Market Sentiment Shifts: AI Capex No Longer Under Scrutiny

![]() 08/21 2025

08/21 2025

![]() 476

476

Since July 2025, with the release of second-quarter financial reports by leading Chinese and American technology firms, AI has regained center stage in the industry. Investors are keenly awaiting evidence that the colossal investments in AI will translate into sustained financial returns.

The unveiling of financial results by Google, Meta, and Microsoft sparked a shift in market sentiment from apprehension to optimism. Skeptics of excessive AI capital expenditures are now being overshadowed by voices arguing that "the investment is still inadequate."

Analyst Q&A sessions with Google and Meta revealed that, after several quarters of solid performance, the market now has minimal doubts about the certainty of AI-driven revenue growth and the return on AI capital investments.

Our statistics indicate that during Meta's Q4 2024 analyst Q&A session, 6 out of 8 questions focused on AI monetization and capital return. Among the 15 specific issues raised by Google's 8 analysts, 7 pertained to AI commercialization and its contribution to revenue.

In Q2 2025, significant AI investments by major American tech firms are gradually demonstrating their ability to drive revenue. However, as noted by Meta CFO Susan Li, players in the AI field are still in the nascent stages of the return curve.

In summary, the market no longer questions AI Capex.

01

AI's Dual Blooms

By analyzing the second-quarter financial reports of various tech giants, we found that among the myriad AI-benefiting businesses, online advertising and the efficiency enhancement and revenue increase of cloud services have been the first to exhibit clear benefits.

1. AI fuels Google's cloud services and advertising revenue

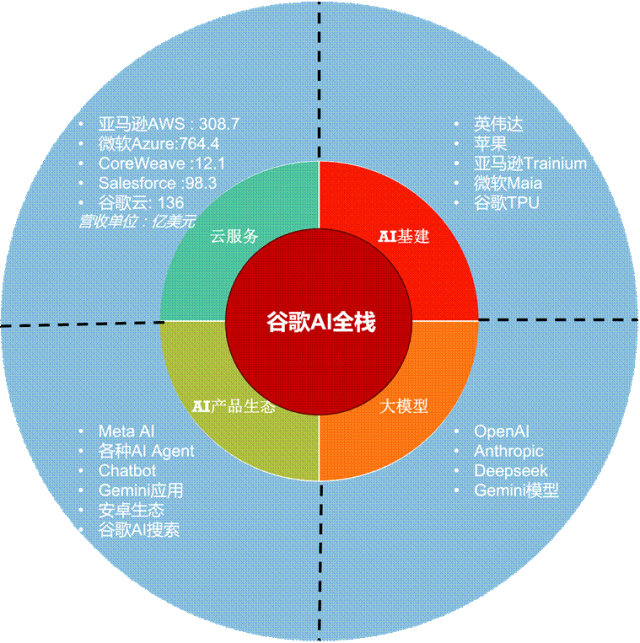

Google serves as a bellwether for cutting-edge AI technology: In Q2, Google's performance injected a surge of energy into the entire industry, alleviating doubts about AI capital investments. Google's AI large model infrastructure, development, and applications are thriving, underpinning Sundar Pichai's call for full-stack AI.

In terms of performance, quarterly revenue continued to grow by over 10%, with cloud services emerging as the quarter's brightest spot.

● Quarterly revenue was $96.4 billion, up 14%, thanks to double-digit growth in search, YouTube, subscriptions, and cloud services.

● Google services revenue was $82.5 billion, up 12%, buoyed by increased search advertising revenue due to higher search volume, YouTube advertising, and subscription business revenue.

● Cloud service revenue was $13.6 billion, up 32%, outpacing the core search business, primarily due to an increase in AI-driven cloud service orders.

● Cloud backlog reached $106 billion at quarter-end, a 18% quarter-on-quarter increase, indicating robust customer demand.

● Cloud service operating margin increased from 11.3% to 20.7%.

● Capital expenditure was $22.4 billion. Management forecasts that due to server delivery timing and accelerated data center construction, full-year capital expenditure is expected to increase by $10 billion to $85 billion.

AI-driven enhancements in new product platforms' multi-mode and agency functions have boosted customer and developer engagement, thereby increasing cloud service adoption. Cloud order volume surged 38% year-on-year to $106 billion. Transactions exceeding $250 million doubled, and new customers on the Google Cloud Platform (GCP) increased 28% quarter-on-quarter.

