AI: The Vanguard of the Current A-Share Bull Market

![]() 08/21 2025

08/21 2025

![]() 577

577

This week, A-share stocks have surged to new heights, clearly showcasing the defining feature of this bull market: AI is leading the charge. A similar trend is observable in US stocks, albeit with a distinction between those with overseas revenue streams and domestic-focused mapped stocks.

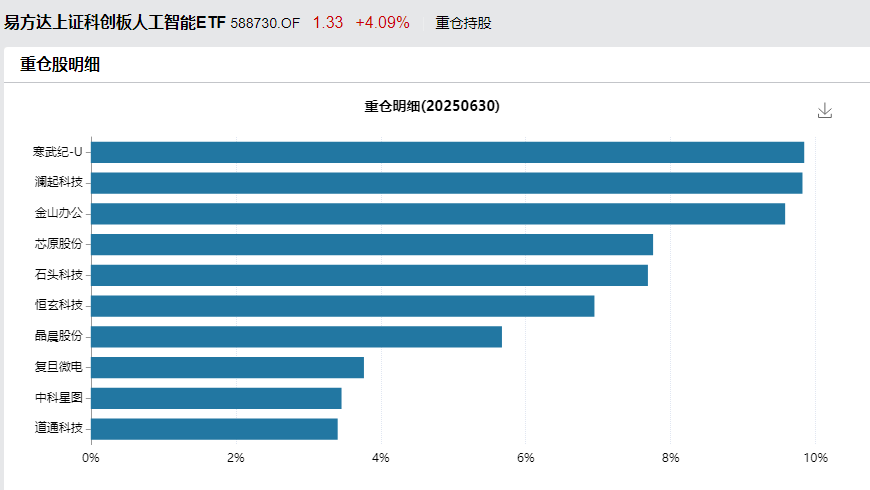

Since our mention of the Science and Technology Innovation AI ETF (588730) on July 25, this ETF has consistently delivered gains exceeding 20%.

As previously discussed, AI remains a complex field with limited deep understanding among the general public, akin to innovative drugs where even seasoned sell-side analysts often misjudge trends. The research prowess of professional investors and individual investors is on par, creating opportunities for expectation gaps and the gradual normalization of valuations.

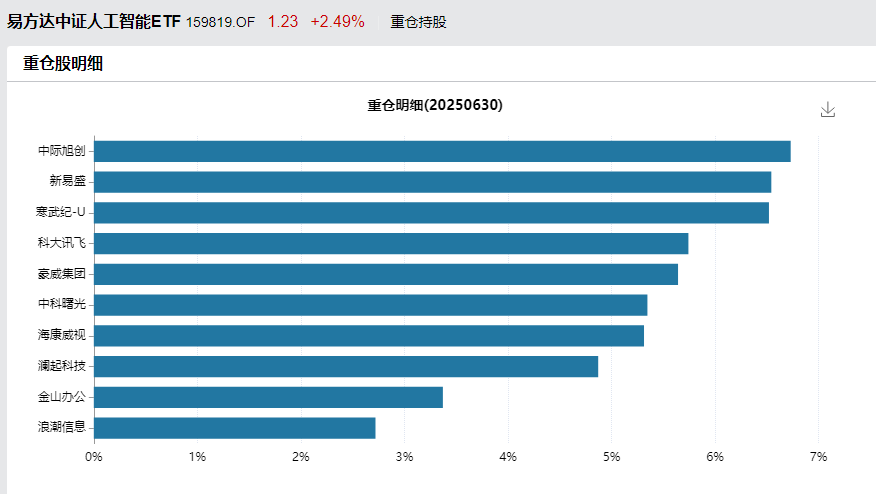

The AI industry is in a constant state of evolution, and we are witnessing the nascent stages of its second growth phase. The past two years marked the initial 0-1 phase, and the forthcoming period promises a leap from 1-10. AI continues to be a cornerstone of portfolio allocation, making ETFs like the Science and Technology Innovation AI ETF (588730) and AI ETF (159819) straightforward and effective investment vehicles.

Catalysts for the AI Bull Market

1. North American Vendors' AI Flywheel Effect: These vendors are entering a phase of larger-scale investments, evidenced by their significant first-quarter investments despite a near-halving of AI stock prices in the first half of the year. This period of pessimism paradoxically saw peak investment, indicating a wide market expectation gap.

