The 'Intelligent Driving Anxiety' of Manufacturing Giants: Great Wall Motors' Soul Wavers

![]() 01/19 2026

01/19 2026

![]() 417

417

Author | Chen Wen

Source | Insight New Research Society

The 'beloved son' Haomo is out, and Great Wall Intelligent Driving welcomes a 'battle of the gods'.

A white seal is affixed to the tightly shut door, and the office area of Haomo Drive, once a star autonomous driving company valued at $1 billion, stands deserted. Less than ten kilometers from the headquarters of Great Wall Motors, the company that once carried Wei Jianjun's dream of becoming 'China's number one in intelligent driving' has come to a halt.

This scene unfolded in November last year. Just a short while ago, Great Wall Motors confirmed a collaboration with intelligent driving company Momenta. The latter secured fixed point (designated supply) for two new models from Great Wall, including the Haval Menglong model. Vehicles equipped with Momenta's intelligent driving solution are expected to hit the market in early 2026.

This ebb and flow reflect the collective anxiety and strategic wavering of traditional automakers amidst the wave of intelligence.

01 The Industry Tide Amidst Fierce Competition

Haomo Drive was once the core carrier of Great Wall Motors' intelligent strategy. Founded in 2019, the company's predecessor was the Intelligent Driving System Development Department of Great Wall Motors, with Wei Jianjun, the chairman of Great Wall Motors, as its actual controller.

Wei Jianjun once boldly declared, 'Haomo will become China's number one in intelligent driving,' viewing it as the key to the group's intelligent transformation. At its peak, Haomo Drive completed seven rounds of financing, with its valuation once surpassing $1 billion.

However, the ruthless competition in technology quickly shattered this vision. The crucial setback occurred in the race to implement high-level urban navigation-assisted driving (Urban NOA).

In 2022, Haomo proudly announced its plan to cover 10 cities with its Urban NOH system by the end of the year and envisioned expanding to 100 cities in 2023. However, the slogan failed to translate into market competitiveness. The system ultimately only landed in a few cities, including Beijing, Baoding, and Shanghai, and its user experience and iteration speed fell short of expectations.

As Haomo stumbled, the industry's technological paradigm swiftly shifted towards more efficient and adaptable 'end-to-end large models + mapless' solutions. A stark contrast emerged: while external supplier Rongxin Auto took only about three months to adapt a similar mapless Urban NOA for Great Wall's new models, the highly anticipated Haomo took nearly two years without achieving a decisive breakthrough.

This significant lag and capability gap in a critical track (competitive arena) completely shook Great Wall's confidence in Haomo as its exclusive core technology source.

The internal weakness and the urgency of external competition forced Great Wall to make swift and decisive remedies.

The signal of strategic shift was clear and strong. In March 2024, Great Wall Motors instead led the Series C financing of competitor Rongxin Auto, amounting to $100 million. This was by no means a simple financial investment but a reselection of technological routes.

Subsequently, actions quickly materialized. In August of the same year, the new Blue Mountain Intelligent Driving Edition launched by Great Wall's premium brand, WEY, replaced its core intelligent driving system with Rongxin Auto's solution. This public switch at the product level officially declared the internal change of Great Wall's core intelligent driving supplier.

As Great Wall was busy with internal strategic adjustments and supplier switches, the entire intelligent driving sector had entered a phase of comprehensive popularization and price decline, a 'melee' stage where competitors left no room for respite.

Industry penetration is accelerating at an unprecedented pace. According to predictions by authoritative industry institutions, by 2026, Level 2 assisted driving will become standard equipment for over 70% of new cars and will massively penetrate the economic electric vehicle market at the 100,000-yuan level. This signifies an ongoing 'intelligent empowerment' movement, from which no mainstream automaker can afford to be absent.

The aggressive strategies of major competitors have further intensified the competitive pressure:

BYD, leveraging its vertical integration and scale cost advantages, announced the rapid rollout of its high-level intelligent driving system, 'Divine Eye,' planning to cover its main models priced between 100,000 and 200,000 yuan and even extending to the Seagull model with a starting price of around 70,000 yuan, aiming to reshape the market landscape with 'technology for all.'

