GEO Concept Stock: Guangyun Technology's Stock Price Fluctuation Sparks Interest - Is the AI Search Trend Upon Us?

![]() 01/15 2026

01/15 2026

![]() 415

415

GEO, or Generative Engine Optimization, represents the "new SEO" in the AI era. Its essence lies in optimizing content so that brand information can directly appear in AI-generated answers, thereby seizing new traffic entry points. At present, over 30% of online information acquisition is achieved through generative AI, and the industry's growth potential is widely recognized (viewed positively).

Capitalizing on High Repurchase Rates

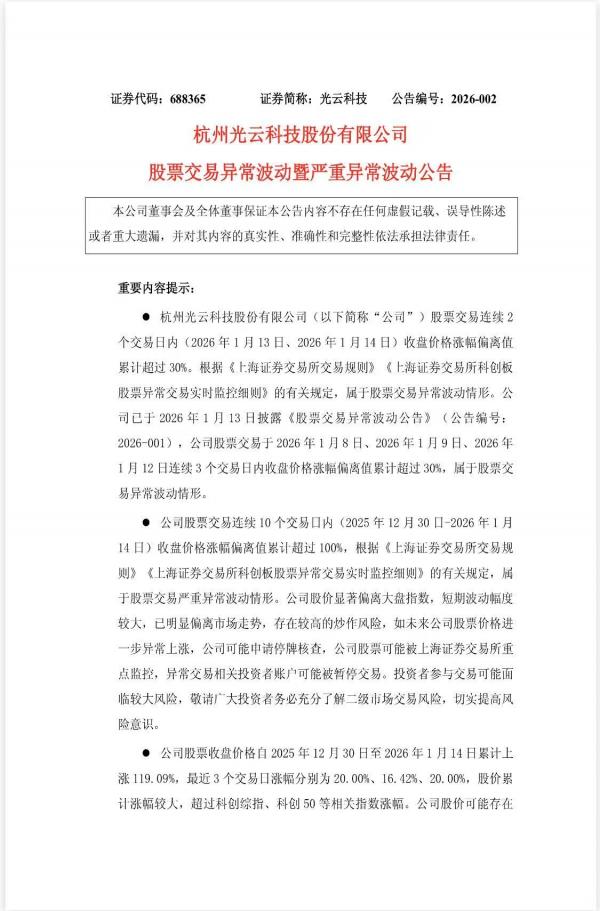

Consequently, the recent surge in popularity of the GEO concept has led to Guangyun Technology, the "A-share E-commerce SaaS Pioneer," being listed as a related concept stock. On January 14th, its morning trading session saw the stock hit a 20% daily limit. However, it must be emphasized that no official information confirms Guangyun Technology's involvement in substantive GEO business, and the company's announcements have never mentioned related technologies or strategic layouts.

On the same day, Guangyun Technology issued an announcement stating that its stock price had experienced a cumulative deviation exceeding 100% in closing prices over ten consecutive trading days, significantly diverging from the overall market trend and constituting a scenario of severe abnormal fluctuation.

In the announcement, the company openly stated (frankly spoke) that the current stock price carries a high level of speculation risk and warned that if the stock price continues to rise abnormally, it may apply for a trading halt for verification purposes. The stock could come under key monitoring by the Shanghai Stock Exchange, and related abnormal trading accounts might even face penalties, including suspended trading.

Notably, the company specifically clarified that its AI-related products are merely application-layer integrations that access third-party large models, without any involvement in foundational large model research and development. Moreover, related revenues constitute a minimal share of the overall revenue, with significant uncertainty regarding their contribution to performance.

This announcement not only dampened the fervent market sentiment but also thrust this enterprise, deeply rooted in the e-commerce SaaS sector, into the spotlight of capital speculation and value scrutiny.

As one of the first e-commerce SaaS providers to list on the STAR Market in China, Guangyun Technology's developmental journey serves as a microcosm of the industry.

Founded in 2013, the company's core business revolves around mainstream e-commerce platforms such as Taobao, JD.com, and Douyin, creating a product matrix that covers the full spectrum of merchant operations, including "Super Store Manager," "KuaiMai ERP," and "ShenHui Graphic Design Robot." It has served over 6 million merchants, with small and medium-sized merchants accounting for over 90%, forming a "broad-coverage, high-stickiness" customer base.

In particular, its "subscription-based + value-added services" business model once gained a solid foothold in the industry due to high repurchase rates.

