Feasting on the Tech Buffet: BAIC BJEV Raises ¥10.1 Billion, AITO Secures ¥11.1 Billion in Funding

![]() 12/25 2024

12/25 2024

![]() 622

622

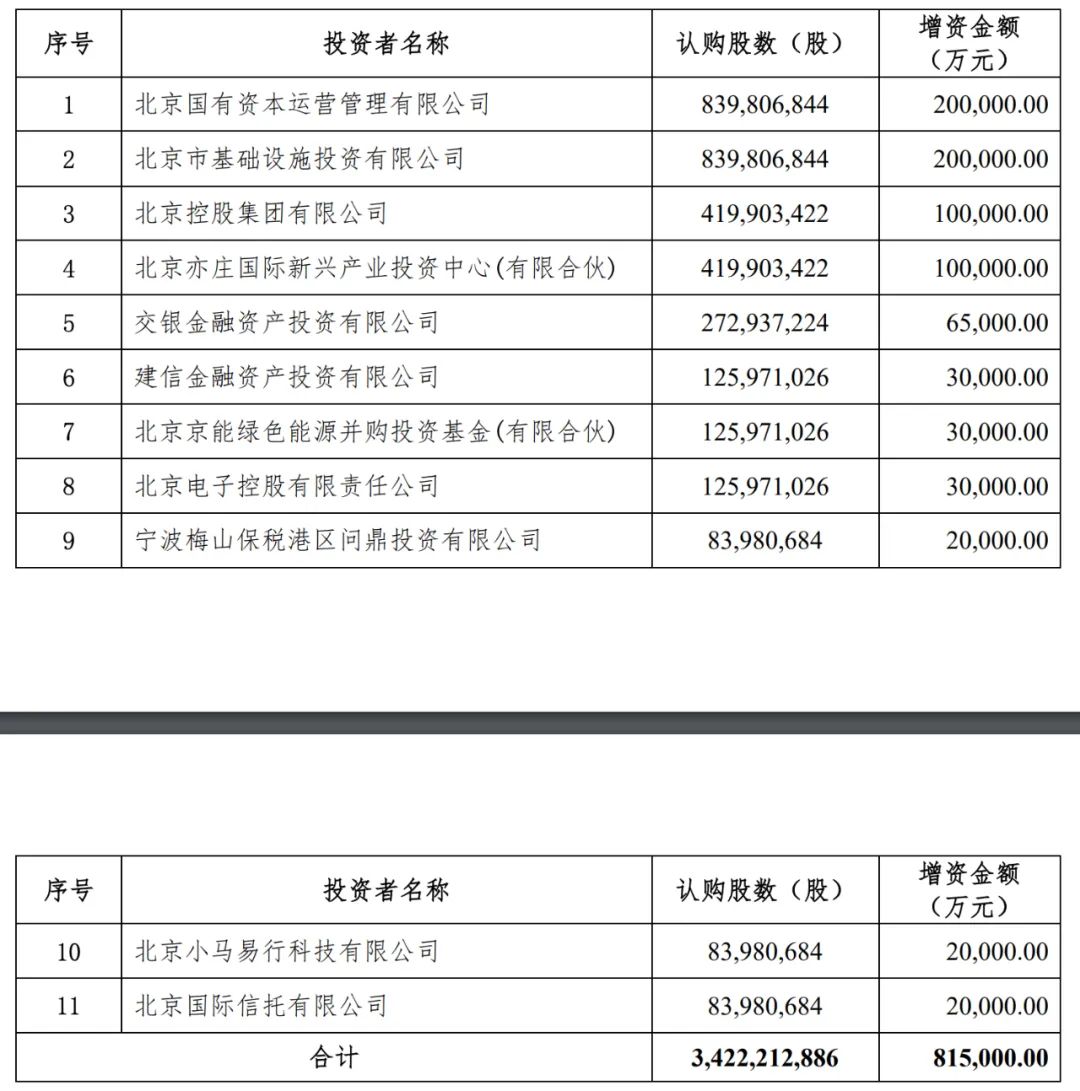

On December 24, Beijing time, BAIC BJEV (600733), an A-share listed company and a key collaborator with Huawei in the automotive sector through HarmonyOS SmartDevice, announced the progress of its subsidiary's capital increase and share expansion. A total of 11 strategic investors, including Beijing State-owned Capital Operation and Management Co., Ltd. and Pony.ai, invested ¥8.15 billion.