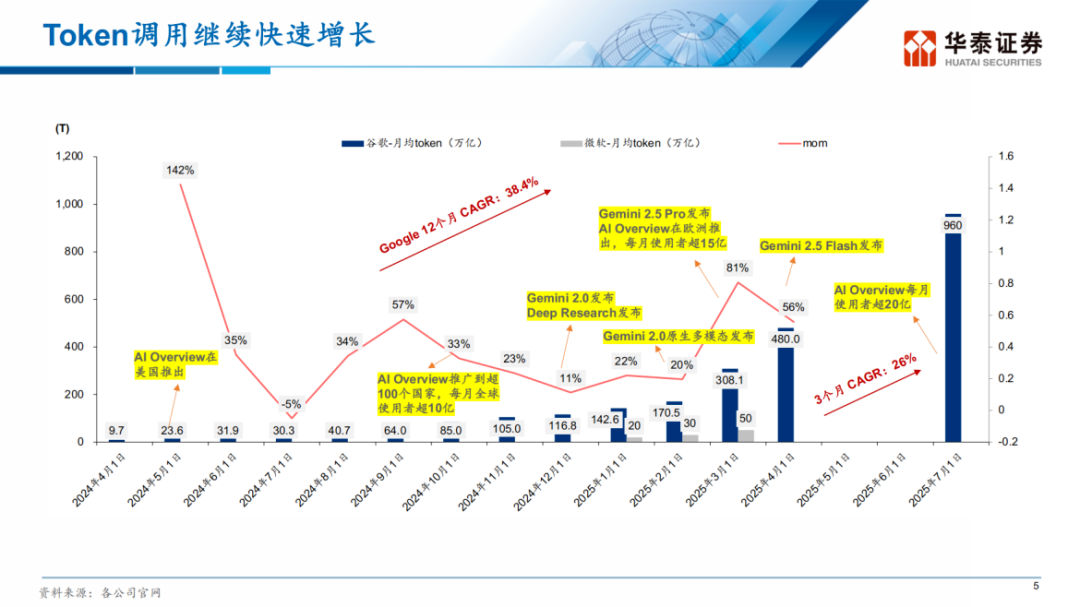

The simplest approach to successful AI investments is to track changes among North American cloud vendors. For instance, Google's token usage has doubled, from 480 trillion tokens per month in April to 960 trillion in July.

Recent data underscores the rapid growth in token consumption by large AI models, particularly OpenAI, which witnessed a monthly increase in July surpassing any month in the first half of the year. This explains Sam Altman's assertion that computing power demand will multiply in the next five months.

The surge in token consumption signals a transition from chatbots to AI agents, entailing a significant increase in computing power demand.

Despite some disappointment with GPT-5, its commercial success is undeniable and may unlock further commercialization potential for model vendors like OpenAI. Importantly, it will further propel the computing power flywheel, with cloud vendors reinvesting their earnings to scale up, as already observed among American cloud vendors.

2. Domestic Internet Stocks' AI Narrative: Following the news that H20 can be re-exported to China, the A-share market has focused on companies like Zhongji Xuchuang and Xinyi Sheng exporting optical modules, domestic server component chains, and exaggerated domestic substitution plays like Cambricon.

Recent reports suggest that NVDA is designing a castrated version of B200 for Chinese internet stocks, potentially offering several times the performance of the previous H20. Simultaneously, rumors of increased purchases of Cambricon's inference cards by internet stocks persist.

Both rumors appear credible. While AI adoption in China is slower, the development of AI hardware is recognized as essential, with token consumption also growing rapidly.

Goldman Sachs estimates that with the lifting of the H20 export ban, internet stocks' AI capex will accelerate, potentially exceeding initial market expectations.

US tech stocks are now in the second round of AI application competition. Initially, investing in AI was a gamble; now, its profitability is proven. As "gold miners," tech companies will invest in more tools (AI hardware) to strengthen their models, generating more revenue. This applies to domestic AI hardware firms like Cambricon, whose surge may be puzzling but warranted by its scarcity value.

As AI application penetration increases, a synergistic growth between AI hardware and software is likely, with hardware leading the way and software following suit.

Investing in AI at this juncture should transcend this year's revenue performance, focusing instead on forward-looking valuations for next year and beyond. Continuous monitoring of AI progress globally is crucial. Notably, some AI hardware firms have already reported impressive revenues this year, with next year poised for higher-margin 800G product volumes.

From a medium to long-term perspective, we are still in the 1-10 stage of AI development. Companies are exploring applications, and when a few excel, market expansion will accelerate. While the frontrunner is unclear, ETF investments across the industry mitigate the risk of picking the wrong company.

Examples include the Science and Technology Innovation AI ETF (588730) and its linked funds (023564/023565), as well as the AI ETF (159819) and its linked funds (012733/012734), offering both domestic substitution-focused and NVDA chain-integrated configurations.