Xiaomi Auto on the Verge of Profitability: Will BYD Reap Unseen Benefits?

![]() 12/20 2024

12/20 2024

![]() 637

637

Author | Meng Xiao

Learn more financial information | BT Financial DataLink

This article is approximately 3,352 words and is expected to take 9 minutes to read

Xiaomi Auto, which has been in operation for just a year, is poised to turn losses into profits?

On December 16, Gree Electric Appliances Chairman Dong Mingzhu once again criticized top entrepreneur Lei Jun, questioning how much Lei Jun had paid in dividends to shareholders, a topic that quickly went viral on social media.

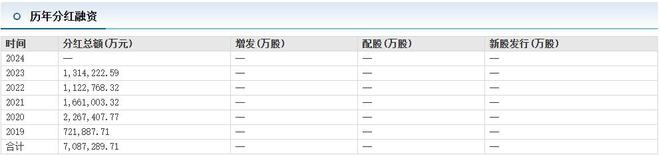

Lei Jun currently boasts 35.73 million followers on Douyin and around 25 million on Weibo, making him a top influencer on both platforms. It's unclear why Lei Jun often becomes a target of criticism. On December 9, Xiaomi Auto's second model, the YU7, appeared on the Ministry of Industry and Information Technology's latest new vehicle list and also went viral on social media. When the Xiaomi YU7 was first revealed, Xiaomi's share price surged 3.51%. On the first trading day of 2024, Xiaomi's share price was HK$15.60. As of December 18's close, Xiaomi's share price stood at HK$30.80, marking an intra-year increase of 97.4%. This suggests that despite Dong Mingzhu's criticism about Xiaomi giving less in dividends to shareholders, the company remains popular in the capital market. Gree Electric Appliances, which boasts of giving more dividends to shareholders, saw a 45% share price increase over the same period. While this significantly outperformed the broader market, its growth rate was less than half of Xiaomi's.

Moreover, Gree Electric Appliances' total market capitalization of 243.4 billion yuan is far less than Xiaomi's 769.3 billion Hong Kong dollars. Notably, Xiaomi Auto, under Lei Jun's leadership, is highly likely to turn losses into profits in the fourth quarter. In the third quarter, Xiaomi Auto delivered an impressive performance. The company delivered a total of 39,790 vehicles, with revenue soaring to 9.7 billion yuan and gross margin increasing to 17.1%. At the same time, losses were reduced to 1.5 billion yuan. This means Xiaomi Auto's gross profit has reached approximately 1.66 billion yuan. Upon conversion, it can be found that Xiaomi Auto's gross profit per vehicle in the third quarter has reached approximately 41,700 yuan (calculated at a gross margin of 17.1%). Many new energy vehicle makers are still burning money endlessly. How did Xiaomi Auto achieve such a high gross margin?

1

Why Does Dong Mingzhu Frequently Criticize?

On December 16, Gree Electric Appliances Chairman Dong Mingzhu said in a conversation with Sina Finance CEO Deng Qingxu on a program that Xiaomi recently paid Gree 500,000 yuan for patent infringement.

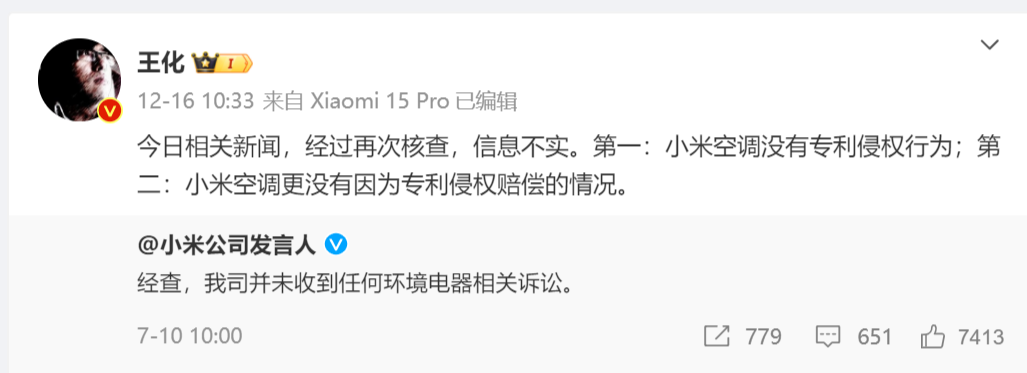

Xiaomi responded promptly. Wang Hua, General Manager of Xiaomi's Public Relations Department, forwarded a tweet from Xiaomi's official account from July this year and responded, "Regarding today's related news, after re-verification, the information is inaccurate. First: Xiaomi air conditioners have not infringed on any patents; Second: Xiaomi has not paid 500,000 yuan for patent infringement."

