Taobao Flash Sale: Redefining Competition in the Food Delivery Sector

![]() 01/19 2026

01/19 2026

![]() 329

329

Yesterday, Qianwen held a press conference to announce its complete integration into the Alibaba ecosystem, accompanied by an upgrade of over 400 AI service features.

After fully linking up with various lifestyle and consumption scenarios, including Taobao, Flash Sale, Fliggy, Amap, and Alipay, Qianwen's ability to deliver real-world services has seen a remarkable enhancement.

In recent times, the introduction of AI products has often led to a sense of "aesthetic fatigue." Discussions frequently revolve around model parameters and benchmarking progress, or they focus on the trio of PPT presentations, photo editing, and front-end demonstrations.

Therefore, I must say that the time invested in watching Qianwen's live broadcast yesterday proved to be worthwhile.

Fortunately, Wu Jia avoided such trivialities on stage. He refrained from discussing parameters or showcasing benchmarks.

Instead, he demonstrated Qianwen's capability by ordering 40 cups of "Boyue Juexian" milk tea from Overlord Tea Princess, a well-known milk tea brand.

Later, when a Taobao Flash Sale courier delivered the milk tea to the venue, it became evident that Alibaba's grand strategy for integrating consumption and AI had achieved a significant milestone.

AI is transitioning from being merely an intelligent tool in the digital realm to actively intervening in real-world transactions and fulfillments.

Over the past decade, the evolution of the food delivery industry has primarily focused on the supply side: enhancing ground promotion capabilities, increasing merchant supply density, refining subsidy mechanisms, and optimizing order allocation and fulfillment algorithms.

These efforts have substantially improved supply efficiency.

However, the demand side has not witnessed comparable progress.

We have consistently lacked a superior method to understand users' true needs and efficiently match them with suitable products and services.

To some extent, the overwhelming abundance of supply and aggressive marketing have only complicated this process. The distance between the origin of demand and the endpoint of transactions has lengthened, and the path has become less clear.

Therefore, when "ordering food delivery with a single sentence" becomes feasible, a natural question arises: Will the competitive dynamics of the food delivery industry shift accordingly?

Indeed, the logic of food delivery competition has evolved since Qianwen demonstrated its ability to order milk tea.

During last week's AGI-Next roundtable dialogue, Yao Shunyu made a pertinent observation that C-end users do not typically require extremely high intelligence. This statement holds merit because the perceptible improvements in frontier model capabilities are not readily apparent to C-end users.

However, it is crucial to acknowledge a limiting factor here. When AI operates solely in highly controlled, low-friction scenarios, it struggles to reach or reveal its upper capability limits. Dialogues, Q&A sessions, and summaries represent typical scenarios that are too closed, too clean, and too effortless for large models.

Yet, once models are tasked with completing more complex tasks, transitioning from "capable of dialogue" to "capable of getting things done," their upper capability limits will directly determine their ability to comprehend the complex constraints of the real world.

Qianwen's full integration into Alibaba's service ecosystem exemplifies the challenge of pushing model limits and constructing a capability feedback loop.

Take "ordering food delivery with a single sentence" as an illustration.

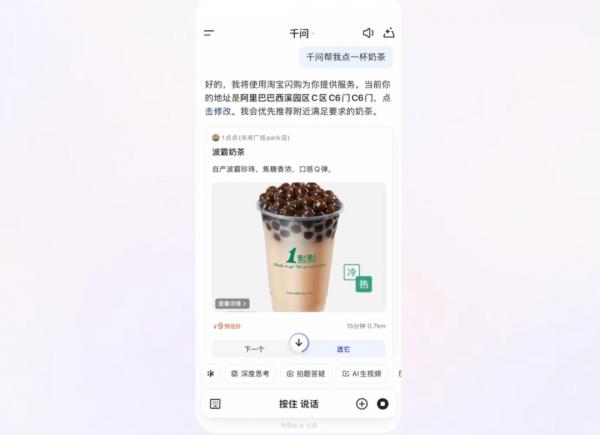

By leveraging Taobao Flash Sale, a seamless closed loop is established from demand expression, merchant matching, order generation, to Alipay AI payment. Users simply express their intentions, and AI accurately receives the demands and initiates consumption actions, providing a smoother experience than traditional food delivery processes.

If your description is precise, such as "pearl milk tea with less ice and less sugar," Qianwen will directly retrieve a list of eligible products from Taobao Flash Sale's product library, present options through a card-based UI, and automatically apply the maximum discount during checkout. If the description is relatively vague, Qianwen will first clarify the demands before recommending options.

Most importantly, these dialogues are not "disposable." Qianwen accumulates your taste preferences and personality habits over time, resulting in shorter paths and fewer frictions in subsequent interactions.

Of course, at this stage, the actual performance of using Qianwen to order from Taobao Flash Sale is not always flawless.

However, to comprehend AI, one must first learn to anticipate and think from the end goal.

For a considerable period after Cursor's launch, the product experience was also subpar. But with the release of Claude 3.7, Cursor's AI programming capabilities underwent a qualitative transformation and quickly spread from professional programmers to ordinary users.

The same principle applies to using Qianwen for food delivery. It may not immediately have a disruptive impact, but the competitive dynamics of the industry have already begun to shift.

