Baidu's Apollo Go: Breaking Even in Wuhan, Aiming for Global Expansion

![]() 08/21 2025

08/21 2025

![]() 488

488

Author | Ye Tingting

Editor | Qiu Kaijun

Robotaxi has been in the spotlight recently, but when will it actually start generating profits?

Baidu's answer is, soon.

As one of the world's largest Robotaxi operators, Baidu announced that it is the first to achieve unit economics (UE) break-even in left-hand drive markets.

This "first" milestone was achieved in Wuhan. Baidu founder Li Yanhong revealed that Apollo Go has reached unit economics break-even in Wuhan, despite the fact that "taxi fares there are more than 30% lower than in China's first-tier cities and significantly lower than in many overseas markets."

Baidu disclosed this information during an investor conference call following the release of its second-quarter earnings report on August 20.

Baidu is transitioning from an online marketing company to an AI-driven enterprise. Among the significant directions for AI in the physical world, Apollo Go's Robotaxi represents a new growth point that Baidu is vigorously pursuing.

After successfully validating its city model at the end of last year, Apollo Go expanded rapidly in the second quarter. Li Yanhong believes that forming partnerships with platforms like Uber and Lyft is both logical and strategically important, enabling the company to capture greater value in markets with higher ride prices.

01

Apollo Go: 148% Growth in Ride-Hailing Services

Apollo Go is providing an increasing number of rides.

