From Technology Frenzy to Safety Compliance: Autonomous Driving Financing Enters a New Cycle of "Scenario Closed Loop" in the First Half of 2025

![]() 08/21 2025

08/21 2025

![]() 488

488

Source: Smart Auto Technology

Driven by both policies and capital, the autonomous driving industry is transitioning from a focus on technological competition to the implementation of real-world scenarios.

Summary of Investment and Financing

From January to July 2025, investment and financing in the global autonomous driving and intelligent connectivity fields exhibited a trend of "rational prosperity," with a notable shift towards commercialization scenarios. Capital allocations are deeply aligned with technological iterations and industrial applications.

According to incomplete statistics from institutions like the New Strategy Low-Speed Unmanned Driving Industry Research Institute, the domestic market alone witnessed nearly 90 significant investment and financing events, with a total disclosed amount exceeding RMB 15 billion (including IPO fundraising). July alone saw new financing amounting to approximately RMB 1.5 billion, continuing the robust momentum from the first half of the year.

In terms of financing scale, deals exceeding RMB 100 million have become prevalent, accounting for 32 cases (35.6% share). Among these, five cases surpassed RMB 1 billion, indicating a capital preference for leading enterprises in mature sectors. Large-scale financings are concentrated in three key areas: autonomous driving for commercial vehicles, core hardware technology, and large-scale Robotaxi operations. Compared to the same period in 2024, while the total number of financing events slightly declined, the total disclosed amount increased by approximately 12.5%, and the average single financing amount rose from RMB 120 million to RMB 167 million, reflecting a trend towards capital concentration on high-quality projects.

The sub-sector distribution reveals significant structural characteristics: L4 autonomous driving solution providers for closed scenarios like mines and ports received over RMB 3.5 billion in financing, accounting for 23.3%; intelligent driving system and algorithm companies garnered approximately RMB 4 billion, representing 26.7%; vehicle-road coordination and V2X-related enterprises received approximately RMB 2 billion, or 13.3%; intelligent hardware (including sensors, chips, actuators) secured around RMB 3 billion, accounting for 20%; and other areas (such as smart cockpits, high-precision maps, etc.) received approximately RMB 2.5 billion, accounting for 16.7%.

Industrial funds with state-owned backgrounds have emerged as a significant force among investment entities. Of the disclosed financing events, 55% were clearly dominated by local government funds or state-owned capital, particularly in sectors like chips, autonomous driving solutions, and mine unmanned heavy trucks. Strategic investments by industrial capital (such as automakers and technology companies) accounted for approximately 30%, while the share of traditional venture capital institutions shrank, reflecting a shift in industry investment logic from "technology storytelling" to "industry value creation".

Geographically, the Yangtze River Delta region leads with a 42% share of financing events, centered around Suzhou, Shanghai, and Hangzhou; the Pearl River Delta region accounts for 28%, primarily concentrated in Shenzhen and Guangzhou; the Beijing-Tianjin-Hebei region accounts for 18%; and other regions collectively account for 12%. This distribution is closely tied to local industrial policy orientations and the abundance of application scenarios. For instance, enterprises like Suzhou TianTong Vision and Shanghai Shijia Technology received strong support from local state-owned capital.

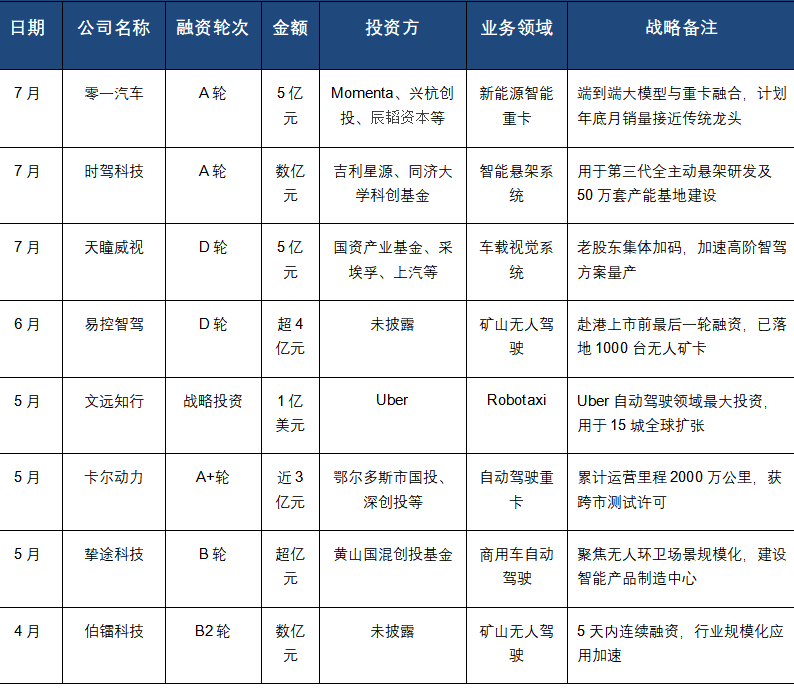

Major Investment and Financing Events

Investment and financing in the first half of the year demonstrated three notable characteristics: firstly, deep ties between industrial capital and technology enterprises, exemplified by Momenta's investment in Zero One Auto to foster "passenger vehicle-commercial vehicle" technological synergy; secondly, substantial participation by state-owned platforms and local industrial funds, such as Erdos Guotou's continuous investment in Kaer Power, reflecting the integration of resources and capital; thirdly, commercialization capability emerged as the key to securing financing, with Yikong Zhijia and Zhitu Technology leveraging specific implementation data as financing endorsements.

