Lexus to Produce Locally in China: Is the Luxury Brand's Electrification Strategy in Full Swing?

![]() 12/25 2024

12/25 2024

![]() 991

991

The Chinese market stands as a pivotal player in Lexus's transition towards electrification.

It's no longer a mere rumor.

According to Japanese media reports, Toyota Motor has finalized plans to establish a new factory in China dedicated to producing pure electric vehicles (EVs). The company aims to commence production in Shanghai around 2027, primarily focusing on electric models under the Lexus brand. This will mark Toyota's debut as the first Japanese automaker to establish a wholly-owned factory in China.

Industry observers note that amidst the exodus of foreign automakers from China, the Chinese government hopes that the establishment of a high-value-added Lexus factory will retain foreign investments. This aligns with Toyota's aspiration to operate the factory independently.

If true, this signifies a significant shift in Toyota's investment strategy in China, transitioning from reliance on imports to local production.

Experts believe that establishing a wholly-owned EV factory in China offers multiple benefits to Lexus. Beyond integrating Chinese characteristics into products and technology to better meet local consumer needs, it allows the brand to leverage China's supply chain and labor cost advantages. This eliminates international transportation costs and import tariffs, enabling Lexus to better navigate current price competitions.

More importantly, it harnesses China's relatively mature EV supply chain, enabling Lexus to swiftly catch up with the EV development trend in the country.

Is the timing right?

Rumors of Lexus's "localization" have circulated before.

Since entering the Chinese market two decades ago, rumors of Lexus's localization have repeatedly emerged, each time like a false alarm.

In 2006, Lexus first hinted at local production if sales exceeded 30,000 units in China. By 2007, GAC Toyota's Chinese management suggested considering local production if annual sales hit 50,000 units. In 2012, the threshold for localization was raised to 100,000 units.

In 2013, Toyota China officially discussed localizing Lexus production in China for the first time.

In 2016, when Lexus surpassed 100,000 annual sales in China, localization plans were later denied. In October 2018, media outlets quoted Toyota insiders stating that to compete with BBA, Toyota's senior management was eager to boost Lexus sales and actively promoted the localization project in China. Specific localization plans had already been confirmed.

Insiders revealed that while discussions on factory construction and production in China had indeed taken place, it was not a straightforward task. Toyota was hesitant about localizing Lexus. "They (Toyota's senior management) always believed the timing and conditions weren't right."

Notably, in 2020, despite launching a global new factory plan, Lexus chose India, with annual sales of mere hundreds of units, for its new global factory.

So, why now?

As a luxury brand under Toyota, Lexus has been a profitable venture in China. According to official data, by 2019, Lexus's cumulative sales in China had surpassed 200,000 units, marking a 25% year-on-year increase.

However, with the electrification wave, Lexus's golden days are over.

In 2023, Lexus sold approximately 181,400 units in China, recording a mere 3% year-on-year increase. Conversely, in 2023, Lexus witnessed over 20% growth in all global markets except China. Regions like the Middle East, Japan, and East Asia saw year-on-year growth rates exceeding 60%, with some regions reaching 130%.

From January to November this year, while Lexus's total imports reached 162,000 units, a year-on-year increase of 8.2%, positioning it among the few luxury car brands maintaining positive growth, the brand faces multiple challenges in the Chinese market, including the rise of Chinese brands and intense price wars. Crucially, Lexus missed China's electrification wave.

Akio Toyoda, Toyota Motor's president, once stated that the Chinese market would play a crucial role in Lexus's electrification transformation.

According to plans, Lexus aims for 100% electrification by 2035. Toyota's latest plan includes launching next-generation BEV (Battery Electric Vehicle) products developed by BEV Factory, with Lexus introducing these all-new BEV models starting in 2026.

In July, reports suggested that with Lexus establishing an independent factory in China, it would lead production of a new UX hybrid version and a pure electric model. These models would be sold in the Chinese market and exported to overseas markets like Japan.

Insiders confirmed this, stating, "(The Shanghai side) did contact Toyota, but there are still uncertainties regarding the implementation of Lexus's plan to establish a wholly-owned factory. Of course, if Lexus establishes a wholly-owned factory in China, it will produce pure electric models rather than hybrid products."

Dark Clouds Loom

Over the past two years, Toyota Motor has been the world's best-selling and most profitable automaker. However, this year, the automotive giant has been shrouded in negative news, including fraud scandals, fraudulent quality testing, vehicle recalls, and production halts.

