Kuaishou's "AI Business Internal Cycle" Thrives Seamlessly

![]() 08/28 2025

08/28 2025

![]() 395

395

When envisioning era-defining technological advancements, many picture scenes of disruption and upheaval: the Industrial Revolution's swift demise of agricultural civilization with the roar of the steam engine, and the Information Age's global sweep, transforming traditional lifestyles through the advent of the Internet.

However, in reality, truly transformative technologies that take root and reshape the world rarely achieve success overnight through mere "substitution." Instead, they often coexist and evolve alongside traditional models, improving efficiency and reducing costs, ultimately reshaping the landscape quietly but significantly.

This year's mid-year reports from Google and Meta serve as prime examples. Despite limited commercialization of pure AI products, both companies significantly exceeded market expectations, leveraging the rapid advancement of AI-driven advertising businesses like Advantage+, Reel, and Pmax.

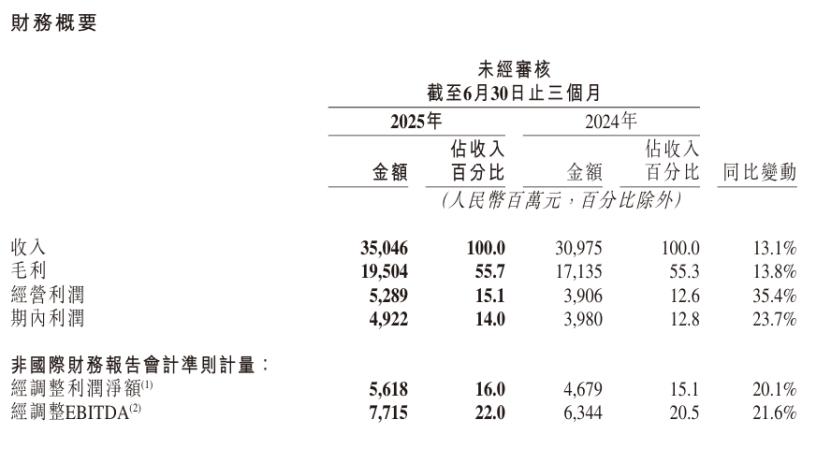

Focusing on the domestic market, the current main logic of AI development and application follows a similar trajectory. Just yesterday, Kuaishou, a leading Chinese video big model company, released its 2025 mid-year report: revenue totaled 35.046 billion yuan, with a year-on-year increase of 13.1%, and adjusted profit was 5.618 billion yuan, up 21.6% year-on-year, both significantly exceeding expectations.

Furthermore, regarding future expectations, Kuaishou has also shown relatively optimistic signals regarding the development of AI and overall business growth. During the earnings call, CFO Jin Bing revealed that Kuailing AI's full-year revenue for 2025 is expected to double compared to the initial target set earlier this year, reinforcing Kuaishou's commitment to long-term investment in Kuailing AI. It is anticipated that investment in Kuailing AI-related Capex for 2025 will also double compared to the initial budget at the beginning of the year.

Simultaneously, Kuaishou announced its first special dividend since going public, amounting to HK$0.46 per share, totaling approximately HK$2 billion. While rewarding shareholders, this also demonstrates to the capital market its confidence in the new cycle. Following the financial report and earnings call, the capital market also gave positive feedback to Kuaishou's mid-year report that exceeded expectations, with Kuaishou-W (HK1024) rising nearly 5% intraday today.

Kuaishou's exceptional mid-year report provides us with an advanced example for observing how AI deeply transforms mature business ecosystems. Based on this report, we will delve into how AI reshapes the existing short video business ecosystem from four aspects: supply and demand, as well as content and e-commerce, organized into a "2X2" framework.

01 Breaking Demand Barriers: AI Elevates Kuaishou's Growth Potential

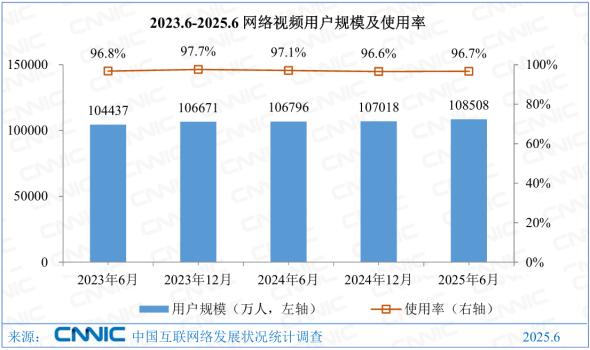

According to the China Internet Development Report, from the second half of last year to the beginning of this year, due to the saturation of internet-connected devices, the overall user utilization rate of online video has shown a trend of high-level decline over the past 18 months, dropping from 97.7% to 96.7%.

