Robotics Industry: Beyond Hype, Toward Practicality

![]() 09/01 2025

09/01 2025

![]() 701

701

Recently, the buzz around the impending introduction of a "robotic mother" within a year has been clarified, yet the robotics industry remains uncharacteristically vibrant.

In the summer of 2025, two major technology events jointly propelled the industry to new heights. Data reveals that the World Robot Conference attracted 271,000 visitors and 52 million live stream viewers. Fifty equipment manufacturers showcased their diverse skills in folding clothes, sorting, and engaging in robotic combat on the same stage.

Concurrently, the World Humanoid Robot Games saw 280 teams compete in 26 events. A video of Unitree Robotics completing a 1500-meter run in 6 minutes and 34 seconds went viral. However, beneath the excitement, a set of data paints a contrasting picture: By July 2025, there were 834 domestic enterprises related to humanoid robots, with new registrations surging by 180% year-on-year in the first half of 2025.

Notably, two robotic enterprises listed on the Hong Kong stock market, UBTech and Crossing Innovation, were not profitable as of 2024. Other loss-making enterprises during the same period include Ludong Robotics and Woan Robotics. A detailed analysis shows that 10 out of 12 robotic enterprises that submitted listing applications in 2025 incurred losses.

A question arises: Does the real world genuinely need so many robots? While there is always a demand for technology, when capital, media, and market imagination fuel the frenzy for robots as an "advanced demand," the industry becomes constrained by expectations far exceeding its technological capabilities and real demand.

Capital Packaging: Future "Rigid Demand"

The robotics industry in 2025 seems to be mirroring the "Thousand Group War" of internet startups in 2015. According to ITJuzi statistics, in the first three months of 2025, there were 54 investment and financing transactions in China's embodied intelligent robots, totaling 6.046 billion yuan. The number of financed enterprises has already surpassed the total for the entire year of 2023.

In the primary market, Unitree Technology initiated IPO counseling with a valuation of 12 billion yuan, Zhiyuan Robotics plans to invest 2.13 billion yuan to acquire a controlling stake in listed company SWANCOR, and CloudMinds, one of the "Six Dragons of Hangzhou," raised nearly 500 million yuan in a single funding round. Itshi Zhihang even secured a $122 million Angel+ round of funding led by Meituan.

Capital's real money voting quickly pushed the industry's valuation to new heights. Currently, in the robotics sector, the valuation of first-tier enterprises exceeds 7 billion yuan, the second tier reaches 2 billion to 5 billion yuan, and other popular companies are valued at roughly 2 billion yuan.

As capital continues to penetrate and expand in the robotics industry, it forces non-essential technological possibilities into so-called "rigid demands." The birth of some robots does not stem from real-life developmental needs but rather from capital's desire to control industry discourse by amplifying scenario-specific anxieties, such as surrogate robots hyped on short video platforms.

Admittedly, with rising infertility rates, the dilemma of fertility has become a significant issue, and the demand for assisted reproductive technology is growing. Data shows that China's in vitro fertilization service market size increased from 18.91 billion yuan in 2016 to 28.2 billion yuan in 2019, expected to reach 48.76 billion yuan by 2025.

Perhaps due to the potential of the assisted reproductive market and the traffic value of fertility anxiety, capital attempts to embed the concept of robots into this demand scenario. However, the core technology supporting this concept is far from mature. The combination of a "artificial uterus + robot body" remains at the level of science fiction.

Technically, the core difficulty of a "robotic mother" lies in the "artificial uterus," which has only made limited progress in animal experiments. In 2017, the "EXTEND" system at Children's Hospital of Philadelphia allowed eight premature lambs to survive outside the body for four weeks, but these lambs already had autonomous blood circulation and could not support embryo implantation.

More crucially, there are strict ethical restrictions on culturing human embryos outside the body, generally not exceeding 14 days (some countries suggest extending it to 28 days), while human fetuses require 10 months of gestation, far exceeding the ethical red line. This means "robotic surrogacy" will not be feasible for a long time.