This year, there have been increasing verbal spats between Dong Mingzhu and Lei Jun, but they are mostly initiated by Dong Mingzhu. Some netizens commented under the news, "Now Dong Mingzhu can't speak without mentioning Xiaomi and Lei Jun." From the billion-dollar bet in 2013 to the current verbal spats, Gree and Xiaomi, Dong Mingzhu and Lei Jun, have been in a long-distance race for 11 years. During these 11 years, Gree Electric Appliances' revenue increased from 120 billion yuan to 205 billion yuan, an increase of 85 billion yuan over 11 years. During the same period, Xiaomi's revenue increased from 26.58 billion yuan to 271 billion yuan, an increase of 244.42 billion yuan, almost three times that of Gree.

With the downturn in the real estate market, the air-conditioner market has also experienced a downturn. According to AVC Revo data, in the first 11 months of 2024, the retail sales volume of the air-conditioner market was 198 billion yuan, a year-on-year decrease of 3.2%; the retail volume was 57.43 million units, a year-on-year decrease of 2.4%. This has not had a significant impact on Xiaomi, but it has had a greater impact on Gree. The first-half financial report shows that Gree's revenue in the first half of the year was 100.3 billion yuan, with air-conditioner revenue reaching 77.961 billion yuan, accounting for 78.14% of total revenue.

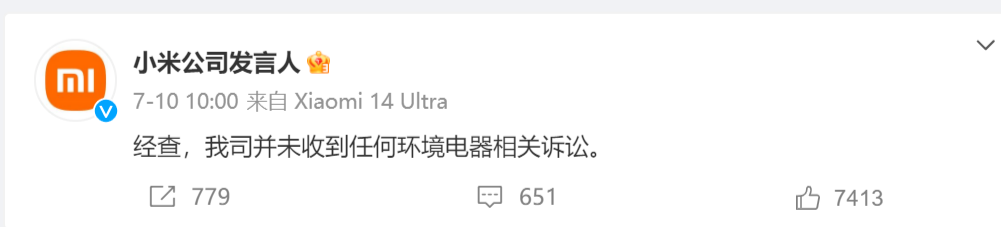

Perhaps in response to Dong Mingzhu's comments, on December 16, Xiaomi Group Partner and President Lu Weibing posted that Xiaomi's air-conditioner sales increased by 53% year-on-year from January to November. According to AVC Revo data, from January to November this year, Gree and Xiaomi's cumulative online sales of air conditioners increased by 1.15% and 67.22%, respectively, ranking second and third in market share; offline sales increased by 4.17% and 349.8%, respectively, ranking second and 18th in market share. In terms of volume, Gree still has an absolute advantage, but in terms of growth rate, Xiaomi has far surpassed Gree. What about the dividend issue that Dong Mingzhu has been criticizing? From 2019 to 2023, Gree Electric Appliances' total dividend payments amounted to 70.873 billion yuan. However, it doesn't mean that companies with more dividends are favored by investors.

Investor Liu Bo said that dividends are just one way to reward investors. There are also many other ways, such as share buybacks to increase share prices and increase the market value of minority shareholders' holdings. "Xiaomi is a technology company, and its smartphone, AIoT platform, smart hardware, and automotive fields all require significant R&D investment to maintain competitiveness. At the same time, the development and marketing of new businesses such as automotive and home ecosystem construction require a lot of funds. Dividends may affect the progress of these projects and Xiaomi's overall competitiveness. In recent years, Xiaomi has focused on cash flow, and its debt ratio has decreased significantly. If Xiaomi only retains smartphone R&D and abandons new businesses, it will generate a large amount of cash dividends, but this is not what investors want."

2

Xiaomi Auto on the Verge of Profitability: Will BYD Reap Unseen Benefits?

Since its launch in March, Xiaomi's SU7 has sold 110,500 units by the end of November. The annual sales target of 100,000 to 120,000 units will likely be successfully completed without surprises, considering that with 23,156 SU7 units sold in November alone, Xiaomi's annual sales will be around 130,000 units. This is a remarkable achievement for an automaker that has launched its new car for less than a year. Among many new energy vehicle brands, Xiaomi's sales have ranked in the top eight. Moreover, this year's automotive market may witness the birth of a miracle – Xiaomi Auto, under Lei Jun's leadership, is highly likely to turn losses into profits in just one year.

