The Information's Top 10 Charts of the Year: Unveiling the Last 'Fig Leaf' of AI Prosperity

![]() 12/30 2025

12/30 2025

![]() 422

422

Beyond the Power Bills: What Lies Ahead?

As we cast our gaze back over 2025, the tech landscape unfolds as a highly fragmented tapestry.

On one front, infrastructure construction is surging ahead, with data centers' power demands pushing the boundaries of the physical realm. On the flip side, capital markets remain exceedingly cautious. IPOs are making debuts at break-even points, and the valuations of unicorns are dwindling, leaving Silicon Valley with a post-party 'hangover' that's hard to shake off.

The Information's latest annual compilation of the top 10 charts cuts through the year's buzz and lays bare the truth with stark, unvarnished data. Stripped of the grand narratives that often accompany product launches, these 10 charts piece together the authentic commercial landscape of 2025.

01

The Cost and Leverage Dynamics of Computing Power

If there's one persistent worry that looms large in 2025, it's the specter of 'power shortages'.

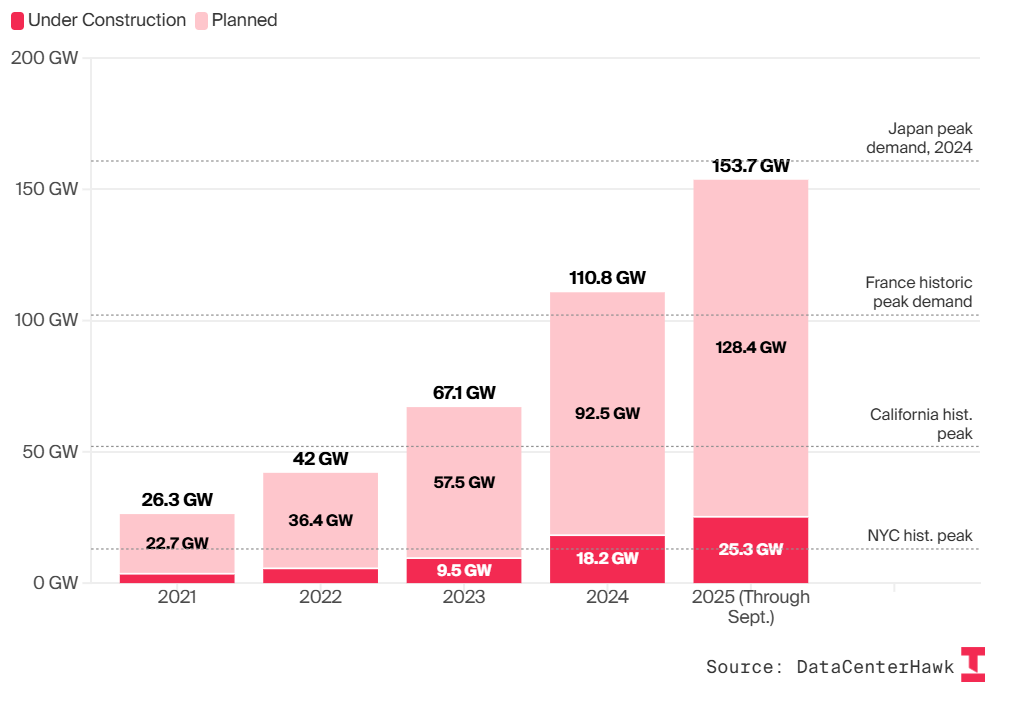

To fuel the next giant leap in large-scale AI models, the race for computing power has morphed into a frenzied scramble for electricity. The numbers are staggering: as of September, data centers currently under construction are projected to devour 25.3 gigawatts of power - and that's just the tip of the iceberg.

More alarmingly, planned projects that have yet to break ground are expected to consume a whopping 128 gigawatts. If fully realized, this new demand would nearly triple California's historical peak electricity usage. The computing power bottleneck has now morphed into an energy bottleneck.

Amidst this infrastructure frenzy, even the biggest winner, NVIDIA, has resorted to financial sleight of hand.

