High-Speed Rail and Rail Transit Receive Positive News! Concept Stocks Unveiled (List Included)

![]() 12/25 2024

12/25 2024

![]() 704

704

Recently, stocks related to the high-speed rail and rail transit concept have collectively strengthened, with notable gains in shares such as Weiao, Tongye Technology, and China Railway High-Speed. This surge has ignited interest in the transportation sector. What opportunities does this present for the transportation equipment industry?

01. Central Government and State Council: Encouraging Social Capital to Participate in Railway Construction and Operation

As one of China's leading modern modes of transportation, rail transit plays a pivotal role in China's economic and social development, holding a significant position in the overall transportation landscape.

In recent years, backed by national policies, the construction of rail transit has been consistently strengthened. China's total operating mileage and network density of rail transit have continued to rise, laying a solid foundation for the industry's growth.

The rail transit equipment sector has recently demonstrated robust performance. On the policy front, the General Office of the CPC Central Committee and the State Council issued the "Opinions on Accelerating the Construction of a Unified and Open Transportation Market," emphasizing the need to moderately advance transportation infrastructure construction, expedite the main framework of the national comprehensive three-dimensional transportation network, steadily push forward reforms in natural monopoly areas of transportation, and support local railway enterprises in independently choosing their operational and management models.

Since 2008, China has consistently bolstered railway construction, leading to a rapid increase in domestic railway operating mileage. From 2008 to 2023, domestic railway operating mileage surged from 79,700 kilometers to 158,700 kilometers, representing a compound annual growth rate of 4.70%.

According to data released by the China State Railway Group, from January to November of this year, the country's railway fixed asset investment reached 711.7 billion yuan, a year-on-year increase of 11.1%. Additionally, on November 5, 2024, the China State Railway Group announced the third batch of tenders for Fuxing high-speed smart electric multiple units (EMUs) capable of reaching speeds of 350 km/h, involving 80 sets. To date, the China State Railway Group has publicly tendered a total of 245 high-speed EMUs in 2024, marking a significant increase compared to 2020-2023.

The "14th Five-Year Plan for the Development of a Modern Integrated Transportation System" aims to achieve a nationwide railway operating mileage of 165,000 kilometers by 2025, with 50,000 kilometers dedicated to high-speed railways. Aligning with these planning goals, by the end of next year, nearly 5,000 kilometers of new lines (including approximately 4,000 kilometers of high-speed railways) are expected to be operational.

Looking ahead, with the implementation of policies, the extension of central city rail transit to neighboring towns, and the integration of trunk railways, intercity railways, suburban railways, and urban rail transit, it is anticipated that this will drive the construction of an even larger scale of rail transit facilities, thereby boosting the development of the transportation equipment industry chain.

02. Review of Related Concept Stocks

The rail transit equipment industry chain constitutes a complex and extensive system encompassing all facets from raw material supply to final operation and maintenance. It primarily includes raw materials, design and R&D, manufacturing and assembly, installation and commissioning, operation and maintenance, and after-sales market services. Within this chain, raw materials and construction machinery fall under the upstream engineering industry, while the midstream sector holds the higher added value, encompassing mechanical parts, power systems, electronic components, and vehicle manufacturing.

