[Hot Topic] Google [Turns the Tables] and Earns Apple's Money: The $1 Billion-a-Year [Hybrid Siri] Deal is Finalized

![]() 01/19 2026

01/19 2026

![]() 430

430

Preface:

Apple and Google have officially announced a multi-year deep collaboration, with the next-generation Siri and Apple Intelligence to be built on Google's Gemini model and cloud technology.

These long-time rivals in the smartphone sector, who have been locked in a fierce battle for over a decade, have suddenly joined forces in the AI era. This move not only propelled Google's market value to surpass $4 trillion for the first time but also marked a new stage in the global AI competition, where ecosystems are pitted against each other.

Image Source | Network

Rivals Unite: An AI Deal for Mutual Benefit

The collaboration between Apple and Google has been nothing short of dramatic from the start. These two companies, fierce competitors in the smartphone market with an ongoing ecosystem rivalry between iOS and Android for over a decade, have chosen deep integration in the AI field.

According to their joint statement, Apple will receive a customized version of the 1.2 trillion-parameter Gemini model to revamp Siri and strengthen the Apple Intelligence platform. Meanwhile, Google will achieve large-scale deployment of its AI technology through Apple's global network of over 2 billion active devices.

The core of this collaboration lies in a 'white-label' soul transplantation. Users interacting with Siri will not see any Google branding or need to link a Google account. The interface and experience will remain purely 'Apple-flavored,' but the underlying intelligent core will be replaced with Gemini.

Apple's choice of this collaboration method is both to maintain the integrity of its ecosystem and to respond to user privacy concerns.

Data privacy is a top priority in this collaboration. Apple insists that user data must not leave its ecosystem and has adopted a 'hybrid processing model.'

Simple tasks like checking the weather or setting alarms will still be completed on-device by Apple's self-developed small models, with data never leaving the device. Complex tasks like summarizing PDFs or planning trips will be handled by the Gemini model deployed in Apple's private cloud.

More critically, user queries will pass through a 'privacy buffer layer' to strip out personal identifying information, processing them as anonymized data. The data will be discarded immediately after processing, preventing Google from accessing the raw data or using it to train its own models.

External estimates suggest that Apple will pay Google around $1 billion annually in licensing fees, creating an interesting contrast with the $15-20 billion Google pays each year to be the default search engine on the iPhone.

The once one-way flow of funds has now become a two-way exchange of value.

For Google, this deal not only brings stable cash flow but also grants the Gemini model access to the world's most premium consumer-grade scenarios.

For Apple, this is a pragmatic move to address its AI shortcomings, enabling it to launch competitive products in the short term.

Google's Comeback: From Red Alert to $4 Trillion Market Value

Who could have imagined that Google, which sounded internal 'red alerts' three years ago due to the emergence of ChatGPT, would now stage a comeback as Apple's AI partner and propel its market value to surpass $4 trillion through this collaboration?

Google's AI turnaround has been nothing short of spectacular. When ChatGPT took the world by storm in late 2022, Google was criticized for going from an industry pioneer to a follower. Its initial Bard model performed poorly, leading Wall Street to almost issue a 'death sentence.'

However, under immense pressure, Google launched a comprehensive counterattack. Gemini 1.5 became the key to its turnaround, allowing Google to regain its foothold in the AI era.

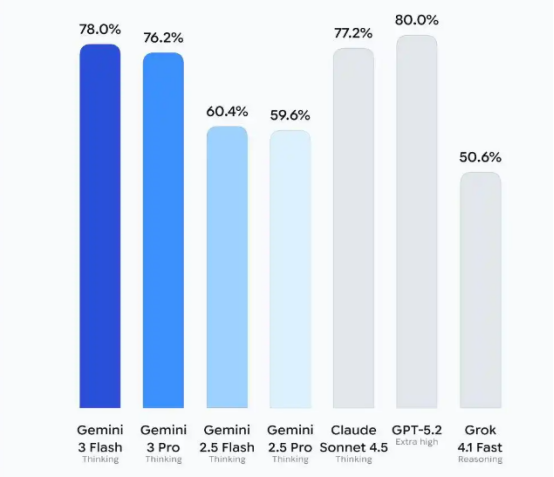

Gemini 2 and 2.5 continued to reclaim lost ground, while the release of Gemini 3 in November 2025 marked a decisive turning point. Its multimodal capabilities and reasoning cost control reached world-class levels, placing it on par with OpenAI.

