Hongjing Optoelectronics IPO: Questions Raised Over Product Homogenization, Employees' Abandonment of Social Security Suspected of Violation

![]() 10/14 2024

10/14 2024

![]() 744

744

On October 14, 2024, Guangdong Hongjing Optoelectronics Technology Co., Ltd. (hereinafter referred to as "Hongjing Optoelectronics") submitted its IPO application for the first time.

Caiwen News understands that Hongjing Optoelectronics is engaged in the research and development, design, production, and sales of optical lenses and camera modules. Its main products include optical lenses and camera modules for smart cars and emerging consumer electronics, with smart car products applied in smart cockpits and intelligent driving, and emerging consumer products in smart homes, panoramic/action cameras, and other products.

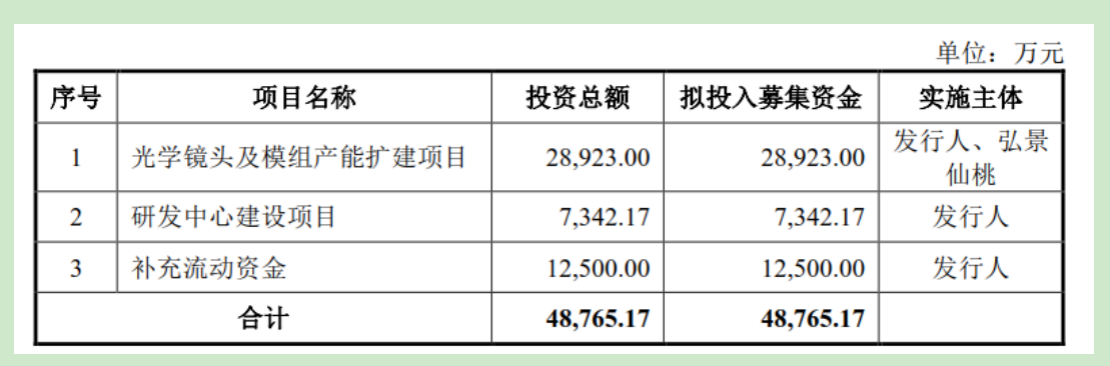

Hongjing Optoelectronics plans to raise 487.6517 million yuan through this IPO, with 289.23 million yuan allocated to the "Optical Lens and Module Capacity Expansion Project"; 73.4217 million yuan to the "R&D Center Construction Project"; and 125 million yuan to "Supplement Working Capital".

During the IPO process, the company received two rounds of inquiry letters from the stock exchange, mainly focusing on issues such as market position, related-party transactions, insufficient social security contributions, and housing provident fund contributions.

