Good News or Bad News? China's Automotive Chip Self-Sufficiency Rate Rises from 10% to 15%

![]() 01/06 2025

01/06 2025

![]() 695

695

Recently, media outlets have reported that China's automotive chip self-sufficiency rate has achieved significant progress, now standing at approximately 15%, with the remaining 85% still requiring importation.

Upon hearing this news, opinions have diverged sharply, with some seeing it as good news while others view it as bad news.

Those who consider it good news point out that just a year ago, in 2022-2023, this rate hovered around 10%. During that time, China imported over 20 billion automotive chips annually, with over 90% sourced from abroad.

Now, after a year, the rate has risen from 10% to 15%, marking a 50% increase—an exceptionally rapid growth rate.

Conversely, those who perceive it as bad news argue that while China's overall chip self-sufficiency rate has surpassed 30%, the automotive chip self-sufficiency rate stands at only 15%, with 85% still dependent on imports.

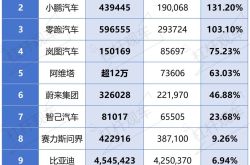

As a major producer and consumer of automobiles, China manufactures and sells up to 30 million vehicles annually. The demand for automotive chips is immense, and heavy reliance on imports for such a significant volume poses a serious challenge.

It's crucial to note that new energy vehicles (NEVs) may require 5-10 times more chips than traditional fuel vehicles. While fuel vehicles typically need 300-500 chips, NEVs may demand 2000-3000 chips. As the adoption of NEVs continues to rise, our demand for automotive chips will escalate, and a reliance on 85% imports signifies excessive external dependence, which is undeniably concerning.

Indeed, different perspectives yield varying viewpoints.

However, in my opinion, the ability to increase from 10% to 15% in roughly a year is undeniably good news.

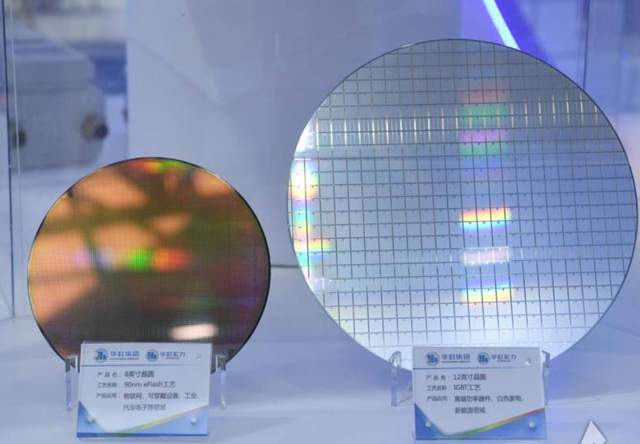

It's essential to understand that automotive chips are highly complex. Unlike other consumer electronic product chips, automotive chips demand rigorous standards in durability, stability, heat resistance, humidity resistance, and yield rates.

Given that China's automotive chip industry is relatively nascent, initially, almost 100% of chips were imported. Yet, we began with low-end products and gradually replaced imports with domestic alternatives, achieving the current 15%. Once established in this industry, future development will undoubtedly accelerate.

Particularly as domestic automotive companies either engage in R&D or begin supporting domestic chips, the substitution of domestic chips will accelerate. With a 50% annual growth rate, if this pace is maintained, our automotive chip self-sufficiency rate could exceed 50% within just three to four years—a remarkable achievement.

Thus, although 15% self-sufficiency may seem low in the broader context, as long as we sustain a 50% growth rate, there is no cause for alarm.