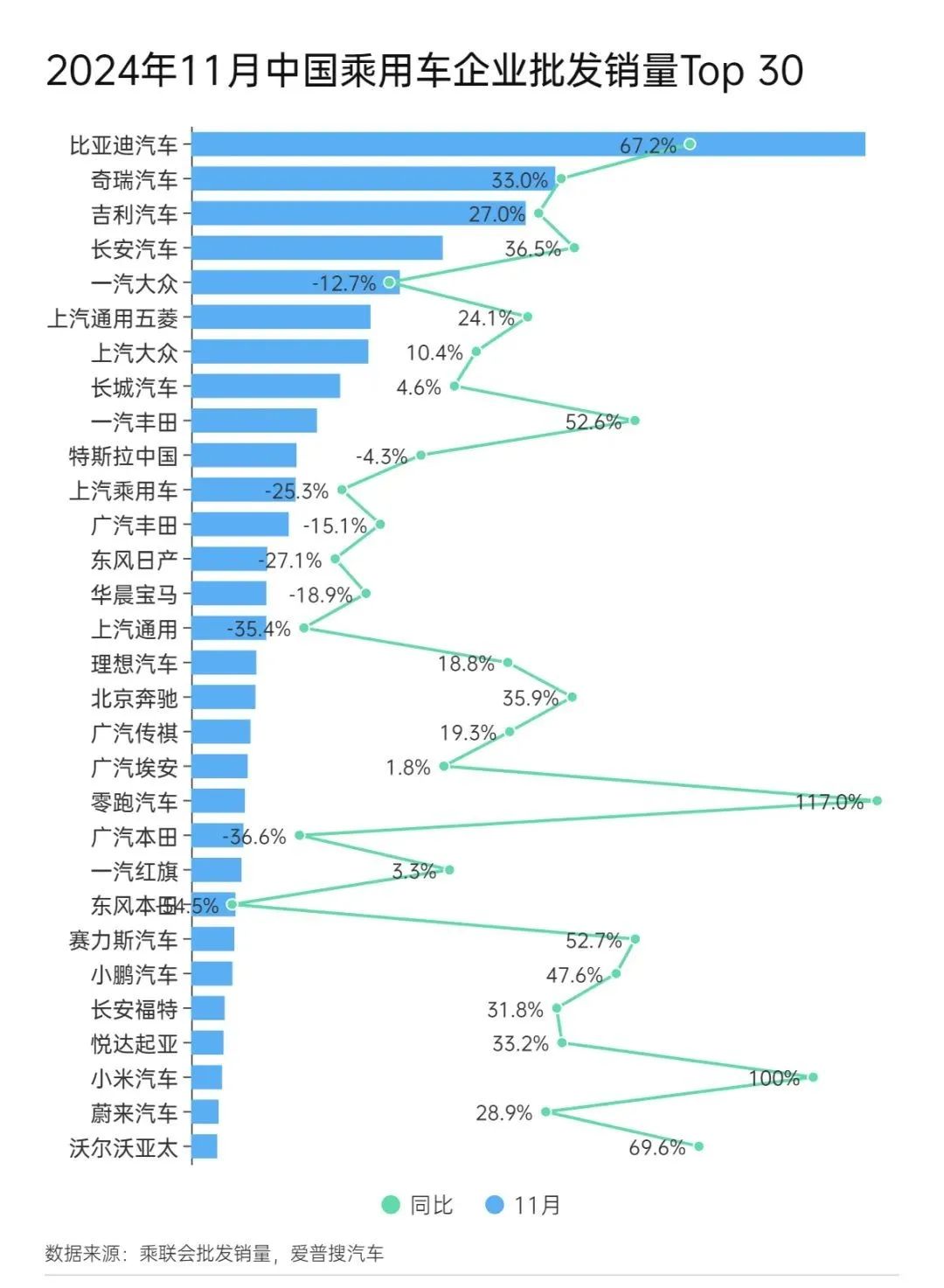

The top 30 wholesale sales rankings for Chinese passenger car and new energy passenger car enterprises in November 2024 have been unveiled:

In the top 30 passenger car sales, independent brands captured the top four spots (BYD, Chery, Geely, Changan), while sales of joint venture/foreign-owned enterprises such as FAW-Volkswagen, Tesla China, GAC Toyota, Dongfeng Nissan, BMW Brilliance, SAIC-GM, GAC Honda, Dongfeng Honda, among others, all witnessed year-on-year declines.

Xiaomi Motors surpassed competitors like NIO and Volvo Asia Pacific.

