"Technological Convergence" May Not Be Enough to Save Honda and Nissan

![]() 12/27 2024

12/27 2024

![]() 589

589

Introduction

The effects of integration remain to be rigorously tested by time and the market.

"This could be the biggest automotive news of 2024 and even recent years." Regarding the largest integration event in the history of Japan's automotive manufacturing industry, pursued by Honda and Nissan with the goal of listing on the Tokyo Stock Exchange in August 2026, there is consensus among internal discussions within the corporations.

The merger of Honda, Nissan, and Mitsubishi demonstrates Japanese automakers' determination to face intense competition from emerging forces like Tesla and Chinese automakers, amidst their own operational crises and profound changes in the global automotive industry landscape. Especially with Foxconn's "divine assist," the "progress bar" has begun to accelerate.

As the integration involves collaboration across multiple areas such as business, technology, and procurement, with ambitious goals of cost reduction, efficiency improvement, and advancement to the top three in global competitiveness, the difficulty of integration is predictable.

What we are most concerned about, of course, is how Honda and Nissan will integrate technologically. Let's delve into some deductions in this article. After all, both parties face many challenges in overlapping markets and technologies, as well as handling existing cooperative relationships. The effects of integration remain to be rigorously tested by time and the market.

Honda Remains the King of Hybrids

Will the merger of Honda and Nissan become another "Losers' Alliance"? Let's set that aside for now and explore the possibility of technological integration between the two parties, as well as how far they still lag behind Tesla and Chinese automakers in terms of intelligent electrification.

Based on current estimates, using 2023 sales figures, the merged Honda-Nissan-Mitsubishi group will have an annual vehicle sales volume of 8.13 million, potentially catapulting it to the world's third-largest automaker. This figure is quite enticing.

Moreover, the integration of Honda and Nissan is a proactive move led by the Japanese government, outside the Toyota system, to respond to the sudden changes in the global competitive landscape. Honda's expertise in hybrid technology and Nissan's deep experience in electric technology will be the core competitiveness of both companies in the new energy vehicle market.

Technologically, Nissan has extensive experience in mass-producing electric vehicles, from the Leaf to the current Ariya. Honda, on the other hand, is rapidly advancing in the development of next-generation hybrids and electric vehicles. Ideally, if their technologies can be successfully integrated, it is expected to shorten the research and development cycle, save R&D expenses, and achieve economies of scale.

Therefore, how to share technology becomes the key to this integration, especially in software development and electrification technology. Here, let's take a look at the three ideas outlined in the memorandum officially announced by Honda, Nissan, and Mitsubishi, benchmarking against Toyota:

- Integrate both parties' technological advantages and achieve technology sharing in the fields of intelligence and electrification to accelerate the development of electric vehicles and intelligent connected vehicles;

- Optimize R&D, production, and supply chain management through closer cooperation to achieve resource sharing and optimization;

- Jointly develop products and explore emerging markets to provide customers with more diverse options, thereby creating market synergies.

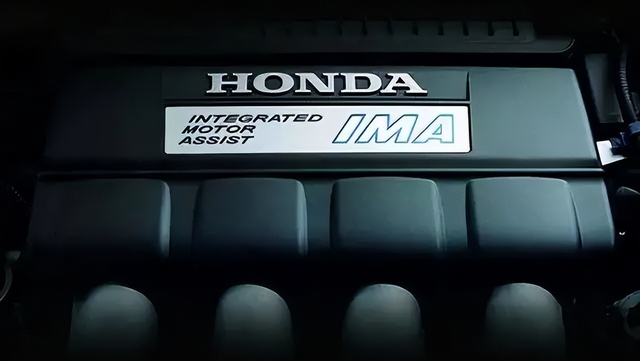

In terms of hybrid technology, Honda's i-MMD technology has been iterated to the fourth generation, and Honda actually has four hybrid systems, including the Honda IMA hybrid system, i-DCD hybrid system, i-MMD dual-motor hybrid system, and SH-AWD hybrid system.

Among them, Honda released the latter three hybrid technology routes simultaneously after IMA, suitable for small, medium, and large vehicles, respectively, which can be seen as three versions of one system.

As everyone knows, Honda's first-generation IMA (Integrated Motor Assist) hybrid system was developed in 1997. In 1999, the Honda Insight, equipped with the first-generation IMA system, was launched and has since evolved to the sixth-generation IMA. IMA is a typical parallel hybrid system, a single P2 motor hybrid system.

Honda's i-MMD (Intelligent Multi Mode Drive) hybrid system is the most well-known P1+P3 dual-motor hybrid system in the Chinese market.

This system is equipped with a 2.0L Atkinson cycle dual overhead camshaft variable valve timing (DOHC i-VTEC) gasoline engine and a high-power dual-motor (eCVT), allowing smooth switching between electric, hybrid, and engine drive modes. It excels in energy efficiency, achieving the highest level of fuel economy in its class globally, with rapid acceleration and superior sports performance.