Questions Raised Over Product Homogenization and Market Position

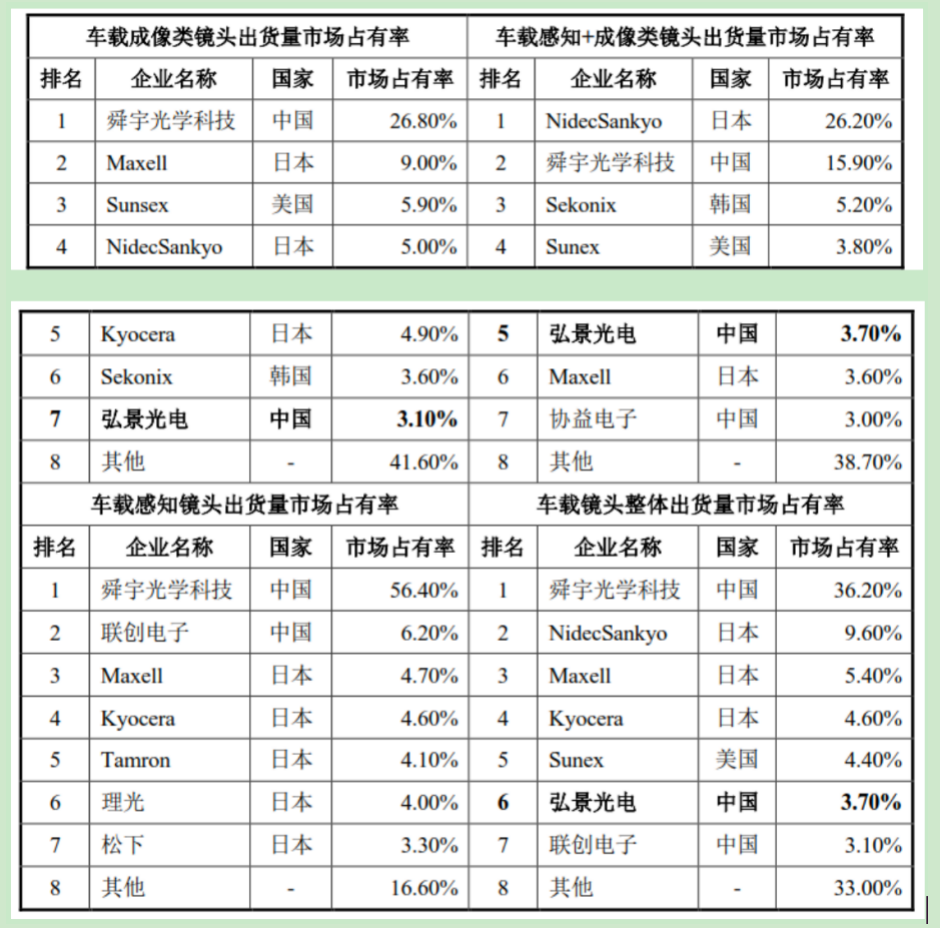

In the first round of inquiry letters, the stock exchange noted that Hongjing Optoelectronics' competitors in the same industry include eight listed companies such as Sunny Optical Technology and United Optoelectronics. Hongjing Optoelectronics' main products or services overlap to some extent with those of these eight companies, but there are differences in niche areas and applications, and Hongjing Optoelectronics has a relatively low market share in its main products.

The stock exchange requested Hongjing Optoelectronics to fully disclose whether there are situations and risks of product homogenization, iterative updates, and intensified market competition; analyze the future development trends of products and business cooperation and their impact on Hongjing Optoelectronics' performance; and verify the accuracy of the term "domestic mainstream market participants."

It also required Hongjing Optoelectronics to explain its specific advantages over competitors in terms of product types and main performances, application fields, core technologies, and core competitiveness; the measures taken to address increased competition; and the likelihood of significant adverse changes in market share and competition landscape. Furthermore, the company was asked to outline its primary measures for developing and maintaining stable customer relationships and core competitiveness. Finally, the stock exchange advised Hongjing Optoelectronics to improve the quality of its information disclosure.

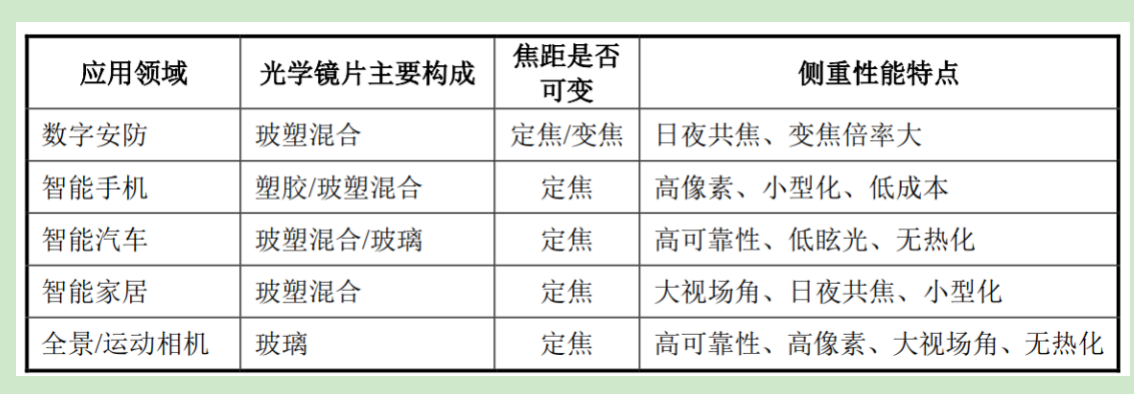

In its response, Hongjing Optoelectronics detailed comparisons with listed companies in the same industry in terms of product categories, application fields, end markets, main business structures, and major customers. It also explained that optical lenses for different application fields have different performance emphases in optical and structural design, publishing a comparison of the performance characteristics of optical lenses in areas such as digital security, smartphones, smart cars, smart homes, and panoramic/action cameras.

Regarding Hongjing Optoelectronics' focus on "high-growth markets," the company stated that according to survey data published by various agencies, its primary focus areas of smart cars, smart homes, and panoramic/action cameras belong to emerging application fields that are undergoing rapid development, fueled by new technologies such as 5G communication, IoT, and intelligent driving. The downstream market has maintained a compound annual growth rate of over 10%, making it a "high-growth market" compared to mature markets like smartphones and digital security.