According to financial reports, in the second quarter, Xiaomi Auto delivered 27,307 SU7 models, with automotive business revenue reaching 6.4 billion yuan and achieving a gross margin of 15.4%. Nonetheless, the company still faced a net loss of 1.8 billion yuan during the quarter. It is worth emphasizing that Xiaomi Auto's gross profit has climbed to 990 million yuan, equivalent to a gross profit contribution of approximately 36,000 yuan per vehicle delivered. However, due to the accumulation of expenditures such as R&D investment, sales costs, and administrative expenses, as well as depreciation and amortization of capital expenditures such as factory construction, total expenses reached approximately 2.8 billion yuan, resulting in a final financial loss.

In the third quarter, Xiaomi Auto's performance became even more impressive. During the quarter, the company delivered a total of 39,790 vehicles, with revenue surging to 9.7 billion yuan and gross margin significantly increasing to 17.1%. During this period, net losses narrowed to 1.5 billion yuan. This marked a significant increase in Xiaomi Auto's gross profit, reaching approximately 1.66 billion yuan, an increase of 66% compared to the second quarter. Although net losses remained at 1.5 billion yuan, the company's total expenses increased to approximately 3.16 billion yuan, an increase of approximately 360 million yuan compared to the second quarter.

It is worth mentioning that in the third quarter, Xiaomi Auto's gross profit per vehicle reached approximately 41,700 yuan (calculated at a gross margin of 17.1%). This undoubtedly provides a solid foundation for Xiaomi Auto to achieve profitability in the fourth quarter. Perhaps surprisingly, when Xiaomi YU7 was officially announced, BYD might be the biggest beneficiary. One might generally think that the launch of Xiaomi YU7 has nothing to do with BYD, and there may even be a competitive relationship between the two automakers.

Xiaomi Auto's sales are promising, and suppliers will also benefit. Among Xiaomi Auto's suppliers, BYD ranks at the top. According to Xiaomi Auto's filing information with the Ministry of Industry and Information Technology, the SU7 standard version is equipped with a lithium iron phosphate battery produced by BYD Fudi Battery in Xiangyang. Currently, the Xiaomi SU7 standard version is one of Xiaomi Auto's main sales models.

Currently, Xiaomi's second model, the YU7, has generated significant buzz even before its launch, and it is expected that a large number of BYD-produced power batteries will be used when it goes into production. Therefore, when the Xiaomi YU7 was exposed on December 9, not only did Xiaomi's share price rise, but BYD's share price also increased by 0.73%. It is worth noting that Xiaomi's share price has increased by 97.4% since the beginning of 2024, while BYD's share price has also increased by more than 45% during the year, making it one of the domestic automakers with a higher share price increase.

3

Will Xiaomi Auto Replicate Its Success in the Smartphone Sector?

Xiaomi has launched its second model, and analysts predict that Xiaomi Auto's sales will more than double by 2025. According to Bloomberg, Xiaomi's share price is approaching its all-time high, and Xiaomi is replicating its initial success in the smartphone sector in the highly competitive electric vehicle market. Despite significant declines in the share prices of many listed companies in recent years, Xiaomi's share price is approaching its 2021 peak, and many institutions predict that Xiaomi's share price still has room for growth or may usher in a wave of consecutive increases.

(Comparison of Xiaomi's share price increase with peers over the same period)

Feng Shuyan, Deputy General Manager of Investment Management at Huatai Asset Management (Hong Kong) Co., Ltd., believes that Xiaomi is a dark horse in the stock market, with its share price severely underestimated. When Lei Jun invested billions of dollars to build cars, almost no one believed he would actually succeed. However, Xiaomi is now one of only three new energy automakers to have completed their annual sales targets, along with BYD and Zero Running. "With an annual sales volume of 130,000 units for a single model, Xiaomi's sales are expected to increase significantly after the launch of the YU7, enriching its product line." Automotive media person Zhang Zhiyong is optimistic about Xiaomi's sales and believes that Lei Jun is a marketing master, which has a decisive impact on Xiaomi Auto's sales. Since September, nine institutions have given Xiaomi a "buy" rating. Among them, China International Capital Corporation (Hong Kong) has set a target price of HK$34 for Xiaomi, which is already close to Xiaomi's all-time high of HK$35.9 on the Hong Kong stock exchange, demonstrating institutions' optimism towards Xiaomi.

Bloomberg Intelligence analyst Steven Tseng also wrote in a report, "Xiaomi's electric vehicle business is likely to replace smartphones as the main driver of the company's sales growth in 2025, and the YU7 could drive a 137% increase in Xiaomi's electric vehicle sales in 2025." Let's return to the question at the beginning: Why can Xiaomi Auto achieve profitability in just one year, while many new energy automakers are still struggling to survive?