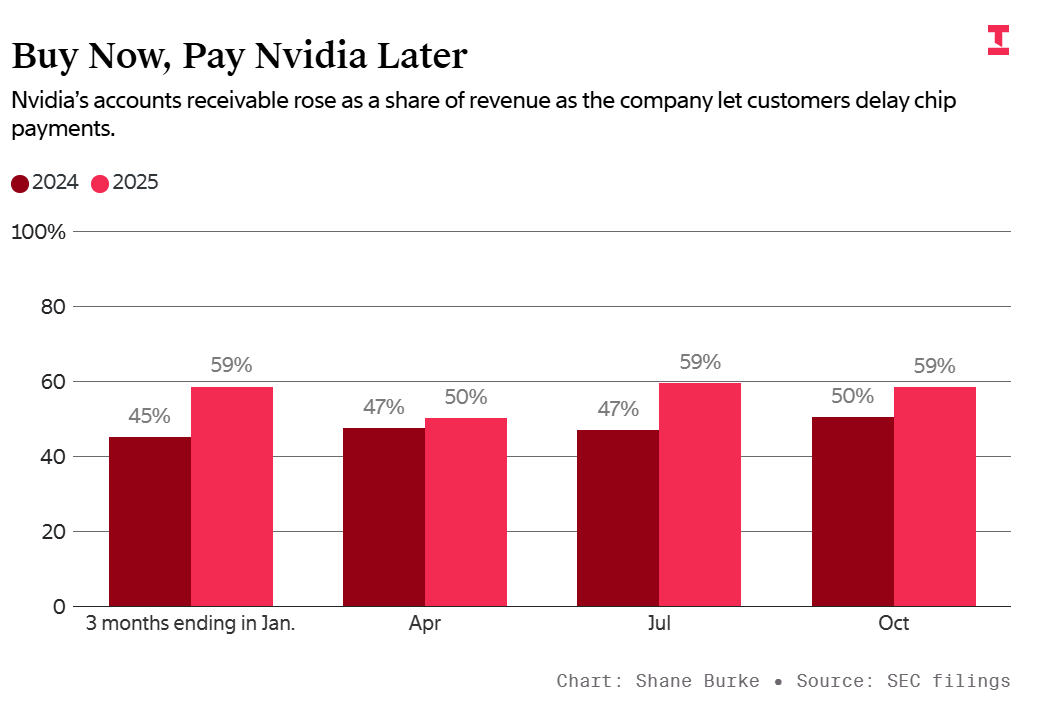

To make its pricey chips affordable for clients beyond the cash-rich giants, NVIDIA has started offering deferred payment options to stimulate demand. Financials reveal that NVIDIA's accounts receivable as a percentage of revenue have surged this year, nearing 60% at one juncture.

This 'buy now, pay later' strategy keeps high-growth reports afloat but exposes underlying concerns: the cash flows of downstream manufacturers might be tighter than initially imagined.

02

Software Hype Versus Breakthroughs in the Physical World

While massive computing power is being harnessed, software and hardware are delivering vastly different outcomes.

In the software realm, 2025 has been dubbed the 'Year of the Agent,' but the reality falls far short of the hype.