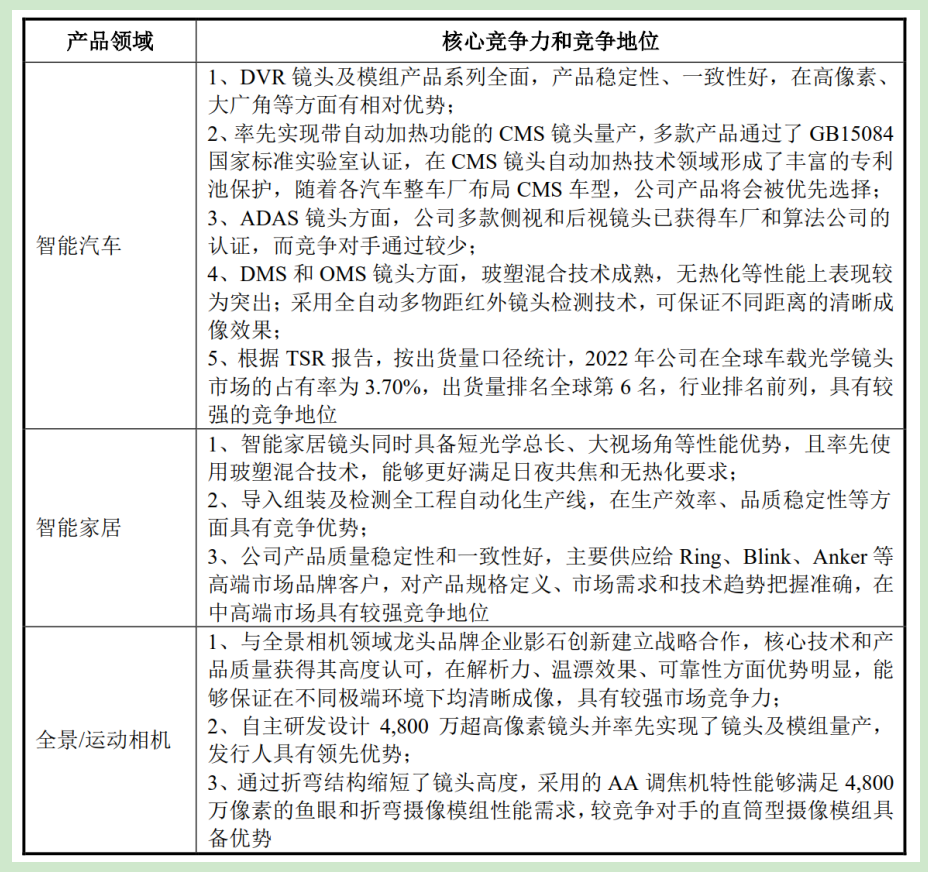

By comparing itself with competitors, Hongjing Optoelectronics believes that its products in various niche areas meet the technical requirements of mainstream industry products and have prominent competitive advantages in some products and technical indicators.

Hongjing Optoelectronics emphasized that it continuously strengthens its technological advantages in niche areas such as 100-200 megapixel side-view ADAS lenses, CMS lenses with automatic heating function, and high-stability and consistency DVR lenses, forming differentiated competitive advantages in these segments with minimal risk of intensified competition.

The smart home optical lenses have entered niche market leaders like Ring, Blink, and Anker, positioning themselves in the high-end market with performance advantages such as super-wide-angle, ultra-thin, and excellent night vision. Based on brand manufacturers' requirements for performance, quality stability, and rigorous supplier audit systems, the degree of homogenization is relatively low, and the risk of intensified competition is minimal.

The product homogenization in the panoramic/action camera lens and module market is low, with few market participants. Different manufacturers have formed a differentiated competition landscape based on their technical paths and production processes, minimizing the risk of intensified competition. Hongjing Optoelectronics believes that while the industry experiences rapid technological iterations, the company actively engages in R&D and innovation of new products, technologies, and production processes, aligned with industry trends and equipped with rich product technology reserves, thereby facing minimal risk from technological iterations.

Regarding the technical barriers involved in Hongjing Optoelectronics' entry into Insta360's innovation system, the company responded that based on interviews with Insta360's optical supervisor, other competitors cannot fully meet Insta360's technical standards in terms of reliability and temperature drift performance. Meanwhile, the lens modules supplied by Hongjing Optoelectronics to Insta360's X3 product are 48-megapixel, and while other lens module suppliers have also developed 48-megapixel lens modules, they have not achieved mass production.