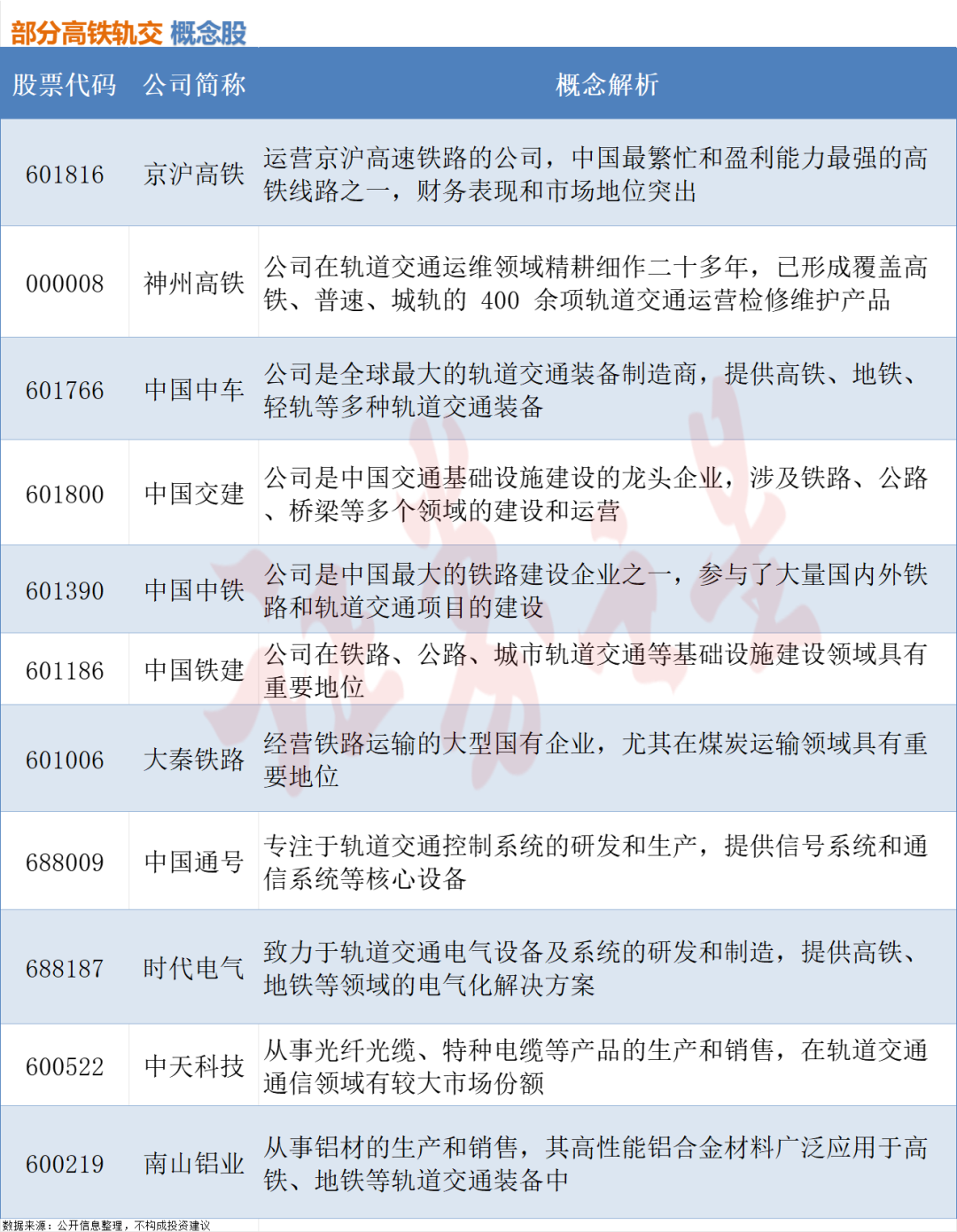

As the performance of the China State Railway Group continues to improve and policy-driven demand increases, the growth potential of the industry chain is vast. Here's a review of related concept stocks:

A research report from Southwest Securities highlights that with the acceleration of equipment replacement, the increase in EMU maintenance and repairs, and the rise in new locomotive vehicle tenders and deliveries, railway equipment is once again entering a period of high growth.

A previous research report from Huatai Securities emphasized that sustainable growth should focus on the following three key areas:

First, in terms of new additions, there is a guarantee for subsequent new railway lines, and passenger volume/overseas expansion is anticipated to be beneficial.

Second, regarding the sustainability of equipment renewal, the fifth-level repair of EMUs is expected to peak in 2026/2027, while locomotives and communication signaling systems are gradually entering their renewal cycles.

Third, policies continue to support and promote reform, and new technologies/industries are projected to drive incremental growth. As the rail transit equipment industry continues to stabilize and improve, companies within the industry chain are expected to continue benefiting.