Honda's i-DCD hybrid system is positioned for small cars and compacts, essentially a single-motor plus DCT P3 hybrid system. The SH-AWD hybrid system, as the name suggests, adds electronic four-wheel drive and energy recovery modes to the i-MMD.

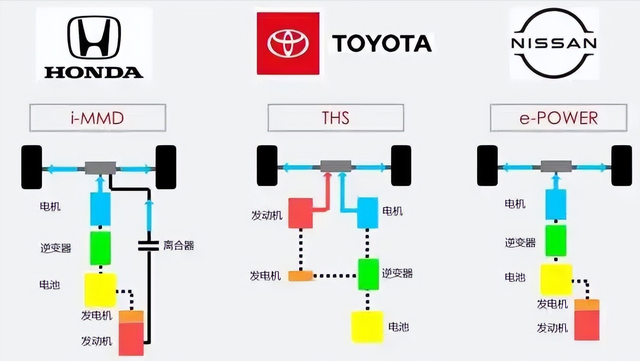

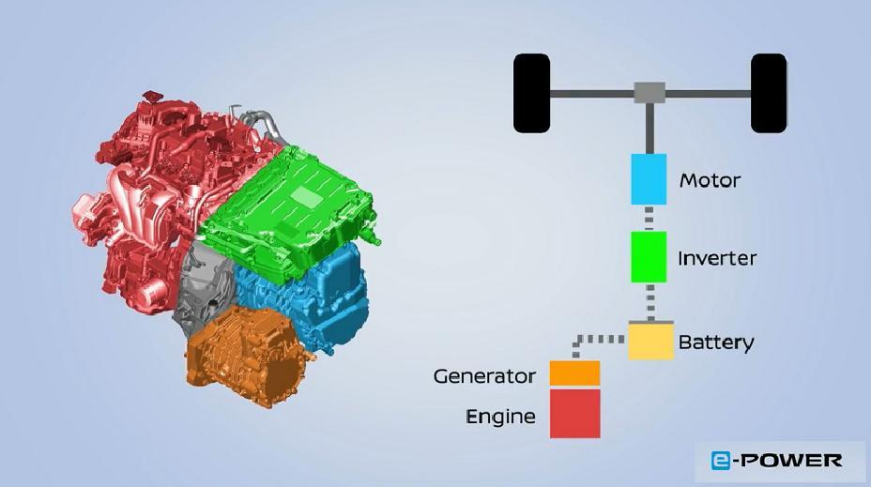

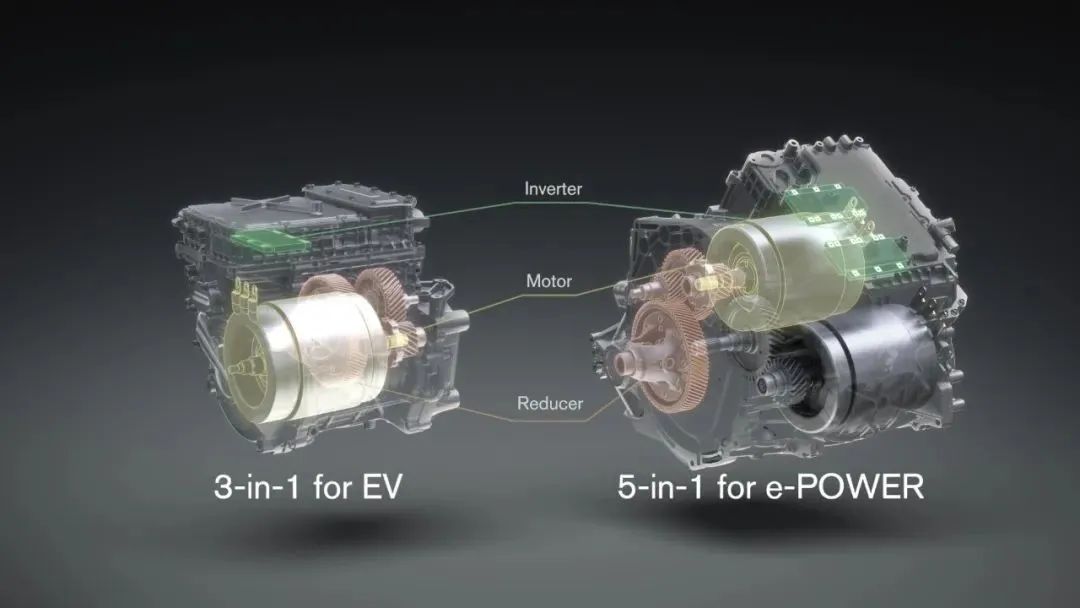

Although classified as HEV (Hybrid Electric Vehicle), Honda's i-MMD hybrid system is a typical mechatronic integrated system. In contrast, Nissan's e-POWER system is classified as a PHEV but logically belongs to a traditional extended-range system, prioritizing the motor.