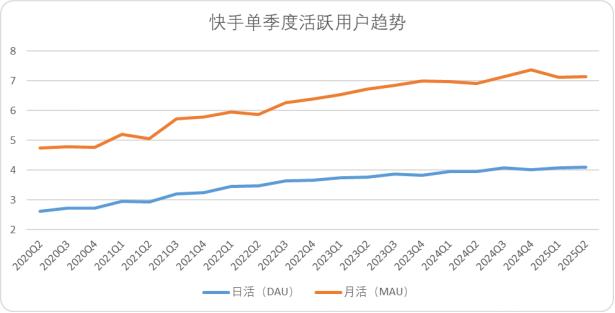

Chart: Online video user scale and utilization rate over the past two years, Source: China Internet Network Information Center

Despite the industry's general decline, Kuaishou presents a unique picture. The mid-year report reveals that in the second quarter of this year, Kuaishou's DAU and MAU reached 409 million and 715 million, respectively, with year-on-year increases of 3.4% and 3.3%. The average DAU hit a new high and exceeded 400 million for the fourth consecutive quarter. The average usage time reached 126.8 minutes, and the total user usage time increased by 7.5% year-on-year.

The steady growth of Kuaishou's core operating data hinges on the enhancement of its recommendation mechanism through AI technology, achieving a closer match between content supply and user demand.

In a stable user base scenario, the relationship between content supply expansion and demand growth is not linear, especially for short video content platforms, which inherently possess an asymmetric supply-demand business model. For example, users who enjoy funny videos will not see an increase in demand even if there is an abundance of science-based content.

Admittedly, similar to the supply of physical goods, the quantity of content supply today is not the core obstacle to demand. The key lies in whether the optimization of supply-demand matching can increase user stickiness, thereby driving overall usage time growth and boosting total traffic.

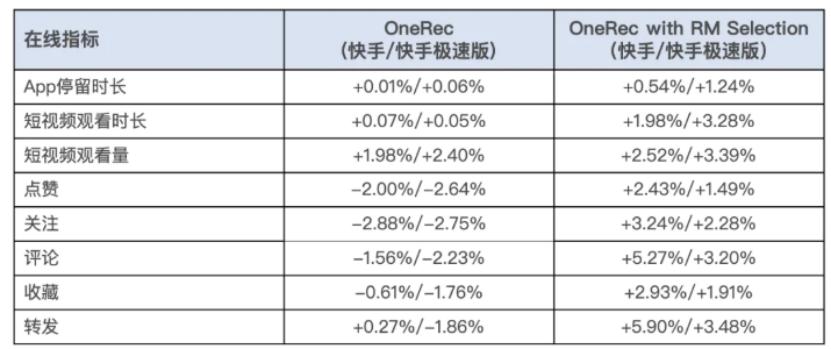

Kuaishou has found an effective method to improve supply-demand matching on the content side through the application of AI technology, such as the OneRec end-to-end recommendation big model, which is already available on both ends of the Kuaishou app (APP and Lite version).

Traditional recommendation models generally follow a "multi-stage pipeline" architecture. The core issue is that each layer of the model only focuses on its own part, making it difficult to consider users' real interests holistically. Moreover, multiple layers of models can create constraints, balancing the need to increase click-through rates while also accommodating niche and diverse content, ultimately leading to a continuous deterioration of consistency and efficiency.

Essentially, OneRec shifts the recommendation problem from a multi-stage, layered screening process to an end-to-end large model generation. In the past, the recommendation system was like an assembly line, screening content layer by layer; now, OneRec directly generates a list of video content that users are most likely to be interested in through a large model.

Overall, the OneRec end-to-end large model solves two core issues:

First, cost and efficiency.

Through architectural innovation, the compute utilization rates (MFU) for training and inference have soared to 23.7% and 28.8%, respectively, with operating costs (OPEX) being only 10.6% of traditional solutions. On the efficiency side, large language models generally achieve compute utilization rates of over 40% on top-tier chips like the H100.

