Oracle’s Stock Soars 27%: Is This a Final Flare or the Ascent of a New AI-Era Titan?

![]() 09/10 2025

09/10 2025

![]() 729

729

Oracle’s Stock Soars 27%: Is This a Final Flare or the Ascent of a New AI-Era Titan?

This article is an original piece by MGresearch (US-Hong Kong Investigation).

Editor: Chief Inspector

"We're not celebrating a win; we're witnessing a coronation."

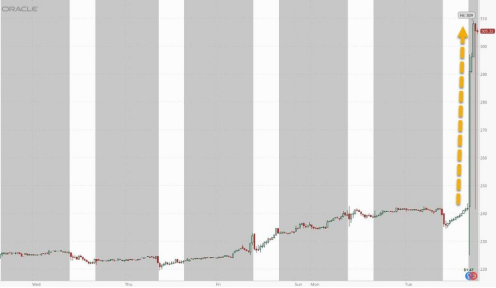

When Oracle, the seasoned tech giant, released a "blockbuster" financial forecast after the earnings season, its stock price rocketed 27%—marking its largest single-day surge since the dot-com bubble. This moment signaled that the "era of unbridled growth" for AI infrastructure has truly arrived. Oracle is no longer the database software company you once knew; it has transformed into a full-fledged "AI titan," poised to soar.

Why is the market ablaze with excitement? The answer lies in a figure that would set any investor's pulse racing:

$455 billion.

$455 billion: Not Just a Number, but a 'Future Contract'

In its earnings report, what truly electrified Wall Street wasn't the quarterly revenue of $14.9 billion, but a metric known as "Remaining Performance Obligations" (RPO). Like an untapped gold mine, RPO represents the "future wealth" that the company has secured through contracts but has not yet recognized as revenue.

$455 billion, a staggering 359% increase year-over-year.

In just one quarter, Oracle secured $317 billion in new contracts.

What does this mean? It's equivalent to Greece's annual GDP and nearly five times Salesforce's market capitalization. It implies that even if Oracle ceased signing new contracts today, these locked-in "orders" would keep it comfortably profitable for years. In a capital market rife with uncertainty, is there a more tantalizing "certainty" than this?

Behind this "Future Contract" stand the "big spenders"—OpenAI, xAI, Meta—the brightest stars in today's AI universe. They are entrusting Oracle's Cloud Infrastructure (OCI) with the critical task of training the next generation of groundbreaking AI models. Oracle has evolved from a traditional database giant into the "arms dealer" of the entire AI ecosystem.

From 'Database Dinosaur' to 'AI Arms Dealer': A Textbook 'Second Curve' Revolution

Years ago, when the cloud computing wave surged, Oracle was derided as a "dinosaur out of touch with the times." Its core database business stagnated, and it fell far behind Amazon AWS and Microsoft Azure in the cloud race.

However, as the saying goes, "When the era abandons you, it doesn't even say goodbye." Yet, the era also rewards those bold enough to "go all in" on the future. Oracle clearly chose the latter path.

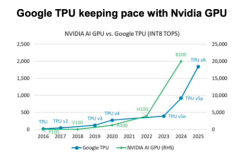

Betting on AI computing power: As the demand for generative AI computing power exploded exponentially, Oracle keenly sensed the opportunity and decisively positioned its Cloud Infrastructure (OCI) as the "cradle of AI supercomputers," deploying massive clusters of tens of thousands of NVIDIA H200 GPUs specifically designed for training and inferring the most cutting-edge AI models.

Binding core customers: Oracle signed a $4.5 GW data center cooperation agreement with OpenAI and secured massive cloud contracts with giants like xAI and Meta. These "bellwether" enterprises in the AI field collectively voting with their feet is the strongest endorsement of Oracle's technical prowess.