The company believes that through active collection of product and technical information, collaboration and technical exchanges with industry-leading brand customers, continuous R&D investment, and pre-research into new product technologies, it has formed advantages in product development and technological iteration in some niche areas. Therefore, the company is a mainstream market participant in these niche areas, with accurate and well-founded representations.

In terms of technological strength, Hongjing Optoelectronics believes that it and its listed competitors each have their strengths and weaknesses in different niche technology areas. In the action camera segment, according to Insta360's disclosed estimates, Insta360 holds approximately 1.06% of the global action camera market share, with Hongjing Optoelectronics' lens modules sold to Insta360 primarily used in panoramic cameras, resulting in a relatively low market share for Hongjing Optoelectronics in the global action camera lens module market.

Regarding the primary measures for developing and maintaining stable customer relationships, for new customer acquisition, Hongjing Optoelectronics actively participates in industry exhibitions and technical forums to promote its products, captures the latest industry trends, and promptly grasps the latest market demand dynamics. After establishing initial contact with customers, the company further promotes its products through on-site company and product introductions, technical exchanges, and core product demonstrations, aiming to secure business opportunities.

The company's core competitiveness in developing and maintaining stable customer relationships encompasses R&D and technology, product performance, precision manufacturing, and quality management.

Related-Party Transactions, Insufficient Social Security Contributions Draw Attention

In addition to the above issues, the stock exchange also noted related-party transactions between Hongjing Optoelectronics and Desay SV Automotive, Shenzhen Fangzhengda Technology Co., Ltd., Zhongshan Oumu Electronics Co., Ltd., and Matsuo Kazuo, with Matsuo Kazuo being a former director, supervisor, or senior executive of Hongjing Optoelectronics, and Shenzhen Fangzhengda Technology Co., Ltd. and Zhongshan Oumu Electronics Co., Ltd. being controlled by former directors, supervisors, or senior executives.

The company's former directors, supervisors, and senior executives include Qian Min, Xiao Gonghe, Gao Guocheng, and Matsuo Kazuo. Xiao Gonghe controls a series of companies such as Guangzhou Baichuan Optoelectronics Technology Development Co., Ltd., while Gao Guocheng's controlled Zhongshan Oumu Electronics Co., Ltd. and Zhongshan Ouben Optoelectronics Technology Co., Ltd. have been dissolved. Zhongshan Oumu Electronics Co., Ltd. historically had equity trusteeship arrangements.

During the reporting period, Hongjing Optoelectronics leased a factory SMT workshop and related machinery and equipment located at 27 Qinye Road, Zhongshan Torch Development Zone, to the related party Zhongshan Oumu Electronics Co., Ltd., covering an area of approximately 600.00 square meters. The sponsorship work report shows that Gao Guocheng resigned from Hongjing Optoelectronics during the reporting period, established a business venture, and subsequently rejoined Hongjing Optoelectronics.

Moreover, transactions between Zhongshan Ruike, Hubei Ruike, Hubei Chaoyuan (controlled by Xia Hongtao) and Hongjing Optoelectronics involve procurement of raw materials, fixed assets, sales of products, leasing, patent licensing, and other transactions with relatively large amounts. Hubei Chaoyuan was established in 2018 by partners including Zhao Shuwu, who lacked relevant business backgrounds, and was subsequently acquired and taken over by Xia Hongtao through introductions from Hongjing Optoelectronics. The prospectus did not disclose these details, and Hubei Chaoyuan is among Hongjing Optoelectronics' top five suppliers. The entities serving as guarantors for Hongjing Optoelectronics include Zhao Zhiping, Yi Xijun, Zhou Dong, Gao Guocheng, and their respective family members.

Regarding the above issues, Hongjing Optoelectronics provided detailed disclosures on Xia Hongtao's resume, background, invested and controlled enterprises, and their relevant historical developments. The company stated that Chen Zurong's holding of equity in Hubei Chaoyuan on behalf of Xia Hongtao was unrelated to Hongjing Optoelectronics, its controlling shareholders, or actual controllers. The equity trusteeship in Hubei Chaoyuan's historical development was also unrelated to Hongjing Optoelectronics, its controlling shareholders, or actual controllers, and there was no equity trusteeship of Hubei Chaoyuan on behalf of Hongjing Optoelectronics, its controlling shareholders, actual controllers, directors, supervisors, senior executives, or their close family members.

