Collapse! Government Turmoil, Auto Industry Crisis, and the Fall of 'Made in Germany'

![]() 12/20 2024

12/20 2024

![]() 590

590

Signs of Germany's stagnation emerged on December 16.

On that day, the German Bundestag held a rare vote of no confidence in the Scholz government, with 394 members of parliament voting against, 207 voting in favor, and 116 abstaining.

The Scholz government has come to an abrupt halt. Next, the president will dissolve the Bundestag and await new elections on February 23, 2025.

Behind the government's stagnation, the German economy, epitomized by the automotive industry, is also collapsing. Volkswagen, the engine of the German economy, is closing three domestic factories and planning layoffs of tens of thousands of employees; Bosch, the "king of automotive components" in Germany, has also announced layoffs of nearly 10,000 people.

Familiar brands such as BBA, Porsche, and automotive component manufacturers ZF, Continental, Schaeffler, etc., are also reducing production and laying off employees.

'Made in Germany', 'German spirit', and the superiority complex of the Germanic people, once held in high esteem by many, have suddenly collapsed.

01.

On December 9, nearly 100,000 Volkswagen employees from nine nearby factories gathered in Wolfsburg, Volkswagen's headquarters, for another two-hour warning strike.

Volkswagen originally planned to lay off 30,000 employees. Under pressure from employees and unions, Volkswagen management hesitated, denying the layoff plan but proposing a 10% salary reduction for 140,000 employees.

According to the agreement, Volkswagen does not have the authority to lay off employees. In 1994, Volkswagen signed an employment guarantee agreement with the union, stipulating that Volkswagen has no right to dismiss employees for business reasons before 2029.

In Germany, many companies have a lifetime employment system with their employees, and unions hold significant power in corporate management, even participating in board decisions.

However, like many large companies, Volkswagen's problem is that it can no longer guarantee the current number of jobs. Volkswagen executives expressed frustration that Volkswagen's sales in Europe have decreased by 500,000 units compared to pre-pandemic levels, equivalent to the production capacity of two factories.

According to the third-quarter report, Volkswagen's net profit for the third quarter fell from €4.34 billion in the same period last year to €1.57 billion, a year-on-year drop of 63.8%; operating profit was €2.86 billion, a year-on-year drop of 42%; and operating profit margin fell from 6.2% to 3.6%, the lowest level in more than four years.

In other words, Volkswagen's profitability is declining significantly, and the company's financial reserves are also dwindling.

However, unlike us, German auto workers are not timid. They dare to confront the CEO directly: Making money is your management's responsibility, but employees' interests cannot be compromised.

Not only should there be no compromise, but there should also be a salary increase. Hundreds of thousands of Volkswagen production line workers have entrusted the union to negotiate with management, demanding a 7% salary increase.

An unimaginable spectacle for us Chinese has emerged: While corporate management is considering layoffs, plant closures, and salary reductions, employees are still thinking about salary increases.

They are in the same company but seem to inhabit two different worlds.

This is actually tied to the German people's rigorous, rigid, rational, and almost inhumanly principled personality. Employees are not unaware of the company's situation, but they believe that it is not the concern of ordinary employees.

What concerns the "screwdrivers" is that after the Russia-Ukraine conflict, prices in Germany have risen significantly. Although there has been some relief this year, once prices rise, they will not fall again. How can families live securely without a salary increase?

The union represents the interests of employees and is prepared for a protracted struggle with corporate management. Management hesitates to speak out, as the union is not to be trifled with, but the demands of the board of directors cannot be met, leaving them in a dilemma.

This is not just a rift within Volkswagen but a challenge faced by all German companies. Those with stronger profitability can solve the problem more easily, while those with weaker profitability and greater impact can only negotiate slowly.

It's not just the automotive industry; machinery manufacturing, chemicals, and other industries known as the "glory of Germany" are also affected. These three industries account for 30% of Germany's GDP.

This widespread phenomenon is bound to extend to government departments. Even Scholz himself felt that he could no longer continue and supported the vote of no confidence, even though he knew it was not in his favor.

Now, even if Scholz has plans, they cannot be implemented due to the tug-of-war between multiple factions in the government, leading to his self-termination.

02.

