Aerospace Electronics' Ambition in the Low-Altitude Market: Behind its RMB 35 Billion Market Value, How Can RMB 20.2 Billion in Inventory Support the Drone King?

![]() 08/14 2025

08/14 2025

![]() 774

774

As the Long March 12 rocket soars into the sky and Chang'e-6 triumphantly returns with lunar soil, one company's electronic systems quietly safeguard the glory of China's aerospace in the silent void.

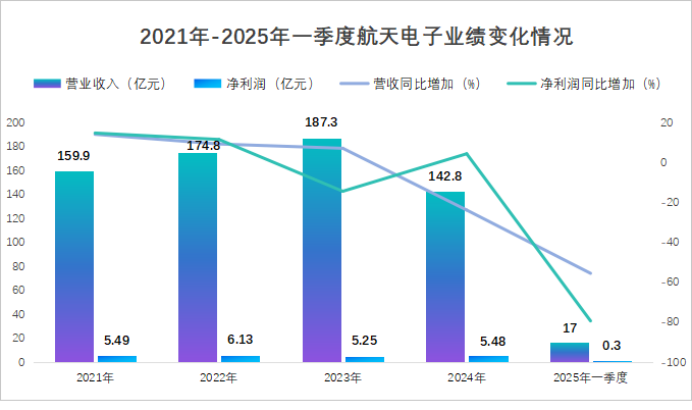

In 2024, Aerospace Electronics supported a market value of RMB 35 billion, generating revenue of RMB 14.2 billion, with RMB 20.2 billion in inventory starkly contrasting its non-deductible net profit, which plummeted by 88%.

Behind these contradictory figures, an aerial revolution from satellite payloads to eVTOL (electric vertical take-off and landing) is quietly unfolding.

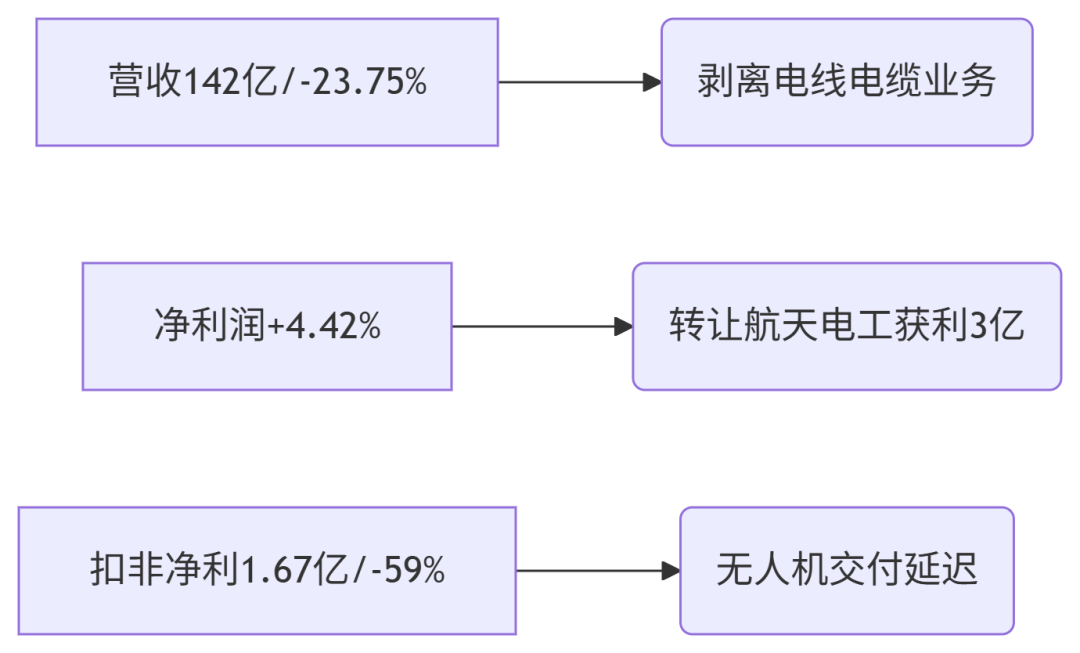

Strategic maneuvering lies behind the sudden 23% drop in revenue.

Opening the 2024 financial report, Aerospace Electronics' performance chart presents a bizarre dichotomy.

Triple impacts of business restructuring:

1. Rebirth through drastic measures: Transferring 51% equity of Aerospace Electrics and severing traditional businesses with annual revenue exceeding RMB 3 billion.

2. Painful transition: Project delays at subsidiary Aerospace Feihong led to a shortfall of 40 drone deliveries.

3. Ready to go: RMB 4.1 billion private placement finalized for investment in intelligent unmanned systems.

In Q1 2025, non-deductible net profit plummeted by 88% to RMB 15 million, exposing the weak delivery cycle of military enterprises. However, the inventory structure reveals a deeper truth. Raw materials and work-in-progress accounted for 95%, with only RMB 565 million in finished goods out of the RMB 20.2 billion inventory. Full-year inventory impairment provisions amounted to only RMB 21 million, attributed to preparations for major missions such as Shenzhou 18/19 and Tianwen 3.

"Only by shedding the burden of cables can we leap into the new battlefield of aerospace with lighter loads," said the chairman during the performance presentation, revealing the strategic essence of this financial pain.

Moat built by 83% of aerospace revenue.

