Evergrande Auto's Restructuring Stalls Amid Lack of Investors

![]() 02/08 2025

02/08 2025

![]() 604

604

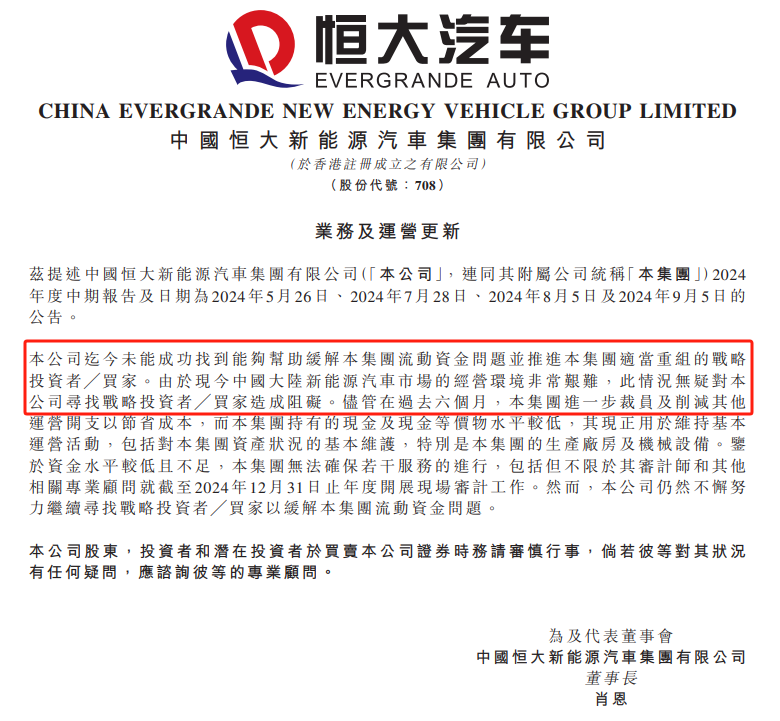

On February 3, Evergrande Auto announced its inability to secure strategic investors or buyers who could alleviate the company's liquidity crisis and facilitate a viable restructuring. This revelation has garnered substantial market attention, once again casting significant challenges on Evergrande Auto's restructuring plans. The announcement further noted the challenging operating environment for new energy vehicles in mainland China.

Dual Pressures of Financial Distress and Market Conditions

Despite cost-cutting measures including layoffs over the past six months, Evergrande Auto reported that its cash and cash equivalents remain insufficient, barely covering essential operational needs. Additionally, due to insufficient funds, the company is unable to provide crucial services, including audit and consultancy, particularly on-site audits for the end of 2024.

Moreover, Evergrande Auto emphasized the tough operating environment for new energy vehicles in China, which complicates its efforts to attract strategic investors or buyers. Amidst fierce market competition and industry uncertainties, potential investors or buyers may be hesitant about Evergrande Auto's future prospects.

Turbulent Restructuring Journey

Evergrande Auto has previously attempted to ease financial strain and facilitate restructuring through strategic investments and share sales. For instance, in May 2024, the company announced a potential share transfer plan, which was ultimately abandoned due to funding issues. Similarly, in August 2023, Evergrande Auto reached a strategic investment agreement worth $500 million with NWTN Group, but the deal fell through due to delays in China Evergrande's debt restructuring.

Future Prospects and Challenges

Despite the obstacles, Evergrande Auto affirmed in its announcement that it remains committed to finding strategic investors or buyers to address liquidity issues. However, the unpredictability of the market and the company's operational challenges render this process uncertain. As of February 6's Hong Kong stock market close, Evergrande Auto's share price stood at HK$0.2 per share, with a total market value of approximately HK$2.2 billion. This valuation underscores market concerns about Evergrande Auto's current situation and the pressure it faces in the capital market. Multiple factors, including funding shortages, the difficulty in securing strategic investors, and a challenging market environment, hinder Evergrande Auto's restructuring plan. While the company actively seeks solutions, it continues to face substantial future challenges. The next phase of Evergrande Auto's development hinges on its ability to find suitable partners in a complex market and effectively improve its operational conditions.