The premature hype of "surrogate robots" is not an isolated incident. In the robotics industry, capital deliberately packages future "rigid demands," often using topical performance scenarios as entry points and amplifying heat with rapidly established business chains, such as robot competitions attracting hundreds of millions of online views.

Huanmeng Technology's 1,000 robots, including humanoid robots, robot dogs, and robotic arms, conducted exhibitions in cities like Beijing, Shanghai, and Guangzhou. The net profit of one exhibition can reach several hundred thousand to several million yuan, even with half the seating capacity filled.

Capital has swiftly built a mature business track, encompassing event tickets, live broadcast rights, brand sponsorships, and even robot soccer matches mimicking human soccer's "transfer" and "youth training" systems. The High-Tech Robotics Industry Research Institute predicts that by 2030, China's humanoid robot market will reach 38 billion yuan, with sales surging from 4,000 units to 271,200 units, representing a compound annual growth rate of over 60%.

Currently, major cities, enterprises, and universities are organizing robot competitions.

Beneath the lively business facade lies a capital trap, using false prosperity to prop up industry valuation and attracting resources with the illusion of "rigid demand," ultimately harvesting traffic dividends and investment returns. When technology will breakthrough and real demand will be met has long been overshadowed in this capital game.

The Era of Robots "Serving Humans" is Yet to Come

In 2025, the humanoid robot industry witnessed explosive growth. Global humanoid robot sales are expected to exceed 10,000 units in 2025, a year-on-year increase of 125%. Since 2025, orders for humanoid robots in China have shown similar growth, with companies like Tiantai Robotics, Zhiyuan Robotics, UBTech, JPT, and Unitree Technology receiving humanoid robot orders.

In July, the China Bidding and Tendering Public Service Platform announced that UBTech won a robot equipment procurement project worth 90.5115 million yuan from Miyi Automobile, setting a new record for the highest single bid amount by a global humanoid robot enterprise. However, when will large-scale "demand" actually arrive? No one can say for sure.