The launch of Gemini 3 Flash further solved Apple's most pressing cost concern by delivering effects close to those of Gemini 3 Pro at a lower price.

This technological advantage quickly translated into commercial success. The monthly active users of the Gemini APP surged from 450 million last summer to 650 million. Including core Google users who utilize Gemini functions, the total has exceeded 1 billion.

Google's business ecosystem has also formed a virtuous cycle with AI. In the third quarter of 2025, Google Cloud signed more than $1 billion in transactions, surpassing the total of the previous two years. Its advertising business recovered strongly, with fourth-quarter revenue approaching $80 billion.

Capital markets have highly recognized Google's AI transformation. Berkshire Hathaway established a position of 17.8 million Google shares in the third quarter of 2025, valued at over $4.3 billion, further driving up the stock price.

From panic in 2022 to a market value peak in 2026, Google has completed an AI comeback in just three years, proving the adjustment capabilities of tech giants in times of crisis.

Apple's Dilemma: The Latecomer in the AI Era

Apple's decision to collaborate with Google stems from its long-standing struggles in the AI field.

Over the past decade, Siri's design logic has revolved around three things: localization, privacy first, and rule-driven. This approach was an advantage in the 'command-based assistant' era but has become a shackle in the era of large models.

The problem does not lie in the Siri engineering team's lack of effort but rather in the inherent need for large models to rely on cloud computing power, continuous training, and rapid iteration, all of which conflict with Apple's traditional philosophy.

Apple is not incapable of developing models but rather 'cannot make the numbers work.' Apple has the ability to create its own foundational models, but the cost would be extremely high. Most critically, it would not directly lead to hardware premiums.

Against the backdrop of slowing global hardware growth, Apple cannot afford to reconstruct its entire cost structure just to 'chase the AI hype.' Thus, the 'hybrid solution' has become the most rational choice.

As the pioneer of the mobile internet era, Apple has clearly been slow to adapt to the AI wave. This collaboration appears more like a strategic compromise forced by circumstances.

Apple's AI shortcomings have been evident for some time. Since the release of Apple Intelligence in 2024, the launch of its core features has been repeatedly delayed, and Siri's AI upgrades have been postponed three times.

The new Siri, originally planned to launch with iOS 18 in the fall of 2024, ultimately only introduced basic features like notification summaries and writing rewrites. In 2025, the Siri upgrade was delayed again to 2026 due to 'high implementation difficulty and subpar results.'

Talent drain has exacerbated Apple's AI predicament (dilemma). In July 2025, Pang Ruoming, head of Apple's foundational model team, left with his key deputy Tom Gunter and several senior researchers to join Meta.

John Giannandrea, Senior Vice President of AI and Machine Learning, announced his retirement in the spring of 2026, and core members of several sub-teams have jumped ship to competitors like OpenAI and Anthropic.

In 2025, Apple restructured its AI reporting lines, merging projects like Apple Intelligence into the software engineering department and consolidating some independent AI functions into the operating system development organization.

Apple's AI lag stems from conservative strategic decision-making. While Google, Microsoft, and other major players were aggressively investing in AI layout, Apple chose to 'sit tight.' Over the past three years, its investment in computing infrastructure and large model training has been severely inadequate.

As a master of supply chain management, Cook excels at cost control but lacks the determination to invest in emerging technologies at critical moments.