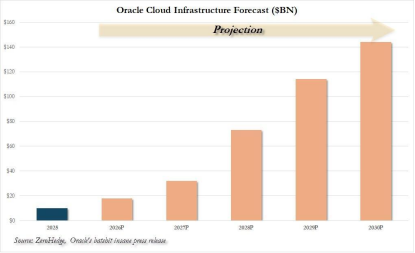

Painting a 'terrifying' blueprint: Management not only forecasted OCI to grow 77% this fiscal year but also outlined a grand vision of revenue multiplying eightfold to reach $144 billion in the next four years. This almost "arrogant" confidence completely ignited the market's FOMO (Fear Of Missing Out) sentiment.

Oracle's stunning "second curve" transformation sends a clear message: Never underestimate the heart of a champion.

Larry Ellison's 'Master Plan': AI Training Is Just the Appetizer; The Trillion-Dollar 'Inference Market' Is the Main Course

If you think Oracle's story is merely about "selling computing power," you're underestimating the ambition of this Silicon Valley "veteran." During the earnings call, Chairman Larry Ellison unabashedly revealed his ultimate "master plan":

"Training AI models is a multi-trillion-dollar market, but the AI inference market will eventually be far larger than the training market."

What is AI inference? Simply put, it's applying trained AI models to real-world scenarios, enabling them to "think" and "solve problems." From self-driving cars to smart factories, from personalized healthcare to automated financial risk control, AI inference will permeate every commercial sector, with demand ten or even a hundred times that of the training market.

And Oracle has prepared a "game-changer" for this "inference revolution"—the AI database.

Core logic: Vectorizing enterprises' vast amounts of private data (financial, customer, supply chain) to make it understandable by AI models.

Application scenarios: Enterprises can ask questions in natural language, such as: "How will the latest tariff policy affect our profits next quarter?" The AI model will perform advanced reasoning by combining the enterprise's private data with public information and provide answers.

Ultimate barrier: Oracle, the world's largest "custodian of high-value private enterprise data," deeply integrates AI capabilities with its core data assets, constructing an almost insurmountable "moat."

From "selling shovels" to "selling gold mines," Oracle aims not just to profit from AI training but to squeeze every drop of profit from the era of AI "landing applications." This is the full truth behind Larry Ellison's "bigger story."

Cold Reflection Amidst the Euphoria: A High-Stakes Gamble Between 'Faith' and 'Reality'

Admittedly, Oracle's blueprint is thrilling, but any euphoria warrants a sober examination.

Can the "pie in the sky" materialize? The $144 billion annual revenue target means OCI must achieve nearly 14-fold growth in four years. This requires not just market demand but immense synergy in company execution, supply chain management, and even global geopolitical stability. A single misstep in any link could cause this "light-speed" giant to hit a reef.

The brutality of the "arms race": To support this vast AI empire, Oracle plans to increase its capital expenditures to $35 billion this fiscal year, a 65% year-over-year increase. This is an "infinite war" with giants like Amazon, Microsoft, and Google, involving astronomical consumption of funds, technology, and talent.

The "ceiling" of valuation: At the latest surge, Oracle's market capitalization will approach $827.5 billion, ranking it among the top ten in the U.S. This requires its future revenue and profit growth to "perfectly" meet the market's ultra-high expectations. Any slowdown in growth could trigger a brutal "valuation slaughter."

Oracle's sky-high RPO is essentially a "giant check" issued by the AI era. Whether it can be cashed depends on the sustained prosperity of the entire AI industry and, more critically, whether Oracle can truly convert this "Future Contract" into "hard cash."

Epilogue: This Is Not Oracle's End, But the 'Starting Point' of the AI Era

Oracle's 27% surge is not just a victory for a single company; it's a powerful signal:

The "golden age" of AI infrastructure has fully begun, with energy enough to rejuvenate any "aging" giant.

When a company founded nearly half a century ago can still captivate the market with its technical heritage and strategic daring, perhaps we should treat the phrase "AI changes everything" with deeper reverence and anticipation.

- END -

Disclaimer: This article is based on the public company attributes of listed companies. MGresearch strives for objectivity and fairness in its content and viewpoints but does not guarantee their accuracy, completeness, or timeliness. The information or opinions expressed in this article do not constitute any investment advice, and MGresearch assumes no responsibility for any actions taken based on this article.