Funding Surge: Eight Emerging Unicorns in the Smart Lawn Mowing Robot Sector Nationwide

![]() 09/03 2025

09/03 2025

![]() 648

648

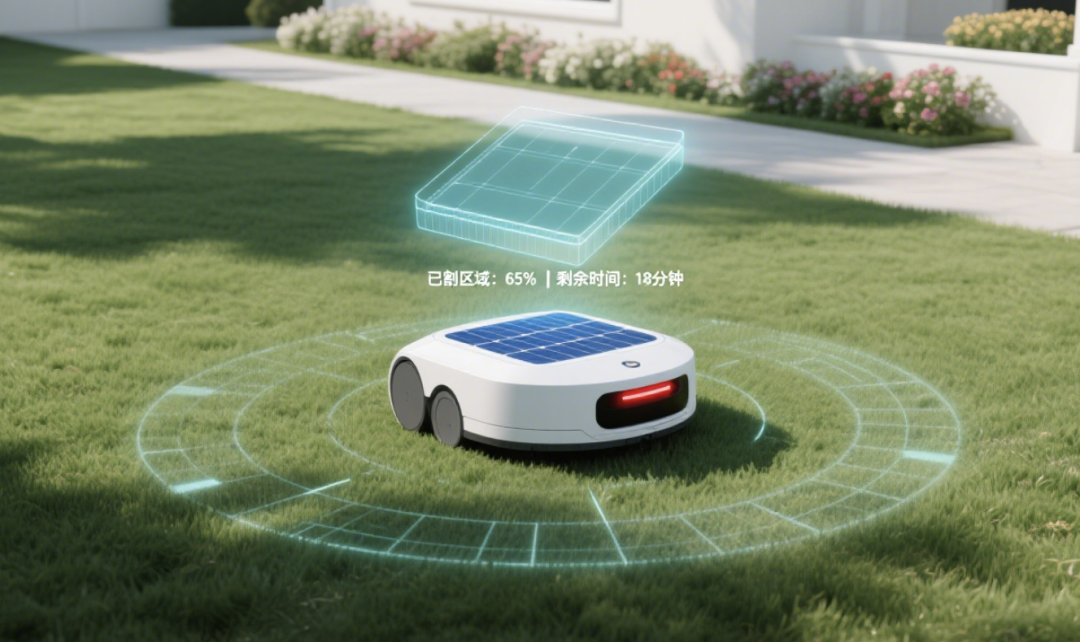

A cohort of potential unicorns has recently emerged in the realm of smart lawn mowing robots.

Since the start of the year, this sector has witnessed robust funding activity, with a cumulative total of approximately eight enterprises securing investments. Most recently, Laimou Technology raised tens of millions of yuan. Prior to this, Yuanding Intelligence secured 1 billion yuan in April, and Hanyang Technology raised 100 million yuan in July.

Lawn mowing robots that have received funding this year (Image source: Xiniu Data)

The influx of capital undoubtedly underscores the immense appeal of this sector.

In Europe and America, smart lawn mowing robots are no longer a novelty. With approximately 250 million gardens globally, Europe and America account for two-thirds of this total, making lawn maintenance a rigid demand.

In contrast, the domestic lawn mowing robot market emerged relatively late, with about 50% of enterprises entering the space only after 2020. Despite the presence of giants such as Ninebot, Ecovacs, and Dreame Technology, opportunities still abound in niche scenarios for aspiring entrepreneurs.

For small and medium-sized lawn scenarios, MOVA leverages lidar technology to penetrate the European market. For scenarios with specific functional requirements, such as the integration of cleaning and mowing, Kärcher has already introduced relevant products. In the realm of commercial lawn mowing robots, scenarios like municipal parks have an urgent need for high-performance solutions. In terms of precise industrial weeding, the intelligent laser weeding robot developed by Huagong Technology in collaboration with the Harbin Institute of Technology boasts a recognition rate of ≥95%.

- 01 - The Genesis of Demand

You might wonder if there's a demand for smart lawn mowing robots in China. This question is understandable.

If you were in Europe or America, you wouldn't hesitate to ask. This is because European and American households boast a plethora of lawns, accounting for two-thirds of the global total of roughly 250 million gardens. Consequently, lawn maintenance is a pressing necessity.