In Aerospace Electronics' revenue structure, aerospace products contribute 83% of the base, with its core competitiveness lying in the full-link coverage of aerospace electronics.

Undertaking the lunar soil sealing and packaging device for Chang'e-6. Providing terahertz communication payloads for the world's first 6G test satellite. Securing an early lead in scarce orbital resources (China conducted 100 space launches in 2024).

Binding with military clients. The top five customers accounted for 35% of sales. Related transaction volume amounted to RMB 4.49 billion (internal circulation within the Aerospace Science and Technology system). Core supplier for the manned lunar landing project.

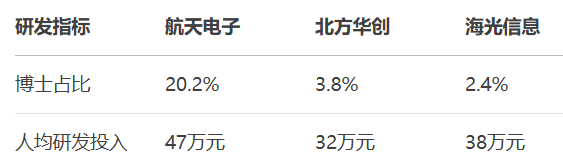

Research and development team configuration.

A research and development team led by 227 PhDs is weaving China's Starlink in near-Earth space.

How will the Feihong series open up a RMB 1.5 billion market?

While DJI dominates the consumer drone market, Aerospace Electronics is carving out a new path in the military field.

Growth trajectory of Feihong drones.

Technological supremacy: 512 FH-95 drones flying in synchronized formation (world record holder). Feihong-97A breaking through a speed of 900 km/h. Fully validated for high-altitude take-off and landing, maritime shipboard, and desert operations.

Of the RMB 4.1 billion private placement in 2023, RMB 2.3 billion was invested in intelligent unmanned systems. With the mass production of the new generation of reconnaissance and strike integrated drones, this business is expected to exceed RMB 2.5 billion in revenue in 2025.

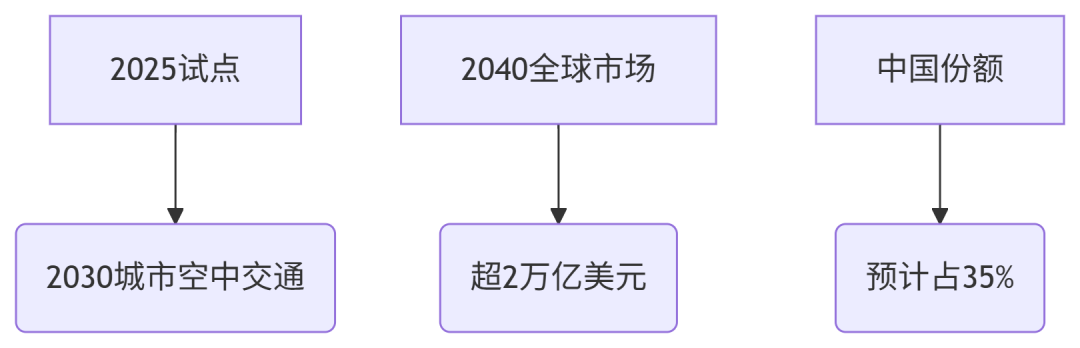

How will eVTOL leverage the trillion-yuan market?

As EHang Intelligence surges on U.S. stock markets, Aerospace Electronics quietly positions itself through its grandchild company SD FlyPeng.

Dimensionality reduction in eVTOL layout. Reuse rate of drone flight control systems reaches 80%. FP-1 eVTOL has received an application for type certificate. "Commercial aerospace + automotive chips" dual-core drive.

Market space calculations reveal greater ambitions.

SD FlyPeng has signed a joint research and development agreement with Geely Volfly, injecting aerospace-grade reliability into civilian aircraft.

The will and courage behind RMB 20.2 billion in inventory?

The 43.77% inventory ratio raises concerns, but it actually hides the special logic of the military industry.

Analysis of inventory structure safety margin.

The manned lunar landing project requires inventory preparation three years in advance. The average time from production to launch for satellite payloads is 28 months. The default rate on payment collection from military clients is less than 0.1%.

"Inventory of aerospace products is not a burden but a reserve of national trust," said the chief engineer at the R&D meeting, revealing the operating rules of this special industry.

Strategic leap from low Earth orbit to urban low-altitude airspace.

In the command hall of Beijing Aerospace City, the electronic large screen simultaneously monitors the data of space satellite constellations and FH-97A drone test flights. As the Feihong cluster draws a Chinese knot in the northwest Gobi Desert and the eVTOL prototype takes off at the Zhuhai Airshow, Aerospace Electronics' dual aerospace strategy has become clear.

The pain of divesting the cable business, doubts about high inventory levels, and confusion about the plunge in net profit all seem insignificant in the face of the centennial aerospace transformation.

With the relaxation of commercial aerospace access and the implementation of low-altitude economy pilots, this national team with 100 rocket launch experiences and over 20% of its staff holding PhDs is injecting aerospace electronics technology into the trillion-yuan civilian market.

From lunar sampling 380,000 kilometers away to flying taxis at 100 meters above ground, Aerospace Electronics' journey has always been in the clouds. When SD FlyPeng's eVTOL obtains airworthiness certification, it may be the time for this aerospace hidden champion to shed the label of "inventory burden," where there is a vast sea of stars and galaxies even more expansive than satellite orbits.

Note: (Disclaimer: The article content and data are for reference only and do not constitute investment advice. Investors act at their own risk based on this information.)

- End - Hope to resonate with you!