Google AI Max, launched in Q1 2025, is an AI feature suite for search advertising within Google Ads. AI Max's primary applications include expanding search scope, optimizing material matching, and providing detailed performance reports. AI Max serves as an assistant for advertisers, optimizing campaigns and providing analysis to enhance advertising efficiency.

Google SVP Schindler disclosed in the financial report that advertisers enabling AI Max in search ad campaigns witnessed a 14% increase in campaign conversion rates (the AI Max feature requires manual activation by advertisers).

In media buying, the new bidding strategy—Smart Bidding Exploration—marks the biggest update in a decade. It allows advertisers to explore bids more frequently and within a larger bidding space, potentially leading to higher conversion rates and ROI. Schindler noted that campaigns using Smart Bidding Exploration saw an average conversion rate increase of 19%.

Google's latest results underscore AI's role in driving C-end product experience innovation and revenue growth in B-end cloud services and advertising. Undoubtedly, AI has become Google's new growth engine strategy for the future.

Given this, Google's aggressive approach to CapEx is understandable. From management's statements, it's evident that for Google, AI investment is "never enough." "Every dollar invested in AI now will generate multiple or even hundreds of times the revenue in the future."

2. AI propels Meta's advertising business

Meta's second-quarter revenue was $47.52 billion, up 22% in both reported and constant currencies, surpassing analysts' expectations of $44.83 billion. Advertising revenue was $46.5 billion, up 22% year-on-year, also exceeding market expectations.

Management attributed this quarter's advertising revenue growth to AI-driven efficiency and revenue improvements in its platform's advertising system.

The new AI advertising recommendation model, deployed on Instagram, drove a roughly 5% increase in ad conversion rates on Instagram and a 3% increase on Facebook. Generative AI creative tools continue to expand in usage and are welcomed by small advertisers with limited budgets.

Meta recently published a paper titled "Testing Enhanced Large Language Models in Advertising Systems." Conducted over 10 weeks from early 2024, the test aimed to assess the new model's overall performance at the advertiser level. Core indicators included ad click-through rate (CTR) and the number of ad copy variations created by advertisers. 35,000 advertisers were randomly assigned: half used the old system Imitation LLM V2 as the control group; the other half used the new system AdLlama trained with RLPF as the test group.

Test results revealed:

a. Compared to advertisers using the old imitation model, those using AdLlama saw a significant 6.7% increase in CTR.

b. With the total number of impressions fixed, AdLlama increased the total number of clicks per advertiser, demonstrating ads' enhanced click efficiency.

c. Advertisers using AdLlama generated 18.5% more ad variations.

While a test, the results are highly promising. While experimental effects may not scale proportionally, they clearly showcase the immense potential of enhanced large models to drive the advertising business.

3. AI boosts Tencent's advertising business

In China, Tencent, among leading internet companies, was the first to release its financial report. Advertising emerged as Tencent's biggest highlight this quarter:

The company's advertising business achieved a 20% year-on-year increase to 36 billion yuan, fueled by AI technology. Growth stemmed from AI-driven increases in revenue per impression, as well as new advertising revenue from the growth of video account and search traffic and the transactional ecosystem on WeChat.

AI's application in the advertising business spans ad creative generation, delivery, recommendation, and effect analysis, effectively enhancing click-through rates, conversions, and advertiser ROI. At the technical level, the advertising platform architecture is upgraded by deploying large models to analyze ad clicks and transactions across applications, as well as user interactions with text, image, and video content, providing real-time insights into user interests and optimizing ad performance.

This quarter, Tencent's operating capital expenditure was 17.9 billion yuan, up 149% year-on-year (but down 30% quarter-on-quarter), primarily invested in GPUs and servers.

Tencent has always shunned the spotlight, offering conventional responses to AI capital investment queries. Management remains cautious and conservative in AI capital expenditures, focusing more on product improvements and ecosystem optimization.

However, this doesn't fully equate to Tencent's conservative AI strategy. Tencent excels at acquisitions. This explains why analysts asked management during the Q&A session about MA evaluations, to which management did not respond. This suggests that future AI entrepreneurs may still have the opportunity to create a stellar product and sell it to Tencent.