Prior to the advent of robots, people relied on traditional gasoline-powered, hand-pushed lawn mowers—tools akin to vacuum cleaners and sweeping robots.

However, hand-pushed lawn mowers have a significant drawback: they are not environmentally friendly due to fuel pollution. These devices typically employ small two-stroke engines that burn a mixture of gasoline and oil.

The exhaust from these engines contains high concentrations of carbon monoxide (CO). Tests reveal that an ordinary 1.5-horsepower two-stroke gasoline lawn mower emits approximately 3.5-5.2 grams of CO per hour, equivalent to the emissions of a new car traveling hundreds of kilometers.

Furthermore, manual lawn mowing is inefficient. For instance, a skilled worker using a gasoline hand-pushed lawn mower would require about 1.5-2 hours to meticulously trim a 200-square-meter lawn and clean up the grass clippings. In complex terrains (such as sloped areas or those with obstacles), efficiency decreases by 30%-50%.

Therefore, as early as 2013, lawn mowing robots began gaining popularity in Europe and America.

For instance, in that year, Husqvarna introduced a robot capable of cutting grass across thousands of square meters, regardless of shape.

According to data from Vision Research and others, by 2023, the market share of lawn mowing robots in North America will reach 36%, 30% in Europe, and the market penetration rate in Nordic countries can surpass 60%, exceeding 40% in Germany and Switzerland, and ranging between 15%-30% in Southern Europe.

- 02 - The Domestic Landscape

When did the domestic market emerge? According to Pencil Road DATA, approximately 50% of enterprises entered the space after 2020.

By 2021-2022, more than a dozen startups focused on borderless lawn mowing robots had emerged in China, backed by numerous capital firms. For example, in cities like Shenzhen, Beijing, and Suzhou, startups such as Hesenberg, Changyao Innovation, Zongguan Innovation, Laimou Technology, and Senhe Innovation made their mark.

This begs the question: Is there a market for lawn mowing robots in China?

Yes, but it differs significantly from European and American markets. The core application scenarios in China are not residential. The reason is straightforward: there are too few residential properties with lawns in China.

Data from the Ministry of Housing and Urban-Rural Development indicates that in 2023, the number of detached houses and townhouses in China exceeded 48 million, of which approximately 37% were equipped with lawns—accounting for roughly 4.55% of the total number of residential properties.

In contrast, according to data from websites like HomeUSA, villas account for 80% of the total number of residential properties in the United States, making the market significantly larger.

In China, the market for lawn mowing robots is more geared towards toB directions, such as parks, golf courses, municipal green spaces, and commercial venues (hotels, estates).

Taking parks as an example, the vast lawn areas and obstacles like trees and flower beds make lawn mowing robots indispensable. In Shenzhen, some parks have already started using them, with YUKA's series of products (from Kuma Technology, founded in 2016) being utilized for mowing and cleaning up fallen leaves.

However, overall, the current lawn mowing robot market remains a niche micro-sector. According to Zhiyan Consulting data, the size of the Chinese lawn mowing robot market will approximate 1.859 billion yuan in 2024, with a year-on-year growth rate of 18.06%.

Of course, the fact that the domestic market is small doesn't preclude the growth of large companies. After all, as mentioned earlier, we can go global—there is demand abroad. We can manufacture lawn mowing robots and sell them to foreign users.

For instance, most domestic giants (Ninebot, Dreame, Kuma Technology) also have overseas operations.

Take Ninebot as an example. Its lawn mowing robots are sold in over 30 countries worldwide, with shipments exceeding 100,000 units and revenue surpassing 861 million yuan in 2024. Among them, the Navimow i series, priced at less than 999 euros, once sparked a minor sensation in Europe.

- 03 - The Greatest Opportunity: Going Global

Despite the small domestic market, capital continues to invest heavily in smart lawn mowing robots. After all, China is a manufacturing powerhouse: producing goods in China and selling them globally is a proven business model.

One might ask: Since the demand is overseas, why can't foreign brands sell as well as Chinese brands? After all, China is the world's factory, boasting technological advantages, supply chain advantages, and affordable prices in manufacturing. This logic also applies to the lawn mowing robot sector.

What are the technical barriers in lawn mowing robots? Positioning and navigation technology, terrain adaptation technology, cutting system technology, intelligent control and algorithm technology, hardware design, and manufacturing.

