How Far Can Electric Vehicle Prices Drop Further Amid Declining Power Battery Costs?

![]() 12/20 2024

12/20 2024

![]() 592

592

The precipitous decline in lithium battery prices has unexpectedly emerged as a new catalyst for the growth of new energy vehicles.

According to a BloombergNEF (BNEF) survey report, the average global price of lithium-ion battery packs reached a new low of $115 per kWh in 2024, marking a decrease of over 20% since the beginning of the year. Lithium batteries, once considered "exorbitantly expensive," have now become highly affordable.

Statistics from the Ministry of Industry and Information Technology reveal that China's total lithium battery production amounted to 890GWh in the first 10 months of this year, representing a year-on-year increase of 16%. Nearly half of this production was supplied to the new energy vehicle sector.

Benefiting from the backdrop of falling battery prices, this year's domestic market price war for new energy vehicles has gained new momentum, with an average price reduction exceeding 30,000 yuan. Concurrently, the battery capacity of new vehicles is on the rise. For instance, electric vehicles priced around 100,000 yuan now come equipped with large batteries of nearly 50 kWh, achieving "lower electricity costs than gasoline."

It can be said that the domestic new energy vehicle price war is primarily fueled by the ongoing decline in lithium battery prices. Predictions suggest that these prices will continue to fall.

Price Reductions from the Start

As a pivotal component of new energy vehicles, power batteries to some extent dictate their pricing. However, for power battery manufacturers, battery prices are not entirely within their control. The cost of power batteries comprises various raw materials such as cathode materials, anode materials, separators, and electrolytes. Fluctuations in the price of any of these materials will impact the price of power batteries.

Taking the two well-known types of power batteries, ternary lithium and lithium iron phosphate, as examples, both rely heavily on lithium carbonate as a raw material. Lithium carbonate accounts for over 30% of the cost of lithium iron phosphate batteries, with an even higher proportion for ternary lithium batteries.

Moreover, the price of lithium carbonate also influences the pricing trends of anode materials, separators, and electrolytes. For instance, in 2022, the price of lithium carbonate surged to a high of 600,000 yuan per ton, leading to a significant increase in the prices of related anode materials, separators, and electrolytes.

Following the decline in lithium carbonate prices in 2024, the average selling prices of anode materials, separators, and electrolytes also experienced notable decreases. Currently, the market price of battery-grade lithium carbonate has fallen to 88,000 yuan per ton, a decrease of over 15% from the beginning of the year. The price of anode materials has plummeted from 53,000 yuan per ton to 30,000 yuan per ton within a year, representing a drop of up to 40%.

It can be observed that amidst the overall market's focus on reducing power battery prices, the prices of battery raw materials are continually being squeezed of excess value. Besides lithium carbonate and anode materials, the average selling prices of electrolytes and separators have also dipped to low levels this year, making further declines challenging.

This trend is also reflected in the half-year financial reports of these companies. According to statistics, among the 17 listed anode material suppliers, half reported year-on-year revenue declines. For example, the largest anode material producer, China Bashi, reported revenue of over 10 billion yuan in the first half of the year but a net profit of only 196 million yuan, marking a year-on-year decline of over 60% in net profit.

Behind the decline in revenue lies not only the reduction in raw material prices but also the repercussions of previous rampant expansion.

In 2023, when power battery prices peaked, the entire industry was in a phase of rapid expansion, with newly invested production capacity exceeding 900GWh for the year, more than double the battery installation volume for new energy vehicles in 2023.

While sales of new energy vehicles continued to increase in 2024, the growth rate has significantly slowed. Notably, the growth rate of pure electric vehicles, the primary type of electric vehicle, has been much lower than that of hybrid vehicles. Market demand for power batteries has notably slowed.

Amidst such market changes, it is estimated that the domestic power battery capacity utilization rate has dropped below 40%. It can be said that the domestic power battery industry has entered a more competitive environment, with price wars affecting all related industries.

Breaking Through and Going Overseas

Faced with the fierce domestic competitive landscape, power battery manufacturers have embarked on the same development path as new energy vehicles: seeking survival overseas.

In fact, as early as the initial stage of new energy vehicle exports, power battery manufacturers were pioneers in going overseas. As the industry leader, CATL was among the first to venture abroad. Currently, CATL has established three overseas factories, all located in Europe.

The first, the Arnsberg factory in Thuringia, Germany, commenced production in 2023 and has successfully become a major battery supply base for Volkswagen in Europe. According to CATL, the factory will achieve break-even within the year.

Additionally, CATL is investing in the construction of another battery factory in Hungary. The factory is currently under construction with a planned capacity exceeding 100GWh.

However, on December 10, CATL and the Stellantis Group jointly announced the construction of a third battery factory in Spain with a planned capacity of 50GWh. As the first overseas joint venture factory, CATL not only holds a 50% stake but also has controlling shares and significant management authority over the factory.

Relying on its early overseas investments, CATL's overseas market share has now surpassed 30%, becoming a crucial revenue source. This year, CATL's overseas battery installation volume surpassed that of LG Energy Solution, firmly securing the top spot.