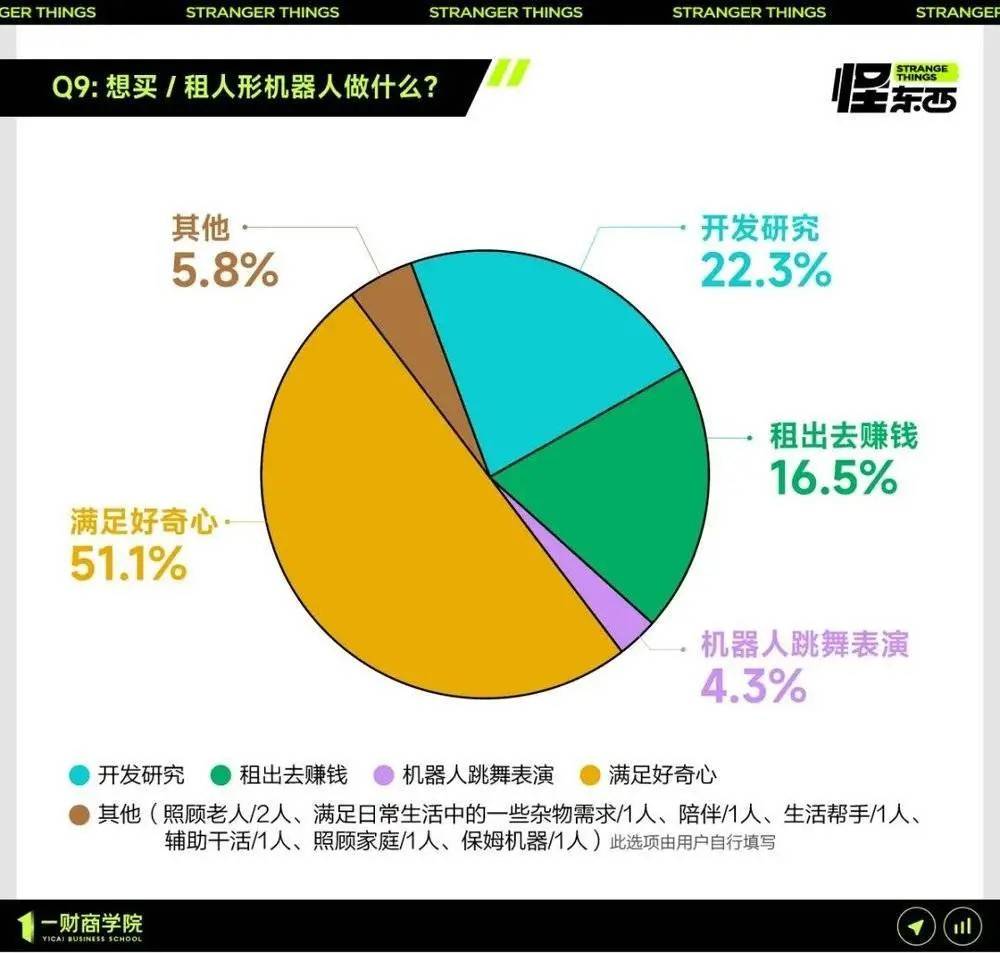

In reality, there is a huge mismatch between supply and demand in this sector. A "Yicai Business School" survey showed that nearly 70% of respondents considered purchasing or leasing humanoid robots. 85.6% of consumers desired humanoid robots for household services (e.g., housework, moving things, tutoring children) and elderly care services (e.g., caring for the elderly, medical nursing). Citibank forecasts that by 2050, C-end scenarios like household services and medical nursing will explode.

However, few humanoid robots have truly entered households today.

The current order boom is mainly supported by B-end industrial scenarios and A-end scientific research and education. Among the hundreds of robots UBTech plans to deliver this year, 500 are industrial robots. Universities have become significant buyers, with Tongji University spending 8.2566 million yuan to procure 10 Unitree H1-2 robots, and over 30 domestic universities being Unitree Technology customers.

These orders hardly meet normal demand expectations. Data shows that over 50% of "commercial" orders are essentially for public relations displays and data collection. The core issue of "non-practicality" stems from substandard robot technology, unable to support normalized use in real-world scenarios.

In the Beijing Half Marathon, 14 out of 20 pacing robots had to withdraw due to overheating joints or balance issues, turning into a situation where humans were serving robots. "Alphabet Rank" bluntly stated that the robot marathon completion rate was only 30%. Most market robots have limited functionality, with basic models performing simple actions like translation and waving, far from the complex services required in reality.

In the technology sector, compared to B-end and A-end, C-end consumer demand feedback and pull are often crucial for technological products to move from the laboratory to "marketization." Robotics precisely faces a lack of C-end demand. Among Unitree Technology's customers, there are few direct C-end consumers.

Even on e-commerce platforms, where the Unitree G1 robot priced at 99,000 yuan is marked as having sold over 800 units, actual reviews mostly pertain to robot dogs, with few consumer reviews for humanoid robots. A few buyers mainly aim to attract traffic, posting notes and videos on social platforms like Xiaohongshu and Douyin about their "experience using the Unitree humanoid robot" and "spending xx million yuan to buy Unitree."

Long-term, if robotics fails to break the "C-end absence" deadlock, it may affect the penetration of AI-related technologies into other fields. Due to overly strong industrial demand, in 2024, important models developed by the industrial sector accounted for over 90% (60% in 2023), with major AI large models dominated by the industrial sector.

Simultaneously, this sector will struggle to replicate the market success of AI mobile phones and consumer-grade drones. After all, any technology's ultimate value must return to "serving humans." At this stage, it's evident whether humans are serving robots or robots are serving humans.