The German economy has been stagnant for some time. In the third quarter of this year, German GDP, which was originally expected to decline, unexpectedly grew by 0.2%, bringing a glimmer of hope.

However, the recession seems to have only just begun as the government lacks the strong-arm tactics to implement widespread reforms. Scholz has a "large-scale spending plan" promising to raise the minimum wage, lower food taxes, and strictly manage debt, but he cannot implement it.

Therefore, many predict that Germany's next government is likely to be dominated by the far-right.

What has pushed Europe's largest economy into darkness?

After the Russia-Ukraine conflict, energy prices in Europe began to rise sharply, leading to an energy and supply crisis. The German Chemical Industry Association (VCI) estimates that energy prices in Germany are currently five times higher than in the United States and two to three times higher than in China.

The result is a direct weakening of consumer spending and corporate production, with rising prices and significantly increased raw material and energy costs for companies.

Over the past four years, industrial electricity prices in Europe have generally increased by more than 50%, with average electricity prices leading among the world's major economies.

As a manufacturing powerhouse, Germany has traditionally maintained a high trade surplus, but with the weakening of manufacturing competitiveness due to rising costs, the trade surplus has begun to decline significantly.

This has given emerging automotive countries like China an opportunity, leading to a sudden surge in auto exports and a "three-year explosion" in auto exports since 2021.

Due to geopolitical factors and great power rivalry, Volkswagen, Bosch, and others have encountered resistance from old forces in their transition to electrification and intelligence, including the politicization of climate issues and the EU's repeated reversal on carbon emission targets, leading to delays and distortions.

Volkswagen once pinned its hopes on its software subsidiary Cariad for intelligence. Even after investing heavily, when it came time to use the products, it was found that highly paid German programmers could not deliver stable products.

Looking back, they found that Chinese automakers and Tesla in the United States had already left them far behind, and it was impossible to catch up. As a result, Volkswagen invested 5 billion yuan in XPeng Motors to participate in the market but was still not assured, so it also invested $5.8 billion in Rivian, leaving a backup plan.

Joining the competition when unable to win is an extremely helpless strategy.

The strength of German thinking lies in rigorous and precise manufacturing, but it is precisely this strength that restricts its exploration in the software field. In the fields of automotive intelligence and AI, Germany has fallen farther and farther behind China and the United States.

Germany's collapse has further extended overseas.

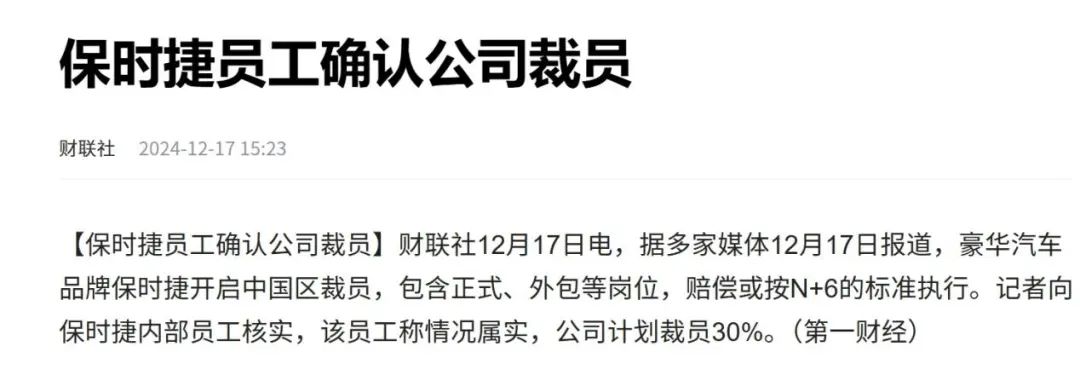

In the Chinese market, Porsche plans to reduce its workforce, including permanent and outsourced positions, by 30%, with compensation based on the N+6 standard. Porsche's parent company, Volkswagen, delivered only 1.345 million vehicles in the Chinese market in the first half of this year, a year-on-year decline of 7.4%, and layoffs began as early as October.

In the next era, German automobiles, which once played an important role in our lives, may quickly become marginalized, and the "luxury" of the Western world may step down from its pedestal step by step.