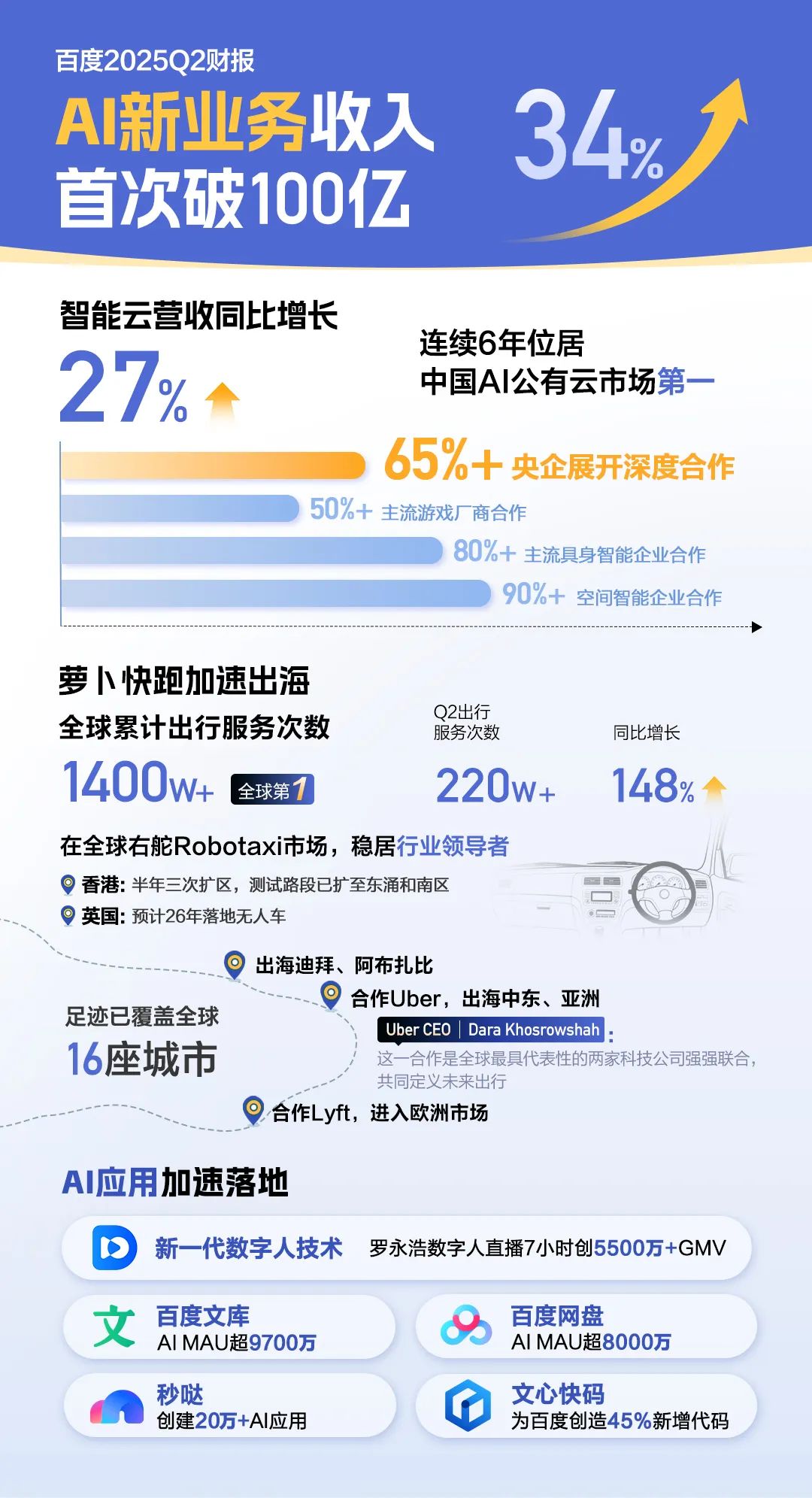

Baidu's second-quarter earnings report shows that Apollo Go offered over 2.2 million ride-hailing services globally in the second quarter, marking a year-on-year increase of 148%. As of August, Apollo Go had provided over 14 million ride-hailing services globally.

Furthermore, Apollo Go is available in an expanding number of cities, covering 16 cities worldwide.

Especially this year, Apollo Go has accelerated its globalization efforts, expanding to Dubai, Abu Dhabi, and other locations, and forming partnerships with the two major global ride-hailing platforms, Uber and Lyft.

In July, Apollo Go announced a strategic partnership with Uber, planning to connect thousands of driverless vehicles to Uber's global ride-hailing network, with a priority launch in the Asian and Middle Eastern markets.

In August, Apollo Go announced that it will provide driverless ride-hailing services in Europe through the Lyft platform. The two parties plan to deploy the sixth-generation Apollo Go driverless vehicles in Germany and the UK by 2026, gradually scaling up to thousands of vehicles in the European market to realize large-scale deployment of driverless vehicles.

Baidu is one of the pioneers in the Robotaxi industry and has recently experienced rapid expansion, further consolidating its leading position.

The second-quarter report states that Apollo Go is a leader in the global right-hand drive Robotaxi market. In Hong Kong, Apollo Go has expanded its test areas three times in six months, with test routes extended to Tung Chung and the Southern District, covering more complex commercial and residential areas. With the experience of deploying right-hand drive and left-side travel vehicles in Hong Kong, Apollo Go is expected to accelerate its globalization.

On August 15, the Chief Executive of the Hong Kong Special Administrative Region met with Li Yanhong and his team, and both sides exchanged views on the development of AI technology and the application prospects and industrial implementation of autonomous driving technology in Hong Kong.

Baidu is also accelerating the launch of a light-asset business model for Robotaxi in China.

In this quarter, Baidu established new partnerships with Hello Inc. and T3 Mobility, expanding its network of cooperation with leading ride-hailing service providers.

Additionally, Apollo Go's fully autonomous vehicle rental service was officially launched on the Ctrip App. This partnership enables Apollo Go to rapidly expand its services while leveraging the operational expertise and existing customer base of its partners, creating an efficient path for broader market penetration.

02

Positive Unit Economics Model

Baidu's Apollo Go dares to expand rapidly globally, and its confidence stems from the "pilot" in Wuhan.

During the conference call, Li Yanhong stated, "In left-hand drive markets, we are the first to achieve unit economics break-even." Globally, "we are one of the very few companies capable of conducting large-scale commercial operations of driverless vehicles in a single complex and densely populated area."

Here, both the first achievement of unit economics break-even and "large-scale operations in a single complex and densely populated area" refer to Wuhan.

Apollo Go entered Wuhan around 2022, and subsequently, the fleet size and operating scope have gradually increased. Currently, the operating scope has expanded to 3,000 square kilometers, covering 12 administrative districts and complex scenarios such as Tianhe Airport and cross-river bridges, serving a population of over 7.7 million. The number of open miles and open areas remains the highest in China, making it the world's largest autonomous driving ride-hailing service area.

More notably, Apollo Go has achieved unit economics break-even here.

Cost reduction through vehicle models is the primary factor in achieving this.

In May 2024, the sixth-generation Apollo Go driverless vehicle (RT6), equipped with Baidu's sixth-generation intelligent system solution, began deployment. At the time, it was planned to deploy a thousand RT6 driverless vehicles in Wuhan by the end of the year.