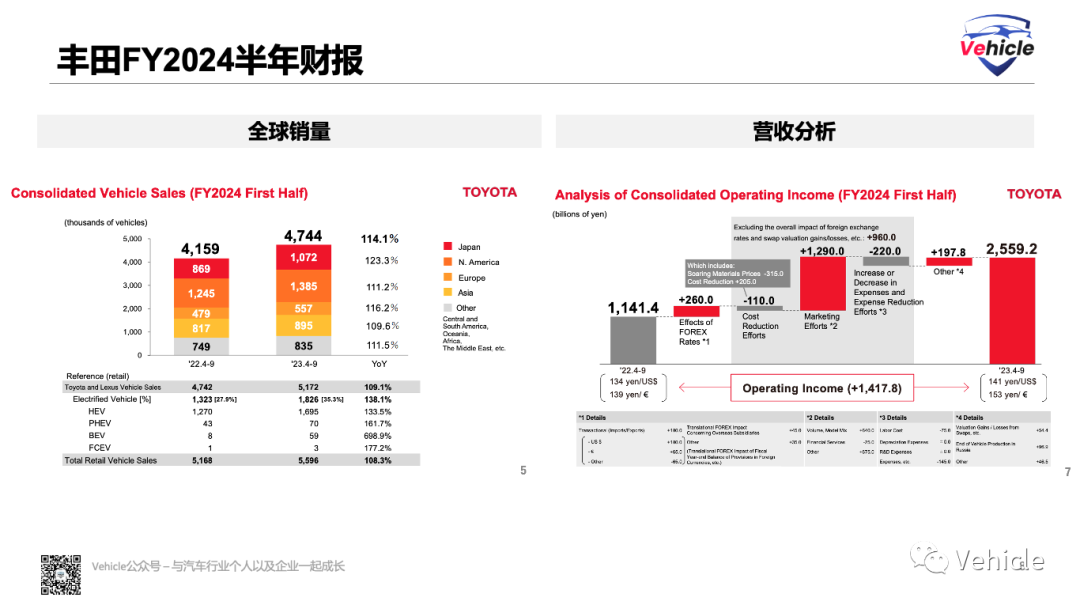

Affected by production suspensions due to certification violations and intensifying competition in the Chinese market, Toyota's financial report witnessed its first profit decline. Its recently disclosed financial report for the first half of fiscal year 2025 (April to September 2024) revealed an operating profit of 2.46 trillion yen, a year-on-year decrease of 3.8%.

In the second fiscal quarter (July to September 2024), net profit halved year-on-year to 573.7 billion yen, marking Toyota's first quarterly profit decline in two years.

Simultaneously, due to production halts caused by recalls, Toyota's global production declined for the first time in four years. In the first half of the fiscal year, it produced 4.71 million vehicles, a year-on-year decrease of 7%. In terms of sales, Toyota's global sales declined by 4% year-on-year to 4.556 million units.

Due to poor financial performance, Toyota revised its global production forecast downward for the fiscal year (including the Lexus brand), considering factors like global economic fluctuations and supply chain challenges. However, as Toyota lowered its global sales forecast for 2024, rumors emerged that it planned to increase production in China.

Media reports suggest that Toyota aims to achieve an annual production target of at least 2.5 million units in China by 2030.

Data shows that Toyota's production in China was 1.84 million units in 2022 and 1.75 million units in 2023. To meet its maximum target, the company's production capacity will need to increase significantly by 63% over the next five years. If Lexus's localization is successful, it will further enhance Toyota's competitiveness in the Chinese market.

However, in China's EV competition, BYD has swiftly gained market share, outpacing Toyota in just 2-3 years. This year, BYD's monthly sales have been three times that of Toyota's sales in China, prompting Toyota to aim to regain market share lost to BYD.

Although Toyota hasn't publicly announced this plan, the company has communicated with suppliers to ensure supply chain stability and security in China. In a statement, Toyota said, "Due to fierce competition in the Chinese market, we are constantly considering various measures." It also stated its commitment to continuing to manufacture better cars for the Chinese market.

To regain its position in the Chinese market, Toyota recognizes the need for close collaboration between sales and production. "They have begun delegating authority to Chinese executives, giving them greater freedom to make decisions in R&D and sales."

Toyota will also delegate development tasks to Chinese employees with a deeper understanding of local market preferences, particularly in electric vehicles and connected car technology. "There is a growing awareness within Toyota that it needs to rely more on local employees to lead and accelerate product development in China, or it will be too late."

Toyota isn't alone; the entire Japanese automotive industry is facing a winter in the Chinese market.

From a market share perspective, Japanese automakers' share in the Chinese market has continued to decline. According to data from the China Passenger Car Association, Japanese brands' market share fell to 17% in 2023, a year-on-year decrease of 3 percentage points, the lowest since 2017. From 2020 to 2023, Japanese cars lost 950,000 sales in the Chinese market.

The difficulties faced by Japanese automakers stem not only from changing market environments and consumer demands but also from their own strategic adjustments and innovation capabilities.

On December 23, to compensate for declining competitiveness, Honda and Nissan jointly announced in Tokyo that they had signed a memorandum of understanding on a merger and would officially commence merger negotiations. If successful, the new group formed by the two parties will become the world's third-largest automotive group after Toyota and Volkswagen.

Historically, Japanese automakers' global success has benefited from open industrial policies in various countries. Whether it was the green light given by the United States during the oil crisis or Southeast Asia's efforts to develop its automotive industry, these factors contributed to the rise of Japanese automakers.

However, the slow transition to electrification has caused Japanese automakers to lose favor in major sales countries. With sales and profits rapidly declining, Japanese automakers are choosing to either produce locally in China or seek partnerships with giants to cope with fierce global competition. Whether they can achieve breakthroughs, particularly in electrification and intelligence, remains a challenging question.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.