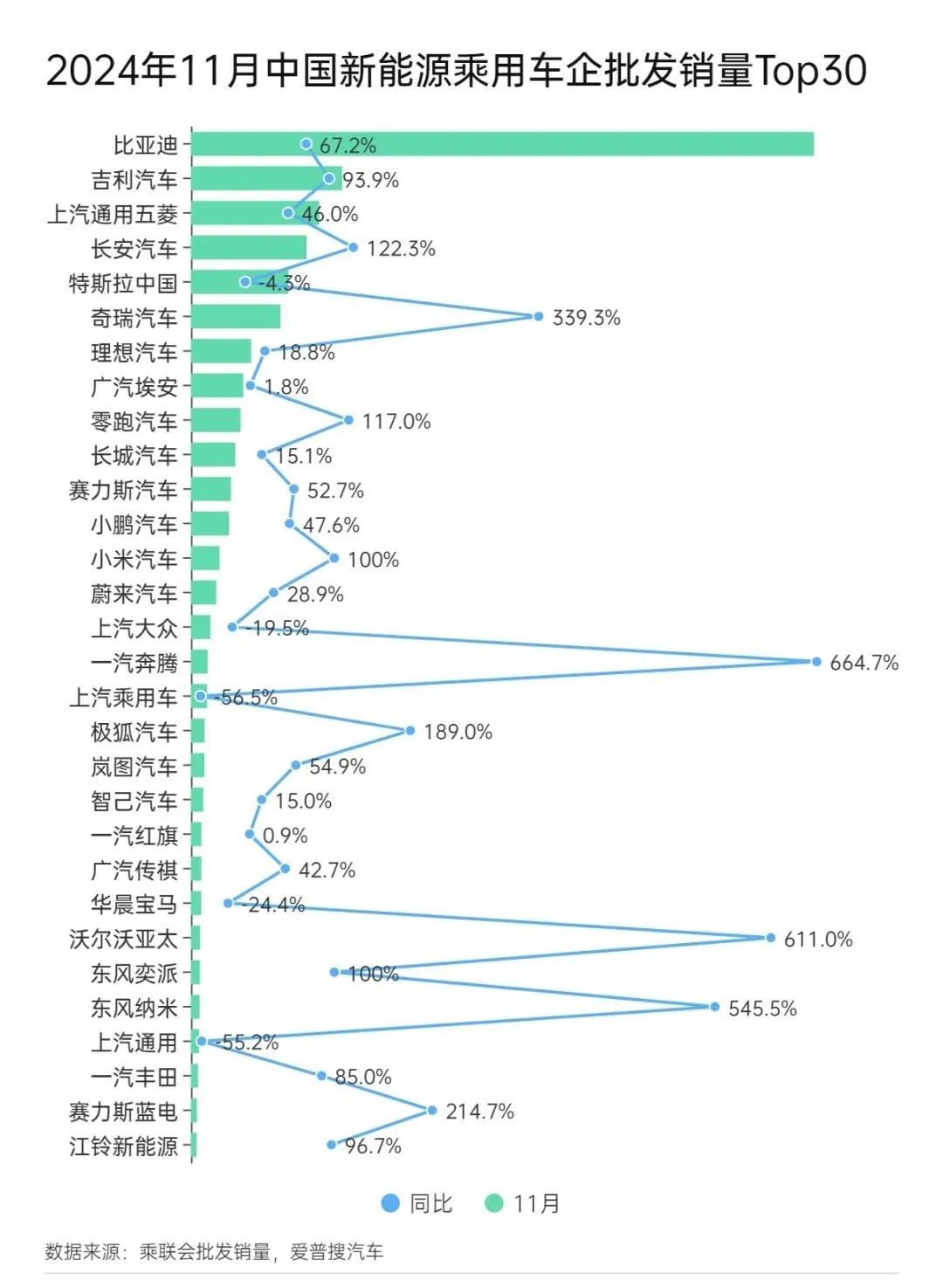

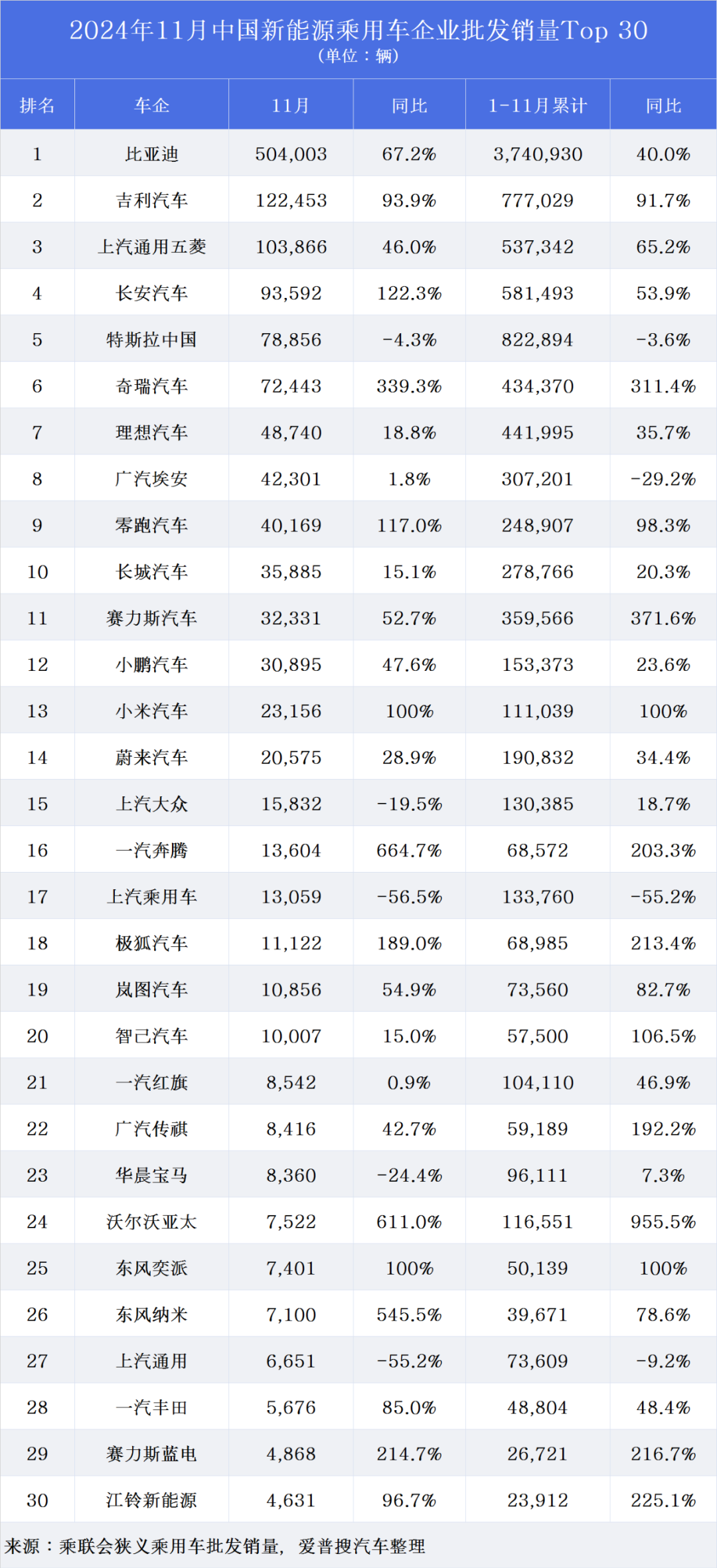

In the top 30 wholesale sales of new energy passenger car enterprises:

The new energy passenger car market continues to evolve rapidly. Tesla China, which long held the second position in China's new energy vehicle sales, was not only surpassed by Geely Automobile, SGMW, and Changan Automobile in November but was also closely followed by Chery Automobile, Li Auto, GAC AION, and NIO.

Among the top 15 new energy passenger car enterprises, 13 independent brand manufacturers reported year-on-year growth in November, while the two foreign-funded enterprises, Tesla China and SAIC Volkswagen, both experienced year-on-year declines.

Xiaomi Motors skyrocketed to 13th place among new energy vehicle enterprises in its inaugural year on the market, outpacing NIO.

Thalys secured the 11th position among China's new energy vehicle enterprises with its Wenjie series, and its newly established Blue Electricity brand also entered the top 30.

The once prominent "NIO, Xpeng, Li Auto" trio has evolved into Li Auto, NIO, Xpeng, again Xpeng, and NIO. Despite topping the list of emerging forces in 2022, Nezha Automobile is now struggling, with only 1,801 wholesale sales in November, failing to make the top 30.

Among Dongfeng Group's independent brand new energy vehicle enterprises, Lantou Automobile currently performs best, followed by Dongfeng Yipi, Dongfeng Nano, and Dongfeng Fengshen. If the latter three are combined (with a total sales volume of 19,181 new energy vehicles), they would rank 15th.

The auto market has witnessed intense price wars this year, leading to the collapse of many auto enterprises. During the Guangzhou Auto Show, Yao Fei, Deputy General Manager of the Chery Brand Marketing Center, said in an interview with media that price wars signify the start of consolidation in the auto industry. Similar to the current home appliance and mobile phone industries, there will undoubtedly be fewer brands in the future. I believe that at most five Chinese brands will survive the upcoming consolidation.

He Xiaopeng, Chairman of Xpeng Motors, stated in August this year that in ten years, there may only be seven mainstream Chinese auto brands left, and annual sales exceeding 1 million vehicles will be the bare minimum to compete.

Zhu Huarong, Chairman of Changan Automobile, noted last year that "60% to 70% of auto brands may cease operations, merge, or transfer in the next 3 to 5 years."

Li Bin, Chairman of NIO, recently said in an interview that leading auto enterprises are still in the accumulation stage in 2024. Starting from 2025, they will accelerate, further widening the gap between leading and second-tier auto enterprises. By 2027 at the latest, the market penetration rate of new energy vehicles in China will exceed 90%; China's auto ownership stands at 340 million vehicles and will peak at 400 million. Future opportunities for Chinese auto enterprises will primarily stem from replacements and overseas markets.

Source: IPSO Auto