Baidu's Sixth-Generation Autonomous Driving Vehicle RT6

Baidu's Sixth-Generation Autonomous Driving Vehicle RT6

Li Yanhong said that the RT6 is the world's first and only mass-produced vehicle designed specifically for L4 autonomous driving from the outset. Unlike some modified vehicles, the RT6 was specially designed from scratch, focusing on safety system integration and cost efficiency.

The key is that "it has the lowest unit cost among L4 autonomous driving vehicles globally."

At the same time, Li Yanhong believes that Apollo Go has "the most efficient operations." Although taxi fares in Wuhan are low, "we still proved the feasibility of the city model there, and this operational excellence and cost efficiency are unparalleled globally."

Based on low-cost vehicles and efficient operations, Li Yanhong said, "With this advantage, we are confident in expanding to more cities globally, especially those with higher ride fares."

"For us, expanding overseas means transitioning from low-fare markets to high-fare markets, where fares are often several times higher. Our significant cost advantage can bring stronger unit economics in most major cities globally."

Based on this, Baidu has adopted a cooperative approach with Uber and Lyft to enter overseas markets as soon as possible and establish a leading position.

03

Baidu Accelerates AI Transformation

The second-quarter earnings report released on August 20 shows a Baidu at an "inflection point" – transitioning from the internet to AI.

In terms of overall revenue and profit, Baidu's revenue decreased but profit increased, demonstrating the profitability of its emerging businesses.

The second-quarter report shows that Baidu's total revenue reached 32.7 billion yuan, a year-on-year decrease of 4%. Baidu Core's revenue was 26.3 billion yuan, a year-on-year decrease of 2%. Net profit was 7.3 billion yuan, a year-on-year increase of 33%, and net profit attributable to Baidu Core was 7.4 billion yuan, a year-on-year increase of 35%.

More attention should be paid to the business structure.

In the second quarter, Baidu's new AI businesses showed significant growth, with revenue exceeding 10 billion yuan for the first time, a year-on-year increase of 34%. Among them, intelligent cloud revenue increased by 27% year-on-year.

Baidu founder Li Yanhong

"Our unique end-to-end four-layer AI architecture has become our core competitive advantage," said Baidu founder Li Yanhong. Full-stack AI capabilities are driving healthy growth in the intelligent cloud business.

Recently, IDC released the report "China AI Public Cloud Service Market Share, 2024," ranking Baidu Intelligent Cloud first for the sixth consecutive year. In the latest IDC report released on August 20, Baidu Intelligent Cloud ranked first in the large model platform market.

In addition to intelligent cloud, Baidu is also experiencing rapid growth in areas such as intelligent search, foundational models, and digital humans.

Baidu is currently redefining search with intelligence.

In the second quarter, Baidu continued to accelerate its search transformation, with AI-generated, structured, and multimodal answers gradually replacing static hyperlinks. In July, the proportion of AI-generated content on mobile search result pages rapidly increased from 35% in April to 64%; on the Baidu App, over 60% of search result pages featured rich media content at the top.

This improvement has given the search business a sense of "rejuvenation" – in June, the monthly active users of the Baidu App increased by 5% to 735 million; in July, AI features covered over 90% of monthly active users.

However, how to commercialize AI search remains a challenge. Baidu executives stated that they have adopted a very cautious approach, and large-scale commercialization has not yet begun.

Recently, Baidu released a new generation of digital human technology based on the ERNIE Bot large model, reaching the industry's leading level. Taking Luo Yonghao's digital human live stream as an example, the 7-hour live stream script, dialogue, tone, and motion cues were all supported by the ERNIE Bot large model series, achieving near-human performance and successfully generating 55 million yuan in GMV.

In recent quarters, the utilization rate of digital human technology has gradually increased, being applied by an increasing number of merchants in industries such as e-commerce, legal services, education, automobiles, and healthcare. In the second quarter, revenue generated by digital humans increased by 55% quarter-on-quarter, calculating to approximately 500 million yuan based on information disclosed during the conference call.

From the perspective of revenue share, online marketing revenue still accounts for about 60%, but the growth trend of non-online marketing revenue is evident. Soon, Baidu's main business may no longer be traditional search.

"Looking ahead, Baidu will adhere to our long-term mission, advance with a more focused and determined attitude, and continue to transform AI innovations into real-world value," said Li Yanhong.

-END-