It was emphasized that there were no affiliations between Xia Hongtao and his controlled enterprises (Zhongshan Ruike, Hubei Ruike, and Hubei Chaoyuan) and Hongjing Optoelectronics, its controlling shareholders, actual controllers, directors, supervisors, senior executives, or their close family members. The fund flows between Zhao Yuqiong and Hubei Chaoyuan's shareholders Xia Hongtao and Zhao Heping were clear and for specific purposes, unrelated to Hongjing Optoelectronics, and involved relatively small amounts, with no evidence of cost-sharing or interest transfers benefiting Hongjing Optoelectronics or its suppliers.

There were no other financial transactions, special interest arrangements, or other fund flows between Xia Hongtao and his controlled enterprises (Zhongshan Ruike, Hubei Ruike, and Hubei Chaoyuan) and Hongjing Optoelectronics or its controlling shareholders and actual controllers. The company believes it is reasonable for Xia Hongtao's controlled enterprises to become major suppliers to Hongjing Optoelectronics, with fair transaction prices and reasonable and necessary reasons for related-party transactions. There were no situations of cost-sharing or interest transfers benefiting Hongjing Optoelectronics or its related enterprises.

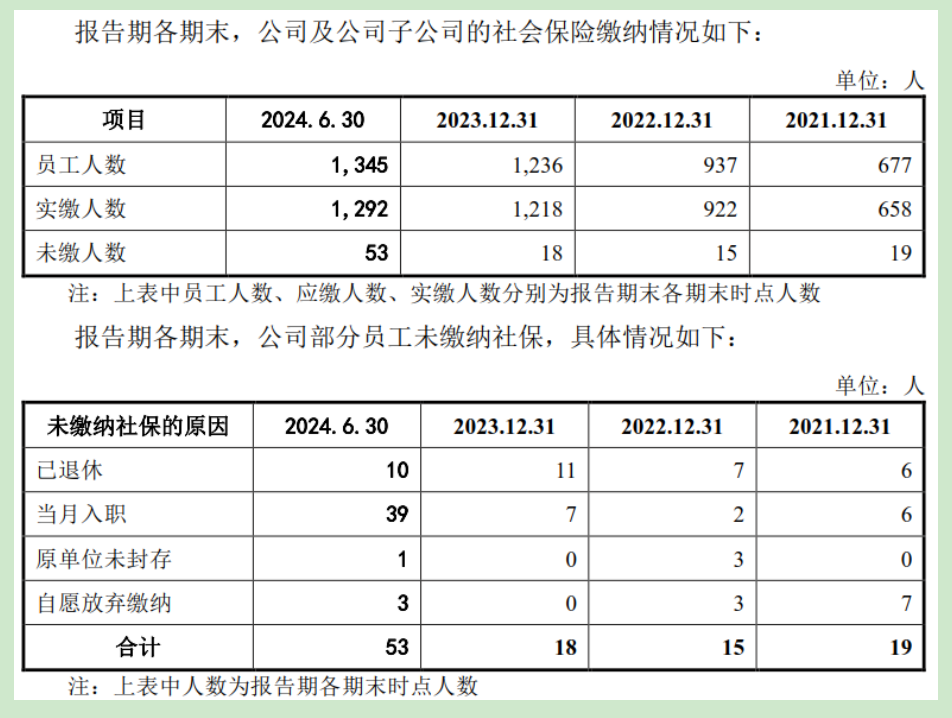

Regarding the company's compliance matters, the stock exchange noted Hongjing Optoelectronics' insufficient social security and housing provident fund contributions. According to the company's prospectus, as of the end of June 2024, three employees voluntarily waived their contributions.

However, publicly available information indicates that it is illegal for employees to voluntarily waive social security contributions.

Hongjing Optoelectronics stated that it continuously strengthens publicity and guidance for new and current employees regarding the situation of insufficient social security and housing provident fund contributions during the reporting period, actively improving the contribution situation and increasing the coverage rate.

As of December 31, 2022, the coverage rate of social security and housing provident fund contributions among Hongjing Optoelectronics' employees had significantly increased, with 98.40% of employees contributing to social security and 97.65% contributing to the housing provident fund. Additionally, the company provides dormitories for employees with accommodation needs and housing allowance benefits for those applying.

Regarding the risks of back payments, penalties, or compensations for Hongjing Optoelectronics' insufficient social security and housing provident fund contributions, the company's actual controller, Zhao Zhiping, has issued an unconditional undertaking to unconditionally bear all economic losses arising therefrom with assets other than his shares in Hongjing Optoelectronics, ensuring that Hongjing Optoelectronics and its controlled subsidiaries will not suffer any economic losses. Caiwen News will continue to closely follow the progress of Hongjing Optoelectronics' subsequent IPO developments.