Traditional powerhouses like Geely and Changan are also launching fierce attacks. Changan Automobile announced plans to introduce lidar hardware into models priced at the 100,000-yuan level and aims to achieve full-scenario Level 3 intelligent driving by 2026, showcasing its ambition for leapfrog development.

New forces continue to deepen their technological moats. Companies like XPeng, Li Auto, and NIO are advancing algorithm self-research while venturing into upstream chip design. For instance, XPeng's self-developed chip has successfully taped out, aiming to build a complete ecological closed loop (closed loop) from underlying hardware to upper-layer software.

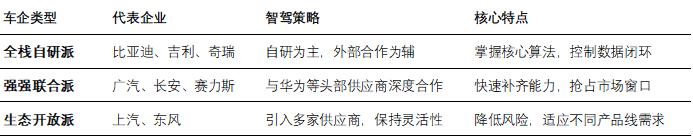

Intelligent Driving Strategies of Mainstream Automakers

Intelligent Driving Strategies of Mainstream Automakers

In this competition, data has become a key asset. By November 2025, vehicles equipped with Rongxin Auto's Urban NOA solution had reached 200,000 units. In contrast, after losing its main position at Great Wall, Haomo Drive's official website showed that its Vehicle companies (complete vehicle enterprise) partners had long been limited to only Great Wall Motors.

02 The Clash Between Traditional Automakers' Manufacturing Mindset and Software Iteration

Faced with Haomo Drive's failure to break through technologically, Great Wall Motors did not dwell on the path dependency of 'full-stack self-research.' Instead, it swiftly shifted to build a multi-tiered, risk-diversified supplier system. This strategic adjustment essentially represents the most pragmatic and efficient choice made by Great Wall to cope with the intelligence arms race amidst a temporary absence of core capabilities.

In 2024, Great Wall Motors successively established partnerships with Rongxin Auto and Drivetech, forming a supplier structure with high, medium, and low tiers. Rongxin Auto primarily serves premium models like WEY, providing Urban NOA functionality; Drivetech develops intelligent driving solutions for affordable models like Haval.

The recent collaboration with Momenta represents a significant attempt by Great Wall in terms of technological routes. The new models will be equipped with Momenta's latest one-stage end-to-end solution, adopting the R6 Flywheel Large Model, developed based on the Qualcomm Snapdragon 8620 chip, with an effective computing power of 156 TOPS.

This 'high-medium-low' full-stack cooperation model reflects Great Wall's profound mindset shift from 'self-reliance' to 'building extensive alliances.' As an industry observer put it, 'Great Wall's changing supplier list is a precise 'technology procurement checklist.' It no longer dwells on 'who does it' but is extremely pragmatic about 'what level of functionality can be achieved, at what cost, and by when.'

Great Wall Intelligent Driving Suppliers

Great Wall Intelligent Driving Suppliers

Great Wall's twists and turns in intelligent driving are by no means isolated cases. They sharply reveal the structural and systemic challenges faced by traditional automotive giants in their intelligent transformation.

Firstly, there is a fierce clash between the deeply ingrained 'manufacturing mindset' and the Internet-style 'software mindset.'

Yu Chengdong, CEO of Huawei's Intelligent Automotive Solution BU, once sharply pointed out, 'Collaborating with traditional automakers, a software upgrade approval process requires stamping two or three dozen seals, with a lengthy cycle. By the time the process is complete, competitors' next-generation functionalities are already on the road.'

This vividly illustrates the fundamental contradiction between the rigorous, lengthy, hardware-centered development process (V-model) of the traditional automotive industry and the software-driven, small-step, fast-run, continuous iteration Internet development model (Agile Development).

When intelligent driving algorithms require data feedback and optimization in units of 'weeks' or even 'days,' the traditional automakers' model replacement rhythm in units of 'years' and complex internal decision-making chains become heavy shackles.