According to BAIC BJEV's announcement on December 16, BAIC Motor and its subsidiary BAIC BJEV signed a "Capital Increase Agreement" to inject an additional ¥2 billion. Following two rounds of capital increases from 12 strategic investors, BAIC BJEV has cumulatively raised ¥10.15 billion.

The details of the eleven strategic investors and the amount of capital injected in this round are as follows:

Notably, Pony.ai invested ¥200 million. Previously, Pony.ai listed in the US, and BAIC Group announced a strategic investment of US$70.35 million in Pony.ai on November 29. The two parties also signed a technical cooperation agreement on November 2 to jointly develop fully autonomous Robotaxi models.

There is no indication that BAIC BJEV's current funding round will be directed towards Inway. Instead, it might primarily focus on developing its own brand ARCFOX and Xiange, one of the four brands collaborating with Huawei's HarmonyOS SmartDevice. Xiange has launched its first model, the Xiange S9, and plans to introduce multiple models, including an extended-range version, in the future. It's worth mentioning that ARCFOX has sold over 10,000 units in recent months, which is commendable.

Next, we'll observe if the launch of the extended-range version of the Xiange S9 and additional models can achieve sales growth comparable to AITO, another Huawei automotive collaboration model. AITO recently announced securing C-round financing of ¥11.1 billion.

On December 17, AITO, a subsidiary of Changan Automobile and a Huawei automotive collaboration partner, successfully completed C-round financing totaling ¥11.1 billion. Key investors in this round included Changan Automobile and the Chongqing government-backed Anyu Fund, which injected ¥4.551 billion and ¥2.8 billion, respectively. As AITO's largest shareholder, Changan Automobile's equity remained at 40.99% post-funding.

Previously, Changan Automobile acquired a 10% stake in Huawei's new company Inway through AITO for ¥11.5 billion. On October 16, AITO completed the first equity investment payment of ¥2.3 billion, with the remaining ¥9.2 billion due.

Clearly, in addition to providing necessary financial support for company growth, AITO's current funding is primarily aimed at investing in Inway. Moreover, AITO has set a clear goal of going public in 2026.

As of August 31, 2024, AITO's financial data disclosed by Changan Automobile showed an undistributed profit of -¥8.313 billion, net cash flow from operating activities of ¥1.537 billion, total assets of ¥12.315 billion, and total liabilities of ¥12.337 billion.

AITO is also under significant operational pressure. However, with the recent launch of extended-range models, sales have steadily increased, surpassing 10,000 units in November. The main model, AITO 07, sold over 8,300 units that month. It's hoped that this growth momentum continues.

With tens of billions of yuan in new funding, BAIC BJEV's brands ARCFOX and Xiange, along with AITO, are poised for significant capital replenishment in 2025. This should alleviate potential consumer concerns about company stability.

The sudden collapse of Geely&Baidu's Geelyue in late 2024 shocked the industry and potential consumers. Relying on giants like Geely and Baidu, Geelyue's downfall was unexpected. Future buyers will undoubtedly be more cautious when choosing brands.

Automakers seeking collaboration with Huawei must be prepared to invest billions of yuan. For those still in the game, this is a substantial amount. A question arises: will Huawei's collaborating brands compete against each other? This is already evident as IntelliSpace R7's monthly sales exceed 10,000 units, while AITO's sales show a downward trend.

With limited model diversity and insufficient differentiation in Huawei's new technologies, consumers may experience aesthetic fatigue. How Huawei and its partners address this challenge remains to be seen.