Policy Decline and Momentum Shift: What Challenges Will the Chinese Auto Market Face This Year, and How Much New Growth Can Be Expected?

![]() 01/05 2026

01/05 2026

![]() 459

459

As 2025 draws to a close, China's automotive industry, after years of rapid growth, stands at a new crossroads. In 2026, the policy environment, market structure, and growth engines will undergo profound changes. With the adjustment of iconic NEV purchase tax incentives and the industry's gradual shift from 'subsidy-driven' to market-driven, where will China's auto market head?

Parallel Continuation and Decline of Automotive Consumption Policies, Moderating the Stimulus Effect

The main tone of automotive consumption policies in 2026 has become clear, featuring a combination of 'continuation and optimization, but with a moderate decline in overall support.' The core lies in the optimized continuation of national trade-in subsidies and key adjustments to NEV purchase tax incentives.

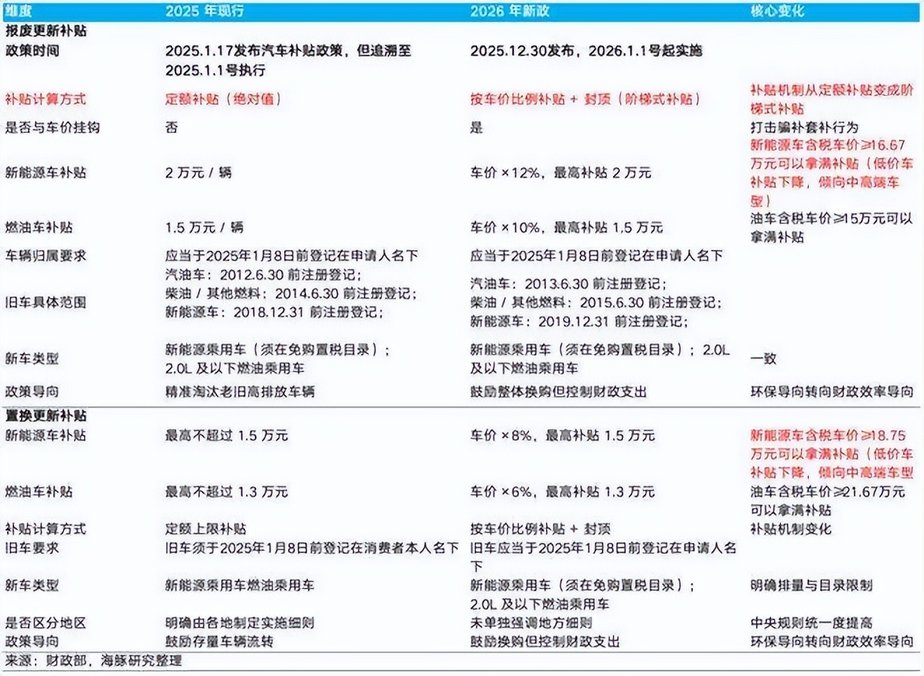

1. Trade-in Subsidies: Optimized Continuation with Broader Coverage

According to a joint notice from the National Development and Reform Commission, the Ministry of Finance, and other departments, trade-in subsidies for automobiles will continue in 2026 with optimized details. Compared to 2025, the main change is the shift from fixed subsidies to subsidies based on a percentage of the new vehicle's sales price (e.g., up to 12% of the car price, capped at 20,000 yuan, for purchasing an NEV after scrapping an old vehicle). This adjustment makes the policy more precise and relaxes the registration year requirements for old vehicles, enabling more owners of aging vehicles to benefit. Preliminary estimates by the China Automobile Dealers Association suggest that over 12 million passenger vehicles could receive subsidies in 2026, driving nearly 1.5 million new vehicle sales.

2. NEV Purchase Tax: Partial Rollback of Policy Incentives

The policy of exempting NEVs from vehicle purchase tax, implemented since 2014 and extended multiple times, will undergo significant adjustments in 2026. According to widespread industry expectations, starting January 1, 2026, a 5% vehicle purchase tax will be reinstated for NEV purchases, but a reduction cap is anticipated (e.g., up to 15,000 yuan in tax relief). This means consumers will bear a portion of the purchase tax cost for models priced over 300,000 yuan.