Dual Catalysts

However, behind the glamorous market layout lie unavoidable operational challenges.

Financial data reveals that the company has been in a loss-making state for three consecutive years, with a net profit attributable to shareholders of -15.0319 million yuan and a core net profit (excluding non-recurring items) of -16.1492 million yuan in the first three quarters of 2025. Meanwhile, its asset-liability ratio has climbed to 46.93%, higher than the industry average, highlighting significant short-term debt repayment pressures.

Product-side bottlenecks are equally evident. Traditional tool-type SaaS products face homogeneous competition, with rising customer acquisition costs. Meanwhile, the expansion of high-end solutions for top brands has been sluggish, with revenue from TOP 10 clients accounting for less than 10%, trapping the business in an "increased revenue but stagnant profit" dilemma.

The surge in Guangyun Technology's stock price essentially reflects market sentiment-driven enthusiasm for the "AI + E-commerce SaaS" sector, compounded by the dual catalysts of the cross-border e-commerce boom.

From an industry trend perspective, e-commerce SaaS is undergoing a critical technological transformation. The deep integration of AI large models is reshaping operational logic across the entire process, from intelligent product selection and dynamic pricing to automated customer service.

The introduction of the "Three-Year Action Plan for Digital Commerce (2024-2026)" further provides policy support for the industry's digital transformation.

Simultaneously, the vigorous development of cross-border e-commerce has opened up new growth avenues. In 2024, China's cross-border e-commerce import and export scale reached 2.63 trillion yuan, a 10.8% year-on-year increase, driving surging demand for SaaS tools compatible with multiple platforms.

Although Guangyun Technology has not developed its own large model, its attempts to integrate AI technology into intelligent customer service and graphic design products, along with its strategic move (layout) into cross-border e-commerce ERP systems, have precisely aligned with market hotspot expectations.

Potential for Breakthrough

Additionally, the company's small free float has facilitated short-term speculation by hot money, collectively fueling this stock price frenzy.

Behind the capital euphoria lies Guangyun Technology's urgent need to break through developmental bottlenecks and address significant risk vulnerabilities.

First and foremost is the severe divergence between valuation and fundamentals. The company's current dynamic price-to-earnings ratio exceeds 200 times, far higher than the industry average of 60 times, while its loss-making status remains fundamentally unchanged, with short-term stock price surges entirely detached from profit support.

Secondly, uncertainties surround technology implementation and commercialization. Despite the fervor over AI concepts, the company's related products remain at the application layer, lacking core technological barriers. Compared to giant products like Alibaba's "Aoxiang" ERP, its competitiveness is markedly inferior. Whether it can translate technological advantages into sustained revenue growth remains uncertain.

Furthermore, industry competition is intensifying. Rivals like Jushuitan and Youzan are accelerating market expansion in niche segments, while platforms like Douyin and Kuaishou are squeezing third-party service providers' survival space through self-built ecosystems, posing risks to Guangyun Technology's market share.

Additionally, regulatory risks loom large. Key monitoring by the stock exchange and potential trading halt verifications could become the final straw to burst the stock price bubble at any moment.

Guangyun Technology's stock price fluctuation also represents a profound test for tech companies caught between concept speculation and fundamentals.

Undeniably, as a seasoned player with over a decade of industry experience, Guangyun Technology holds vast merchant resources and deep operational expertise, possessing the potential to achieve a breakthrough through differentiated competition amid the AI empowerment and cross-border e-commerce waves.

However, in the short term, the company must confront profitability challenges, increase R&D investment to build technological barriers, and optimize its customer structure to enhance services for top brands. Only then can it truly transform from a "tool provider" to a "commercial intelligence partner."

Moreover, Guangyun Technology's official positioning remains that of an e-commerce SaaS enterprise, with its AI technology focused on cost reduction and efficiency enhancement in e-commerce operations.

Currently, the GEO industry is still in its early stages, with immature business models. Some concept stocks' stock price increases have deviated from fundamentals, and Guangyun Technology has also issued announcements warning of speculation risks.

After all, the investment theme for the AI industry in 2026 is "application-driven." Only when technology translates into performance growth does it possess long-term investment value.

Disclaimer to Readers: This article is written based on publicly available information or content provided by interviewees. Global Finance Talk and the article author do not guarantee the completeness and accuracy of the relevant information. Under no circumstances shall this article's content constitute investment advice. The market carries risks, and investment decisions must be made with caution!