Investment and Financing Trend Analysis

1. Policy Driving and Standard Construction Accelerate Industry Maturity

2025 has seen an intense period of policy issuance in the field of autonomous driving. The Ministry of Industry and Information Technology clearly proposed in the "Key Points of Automotive Standardization Work in 2025" to expedite the development of mandatory national standards for autonomous driving system safety requirements, establish a safety baseline, and promote the implementation of key standards such as automatic parking and simulation testing. This policy direction directly influenced capital flows, with enterprises adhering to ASIL-D safety standards and having a clear mass production timeline receiving greater favor.

Local governments have spurred commercialization through a combination of "policy pilot + financial support," such as Shenzhen and Shanghai allowing large-scale applications of unmanned equipment in the cleaning and sanitation sector, directly driving project orders and financing progress for enterprises like Zhitu Technology. The "safety cushion" effect created by policy dividends has attracted previously sidelined capital into the market, particularly in closed scenarios like mines and ports, where policy support and the certainty of commercial value have formed a resonance.

2. Scenario Differentiation: Closed Scenarios Erupt Before Open Roads

In 2025, capital clearly favored "tangible" commercialization scenarios, with mine unmanned driving emerging as the biggest beneficiary. Compared to passenger vehicles, commercial vehicles are more likely to achieve technology implementation in closed/semi-closed scenarios (such as ports, mining areas, and trunk logistics), with clearer economic benefits from cost reduction and efficiency enhancement. From April to June alone, there were six financing events totaling over RMB 1.2 billion. Enterprises like Yikong Zhijia and Bolai Technology have achieved large-scale implementation of over 100 unmanned mining trucks. The appeal of these scenarios lies in their relatively controllable technical requirements in a closed environment, customers being large state-owned enterprises (such as China Huaneng Group) with robust payment capabilities, and the ability to operate 7x24 hours, reducing overall costs by over 30% with a clear commercial value.

In contrast, while Robotaxi for urban open roads still garners attention (such as WeRide receiving a substantial investment from Uber), capital places greater emphasis on its integration capabilities with existing travel networks. The cooperation model between WeRide and Uber—leveraging the latter's global user network and operational system—represents a new trend in this sector: pure technology companies cannot survive independently and must be embedded within the existing ecosystem.

3. Technological Route: End-to-End Large Models Become a New Racetrack

In the financing cases of the first half of the year, "end-to-end" emerged as a high-frequency keyword. Zero One Auto's ZSD autonomous driving technology adopts a "one-stage" architecture, constructing the entire model as a single unit, simplifying the system by 90% and reducing sensor costs by 60%; Zhitu Technology also used end-to-end large models as the primary investment target for its Series B financing. This shift in technological route reflects a deepening of industry cognition: moving away from the technological perfectionism of pursuing "full-stack self-research" towards the engineering pragmatism of "good enough".

Simultaneously, hardware innovation remains a focal point of capital attention, primarily concentrated in areas like skateboard chassis, automotive-grade chips, and sensors. Ningde Times Intelligence, a subsidiary of CATL, received RMB 2 billion in financing for its skateboard chassis technology, with a post-investment valuation exceeding RMB 10 billion, underscoring capital's emphasis on hardware-based innovation; financing for Shijia Technology's intelligent suspension and TianTong Vision's vision system demonstrates that technological breakthroughs in basic components can also gain capital recognition, especially innovations that directly enhance vehicle safety and riding experience. This investment portfolio of "software definition + hardware support" constitutes a dual-wheel drive for industry technological iteration.

4. Capital Structure: The Era of Industrial Support Led by State-Owned Capital Arrives

In the first half of the year, 55% of financing events were dominated by institutions with state-owned backgrounds, compared to only 30% in the same period in 2024, marking a new stage of "state-owned capital support" for autonomous driving investments. The investment logic of local government funds exhibits clear "localization" characteristics: Erdos Guotou's investment in Kaer Power aims to enhance the level of intelligence in local mining areas; Huangshan Guohun Venture Capital's investment in Zhitu Technology directly promotes the implementation of its unmanned sanitation projects in Huangshan High-tech Zone.