However, both i-MMD and Nissan's e-POWER share a common characteristic: the use of "small batteries." They are not as strong in battery performance as domestic models that adopt the "large battery + long range" model. Of course, this is due to differences in development philosophy. Japanese automakers pay more attention to the actual comprehensive energy consumption performance of the entire system rather than individual data. This is an area where Honda and Nissan need to strengthen localized research and development in the future.

Some media outlets have also suggested that the first step in reforming Honda and Nissan's hybrid technology solutions should be to abandon the "small battery" strategy and adopt a CTC (Cell to Chassis) battery chassis integration approach, supporting large-capacity battery packs without encroaching on cabin space. This idea is sound.

However, while Honda excels in hybrid technology, Nissan also has its strengths. For example, the i-MMD system could incorporate Nissan's rear-axle P4 motor, which could be used in performance-oriented or off-road-oriented vehicle models, as the application of rear-axle P4 motors has already been adopted in domestic models.

Conversely, Nissan can rely entirely on Honda's i-MMD system to revamp its products. For example, directly replacing Nissan's existing small-displacement variable compression ratio engine with Honda's LFB hybrid-dedicated engine to enhance the e-POWER range extender system. Technically, this is feasible.

Ideally, after achieving a "1+1>2" technological fusion of their hybrid systems, both parties will experience an explosive increase in the richness of their hybrid vehicle models. This way, both companies' products can cover all categories, from high-performance cars, high-performance off-road vehicles, various sizes of family cars, luxury cars, and extreme energy-efficient models.

Of course, regardless of the direction, the pace of technological integration must be accelerated, right? Otherwise, if Honda and Nissan continue to drag their feet, it will be too late. This is not the era of Tokugawa Ieyasu, where one could "outlast" their rivals. Nowadays, one might just outlast oneself.

Electrification Relies on Nissan

In terms of pure electric vehicles, Nissan has a first-mover advantage over Honda. From the Leaf to the Ariya, Nissan has extensive technical experience in this area.

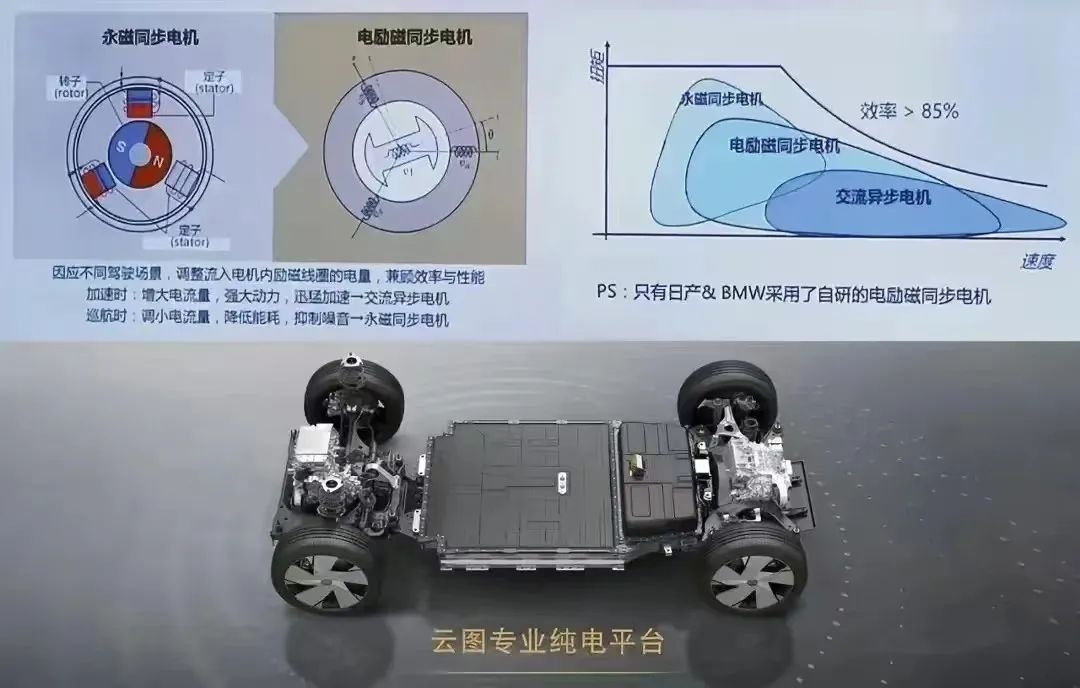

For example, as Nissan's magnum opus, the ARIYA, built on the Cloud Diagram professional pure electric platform, is equipped with the e-4ORCE snow fox electric four-wheel drive system and a 90KWh power battery, with a battery energy density of 155.8Wh/kg. Additionally, the ARIYA boasts a quality reputation inherited from "21 billion kilometers of battery use with zero major safety incidents," a tradition that began with the Leaf era.