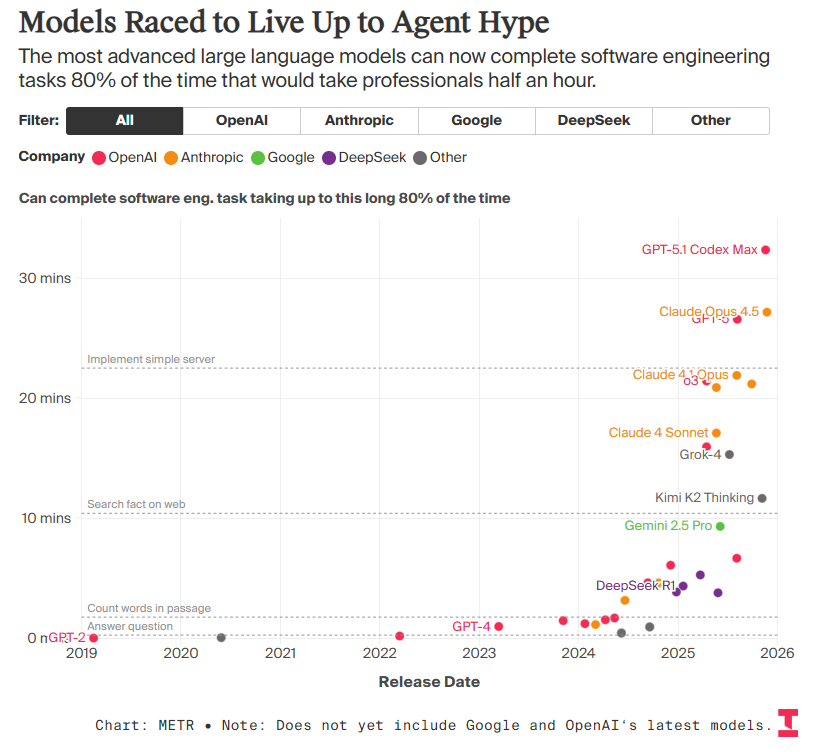

Although OpenAI's GPT-5.1-Codex-Max achieves an 80% success rate in half-hour programming tasks, the remaining 20% uncertainty remains a deal-breaker for enterprise applications. Agents still have a critical 'last mile' to traverse before they can truly 'eliminate human jobs'.

Yet, this hasn't dampened the entrepreneurial spirit.

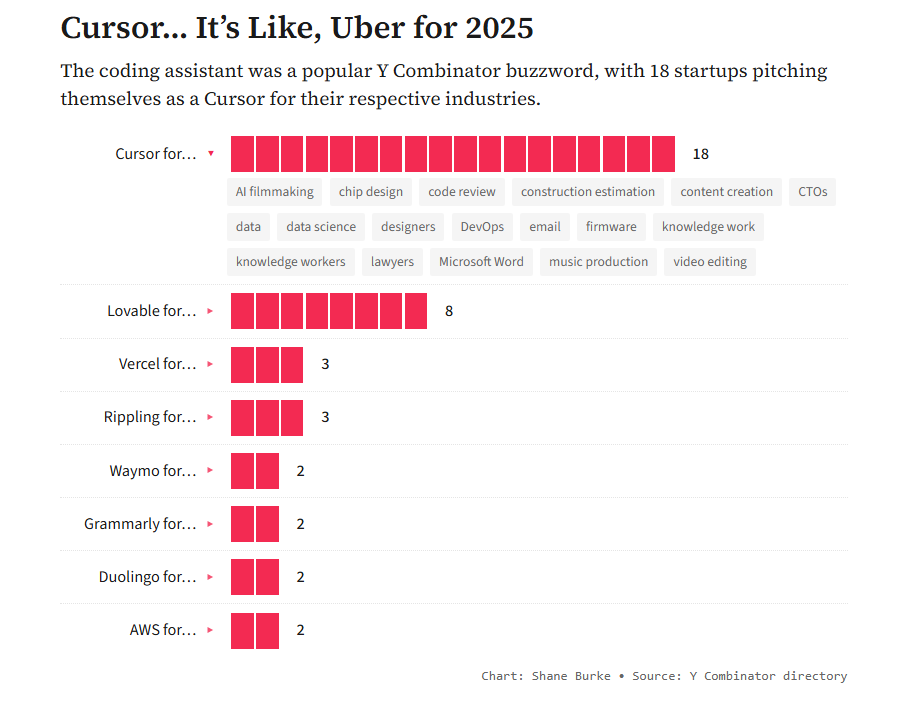

With AI programming tool Cursor surpassing $1 billion in annual revenue, Silicon Valley has witnessed a 'Cursor Effect.' At Y Combinator, 18 startups now claim to be 'the Cursor for [industry]' - spanning from law firms to film sets, as if everything can be 'Cursor-ized.' This homogeneous 'copycat' trend underscores a lack of innovation at the application layer.