Domestic enterprises have already made significant breakthroughs in these technologies.

For example, Ninebot's Segway Navimow X3 employs the EFLS 3.0 precise fusion positioning system, offering wider signal coverage and shorter transmission delay. Another example is Ecovacs' GOAT A3000 LiDAR, which adds dual lidars to enhance recognition, navigation, and obstacle avoidance accuracy, increasing work efficiency to three times that of the first-generation lawn mowing robot.

For some international giants, despite an early start, they have been overtaken by latecomers. In the 1990s, Sweden's Husqvarna (commercial robots) peaked at a 70% share of the European market but subsequently declined to about 50%.

Moreover, a comprehensive supply chain has already been established in China, making robot manufacturing more cost-effective.

For instance, the high-end brand Husqvarna's lawn mowing robots are priced between 3090 and 5299 euros, equivalent to approximately 25,500 to 43,700 yuan. However, Ecovacs' products of the same level are priced at 2000-2500 US dollars on the Amazon platform, equivalent to roughly 15,000-18,000 yuan.

- 04 - Five Latest Opportunities

For entrepreneurs, is there still an opportunity in lawn mowing robots? How monopolized is the market by giants? This is a pivotal question.

Firstly, giants do exist, primarily including Ninebot, Ecovacs, and Dreame Technology—either listed companies or super unicorn enterprises.

Which scenarios have these giants dominated?

Ninebot's largest share is in the residential garden scenario (Europe and America), priced at 1000-2000 dollars, targeting middle-class families in Europe and America with private gardens. It is sold through online e-commerce platforms like Amazon and eBay, as well as offline supermarkets such as Costco and OBI.

Dreame Technology's largest share is similar, focusing on the European residential garden scenario (high-end). Its global cumulative shipments have reached 100,000 units, with its core product, the A2 series, priced at approximately 2000-2800 euros.

Ecovacs' products are also aimed at European and American households but excel in standard gardens of 600 square meters and below.

Overall, in the European and American + residential garden scenario, lawn mowing robots have already been infiltrated by giants. So, in which niche scenarios do new players still have opportunities?

The first is the small and medium-sized lawn scenario.

For instance, MOVA (a sub-brand of Dreame), founded in 2024, utilizes lidar technology to enter the smart lawn mower sector, targeting the European small and medium-sized lawn market.

The second is large but complexly terrained lawns.

For example, Kuma Technology, a sub-brand of SLR Robotics focused on outdoor robots, launched its first borderless lawn mowing robot, LUBA, in 2022, quickly capturing the market with its "complex terrain adaptability." In 2024, its global shipments reached 80,000 units.

The third is scenarios with specific functional requirements.

For instance, the integration of cleaning and mowing. The European cleaning equipment giant Kärcher has ventured into this sector through acquisitions, with its RC series of lawn mowing robots featuring "cleaning + mowing" integration.

These robots can not only trim the lawn but also clean up small particles like fallen leaves and debris on the lawn surface during operation, making them ideal for families that prioritize yard cleanliness.

The fourth is commercial lawn mowing robots.

For commercial scenarios such as municipal parks, golf courses, and large-scale photovoltaic power stations, lawn mowing robots have higher performance requirements, including larger operating areas, higher efficiency, and longer battery life. Consequently, the technical challenges are also greater.

Taking battery life as an example, battery capacity directly impacts endurance. Currently, lithium batteries are the mainstream choice for lawn mowing robots, but their energy density still needs improvement.

For instance, ordinary household lawn mowing robots are often equipped with 2-4Ah batteries, providing only 1-3 hours of endurance. Even high-end models used in large commercial scenarios, equipped with 40V/10Ah batteries, only offer 6-12 hours of endurance. Moreover, in low-temperature environments, the activity of lithium batteries decreases, reducing endurance by 10%-30%.

The fifth is precise industrial weeding.

The all-weather intelligent laser weeding robot developed by Huagong Technology in collaboration with the Harbin Institute of Technology Robotics Laboratory is a prime example. It distinguishes between crops and weeds through high-speed cameras and AI image recognition technology, boasting a recognition rate of ≥95%. This robot has undergone field trials in soybean fields in Aihui District, Heihe City, Northeast China, and can operate continuously for 24 hours.

This article does not constitute any investment advice.