As industry analysts have pointed out, if Jobs were still alive, he would likely have gone all-in on developing his own large model when ChatGPT emerged in 2022. Cook's caution has caused Apple to miss the golden window for AI development.

Faced with obstacles in self-development, Apple considered various external collaboration options, including continuing to trust OpenAI, partnering with startups like Anthropic or xAI, accelerating self-development, or collaborating with Google.

However, OpenAI's model quality has been criticized for declining, and its shift toward consumer-grade AI hardware could make it a future competitor of Apple.

Anthropic's Claude has advantages in security but comes with a high price tag. Startups like xAI have weak foundations and incomplete ecosystems, posing significant risks.

Ultimately, Google Gemini's strong performance, mature ecosystem, and cost advantages made it the best choice for Apple.

Nevertheless, Apple has not abandoned its ambition for self-developed AI. Analysts generally believe that this collaboration with Google is a strategic short-term choice, and Apple is still quietly advancing its own AI layout.

It has invested billions of dollars in purchasing GPUs and building teams, with a trillion-parameter self-developed model currently under development, targeting a 2027 launch. Its self-developed ASIC chip, Baltra, is expected to be delivered in 2028, with tape-out scheduled for the first half of 2026.

Reshaping the Landscape: AI Ecosystem Competition, Cooperation, and Monopoly Controversies

Through collaborations with Apple and Samsung, Google has nearly covered the two major mobile ecosystems of Android and iOS, achieving a quantum leap in the distribution scale of the Gemini model.

OpenAI now faces immense pressure, with its largest consumer-side imagination space evaporating.

Despite still having 1.2-1.5 billion monthly active users, 30-40 million paying users, and over 1 million developers, Google's advantages in resources, ecosystems, and hardware integration capabilities are more pronounced.

To counter the challenge, OpenAI has had to adopt an 'offensive defense' strategy by heavily investing in computing infrastructure and signing partnerships, but the effects have been limited.

Anthropic, while having more enterprise collaborations, lacks consumer platform integration. xAI's Grok is limited to the X and Tesla ecosystems, making it difficult to achieve Scale effect (scale effects).

The collaboration between Apple and Google is essentially a battle for the next-generation gateway, with significance on par with the default search agreements of the past.

In the future, ecosystem integration around AI assistants will become the core of competition. Whoever can control the gateway and orchestrate the service ecosystem will gain the upper hand in the competition.

This competitive landscape takes on a different form in the domestic market. Unlike Apple's reliance on external assistance, domestic smartphone manufacturers like Honor and Vivo are more inclined toward self-developed models or multi-model collaborations to maintain ecosystem dominance.

Meanwhile, model service providers like Doubao and Tongyi Qianwen are vying for 'on-device' opportunities, attempting to achieve large-scale distribution through pre-installation on smartphones.

The uniqueness of the domestic market lies in the highly fragmented service ecosystem, where cross-App execution faces multiple challenges related to permissions, ecosystems, and responsibilities. This makes the competition for AI gateways in the domestic market even more complex and may give rise to new collaboration models and ecosystem alliances.

Conclusion:

From a higher vantage point, the significance of this collaboration lies in the fact that platforms are no longer closed kingdoms but rather assemblies of capabilities.

Operating systems no longer need to possess the strongest intelligence, and terminal manufacturers do not have to develop everything in-house.

AI is becoming a 'pluggable capability.' The future competition will not be about 'who owns everything' but rather about who can better integrate external capabilities and control the ultimate user experience.

Partial Source References: Tencent Tech: 'Privacy, Monopoly: Five Key Questions About Apple's [Hybrid Siri],' 51CTO Technology Stack: 'Apple × Google: The AI Century Alliance is Officially Announced, Google's Market Value Surges Past $4 Trillion Overnight,' MeiTou Investing: 'Google Officially Integrates into Apple's Ecosystem,' Photon Planet: 'Google Has Taken Apple's [Soul]']