Has XPENG Motors Transitioned from 'Equal Access' to 'Paid Access' for Intelligent Driving?

![]() 01/15 2026

01/15 2026

![]() 457

457

“Intelligent driving comes in three tiers: MAX, Ultra SE, and Ultra. XPENG's resurgence is largely attributed to MONA's provision of equal access to intelligent driving. However, it now seems to be following Huawei's lead by implementing tiered pricing—a move that lacks Huawei's brand appeal. The rationale behind this escapes me.”

“The launch event essentially conveys a message: pay up or be left behind by a generation. Why even consider the X?”

“Offering OTA-related features as optional is a terrible decision. It means low-tier models will fall behind, compelling buyers to opt for premium versions.”

What was intended to be a high-profile global product launch, designed to inject momentum into XPENG's 2026 lineup, has left some consumers bewildered by the technical details unveiled.

While some consumers harbor reservations about XPENG's product strategy, it highlights that intelligent driving has become a pivotal attraction for these buyers. The primary concern revolves around the fact that intelligent driving features, previously considered 'standard,' now demand additional expenditure in newer iterations.

Is XPENG, once a proponent of 'equal access to intelligent driving,' now emulating Huawei and Tesla by charging for these features?

Has XPENG Motors Undergone a Transformation?

At this event, XPENG unveiled four models: the 2026 XPENG P7+, XPENG G7 Super Extended-Range, 2026 XPENG G6, and 2026 XPENG G9.

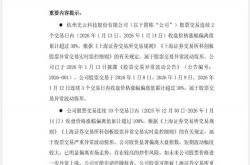

However, a closer examination reveals that all newly launched models are MAX versions. During the event, He Xiaopeng announced the rollout schedule for XPENG's second-generation VLA: In March, the initial batch will include the 2025 XPENG P7 Ultra, XPENG G7 Pure Electric Ultra, and XPENG X9 Super Extended-Range Ultra. Subsequent batches will introduce the 2026 XPENG P7+ Ultra/Ultra SE, 2026 XPENG G6 Ultra/Ultra SE, 2026 XPENG G9 Ultra/Ultra SE, and XPENG G7 Super Extended-Range Ultra/Ultra SE.

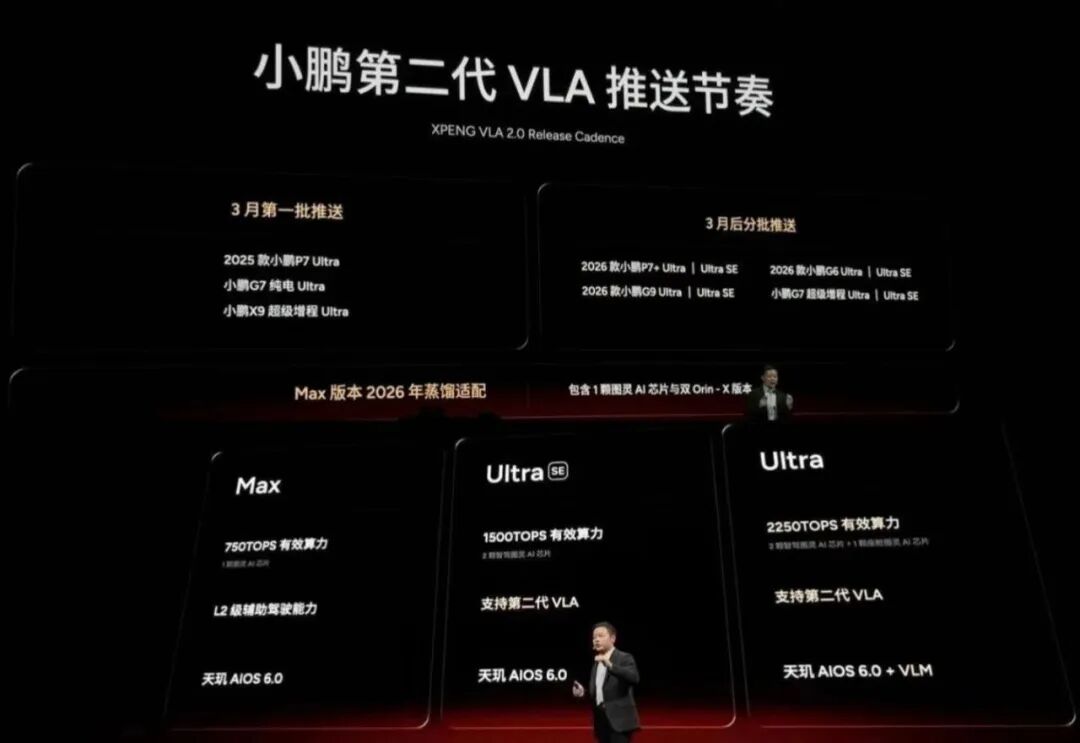

Furthermore, XPENG elucidated the distinctions among the MAX, Ultra SE, and Ultra versions. The primary difference lies in the chips: the MAX version (2026) will feature either a single Turing AI chip or a dual Orin-X configuration. The Ultra SE will be equipped with two intelligent driving Turing AI chips, while the Ultra will boast two intelligent driving Turing AI chips and one cabin Turing AI chip. The computing power for these versions is 750 TOPS, 1500 TOPS, and 2250 TOPS, respectively.

Additionally, XPENG stated that the MAX version offers Level 2 assisted driving capabilities, whereas the Ultra SE and Ultra versions support the second-generation VLA.