In stark contrast, AI in the physical world has made significant strides this year.

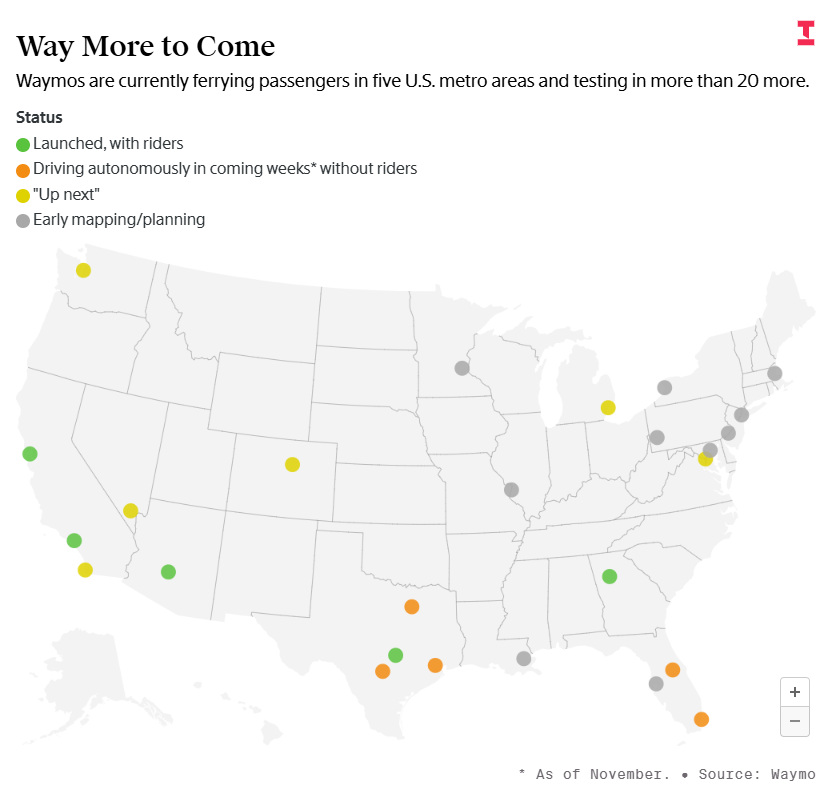

While we engage in online debates about AI's capabilities, Waymo's autonomous fleet has quietly taken over urban streets. From San Francisco to Atlanta, and soon to Miami and New York, Waymo has completed nearly 20 million fully driverless trips. It's no longer a lab experiment but a bona fide piece of infrastructure.

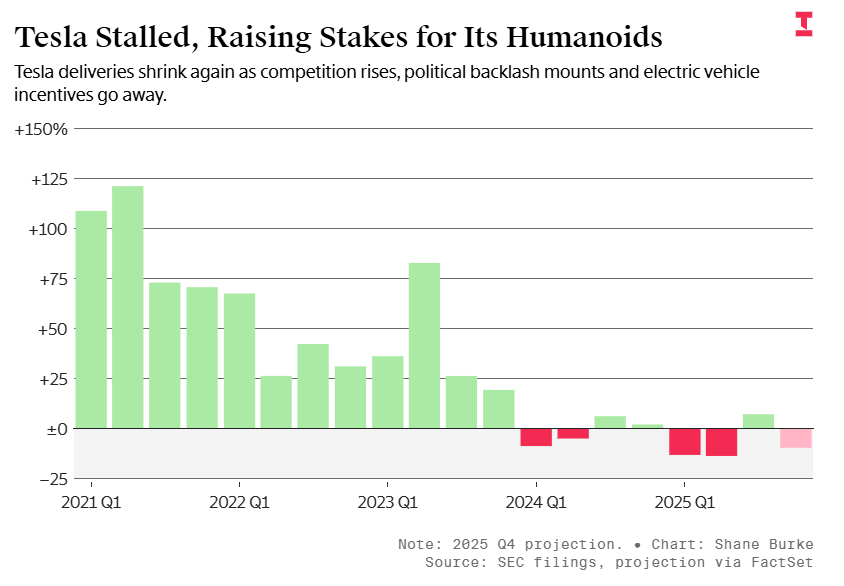

This contrast leaves Tesla in an uncomfortable position.

Plagued by intensifying competition and fading subsidies, Tesla has seen sales decline for the second consecutive year. As Waymo expands its real-world footprint, Musk has entirely shifted his narrative to Cybercab and humanoid robots, using distant sci-fi visions to mask current weaknesses.

03

The Flow of Capital and the Game of Influence

Technological progress, at its core, hinges on the interplay of capital and influence.

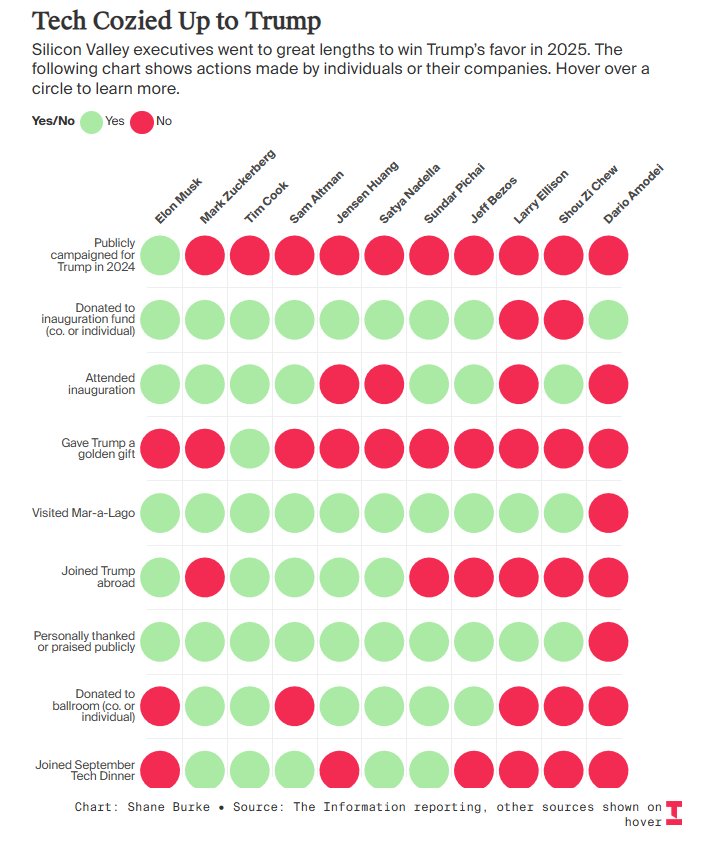

In 2025, with the Trump administration at the helm, tech giants have embraced political pragmatism with gusto. From Cook to Zuckerberg, Silicon Valley executives have courted the White House to secure favorable AI regulations and government contracts.

This 'rightward shift' has directly fueled a cryptocurrency renaissance.

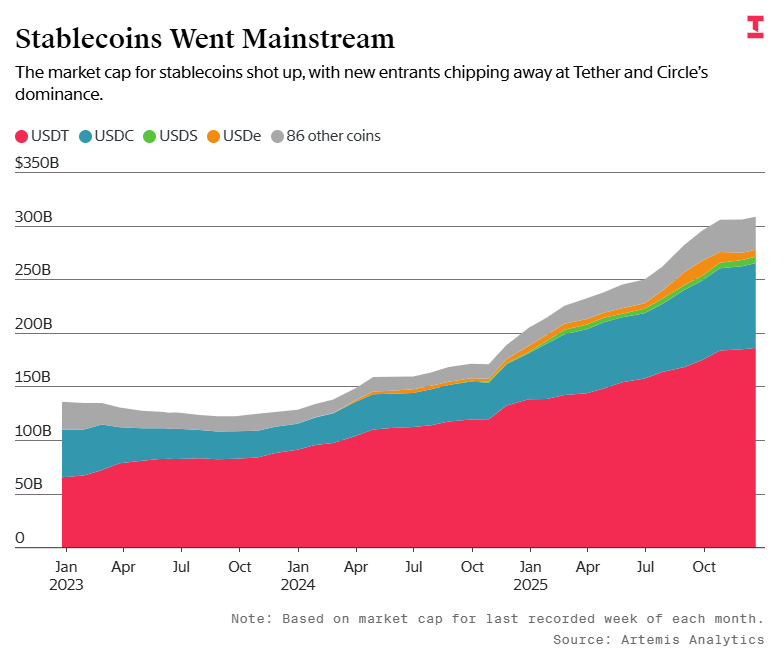

With the signing of GENIUS (legislation that catalyzes the mainstream adoption of stablecoins), stablecoins have shed their gray-zone status. Circle went public, traditional financial institutions jumped on the bandwagon, and stablecoin market caps soared this year.

Meanwhile, consumer speculation is on the hunt for new outlets.

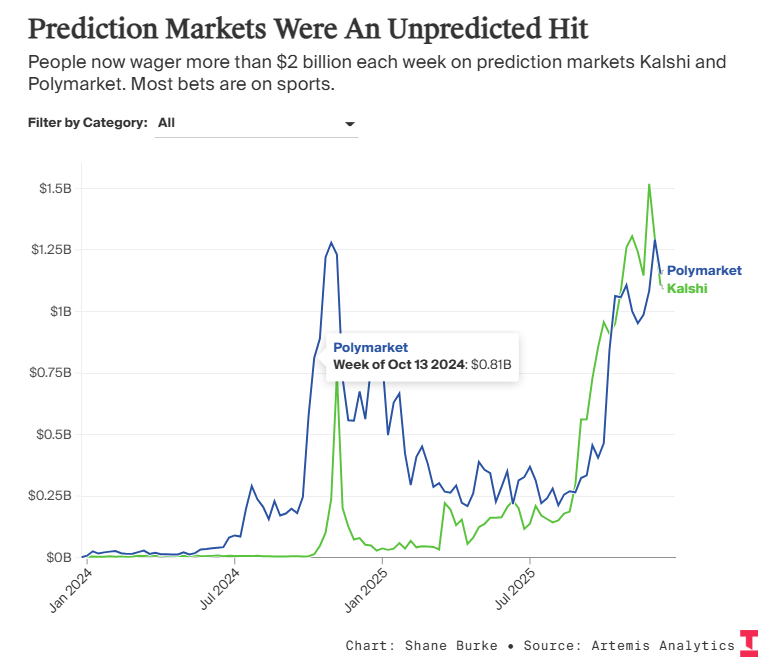

Prediction Markets like Polymarket (think regulated 'betting') have witnessed a surge in popularity this year, with weekly trading volumes exceeding $2 billion. In uncertain 2025, people seem to place more trust in probabilities derived from real money wagers than in expert forecasts.

However, secondary markets are ruthless.

Although the 2025 tech IPO market has finally shown signs of recovery, it feels more like a 'hangover' than a celebration. Among the 23 major tech IPOs this year, over two-thirds ended the year below their offering prices. Even stars like Klarna and StubHub weren't immune to the downturn.

This may be 2025's most crucial lesson: from the 128 GW infrastructure fantasy to the IPO break-even wave, the market is undergoing a fierce 'disillusionment' phase. The era of easy funding through PowerPoints and grand narratives is firmly in the past.

As we step into 2026, both startups and giants must return to the fundamentals of business - delivering positive cash flows and truly usable products.

Original article:

https://www.theinformation.com/articles/10-charts-explain-2025?rc=mmhkuh

Please note that this article is compiled from the original source linked at the end and does not represent Hyper Focus's stance. If you have thoughts or insights on this piece, feel free to leave a comment and engage in discussion.

- END -