On the path of serving humans, current robots have only taken their first step.

Excessive Concept Hype: Overdrawing Technological Innovation Credibility

In 1984, Harbin driver Wang Hongcheng claimed to have invented "water-to-oil" technology, asserting that adding a small amount of combustible acetylene agent to water could turn it into a cheap fuel. This claim garnered media attention and was touted as the "fifth great invention after the Four Great Inventions." It wasn't until 1997 that Wang Hongcheng was sentenced for fraud, ending this decade-long deception.

Over three decades later, a similar scenario persists in the technology circle.

Before the surrogate robot uproar, there were countless misleading rumors, such as the humorous bank customer service robot "Jiaojiao" (actually played by a real person), the independently developed Redcore browser, the "water-to-oil" water-hydrogen car, and the counterfeit singing of "Hua Zhibing." Farces based on false rumors have never been absent from the technology circle.

While these absurd performance games are amusing, they never deviate from the core logic of "sucking up money." This capital agglomeration effect has been common throughout history, akin to the railway frenzy in the 19th century and the internet bubble period in 2000, when huge amounts of capital poured in along the path of concept hype.

Especially when capital is eager to find an outlet, meticulously packaged concepts are far more favored than solid technology.

A CB Insights report shows that in 2024, the total number of investment and financing events in the global AI field reached 4,505, an increase of 6.35% from the previous year's 4,236; total financing amounted to 100.4 billion dollars (approximately 728.35 billion yuan), an increase of 79.61% from the previous year's 55.9 billion dollars, accounting for 69% of the global financing total.

While capital still appears crazy about AI, AI heat in some markets has waned. In China, AI startups raised only 5.2 billion dollars in 2024, accounting for only 7% of the 76.3 billion dollars raised by AI startups in the United States.

Perhaps for some AI enterprises, they urgently need a "surrogate robot" to sustain their momentum.

Furthermore, from a social cognition perspective, while global optimism towards artificial intelligence demonstrates an overall upward trajectory, significant regional disparities persist. In nations like China (83%), Indonesia (80%), and Thailand (77%), the majority of individuals perceive the benefits of AI products and services as outweighing their potential harms.

Conversely, optimism is markedly lower in Canada (40%) and the Netherlands (36%). This disparity might explain why some practitioners resort to risky endeavors, attempting to generate buzz around "cutting-edge" topics like surrogacy that push technological boundaries or even breach ethical norms, thereby artificially inflating societal expectations for AI.

It's noteworthy that the repercussions of shattered illusions often reverberate throughout the entire industry.

Nikola, once valued at $30 billion, duped investors by towing trucks up hills to film "autonomous driving" videos. Following a backdoor listing in 2020, Nikola's market valuation swiftly doubled to $30 billion, even surpassing Ford Motor Company, and attracting investments from giants such as General Motors and Bosch. However, by 2025, it filed for bankruptcy, leading to investor losses exceeding $20 billion.

Currently, the AI sector is also grappling with underlying crises. From the launch of ChatGPT to July 2024, 78,612 newly registered AI enterprises in China have ceased operations, representing 8.9% of the total new additions during that period. The tally of "failed enterprises" has swollen to 353,000 over the past decade. In the first half of 2024 alone, over 237,000 new AI enterprises were registered in China, yet more than 80,000 succumbed to bankruptcy or insolvency.

From "water-to-oil" scams to robotic surrogacy, the tactics employed in technological rumors remain unchanged. When capital ceases to patiently await technological maturity, farces continue to resurface amidst the frenzy, temporarily boosting industry popularity but more often than not, eroding public trust in technology.

Ultimately, all that remains are shattered expectations.

Dao Zong Youli, formerly known as Waidaodao, is a prominent new media outlet in the internet and technology sphere. This article is original content and prohibits any form of reprinting without retaining the author's relevant information.