This year, Honda finally unveiled its newly developed dedicated platform for pure electric vehicles. The platform adopts 2.0GPa-grade hot-stamped materials (ultra-high-tensile steel plates), thin battery packs, and newly developed compact e-Axles. Utilizing Honda's low-floor technology, heavy components are placed in a low position at the center of the vehicle, achieving a low center of gravity and low inertia. In China, models based on this platform from the Inspire and Ye brands have already been released, including the latest Ye S7 and Ye P7.

Not only did it come out late, but "some technologies are good, but the products are not" (in terms of Honda's electric offerings). This is how insiders describe it. Moreover, in terms of electrification, Honda's established policy is that all new vehicles will be pure electric vehicles (EVs) and fuel cell vehicles by 2040. In this regard, Nissan's pure electric technology will certainly come in handy.

Of course, technologically speaking, Nissan is still some distance away from Tesla and the current domestic top level. As written in the commune article "Honda-Nissan Merger: The Ideal of Toyota, the Reality of Stellantis," "Nissan's underlying technology for pure electric vehicles is good, and it has relatively rich productization experience, with solid strengths from the Leaf to the Ariya. However, Tesla has opened up another racetrack for pure electric vehicles by integrating intelligence, with Chinese newcomers quickly following suit. Therefore, Nissan's pure electric vehicles can only gradually increase in volume, while Tesla and Chinese newcomers can experience explosive growth."

Moreover, Nissan's electrification efforts are now lagging. Therefore, after the integration of Honda and Nissan, they will still face a series of issues such as the research and development of electrification technologies and technological collaboration. To catch up with Tesla and BYD after integration, both parties must increase investment and work together to develop electric vehicle platforms, battery technologies, and in-vehicle software systems.

Especially in battery technology research and development. Honda and Nissan need to invest heavily in researching high-performance, long-range, and safe battery technologies, including solid-state batteries, to reduce dependence on external battery suppliers. Notably, both parties have already established large-scale R&D teams for pure electric power systems and battery technologies in China.

However, Nissan sold its original battery business, AESC, to China's Envision Group, and its technology cannot compete with CATL and BYD. Honda's battery cooperation with LG is probably also weak. Moreover, can the corresponding electronic control be adequately developed?

In addition, considering the significant differences in pure electric technology between these two companies, pure electric vehicles may become an important factor differentiating the two brands in the future (after integration). This will also create certain obstacles for the integration of their electrification technologies.

In the areas of intelligent cabins and autonomous driving, software development capabilities are becoming increasingly crucial. Both Honda and Nissan need to strengthen software development and make breakthroughs in intelligent cabin systems and autonomous driving systems as soon as possible to catch up with the first tier.

This also includes fully investing in the research and development and testing of autonomous driving technology, accumulating massive road test data, and iterating algorithms. After all, as the dominant force in intelligence, the Chinese market updates and iterates at a very fast pace and will not give Honda and Nissan more time windows. China has already advanced from end-to-end to VLA. Honda and Nissan have too much homework to catch up. It is easy to imagine that the realization of this vision will be fraught with difficulties.

If Honda and Nissan want to gain a larger market share, localized research and development integration in the Chinese market will become a crucial step.

This involves the challenge of integrating the Chinese market. In China, Nissan has one joint venture company, while Honda has two joint venture companies, Dongfeng Honda and Guangzhou Honda. If integration is to occur, the issues of equity and personnel will be the first to arise. Next, the integration of technologies will also be difficult. How to use the complementary advantages of both parties rather than amplify their disadvantages, and so on.

Unsurprisingly, the integration path for Honda, Nissan, and Mitsubishi will be fraught with challenges, as overlapping business issues and existing cooperative entanglements pose severe tests. From a cultural standpoint alone, the divergence between Nissan's "alliance" culture and Honda's "independent research and development" philosophy could hinder integration efficiency. The ultimate shape of this integration remains uncertain, and we will have to wait and see over the next three years.

Cui Dongshu, Secretary-General of the China Passenger Car Association, shares a pessimistic view on the proposed merger between Honda and Nissan. He remarked, "Both Honda and Nissan require technological innovation and upgrades, not merely scaling up to reduce manufacturing costs. Finding synergy between the two companies will be difficult. According to former Nissan CEO Carlos Ghosn, there is almost no complementarity between them. This is a desperate measure, not a pragmatic deal."

Ideally, should the integration proceed smoothly, it could unlock significant scale and synergy benefits. Coupled with a concerted effort in the electric and intelligent vehicle market, it has the potential to redefine the position of the merged entity, be it "Honda-Nissan" or "Nissan-Honda," in the global automotive landscape.