Second, recommendation effectiveness.

OneRec introduces a multi-modal semantic tokenizer for content understanding. Instead of only looking at video tags, titles, or simple visual features, it breaks down each video into more detailed information fragments – visual content, text, voiceovers, music, and even user interactions.

For example, in a short food video, the tokenizer not only captures ingredients, cooking actions, and kitchen environments in the footage but also analyzes the casual tone in the voiceover, with user comments and danmaku (floating comments) becoming part of the content understanding. After a more detailed and multi-dimensional understanding of user behavior, it becomes natural to clarify user preferences, thereby improving the logic of inference.

We can directly observe the results. Kuaishou conducted a one-week 5% traffic AB test after the launch of OneRec, similar to a head-to-head experiment in the pharmaceutical industry, and achieved positive gains across all interaction metrics such as likes, follows, and comments.

OneRec also performed impressively in Kuaishou's local life service scenarios: AB comparison experiments showed that the solution boosted GMV by 21.01%, increased order volume by 17.89%, and grew the number of purchasing users by 18.58%, with a particularly significant 23.02% improvement in new customer acquisition efficiency.

The difference between users being able to see content and users being able to see the content they want to see is vast. Naturally, this helps Kuaishou enhance user stickiness and increase total traffic.

Next, let's discuss the demand side of products, where Kuaishou is gradually reconstructing the decision-making chain of content e-commerce through AI technology.

The core of maintaining the business chain of traditional shelf e-commerce is search, i.e., people finding products; while the core of maintaining the business chain of content e-commerce is recommendation algorithms, i.e., products finding people. Relying on the capabilities of large models, Kuaishou has not only achieved more precise product-to-person matching but also realized AI-driven services, improving the consumption chain, on top of further refining and evolving its recommendation algorithms.

For example, when buying a piece of clothing, using the AI try-on feature based on AIGC technology on the Kuaishou APP can more intuitively show users the effect of wearing the clothing, shortening the complex steps of traditional product discovery, order placement, arrival, try-on, and return. I personally tested it, and the effect was very good.

Chart: Kuaishou APP try-on function illustration, Source: Kuaishou APP

Benefiting from the optimization of AI empowerment on the demand side of products, the consumer decision-making chain has been significantly shortened. In the second quarter, the number of active buyers on Kuaishou's e-commerce platform reached 134 million, and the repurchase frequency of active e-commerce users has also been increasing.

Simultaneously, Kuaishou has applied AI technology to person-product matching and pre-sales and after-sales experiences. Leveraging the capabilities of large models, Kuaishou can accurately predict user purchasing behavior and preferences, automatically identify strongly related categories and interest tags, allowing the algorithm to better understand users' potential needs.

The intelligence of Kuaishou's pre-sales and after-sales service smart customer service is also much higher than that of traditional automatic customer service, capable of resolving many high-frequency issues that merchants face daily. For example, in the case of Cuilv Jewelry during this year's 618 shopping festival, relying on Kuaishou's AI assistant, pre-sales and after-sales teams answered a large number of high-frequency and specialized product information inquiries from users, solving 60%-70% of routine issues and greatly reducing the pressure on human customer service.

The amplification of the product side through AI technology is also intuitively reflected in the financial report. In the second quarter, Kuaishou's overall e-commerce GMV recorded 358.9 billion yuan, with a year-on-year increase of 17.6%.

In summary, one of the core reasons why Kuaishou has been able to achieve remarkable growth during the bottleneck period when content platforms have hit their bottom is that it has achieved a virtuous cycle at the content level through AI technology and accurately reached users' product demands, thereby breaking through the expected ceiling on the demand side.

02 Supply Innovation: AI Reinvents the Short Video Business Ecosystem

Continuing with the earlier logic, from a business perspective, the supply side is also divided into product supply and content supply. The most intuitive financial reflection of supply optimization is that Kuaishou's mid-year report revealed that the number of new merchants joining Kuaishou in the second quarter of this year increased by 50% year-on-year, and the number of daily active merchants in the mall field increased by 30% year-on-year.

Against the backdrop of the current differentiation and fragmentation of platforms, Kuaishou is still able to capture new supply-side growth. Besides being one of the few platforms that can increase total traffic, as mentioned earlier, what is more important is that Kuaishou continuously alleviates two core pain points for e-commerce merchants through technological empowerment: high marketing costs and operating costs.