Besides CATL, Zhongchuang Xinhang has emerged as a dark horse in overseas expansion this year. According to statistics, the growth rate of battery installations in Zhongchuang Xinhang's overseas market in the first 10 months of this year was 372.1%, ranking eighth in the overseas market.

With the rapid development of the overseas market, Zhongchuang Xinhang has solidified its position as the fourth-largest global power battery installation company, trailing only CATL, BYD's Fudi Battery, and LG Energy Solution. It has pulled ahead of other domestic battery manufacturers by a significant margin.

Guoxuan High-Tech and EVE Energy, which follow behind, also aim to expand into new markets by enhancing their overseas presence, as it has become challenging to win customers from CATL and Fudi Battery domestically.

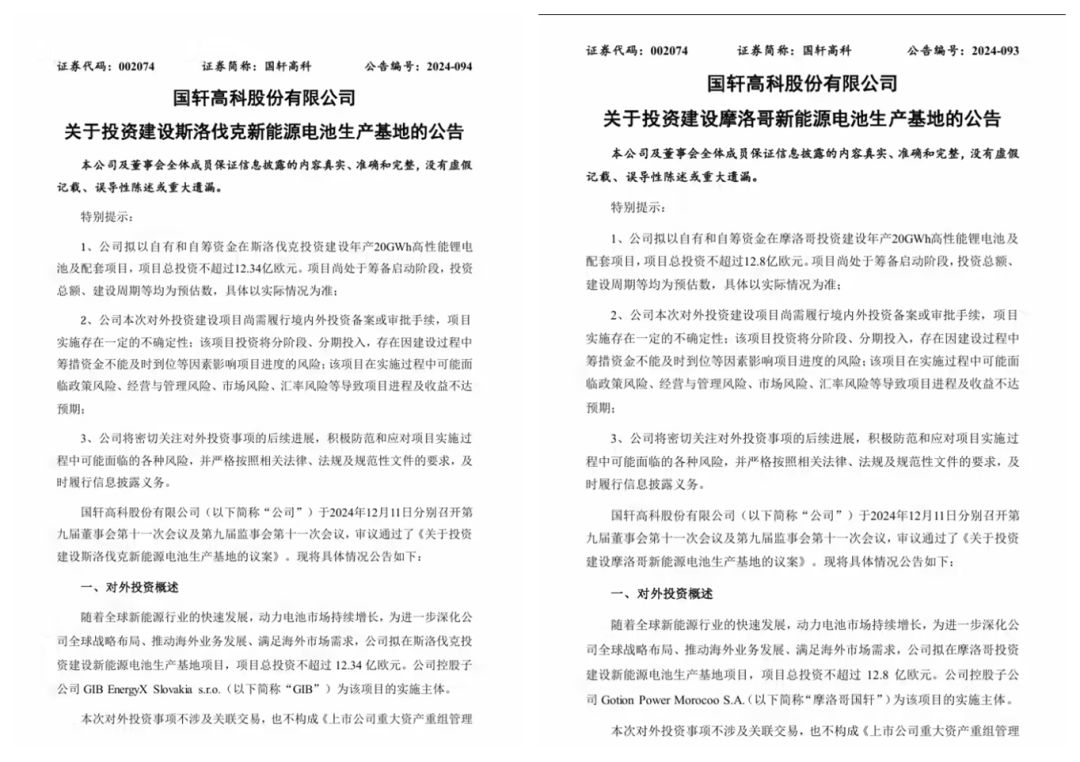

Guoxuan High-Tech even issued two announcements on December 12, announcing the construction of battery factories in Slovakia and Morocco with a total investment of nearly 20 billion yuan.

On the one hand, battery manufacturers establish factories overseas due to factors such as production and transportation costs, enabling a more direct response to local customers. On the other hand, overseas investment is also motivated by local policy subsidies. For example, Slovakia, a major production base for European automobiles with annual automobile production maintaining at 1 million vehicles, introduced the new energy industry to facilitate the local automotive industry's transformation and maintain its stable development.

Slovakia has subsidized Guoxuan High-Tech with 200 million euros, enabling it to remain a significant European automotive production base in the era of new energy vehicles, reducing the influence of countries like Hungary and Spain.

It is evident that as China's power battery industry expands fully overseas, price wars will also unfold internationally. Where there is a market, there is competition. Even after the European Union began imposing tariffs on Chinese new energy vehicles, it cannot truly hinder the development of China's new energy vehicle industry. Especially with an absolute market share, the future of European new energy still relies on Chinese enterprises.

As evidenced by CATL's joint venture factory, under the same shareholding ratio, CATL holds controlling shares in the company, underscoring the importance of technology. The tables have turned. The Chinese automotive industry, which once relied on joint ventures to introduce technology, can now export technology overseas.

However, it is noteworthy that power battery technology is currently evolving rapidly. For instance, the mass production timeline for solid-state batteries is continually being advanced, and new turning points may emerge at any time. Additionally, with the completion of more production capacity, capacity utilization may further decrease. If market demand growth slows down, a new round of price wars may commence among battery manufacturers.

After all, considering current prices, there is still considerable room for power battery prices to drop below the cost line. As 2024 draws to a close, the strength of national subsidies may diminish. To maintain the market, the next round of price wars may soon begin.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.