This trend presents both opportunities and challenges. The positive effect is providing the industry with more stable funding sources and application scenarios, while the negative risk is the potential for resource misallocation—some projects may receive excessive investment to cater to local political performance demands rather than based on market competitiveness. Balancing government guidance and market mechanisms has become a crucial proposition for the sustainable development of the industry.

Future Outlook: From Technology Validation to Scale Replication

Despite the robust financing activity in the autonomous driving field in the first half of 2025, the industry still faces multiple commercialization challenges:

Technological reliability and cost balance: The long tail of issues for achieving fully unmanned driving technology has yet to be fully resolved. Especially in handling extreme scenarios on open roads, existing systems still have limitations. Simultaneously, high hardware costs restrict large-scale implementation.

Lagging regulations and responsibility identification: Globally, the regulatory framework for autonomous driving above L4 is still incomplete. There is a lack of unified standards in key areas such as accident liability identification, data privacy protection, and network security management. Although China actively promotes pilot projects for the "vehicle-road-cloud" integration, the national-level legislative process still lags behind technological development. This uncertainty increases policy risks for enterprises and also affects capital investment decisions.

Sustainability of business models: Robotaxi enterprises generally face profitability challenges. Waymo's operating data in the United States shows that its cost per mile is still approximately 40% higher than that of traditional taxis. Pony.ai's cooperation model with Jinjiang Taxi shares costs through revenue sharing with traditional taxi companies, but long-term profitability remains to be verified.

Based on the investment and financing dynamics in the first half of 2025, the capital layout in the field of autonomous driving is exhibiting three major trend changes:

The commercial vehicle sector continues to lead: In the foreseeable future, capital's preference for autonomous driving in commercial vehicles will continue to strengthen. The capital attractiveness of autonomous driving in commercial vehicles stems from its clear input-output ratio. It is anticipated that in the second half of 2025, scenarios such as trunk logistics and port operations will continue to attract large-scale financing.

"Mass-producible technology" becomes the focus: Capital is shifting from focusing on "lab technology" to favoring "mass-producible solutions." An analysis report by Guotai Junan points out: "With the rapid development of high-level intelligent driving in 2025 and the reduced threshold for deployment after domestic cost reduction, the intelligent chassis is expected to usher in vast market space."

The leading role of industrial capital is enhanced: Industrial capital is becoming the dominant force in autonomous driving investments. Unlike traditional financial investors, industrial capital not only provides funds but also brings technological synergy, supply chain resources, and customer channels. It is anticipated that by the end of 2025, the proportion of industrial capital investment in the field of autonomous driving will further increase from the current 54% to over 60%.

According to TrendForce forecasts, the global Robotaxi market size will exceed RMB 834.9 billion by 2030, and the Chinese Robotaxi market will reach USD 44.5 billion by 2035, with a compound annual growth rate of 96% between 2025 and 2035. In the next three years, with the further maturation of technologies such as multimodal large models, vehicle-road coordination, and high-precision positioning, sub-sectors like mine operations, agricultural machinery, and special vehicles will experience explosive growth.

With the in-depth advancement of the national strategy of "vehicle-road-cloud" and continuous breakthroughs in core technologies, the fields of autonomous driving and intelligent connected vehicles are poised to usher in an even more vigorous development trend in the second half of 2025.

Anticipating the second half of 2025, investors will place heightened emphasis on "replicability" metrics: mining unmanned driving enterprises must demonstrate swift adaptability across varying geological terrains; urban delivery robots need to present standardized solutions for cross-regional operations; and intelligent hardware companies must achieve cost control capabilities from prototype to mass production. By year's end, it is anticipated that the industry will witness the emergence of the first cohort of L4 autonomous driving companies with annual revenues surpassing RMB 1 billion, thus validating the viability of commercialization pathways.

Regarding global strategies, the overseas expansion of Chinese enterprises will emerge as a new focal point. WeRide and Uber aim to deploy Robotaxi services in 15 cities across Europe and the Middle East over the next five years. This "technology export + localized operation" model is poised to become the predominant paradigm for the globalization of Chinese autonomous driving enterprises. Concurrently, international capital's interest in the Chinese market continues to intensify, with Uber's increased investment in WeRide signaling more frequent cross-border collaborations.

Collectively, the investment and financing data for the first half of 2025 suggest that the autonomous driving industry is undergoing a profound shift from being "technology-driven" to "value-driven". The rational reallocation of capital is not indicative of a market cooldown but rather a build-up of momentum for the industry's next phase of explosive growth. When technological maturity, scenario diversity, and capital patience converge, the large-scale commercial deployment of autonomous driving will truly commence.

- End -

Disclaimer:

All content on this official account labeled "Source: XXX (not Smart Auto Technology)" is reproduced from other media sources. The intent of such reproduction is to disseminate and share additional information and does not signify the platform's endorsement of the views expressed or responsibility for their authenticity. The copyright of such content belongs to the original author. Should there be any infringement, please contact us for prompt removal.