When e-commerce merchants want to engage in marketing, the first consideration is calculating ROI. However, the biggest problem with traditional ad delivery tools is that every step of the entire marketing chain cannot be accurately measured, which may ultimately result in the post-investment ROI falling far short of expectations.

The first difficulty is that the cost of marketing materials cannot be effectively controlled. E-commerce marketing has a fast pace and high costs. If marketing materials cannot keep up with traffic trends, the delivery effect will be unsatisfactory.

However, the emergence of Kuaishou's AI technology solves this problem. For example, the Magnetic Pioneering Platform mentioned at this year's Magnetic Conference allows merchants to edit popular video styles with one click, intelligently generate high-quality scripts, and produce digital human videos, obtaining higher-quality delivery materials at a lower cost and faster speed, effectively resolving the contradiction between cost and efficiency.

Another example is Nuwa Digital Human, which supports 24-hour live streaming by virtual humans and possesses matrix operation capabilities, truly realizing "low threshold, high efficiency" in live streaming marketing.

According to the disclosure by Kuaishou's CEO during the earnings call during the annual report season, internal calculations at Kuaishou show that the AI large model is expected to reduce customers' short video marketing material production costs by 60-70% or even higher.

The second difficulty is that the conversion rate of promotional traffic is generally low, and it is difficult for promotional advertisements and organic traffic to interact and match.

Relying on its AI capabilities, Kuaishou has launched the UAX (Universal Auto X, fully automatic delivery) solution, which possesses four core module capabilities: intelligent infrastructure, intelligent regulation, intelligent creativity, and intelligent targeting. It can effectively assist customers and agents in enhancing delivery volume, stabilizing delivery costs, and improving delivery efficiency.

Jiang Peng, the head of Kuaishou's commercialization algorithms, explains that the marketing recommendation model's thinking chain decision-making learning allows it to dissect and summarize complex problems akin to humans, inferring users' purchase intentions and product marketing points. This precise person-product matching has resulted in a 10% increase in product order volume and a 20% surge in new product consumption.

The UAX fully automatic delivery solution has transitioned from rule-based to model-based decision-making. In the second quarter of this year, UAX marketing consumption accounted for approximately 65% of total external cycle consumption.

By enhancing ROI and addressing delivery conversion rate bottlenecks, merchants' inclination to invest in ad delivery naturally increases, driving budget allocation. In the first half of this year, Kuaishou's overall online marketing revenue reached 19.8 billion yuan, marking a 12.8% year-on-year increase, serving as compelling evidence and a fruitful outcome.

The third challenge lies in the traditional long chain from delivery to operational implementation, requiring substantial infrastructure work from merchants to sustain business conversion driven by ad delivery. For small and medium-sized merchants, it's challenging to have sufficient operational experience and labor costs to match the ad delivery conversion demands.

Kuaishou has tackled this issue from both technical and policy angles. Firstly, as mentioned, merchants have access to low-cost AI tools for material production, ad delivery, live streaming product introductions, and smart customer service, supporting business growth driven by ad delivery. Secondly, Kuaishou offers financial subsidies. For new merchants, its e-commerce platform has launched the New Merchant Cold Start Program, focusing on targeted support and growth acceleration within the first 90 days of their first live stream.

Fan Xiaoluo, the owner of a shoe and boot live streaming account, began operating on Kuaishou in late February this year. By May, the account's cumulative GMV exceeded 10 million yuan. Leveraging exclusive support for the first 30 days and continuous growth acceleration for high-quality new merchants within the first 90 days, Fan Xiaoluo achieved significant growth. Additionally, utilizing Kuaishou's cross-field traffic resources, she achieved interoperability between fields, with over 30% of transactions stemming from short video traffic. Full-station promotion also aided in her rapid growth, stabilizing the ROI of ad delivery at around 30.

In summary, by leveraging AI technology, Kuaishou has addressed the three major issues faced by traditional merchants, naturally fostering a thriving supply-side ecosystem. Combined with optimized demand-side matching, this ultimately contributes to the rapid growth of GMV.

03 Ace "Kuailing": The High-Level Narrative of Kuaishou's Value Transformation

By now, we have clarified the four-dimensional logic revealed in Kuaishou's mid-year report regarding how AI transforms supply, demand, content, and products. It's evident that Kuaishou's growth aligns with the logic demonstrated in Meta and Google's second-quarter financial reports.