02

Two Deterministic Business Models

1. AI's advertising application paradigm has been proven

Generative AI's application has converged on online advertising, validating the following directions:

1. LLM and multimodal AI—AI generates images, videos, texts, and speech: Unrestricted material generation and optimization, matching a wider array of user personas, shortening production time, and enhancing delivery efficiency.

2. AI content understanding—targeted delivery: More accurate user understanding and precise targeting.

3. AI Agent—ad campaign management and optimization: Delivery plan formulation, activity management, and effect analysis.

Specifically, generative AI can significantly expand the number of ad creative materials, delivery forms (text, image, and video), and a massive amount of copy content. Various versions of images, texts, and videos can be targeted to diverse potential customers, achieving higher click-through and conversion rates.

As advertisers' delivery effectiveness improves, they can increase their budgets, thereby driving advertising revenue growth.

AI has also shown initial results in games, film production, finance, and other fields but still needs time to prove revenue growth and performance improvement on paper.

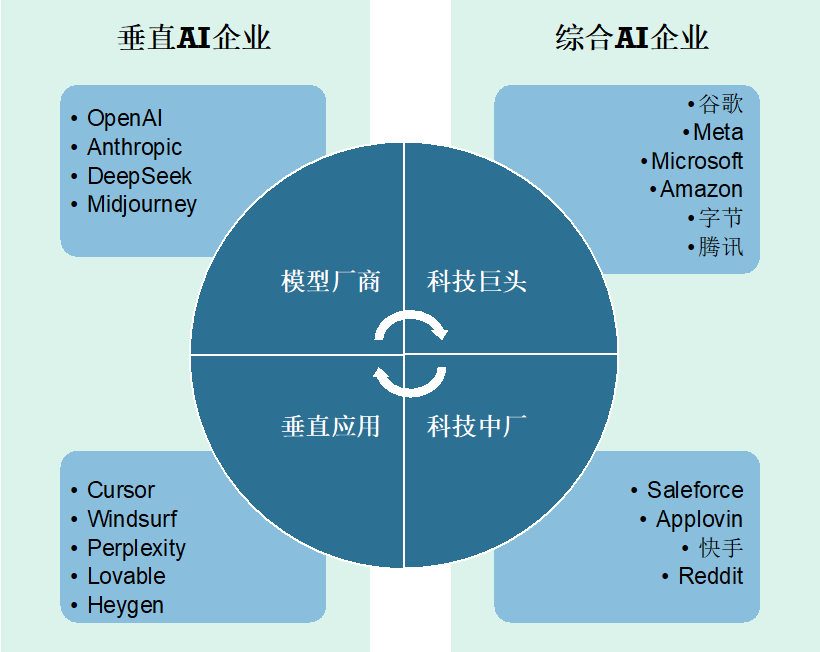

2. Besides advertising, AI fosters vertical application field prosperity

AI has thrived in major companies' business applications. In the broader and more vital internet industry entrepreneurship field, the AI track has emerged as the crown jewel.

In the AI track, large model makers like OpenAI and Anthropic attract as much attention and shine with their own halos as Google, Meta, Microsoft, and other giants.

OpenAI's latest annualized revenue exceeded $12 billion, with a valuation of $500 billion. In July 2025, Anthropic's latest annualized revenue reached $4 billion, valued at $170 billion. These two companies deserve a separate chapter in AI history.

Among numerous AI application segments, AI programming assistants are currently the most popular. In this niche field, if $100 million in ARR is considered a milestone, we've counted several companies crossing this threshold within just a week, as reported, including Replit, Cursor, and Lovable.

Besides the hottest AI programming assistants, Heygen in the AI-generated video field, AI Agent products Devin and Manus, and AI search Perplexy, which were the hottest in 2023-2024, have maintained high market attention to date.

Beyond these mainstream perspectives, AI applications are quietly transforming every corner of the internet.

03

"AI Capex" is power

Google and Meta will continue to increase capital investments, particularly in servers, data centers, and network equipment related to cloud services and online advertising businesses.

Taking Google as an example, capital expenditure in Q1 2025 was $17.2 billion, accounting for 19% of quarterly revenue. The largest portion was invested in servers, followed by data centers supporting Google's various business growth.

