Only Two Automakers Hit Over 10% Growth! SAIC Sets Sights on Regaining Leadership by 2026 with 4.5 Million+ Sales in 2025

![]() 01/05 2026

01/05 2026

![]() 427

427

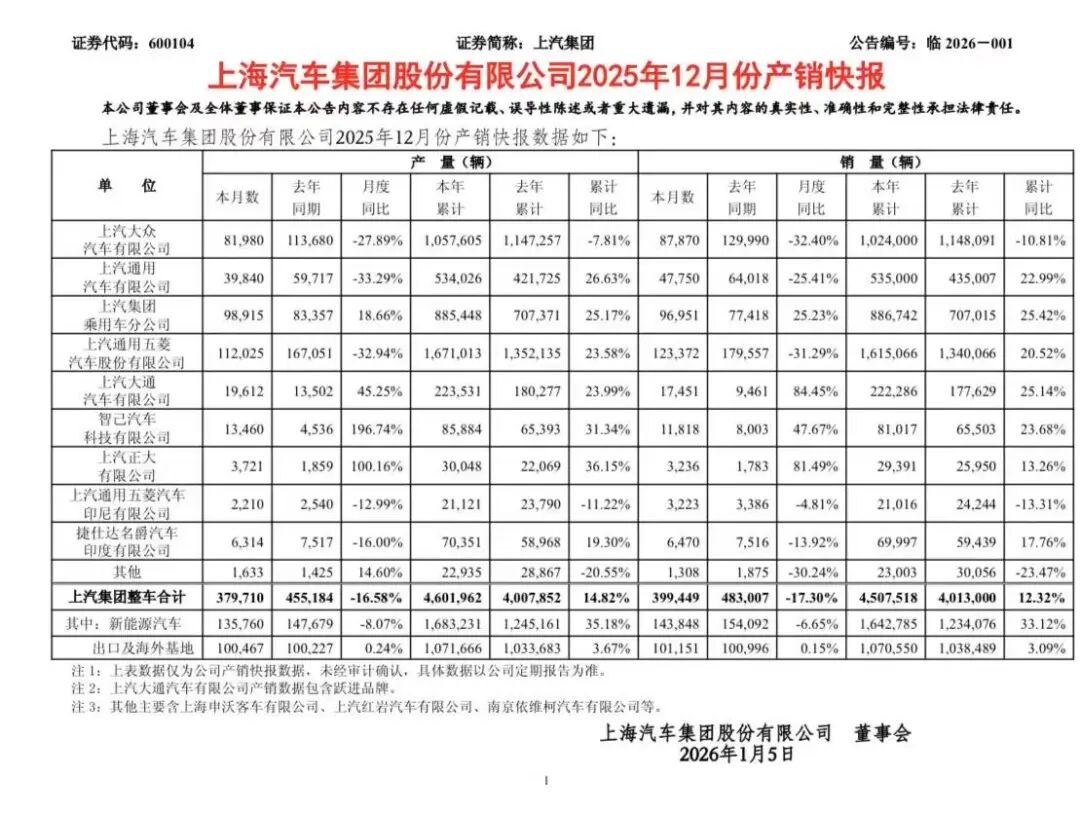

After undergoing a series of reforms and adjustments, SAIC Motor has now entered a phase of stabilization and resurgence. In 2025, the company achieved annual sales of 4.507 million complete vehicles, marking a 12.3% year-on-year increase. Terminal retail sales soared to 4.67 million units. Although SAIC did not reclaim the crown for domestic auto sales in 2025, its growth rate transitioned from negative to positive, outpacing the overall industry growth. Moreover, when considering retail terminal sales, SAIC surpassed BYD's 4.6 million units in 2025, securing the top spot in the industry.

Among the leading automakers that have disclosed their sales figures, SAIC stands as one of only two to achieve a growth rate exceeding 10%, with most others hovering around the 8% mark. The other automaker with a growth rate over 10% is Geely. These figures not only highlight SAIC's sales rebound but also underscore the initial success of the strategic transformation undertaken by this traditional automotive powerhouse.

The overall sales improvement at SAIC is propelled by the "triple engines" of self-owned brands, new energy vehicles (NEVs), and overseas expansion. The first engine is self-owned brands. In 2025, SAIC's self-owned brand sales surged to 2.928 million units, marking a significant 21.6% year-on-year increase and accounting for a historic high of 65% of the group's total sales. This means that for every three vehicles sold by SAIC, two hail from its self-owned brands. Since 2022, when self-owned brands first overtook joint ventures in market share (52.5%), this dominant position has been further solidified in 2025.