However, Kuaishou's AI narrative extends beyond this. Amidst the global AI competition, the value of its ace AI application, "Keling AI", surpasses general market perception, representing a crucial variable for Kuaishou's further value transformation.

Firstly, Keling AI is a pivotal force for China in the peak competition of global AI applications. China needs iconic AI applications to benchmark global frontiers, and Keling AI stands out with its exceptional capabilities.

Currently, the field of multimodal AI applications boasts strong competitors, including Keling AI, Jiemeng, Hailuo, domestically, and established multimodal products like Runway, Sora, and Stability AI, internationally.

Initially, tech enthusiasts and early adopters become opinion leaders in technological applications. As the industry deepens, more professionals explore valuable technological innovations from various facets and details.

At this year's WAIC, Keling AI's capabilities were widely recognized by professionals. Abela, CEO of Freepik, a globally renowned creative content platform, stated, "We have integrated over 10 different large video generation models, and the number of videos users choose to generate using Keling AI surpasses the combined total of other models."

Professionals have powerfully demonstrated Keling AI's global technological leadership and user recognition, establishing it as a representative Chinese AI application.

Secondly, Keling AI continuously proves its immense value as an advanced productive force to the market.

The vitality of AI technology lies in its ability to drive industrial upgrading and social progress. Keling AI vividly illustrates this through extensive commercial applications, such as advertising material production and movie industrialization scenarios:

On June 25, the world's first AI unit story collection, "Loading the New World," premiered in Beijing. Co-produced by Kuaishou's Keling AI and Xingmang Short Dramas, with the production team of Outliers, this 180-minute drama is currently the largest AIGC drama work in the industry in terms of subject matter and narrative volume, attracting a cumulative global viewership of 200 million.

Even in the game industry, Keling AI has numerous applications. The popular mobile game "Ni Shui Han" has deepened its cooperation with Keling AI, incorporating industry-leading AI video generation capabilities to enrich social gameplay.

Data shows that as of July this year, Keling AI has produced over 200 million videos and 400 million images, serving more than 20,000 enterprise customers. Cheng Yixiao also mentioned in the conference call that "in the future, as the model's comprehensive performance improves, Keling AI will gradually possess in-depth application capabilities in industrial-grade scenarios like game production and professional film production, expanding its user base to more industries."

Finally, through its impressive commercial performance, Keling AI has not only increased its valuation but also created a model for a virtuous cycle of capital expenditure in Chinese AI applications.

In the second quarter of this year, Keling AI's operating revenue exceeded 250 million yuan. Few AI applications confidently disclose their commercial revenue progress, but Keling AI has, proving its actual product strength and demonstrating the potential and value of AI application commercialization to the market.

According to the CICC research report, the "Keling AI" series of models holds a 30.7% visit share in the global AI video tool market, firmly occupying the industry's top spot. CFO Jin Bing disclosed during the performance meeting that Keling AI's full-year revenue in 2025 is expected to double compared to the initial target set at the beginning of this year.

Relying on Keling AI's excellent commercial performance, Kuaishou has set a precedent for upgrading capital expenditure in China's AI field. CFO Jin Bing revealed that the Capex investment related to Keling AI has also doubled compared to the budget at the beginning of the year. Considering Keling AI's positive gross margins and stable inference computing power, the additional computing power investment has a controllable impact on the Group's overall profit, enabling capital expenditure to enter a virtuous cycle.

We've analyzed that the key to the current Sino-US AI development competition lies in capital expenditure. Large US companies aim to build and consolidate their business barriers by significantly increasing AI Capex, thereby raising the entry barriers for the AI industry.

Currently, our leading companies are constrained by low AI capital returns, lacking confidence to invest more to bridge the technological gap. However, Kuaishou's Keling AI has increased ROI through its product strength, not only establishing a virtuous cycle for its own capital investment but also setting an example for the development of Chinese AI applications.

If AI enabling existing businesses to drive revenue growth is Kuaishou's potential short- to medium-term expectation gap, then Keling AI's performance undoubtedly provides a boost for Kuaishou's long-term development.

In summary, Kuaishou's interim report clearly shows that AI is not a distant future prospect. On mature platforms, AI technology has deeply integrated into every aspect of connecting users and content, empowering businesses and supply, becoming a key engine driving core business growth.

This article is written based on publicly available information for information exchange purposes only and does not constitute any investment advice.