Secondly, the current performance pressure on Great Wall Motors also limits its long-term investment capability in intelligent driving. In the first three quarters of 2025, although Great Wall Motors' revenue increased by 7.96%, its net profit attributable to the parent company decreased by 17.2% year-on-year, showing a trend of 'increased revenue but decreased profit.'

Faced with new forces investing tens of billions annually in long-term and uncertain R&D such as AI algorithms and large model training, Great Wall needs supplier solutions that can clearly account for costs and deliver quick results.

More importantly, the failure of Haomo Drive exposed the structural contradictions of automakers incubating technology companies. There is an irreconcilable conflict between the positioning as an 'independent supplier' and the reality as a 'subsidiary of the parent company.' When other automakers choose intelligent driving solutions, they have inherent 'trust barriers' towards companies like Haomo Drive, worrying about issues such as core data security and technological independence.

Haomo Drive once announced signing designated cooperation agreements with three OEMs, but its official website showed that its Vehicle companies (complete vehicle enterprise) partners had long been limited to only Great Wall Motors. This 'announcement-as-endpoint' cooperation model exposes the symbolic nature of business expansion over its substantive nature.

03 The Hopes and Concerns of Great Wall's 'Dual-Track System'

Faced with the comprehensive competition in the intelligent driving market in 2026, Great Wall Motors' strategic adjustments will determine its future position in the industry. Industry experts predict, 'From 2026 to 2030, the automotive industry chain and technology will accelerate its spillover and empowerment to other industries.'

Judging from Great Wall Motors' current actions, its layout of intelligent driving technology presents a 'two-legged approach' strategy: one is full-stack self-research for controllability, and the other is an open route for co-creation with industry-leading partners. The advantage of this strategy is that it can both ensure control over core technologies and quickly respond to market changes.

However, this seemingly robust (stable) balanced strategy may face severe challenges in practice.

The first issue is data fragmentation and ecological barriers.

Collaborating with multiple suppliers, the most fatal hidden danger lies in the dispersion of data sovereignty and fragmented user experiences. The algorithms and data closures of different suppliers are independent of each other, preventing Great Wall from forming a unified and coherent user data pool, thereby weakening its core capability to drive rapid system iteration through scaled data. This stands in stark contrast to the exponential evolution achieved by self-research camps like Tesla and XPeng, which rely on a single, massive data flywheel.

The second issue is the dispersion of R&D resources, which may lead to the hollowing out of core technologies.

With limited resources, 'dual-track parallelism' can easily result in 'relying on neither.' External procurement requires continuous investment in funds and engineering adaptation resources, while internal pre-research demands long-term, high investment in AI talent and computing power. This dispersion may prevent Great Wall from excelling in either path, ultimately leading to deep dependence on leading suppliers and the inability to truly establish its software-defined vehicle capabilities.

The third issue is the potential paradox between experience coordination and cost control.

Matching different suppliers' solutions for different brands and models will inevitably bring fragmented intelligent driving experiences to users, damaging brand perception. Meanwhile, the complexity of managing multiple technological supply chains will incur hidden costs far exceeding expectations. This will make it difficult for Great Wall to create a flagship product with both extreme cost-effectiveness and excellent experience in the crucial price range of 100,000 to 200,000 yuan.

In summary, Great Wall's 'dual-track system' is a pragmatic path under current pressures but by no means the ultimate solution to reach the pinnacle of intelligent driving. It exposes the traditional automakers' ongoing struggle in balancing control over the soul (software) and the body (manufacturing).

The true test lies in whether Great Wall can use its current collaborations as a springboard to forge its unified intelligent vehicle core operating system and data capabilities amidst the complex supplier landscape. Otherwise, the 'dual-track system' may evolve into a protracted 'war of attrition,' preventing it from reaching the top of the industrial value chain in the deep waters of intelligence.

Great Wall Intelligent Driving's true choice in the future does not lie in a binary decision between 'self-research' or 'cooperation' but in whether it has the courage to break traditional organizational barriers and build a new system capable of nurturing and carrying a truly intelligent soul.