Evidently, XPENG's transparent technology roadmap indicates that following this launch, it will introduce higher-tier Ultra SE and Ultra models featuring the second-generation VLA—but at a premium compared to the current MAX versions.

This move has left many consumers feeling that XPENG has undergone a transformation. For instance, the 2025 XPENG P7 was launched with four Ultra variants, differing solely in powertrain. Similarly, the 2025 XPENG G7 offered MAX and Ultra versions, both equipped with two chips from different suppliers.

Moreover, in 2025, XPENG repeatedly championed 'technology equality' and 'equal access to intelligent driving,' pledging 'Turing AI intelligent driving as standard across all models—no add-ons, no subscriptions, no extra fees—with high-level intelligent driving from parking spot to parking spot available at delivery.' At the Paris Motor Show earlier that year, He Xiaopeng underscored XPENG's commitment to making intelligent driving and AI standard features, emphasizing a global strategy of 'standard hardware, free software, and frequent OTA updates.'

Yet, at this launch, XPENG announced a ¥12,000 premium for the Ultra SE version and a ¥20,000 premium for the Ultra version—a shift that has left many consumers perplexed.

Notably, while the newly announced models are MAX versions, they all incorporate Turing chips. It is apparent that the Ultra SE and Ultra versions launching in March will also utilize XPENG's self-developed Turing intelligent driving AI chips.

This signifies that starting in 2026, all new XPENG vehicles will predominantly employ self-developed Turing AI chips.

Last year, He Xiaopeng disclosed that the Turing chip, developed over five years, necessitated 'several billion' in investment, with some authoritative media reporting figures as high as 'tens of billions.' Additionally, he stated that XPENG invests approximately ¥5 billion annually (around $700 million) in AI-related technology development, accounting for roughly half of its total R&D expenditure.

Moreover, XPENG's self-developed Turing chip reduces costs by 25% compared to purchasing NVIDIA solutions. Under equivalent computing power, the Turing chip costs merely 40% of NVIDIA's Orin-X. Thus, XPENG's large-scale adoption of self-developed Turing chips this year aims to cut costs and enhance profits.

However, the announced details reveal that future XPENG models will feature varying intelligent driving hardware across tiers. Currently, there is no indication that intelligent driving software will be charged like Tesla's or Huawei's systems. Therefore, only the hardware costs for intelligent driving have increased, with no software fees imposed.

The Pressure Driving the Transformation

XPENG aims to sell 550,000–600,000 vehicles in 2026, marking a 28.1%–39.7% increase from 429,400 units in 2025. This target aligns with NIO's and Li Auto's conservative outlook. However, Leapmotor, which topped new energy vehicle sales in 2025 with 598,000 units, has set an ambitious target of 1 million units for 2026.

Clearly, 2026 will remain a year of intense price competition.

While XPENG focuses on intelligent driving and Leapmotor on affordability, XPENG's sales still heavily rely on the MONA MO3, priced below ¥150,000.

Data indicates that in 2025, the MONA MO3 accounted for 40.8% of XPENG's total sales, while the mid-to-high-end P7+ sedan contributed 17.6%. The G7, the first model equipped with the Turing chip, made up just 5.6%.

Struggling in the high-end market and facing fierce competition in the low-end segment, XPENG finds itself in a precarious position. While XPENG and Leapmotor possess distinct strengths and branding, market disruptions affect all players.

At this launch, XPENG announced another strategic shift: the 'Dual Energy' strategy, offering both extended-range and pure electric versions across all models. While this appears to be a proactive technological upgrade, it is largely a response to imbalanced sales and persistent losses.

The extended-range market, once a blue ocean, has now become a red ocean. Nevertheless, XPENG chose to enter this segment in 2026 because extended-range vehicles alleviate range anxiety and cost pressures associated with pure electric high-end models while appealing to a broader range of household users.

This strategy has demonstrated some success. For example, orders for the P7+ and G7 Super Extended-Range versions exceeded 70%, validating XPENG's approach.

Additionally, extended-range products are driven by profitability concerns. Financial reports show that XPENG incurred losses in the first three quarters of 2025: ¥664 million in Q1, widening to ¥1.142 billion in Q2, and ¥1.523 billion in Q3, with mounting pressure to achieve profitability. The core advantage of the extended-range route lies in 'cost reduction and efficiency enhancement': range extenders cost less than large-capacity batteries, significantly lowering hardware costs while enabling rapid scaling to offset R&D expenses.

The XPENG X9 exemplifies this strategy's direct impact. The 63.3-kWh extended-range version starts at ¥309,800, ¥50,000 cheaper than the 94.8-kWh pure electric version. It secured approximately 8,000 reservations within five days of launch, surpassing the X9 pure electric version's total sales in the first five months of 2025. This 'low price + high volume' combination rapidly boosts revenue and improves gross margins.

At this launch, XPENG confirmed plans to release seven models with super extended-range configurations in 2026, aiming to leverage the 'volume' potential of extended-range vehicles to offset profitability challenges in pure electric high-end models and sustain corporate profitability.

As the first automaker to announce its product roadmap and technology rollout at the start of the year, XPENG has clarified its strategy for 2026. While some consumers may not fully comprehend the marketing approach for intelligent driving hardware configurations, for XPENG, this shift is a necessary step to reduce costs, enhance operational efficiency, and survive in an increasingly brutal competitive landscape.

END