SAIC's self-owned brand portfolio spans from the national-level Wuling and Baojun to the internationally focused MG and Roewe, and then to the high-end ZhiJi, as well as the new intelligent "Shangjie" brand co-developed with Huawei. SAIC has achieved comprehensive brand coverage across entry-level, mainstream, and high-end markets. This diverse brand portfolio empowers SAIC to compete effectively in various market segments.

Of course, SAIC's joint venture brands are also actively pursuing transformations and have achieved notable successes. For instance, SAIC-GM has introduced the high-end new energy sub-brand Buick "Ultium" and adopted innovative sales strategies (such as the "fixed price" model for Cadillac and Buick), resulting in 535,000 units sold last year and a 22.99% year-on-year increase, signaling stabilization and recovery.

Besides SAIC-GM, SAIC Volkswagen has further extended intelligent technologies following the "Pro Trilogy" (Passat Pro, Tiguan Pro, Teramont Pro), launching the Lavida Pro with a starting price of just 88,800 yuan. The first mass-produced model, E5 Sportback, from SAIC Audi's new brand AUDI, also officially debuted in September. However, in terms of sales, SAIC Volkswagen's figures dipped to 1.024 million units in 2025, still facing significant transformation pressure. Nevertheless, starting from 2026, SAIC Volkswagen's new energy products will be fully rolled out, making sales growth inevitable.

The second engine is new energy vehicles, which represent the fastest-growing sector for SAIC. In 2025, SAIC sold 1.643 million NEVs, setting a new historical high with a 33.1% year-on-year increase. The sales volume ranks among the top in the industry, and the growth rate significantly outpaces the industry average. SAIC is also one of only two domestic automakers, alongside BYD, with NEV sales exceeding 1.5 million units. The other is Geely, with 1.687 million units sold in 2025. Additionally, in 2025, Changan sold 1.11 million NEVs, Dongfeng sold 1.04 million, and Chery sold 903,800.

The high growth in NEVs is supported by SAIC's precise market and product strategies, as well as a competitive edge formed by a series of mass-produced technologies, including the digital chassis, DMH super hybrid, Hengxing super extended-range, and "end-to-end" intelligent driving large models. For example, in the entry-level market, the new MG4 entered the A-class pure electric market at a price of 85,800 yuan, consistently selling over 10,000 units per month, surpassing popular models like the Qin PLUS EV and ranking among the top 3 in pure electric compact sedans.

Another example is the new generation ZhiJi LS6 extended-range version, which, with its "large battery" solution, ensures worry-free travel for users while further reducing usage costs. The popularity of this model has driven ZhiJi's sales to consistently exceed 10,000 units. Furthermore, the first model H5 from the "Shangjie" brand co-developed with Huawei quickly filled SAIC's intelligence gap in the 150,000 yuan market segment, becoming a bestseller with over 10,000 units sold per month right after launch, injecting strong momentum into year-end sales growth.

The third engine is overseas expansion. In 2025, SAIC's overseas market sales reached 1.071 million units, marking a 3.1% year-on-year increase, and continuing to rank among the top in the industry. Among them, the MG brand is the main contributor to SAIC's overseas expansion. Last year, the brand sold over 300,000 units in Europe, marking a nearly 30% year-on-year increase; over 70,000 units in India, marking a 17.8% year-on-year increase; and over 29,000 units in Thailand, marking a 13.3% year-on-year increase.

While promoting product exports, SAIC is also upgrading to "value chain overseas expansion." Last year, SAIC officially launched its Overseas Strategy 3.0—the Glocal Strategy, a combined strategy of "global + local," actively building a localized ecosystem and global automotive brand. This indicates that SAIC's global operational capabilities, including localized production, brand building, and service systems, are maturing. Currently, SAIC has formed overseas regional markets with one "300,000-unit" level (Europe) and five "50,000-unit" levels (Americas, Middle East, Australia and New Zealand, ASEAN, South Asia), with products and services available in over 170 countries and regions worldwide, and cumulative overseas sales exceeding 6 million units.

The significant rebound in 2025 undoubtedly validates that SAIC's strategic direction of "turning around like an elephant" is correct and its execution is effective. Now, SAIC's "new triple engines" of self-owned brands, new energy vehicles, and overseas expansion have successfully taken over, becoming the core driving forces for its progress. However, this is only the first step in SAIC's successful "turnaround." Can cooperative projects with Huawei, Momenta, and others continue to help SAIC open up new horizons in intelligence? Can the high-end brand ZhiJi truly establish itself amidst fierce competition? Can the joint venture sector, especially SAIC Volkswagen, find an effective recovery rhythm? The answers to these questions will ultimately determine whether this former industry leader can reclaim the top spot.