Capital expenditure in Q2 was $22.4 billion, up $5.2 billion quarter-on-quarter, accounting for 23% of quarterly revenue. Most capital expenditure was invested in technology infrastructure, with about two-thirds in servers and one-third in data centers and network equipment.

Simultaneously, Google significantly raised its capital expenditure forecast from $75 billion to $85 billion. The increased budget is primarily for additional server investments and accelerated data center construction to meet the strong demand growth for Google Cloud services.

According to a report by theInformation, to promote AI's application in advertising, Google has been particularly bold. Google's advertising department has even established a special fund (akin to a subsidy) to encourage advertisers to use AI technology for advertising. Even if customers use AI tools not from Google, Google will reimburse tool usage fees (such as AI large model subscription fees).

The integration of the AI ecosystem and online marketing benefits companies like Google and Meta, whose core business is online advertising. The better the delivery effect for customers, the higher their future investments on these platforms will be.

Even when customers opt for third-party AI tools, Google directly employs these delivery materials to facilitate a genuine comparison between the efficacy of its own model and that of other large models. TheInformation reported that some advertisers and advertising company executives noted a significant optimization in advertising delivery, aided by generative AI, leading to a 30%-40% increase in delivery budgets.

In contrast, Meta adopts a more aggressive approach to capital investment. In the second quarter of 2025, total costs and expenses amounted to $27.07 billion, accounting for 57% of revenue for the quarter, marking a 12% year-on-year increase. Capital expenditure stood at $17 billion, primarily allocated to servers, data centers, and network infrastructure, accounting for 35.8% of total revenue for the quarter – a proportion notably higher than Google's 23%.

Management anticipates that capital expenditure in 2025 will narrow to a range of $66 billion to $72 billion, representing a $2 billion increase from the previous lower limit of $64 billion to $72 billion. It is projected that capital expenditure will continue to escalate in 2026.

Regarding Google and Meta's substantial investments, we believe they are strategic rather than impulsive. As Meta's CFO stated, large enterprises possess far more precise quantitative models for input-output ratios compared to outsiders. In the nascent stages of AI improving the revenue curve, every billion dollars invested is poised to yield higher returns than in the middle to late stages of the curve.

Furthermore, by substantially increasing AI capital expenditure, major companies continually build and reinforce their business barriers, undeniably raising the entry threshold for the entire AI industry. This trajectory is increasingly becoming the domain of technology giants.

Meta's recent aggressive 'acquisition' of talent serves as evidence. In the technology and internet industry, characterized by a high talent turnover rate, high salaries and ample career advancement opportunities are highly attractive to talented individuals.

With tens of billions of dollars invested, technology giants have transformed into talent magnets, exemplifying the Matthew Effect in talent. This leads to subsequent growth stagnation in AI technology and products at other small and medium-sized companies, which are bound to lose out to technology giants in the long run. Consequently, history has shown that many new technological revolutions ultimately end up being dominated by large companies.

04

The cost war is inevitable and will occur sooner or later.

What do capital investments of tens of billions of dollars bring to companies beyond piles of cash? The answer is – costs. Currently, the servers, training chips, and data centers that are heavily invested in will all 'revert' to the cost side through depreciation.

The depreciation life of AI servers is rarely disclosed in financial reports. According to public information, it generally ranges around 5-6 years:

- Google: 6 years

- Meta: 5.5 years

- Microsoft: 6 years

- Amazon: shortened from 6 years to 5 years

This implies that an annual investment of $10 billion in servers will translate into quarterly costs exceeding $500 million, a figure that surpasses the quarterly revenue of many small and medium-sized listed companies. If the annual capital investment is $50 billion, the quarterly cost will be $2.5 billion, an increment that current technology giants still cannot fully absorb. In other words, the AI industry is still in its ascendancy.

Google's CFO provided a straightforward explanation at the quarterly meeting:

'The substantial increase in our capital expenditure investments over the past few years will continue to exert pressure on the profit and loss statement (P&L), primarily manifesting as higher depreciation. In the second quarter, depreciation increased by $1.3 billion year-on-year to $5 billion, a growth rate of 35%. Given the recent uptick in capital expenditure investments, we anticipate the depreciation growth rate to further accelerate in the third quarter.'

When industry giants generally decelerate their capital investment, the focus of competition will shift from an 'arms race' to maximizing the returns generated by earlier significant investments.

Reference materials: