Sanhua Intelligent Controls' Dream of Being a 'Shovel Seller' for Humanoid Robots Meets the Reality of RMB 3.8 Billion Net Profit

![]() 12/30 2025

12/30 2025

![]() 342

342

A market-leading performance forecast announcement unveils the dual nature of this company:

1. The profit king of traditional manufacturing.

2. A cautious gambler betting on the future.

On December 22, 2025, Sanhua Intelligent Controls once again 'submitted its results early,' releasing an impressive annual performance forecast: net profit attributable to shareholders is expected to surge by 25%-50% year-on-year, reaching RMB 3.874 billion to RMB 4.649 billion.

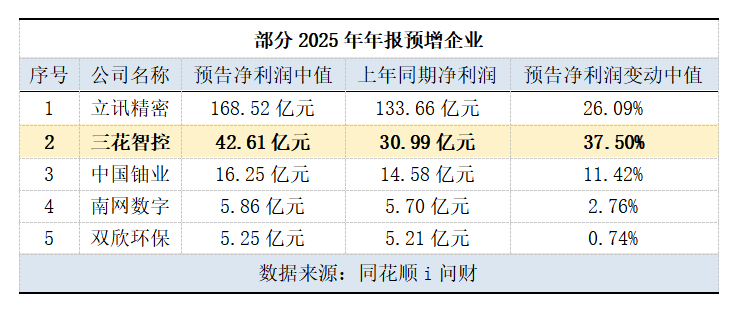

Among listed companies disclosing performance forecasts on the same day, Sanhua Intelligent Controls ranked second in net profit scale, trailing only consumer electronics giant Luxshare Precision. This performance is enough to make it stand tall in the manufacturing sector amid a harsh winter.

However, this is not the whole story. In 2025, from the Spring Festival Gala to government work reports, 'humanoid robots' became the hottest keyword. As a potential supplier of core robot components, such as rotary joints and dexterous hands, Sanhua Intelligent Controls' stock price and market value carry the market's boundless imagination for the future.

But a crucial fact has been selectively overlooked by market enthusiasm: the nearly RMB 4 billion profit has nothing to do with robots. This reveals Sanhua Intelligent Controls' most authentic duality: under the spotlight, it is a future star standing at the window of opportunity (which means 'cutting-edge trend') of 'embodied intelligence'; yet in its financial reports, it remains the invisible champion of manufacturing, earning profits from air-conditioning valves and automotive thermal management components.

So, when dreams meet reality, what enables Sanhua Intelligent Controls to rake in huge profits in traditional fields?

And what makes people believe it can secure a share in the uncertain future of robotics?

Where Does the RMB 4 Billion Profit Come From? It Has Nothing to Do with Robots

We must cut through the fog and see the true source of Sanhua Intelligent Controls' profits.

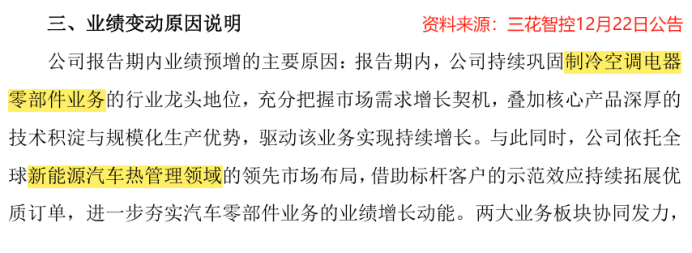

The performance forecast is clear: profit growth in 2025 is driven by the 'refrigeration, air-conditioning, and electrical appliance components business' and the 'new energy vehicle thermal management business.' These two traditional businesses constitute nearly 100% of the company's current revenue and profits.

In other words, the robotics business, which the market is abuzz about, contributed zero to Sanhua Intelligent Controls' 2025 ledger.

This is not because the company is not trying. Since 2022, Sanhua Intelligent Controls has established a robotics division and invested in R&D and capacity preparation. The issue is that the entire industry is in an extremely early stage. As Li Feifei, the 'godmother of AI,' said, the time required for robots to go from concept to commercialization may be even longer than the 20 years for autonomous driving.

Sanhua Intelligent Controls is currently in the 'technology verification, sampling, and small-batch production' stage. In October 2025, the company even personally debunked market rumors of 'securing large robot orders.' This candidly indicates that the robotics business is 'futures,' not 'spot goods.'

Understanding this is crucial. It means that all of Sanhua Intelligent Controls' financial stability, high R&D investment, and confidence in future layout (which means 'strategic layout ') are built on the solid foundation of its two traditional businesses.

A Rare 'High-Profile Player' in Manufacturing

In the manufacturing sector, where profits are generally thin and homogenization is severe, Sanhua Intelligent Controls is a rare 'outlier.' It is not only large in scale but also highly profitable.

It is the world's largest manufacturer of refrigeration control components, with leading global market shares in products like four-way reversing valves and electronic expansion valves. Simultaneously, it is a global leading supplier of core automotive thermal management components, also ranking first globally in market share for vehicle electronic expansion valves.

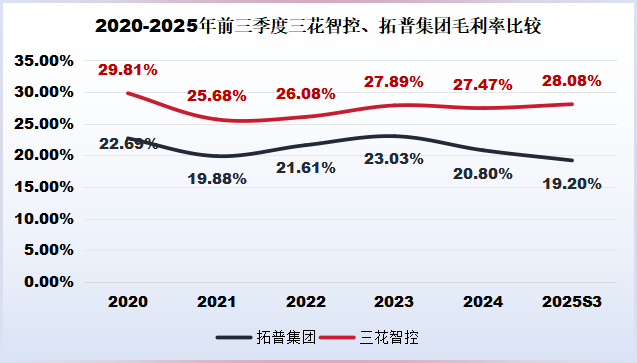

Compared to its peer, Top Group, which has a similar business scope, Sanhua Intelligent Controls has consistently maintained a gross profit margin above 25% over the past five years, reaching as high as 28.08% in the first three quarters of 2025, nearly 10 percentage points higher than Top Group.

How does it manage to be both large and strong? The core lies in its dual moats of 'product value' and 'cost control.'

First, high product value with technological premiums.

Sanhua Intelligent Controls does not produce simple metal parts but high-precision, high-reliability core functional components. For example, the 'eight-way valve' for new energy vehicles acts as the 'central commander' of the thermal management system, directly determining battery cooling efficiency and cabin comfort, with extremely high technical barriers. Customers (especially top-tier automakers like Tesla) are willing to pay a premium for such 'key players' that ensure performance and safety.

In contrast, Top Group's product line is broader, including many low-value-added traditional components like interior parts and shock absorbers, naturally lowering its overall gross profit margin.

Second, exquisite cost control with economies of scale.

1. Raw material price locking: Facing price fluctuations in commodities like copper and aluminum, Sanhua Intelligent Controls often adopts a one-time pricing strategy with suppliers to lock in costs in advance, avoiding profit erosion from raw material price hikes.

2. Comprehensive product line: It is one of the domestic manufacturers with the most complete product lines, offering four more categories than Top Group.

This brings two major benefits:

One is convenience for customers (such as automakers) to centralize procurement, boosting sales scale;

The other is that its own production can share R&D, procurement, and production platforms, significantly diluting fixed costs.

This combination of 'high technological premiums + strong cost control' has enabled Sanhua Intelligent Controls to thrive in the red ocean of manufacturing, acting as a 'profit overachiever' with characteristics of a consumer stock.

Being a 'Fast Fish' and Following the 'Whales'?

Sanhua Intelligent Controls' success stems from its clear strategic focus: deeply binding with industry giants and acting as a 'shovel seller' for trends.

Founder Zhang Daocai greatly admires Tesla and Elon Musk. He once said, 'Tesla is known for innovative management. In this era, it's more about fast fish eating slow fish. Sanhua must be fast.' This statement reveals the company's growth secret: following innovative leaders, responding quickly, and reusing technologies.

First leap (air conditioning → automotive): Around 2010, when new energy vehicles were emerging, Sanhua Intelligent Controls leveraged its precision fluid control technology accumulated in the air conditioning four-way valve field and rapidly reused it. In 2014, it successfully developed the world's first 'vehicle electronic expansion valve,' entering the supply chains of automakers like Tesla and seizing the decade-long boom in electric vehicles.

Second layout (automotive → robotics): When Elon Musk declared that 80% of Tesla's future value would come from robots, Sanhua Intelligent Controls promptly established its robotics division. The 'liquid cooling thermal management system' in its robot joints represents another perfect migration of its core technologies from air conditioning and automotive thermal management.

This 'following giants + technology reuse' model is extremely clever. It allows Sanhua Intelligent Controls to always stand at the most vibrant frontier of innovation without bearing the greatest risks of exploring directions. Whether the downstream involves building cars or robots, as long as they require precision temperature management and fluid control, Sanhua Intelligent Controls has business opportunities.

Robotics: A Vast Ocean, But Navigation Takes Time

All market expectations rest on robotics as the 'future option.'

Sanhua Intelligent Controls' strategic logic remains clear: adhere to the 'shovel seller' route, not building robots but providing core actuators for robot companies.

This is an excellent strategic position. No matter how fierce the competition among downstream robot companies or how technological routes evolve, as long as robots need to move, they need joints. Sanhua Intelligent Controls aims to become the indispensable 'king of joints.'

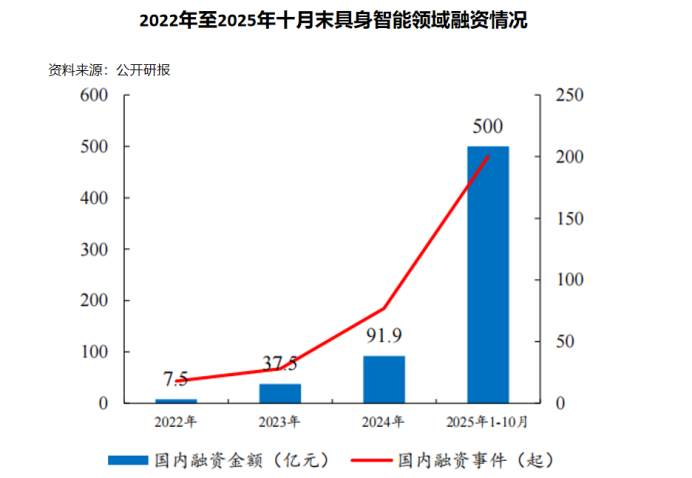

When will commercialization arrive? In the short term, capital is the main driver.

In 2025, financing for embodied intelligence companies in the primary market surged by 400%, exceeding RMB 50 billion. Leading companies like Unitree Robotics and Legend Robot are accelerating their IPOs. After securing funds, these companies' first priority is to expand production. This provides real demand for Sanhua Intelligent Controls' component sampling and small-batch supply.

Founder Zhang Daocai is full of confidence in this long-term layout , believing it is a natural extension of the company's technological capabilities and the key to future sustained growth.

Yan Xi believes that Sanhua Intelligent Controls presents a perfect model for a traditional manufacturing company's transformation. It uses its cash cow businesses (refrigeration, automotive) to build a solid financial fortress while leveraging its technology reuse capabilities to explore future growth curves (robotics).

Its strength lies in the fact that its robotics dream is not built on air but on a solid foundation of billions in annual net profits. This means it has sufficient 'resources' and patience to accompany and wait for the robotics industry to mature without collapsing due to capital shortages before dawn.

However, risks also exist.

1. Expectation management: The company's current market value incorporates high expectations for its robotics business. If the commercialization progress of robotics continues to fall short of market expectations (which is highly likely), the stock price will face pressure.

2. Technological competition: The robot actuator track is attracting a large number of competitors, including other Tier 1 suppliers like Top Group. Whether Sanhua can maintain its leading edge requires continuous technological breakthroughs.

3. Main business cycles: The refrigeration business is linked to the real estate cycle, while the automotive business is tied to the growth rate of new energy vehicles. Whether these two main businesses can continue to provide strong cash flow is fundamental to supporting future bets.

Sanhua Intelligent Controls is like a steady marathon runner, racing on two tracks simultaneously. On the first track (traditional business), it is already a far-leading champion, continuously earning substantial profits through technological and scale advantages. On the second track (robotics business), it has just started but is moving steadily with a clear direction, holding ample 'supplies' earned from the first track.

Not because the concept of robots is so cool, but because it has proven its 'hard skills' in continuously earning profits in traditional fields and its 'real skills' in successfully replicating these skills to new areas.

Robots will eventually change the world, but change takes time. What Sanhua Intelligent Controls values most is perhaps its ability to use profits from traditional businesses to 'buy time' for its future dreams with calmness and strength.

Note: (Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Investors act at their own risk.)

- End - Hope to resonate with you!