This also leads to a broader industry judgment. After AI model capabilities and basic product functionalities gradually converge, the service ecosystem may emerge as a more decisive factor than the models themselves. Because the depth and completeness of the ecosystem are the hardest capabilities to replicate.

Consider the icons in the following figure. Reflect on the substantial investment Alibaba made to acquire them and the resources it has dedicated to their long-term maintenance.

For instance, following Qianwen's update, numerous demonstrations and spontaneous user attempts have centered on the "ordering food delivery" scenario. It is a high-frequency, immediate, and perceptible function that easily captures user attention. However, the prerequisite is that Taobao Flash Sale possesses sufficiently mature supply and fulfillment capabilities.

Conversely, the fusion of Taobao Flash Sale and Qianwen has secured the initial touchpoint for AI transactions.

This signifies that the turning point for food delivery competition has arrived, and the industry is shifting towards competing on overall system efficiency and innovative service experiences.

The seamless experience of AI-powered consumption cannot be achieved by simply allocating funds. It relies on a robust commercial ecosystem, which necessitates long-term establishment, maintenance, and strategic layout. It also hinges on leading AI technological foundations, and as Meta's experience has demonstrated, this is not something that can be resolved by merely spending money.

AI Reshapes the Competitive Landscape of Food Delivery: Why Taobao Flash Sale Holds More Certainty

Over the past 12 months, Alibaba's stock price has doubled, significantly outperforming the market.

Part of this exceptional performance can be attributed to Alibaba Cloud, which has achieved better-than-expected growth. Another contributing factor is Taobao Flash Sale, which has substantiated Alibaba's core narrative in the consumption sector.

Frankly speaking, when Taobao Flash Sale announced its entry into the food delivery war nine months ago, there was significant market skepticism.

However, nine months later, Taobao Flash Sale has demonstrated that after firmly investing to enhance market awareness and user scale, it also possesses the capability to maintain new market share and continuously improve its business structure through system efficiency.

Earlier this month, Alibaba conducted performance pre-communications with several foreign investment banks, revealing several valuable insights.

Management indicated that while Taobao Flash Sale's order volume share remained stable in the fourth quarter, both GMV share and average order value increased, with the order structure continuing to improve. The expected loss for the fourth quarter was 20 billion yuan, significantly lower quarter-on-quarter and converging faster than competitors.

Simultaneously, the synergy between Taobao Flash Sale, Hema, and Tmall Supermarket was significant, with non-dining orders stabilizing at 10 million per day and cross-selling in distant e-commerce meeting expectations. Management was clearly very satisfied with Taobao Flash Sale's progress, reiterating its firm commitment to investment with the goal of achieving market share leadership.

It is evident that today, Taobao Flash Sale possesses multi-dimensional and differentiated competitive advantages in terms of scale, structure, and efficiency in turning losses into profits.

With Qianwen's integration into Taobao Flash Sale, the combination of food delivery and AI further strengthens Taobao Flash Sale's position.

Using AI to transform food delivery is essentially a completely different and higher-quality path for value creation.

Subsidies and price incentives, to a certain extent, are about competing for existing users; AI-powered food delivery, on the other hand, is about using technology to expand the pie, extending the boundaries of effective demand.

When the entire chain from intention understanding to order placement and payment is connected, transaction matching is no longer based on traffic distribution logic but pursues ultimate precision in identifying user demands and reliable execution.

From a merchant perspective, AI will truly bring about the possibility of direct business synergy growth beyond advertising. From a user perspective, friction is continuously reduced, and decision-making costs are significantly lowered. Demands that were previously suppressed due to hassle, triviality, and information asymmetry will inevitably be released.

After yesterday's Qianwen press conference, many people mentioned that Alibaba has accomplished what OpenAI and Google intended to do, and done it better.

OpenAI and Google both lack Alibaba's ecological accumulation. Both companies aimed to integrate with shopping websites but, unable to reach an agreement with Amazon, had to settle for integrating with Walmart.

However, Alibaba's motivations for pursuing this integration differ somewhat from those of OpenAI and Google.

For example, OpenAI has clear commercialization considerations, recently preparing to integrate sponsored ads into its responses. E-commerce is the closest internet business to generating revenue, and integrating with e-commerce is almost an inevitable way to monetize traffic.

But Qianwen has only been launched for two months and is far from the stage where commercialization needs to be considered. Its full integration into the Alibaba ecosystem is primarily driven by meeting the public's expectation for AI to be "capable of getting things done."

From this perspective, you will find that Taobao Flash Sale occupies a rather scarce or fortunate ecological niche.

Wu Jia's use of Qianwen to achieve "ordering food delivery with a single sentence" is not just a product demonstration but also carries a symbolic meaning.

It represents a changing role for Taobao Flash Sale. It is a key pillar of Alibaba's grand consumption strategy and a tangible carrier for the group's AI strategy to take root and flourish.

Consumption forms the foundation of Alibaba, providing stable cash flow and a solid strategic space.

AI carries Alibaba's long-term imagination, significantly raising the future development ceiling.

These two strategies, with dual certainty, amplify each other through positive feedback. The value of Taobao Flash Sale may need to be reevaluated.