Cambrian Share Price Skyrockets, Founder Chen Tianshi's Net Worth Tops 150 Billion Yuan

![]() 08/28 2025

08/28 2025

![]() 545

545

By Xuanxuan Ye

Edited by Gu Qingqing

Produced by Wangjie

On August 25, Cambrian's share price surged again, closing at 1384.93 yuan, with a market capitalization of 579.4 billion yuan. Over the past five trading days, its share price has risen by over 45%.

With this sharp increase in share price, Chen Tianshi, the post-85 founder of Cambrian, has witnessed a substantial rise in his net worth. Holding 28.63% of the company's shares as of the first quarter of 2025, Chen's net worth now stands at approximately 165.9 billion yuan.

This news has garnered significant attention in the technology and investment sectors. As the "first domestic AI chip stock," Cambrian's journey exemplifies the evolution of China's AI chip industry.

01 Behind Cambrian's Share Price Surge

Cambrian's recent share price surge is attributable to several factors. On August 21, the company released DeepSeek-V3.1, emphasizing that its new parameter precision is tailored for the next generation of domestic chips. This announcement immediately popularized the concept of domestic computing power chips, and the following day, Cambrian's share price surged by the daily limit of 20%.

Concurrently, the 2025 China Computing Power Conference, held from August 22 to 24, released information indicating that China's computing power platform is accelerating its construction.

During the conference, the head of the Ministry of Industry and Information Technology also stated that they would guide regions to reasonably deploy intelligent computing power facilities, gradually enhancing the quality of intelligent computing power supply to meet the development needs of emerging and future industries. This boosted market expectations for computing power chips, making Cambrian a focal point.

Goldman Sachs, a leading global investment bank, is also bullish on Cambrian. On August 24, Goldman Sachs raised its 12-month target price for Cambrian from 1223 yuan to 1835 yuan, maintaining a "buy" rating. The bank believes that increased capital expenditures by Chinese cloud service providers, diversification of chip platforms, and Cambrian's emphasis on research and development will propel its continued growth.

Goldman Sachs' optimism has reassured investors, encouraging more funds to flow into Cambrian, pushing its share price and market capitalization to new heights.

02 The Ascent of Chen Tianshi and Cambrian

Born in 1985, Chen Tianshi graduated from the University of Science and Technology of China. In 2016, he co-founded Cambrian with his brother Chen Yunji, naming the company after the Cambrian Explosion geological era to symbolize the future of artificial intelligence.

Cambrian faced numerous challenges in its early days, including being added to the US "Entity List" in late 2022 and suffering consecutive losses before then. However, the emergence of ChatGPT in late 2022 revolutionized human understanding of artificial intelligence, sparking a global AI wave and surging demand for AI chips.

Cambrian seized this historic opportunity. In the fourth quarter of 2024, it achieved net profit attributable to shareholders of listed companies for the first time, amounting to 272 million yuan, successfully turning a profit. In the first quarter of 2025, Cambrian's net profit grew to 355 million yuan, with revenue surging 42 times year-on-year.

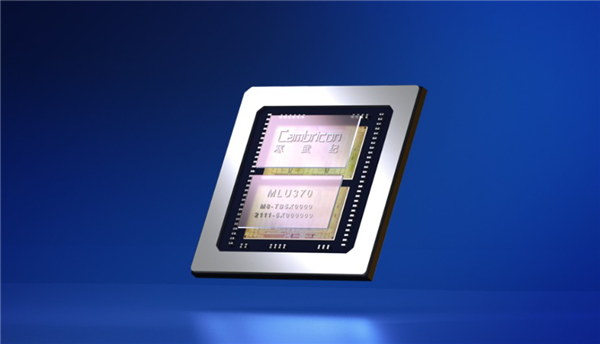

These achievements demonstrate that Cambrian has moved beyond "burning money" and now has the capability to earn through technical products. Its Thinker series of cloud intelligent chips, which cater to various AI tasks like large model training and inference, have gained market recognition.

Chen Tianshi's personal wealth growth mirrors Cambrian's rise. The "2025 Hurun Global Rich List" released by Hurun Research Institute on March 27 showed Chen Tianshi ranking 195th with a net worth of 87 billion yuan.

However, just over a month later, with Cambrian's market capitalization exceeding 570 billion yuan, Chen's net worth has surpassed 160 billion yuan. This rapid wealth accumulation underscores the investment market's focus on Cambrian's potential and indicates that the AI chip field is entering an explosive growth phase.

03 Cambrian's Significance to the Domestic AI Chip Industry

Often dubbed "China's NVIDIA," Cambrian holds a pivotal position in the domestic AI chip industry. Amid US chip export restrictions, the urgency to meet domestic computing power demands with indigenous chips is increasingly apparent.

Cambrian adopts an independent ecosystem approach, collaborating with Huawei to explore new directions beyond NVIDIA, paving the way for domestic chip development.

Market data shows that domestic chips' market share is expanding. According to IDC, in 2024, Chinese local AI chip brands accounted for 30% of the market share, with Cambrian shipping 26,000 units. Donghai Securities predicts that this year, domestic AI chips' market share may rise to 40%, with Cambrian playing a crucial role in this domestic substitution wave.

Major companies like Tencent have stated their intention to consider using chips from domestic manufacturers like Cambrian to fulfill their inference computing power needs. This indicates that domestic chips are gradually gaining the trust of major domestic firms, and Cambrian stands to gain more orders and consolidate its market position amid industry growth.

Cambrian also prioritizes participating in the formulation of technical standards, leading or participating in the revision of 45 international and domestic technical standards. By engaging in rule-making, it standardizes the domestic chip industry's development and helps other domestic enterprises better compete internationally.

In the future, as domestic AI chips aim to enter the global market, Cambrian's accumulated technology and ecosystem experience can serve as a valuable reference for its peers.

Summary: Cambrian's Market Value and Founder's Net Worth Soar

Cambrian's rapid market value growth has propelled Chen Tianshi's net worth beyond 160 billion yuan, becoming a prominent event in recent technology investment circles. The share price surge is a result of multiple factors, including the release of the DeepSeek large model, the China Computing Power Conference's promotion, and the optimism of institutions like Goldman Sachs.

From previous losses to current profitability and popularity, Cambrian has showcased the immense potential of domestic AI chip enterprises.

In the domestic substitution process, Cambrian plays a key role. Amid US chip export restrictions, it explores an independent ecosystem, aids domestic chips in expanding their domestic market share, and contributes to industry standard formulation.

It is anticipated that in the future, Cambrian will withstand market pressures, continue to rely on technological innovation for growth, bring more surprises to China's AI chip industry, and propel domestic chips to not only achieve import substitution but also penetrate the global market.