3. Combined Impact: Anticipated Weakening of Policy-Driven Effect

The combined impact of these two policies is expected to result in a weaker overall policy-driven effect in 2026 compared to 2025. On one hand, the rollback of purchase tax incentives will directly increase vehicle purchase costs, with Morgan Stanley estimating a potential 5% to 8% rise in NEV purchase prices. On the other hand, while trade-in coverage expands, the average amount of local subsidies may decrease. Some institutions estimate that the strong national subsidy policy in 2025 drove approximately 2.6 million additional sales, while the updated subsidy scheme in 2026 is expected to generate a net increase of around 1.5 million sales. The policy engine is shifting from 'strong stimulus' to 'stable support.'

2026 Sales Forecast: Total Growth Under Pressure, Structural Differentiation, Exports as Key Pillar

Affected by multiple factors such as policy adjustments, a high base, and partially front-loaded market demand, mainstream institutions are cautious about the overall growth rate of China's auto market in 2026 but remain optimistic about structural highlights.

Summary of Core Forecast Data for China's Automotive Market in 2026

Several key conclusions can be drawn from these forecasts:

Total Growth Under Pressure: Most institutions believe that the growth rate of the domestic automotive consumption market will slow significantly or even experience a slight decline. This marks a comprehensive shift from 'incremental competition' to 'stock competition.'

Continuous Rise in NEV Penetration: Despite slowing growth, NEV penetration will reach a new level in 2026, with widespread expectations of surpassing 57% and approaching 60%. The electrification trend is irreversible.

Exports as an Indispensable 'Growth Pole': Almost all forecasts view exports as the core highlight and stabilizer of the auto market in 2026. Export volumes are expected to approach 7 to 8 million units, effectively offsetting cyclical fluctuations in the domestic market.

2026 China Automotive Trend Outlook: A Profound Transformation from 'Policy-Driven' to 'Strength-Driven'

In 2026, China's auto market will not only experience a 'slow year' in terms of sales but also a profound reshaping of industrial competition logic. The industry's driving forces are undergoing fundamental changes.

1. Shift in Competition Focus from 'Price Wars' to 'Value Wars' and 'Technology Wars'

With the rollback of subsidies, the survival space for strategies relying solely on low prices will be greatly compressed. Companies must return to fundamentals, building genuine competitive moats through intelligent experiences, product definition capabilities, and extreme cost control. In 2026, L2+ intelligent driving will accelerate its popularize (popularity), and L3 autonomous driving will begin its commercial year, with intelligence levels becoming a key determinant for mid-to-high-end models. Meanwhile, plug-in hybrid (including extended-range) vehicles, due to their lack of range anxiety, may continue to outpace battery electric vehicles in growth, becoming a significant market growth point.

2. Globalization Upgrades from 'Product Exports' to 'Supply Chain Overseas Expansion'

China's automotive 'going global' story is entering a new chapter. In 2026, exports will not merely be a trade activity but the beginning of localized production, technological cooperation, and full supply chain output. Factories such as BYD in Europe (Hungary) and Chery in Spain will commence production, marking China's automotive industry's deep global layout (layout) to address trade barriers and truly integrate into the global market system.

3. Accelerated Industry Elimination and Integration

Against the backdrop of slowing market growth, the market share concentration of leading companies will further increase. Brands lacking core competitiveness in technology, products, branding, and global layout (layout) will face unprecedented survival pressures, intensifying industry reshuffling.

In Conclusion

In summary, China's automotive market in 2026 will officially bid farewell to the old stage of high growth driven by strong policy incentives. The moderating policy-driven effect is a clear signal, marking the dawn of a new era driven by market forces, technology, and globalization.

For automakers, this year presents both challenges and opportunities. The challenge lies in accepting the reality of slower growth and engaging in a more brutal 'melee' in the stock market. The opportunity lies in the vast potential of exports, the technological dividends of intelligence, and structural opportunities arising from consumption upgrades, providing truly capable enterprises with new avenues for navigating cycles and achieving high-quality development.

2026 will be a critical stress test for China's automotive industry in its transition from 'big' to 'strong.' Only those enterprises that return to the essence of automaking, solidify their systemic capabilities, and dare to compete at the top level on the global stage will emerge victorious in this 'elimination round,' leading China towards becoming a true automotive powerhouse.