【Annual AI Insight】2026: Automakers Launch a Strategic Counteroffensive in the Smart Hardware Arena

![]() 01/19 2026

01/19 2026

![]() 345

345

Article by | Intelligent Relativity

When the conversation turns to the most sought-after smart hardware of 2025, smart glasses undoubtedly emerge as a frontrunner. Among the diverse array of entrants in this market, the participation of automakers stands out as particularly noteworthy.

Take, for instance, the AI glasses Livis unveiled by Li Auto, which have sparked widespread debate. The discourse has primarily focused on the user experience and interaction logic of these glasses, including their lightweight design and extended battery life. However, there's also been considerable discussion about whether the response to the command "Li Auto Classmate" during interactions originates from the glasses or the vehicle itself, and whether this could lead to any conflicts between the two.

In truth, Li Auto's foray into AI glasses is more than just a product launch; it signifies another gateway to embodied AI, as the company itself has stated. This move represents a transformative shift in the automotive industry, where, following the impact of intelligent assisted driving, vehicles and other smart hardware are evolving into distinct manifestations of embodied AI agents. When vehicles and smart hardware are seamlessly integrated through AI foundational models, the profit model for vehicles will undergo a fundamental transformation, shifting from a one-time vehicle sale to continuous paid services for intelligent software and hardware.

Expanding our perspective, we observe that the current transition of automobiles into smart hardware is a continuation of the 2019 trend where hardware manufacturers ventured into automotive manufacturing. Back then, this automotive transformation by hardware makers paved the way for vehicle-machine interconnection and intelligent driving. Now, with the advancement of AI, vehicles and smart hardware increasingly share a common core, albeit in different forms, creating new opportunities. The automakers' counteroffensive into smart hardware has thus become an inevitable cyclical trend.

However, it's crucial to acknowledge that the high investment required in AI, encompassing technology, data, computing power, and scale, also dictates a pronounced winner-takes-all effect in this competition. This is accompanied by the harsh reality of commercial rivalries, where failure often leads to obsolescence.

From Hardware to Vehicles to Smart Hardware: New Business Horizons Shaped by the 'Optimal Profit Solution'

The greater commercial potential of smart hardware in the automotive sector is not a baseless claim but a natural progression stemming from two waves of transformation: the shift from hardware to automotive in 2019 and the subsequent transition from automotive to smart hardware in 2025.

In 2019, the growth of hardware industries like mobile phones reached its peak, leading to diminished profits. Simultaneously, China's new energy vehicle sales experienced explosive growth, with an annual increase exceeding 30%. This prompted mobile phone manufacturers to pivot towards automotive manufacturing.

This transition took two distinct paths: one was direct vehicle manufacturing, exemplified by Xiaomi's announcement in 2021 that it was officially entering the intelligent electric vehicle sector;

The other path involved collaboration with automakers to explore intelligent assisted driving and vehicle-machine integration solutions. For instance, Huawei announced in 2019 that it would focus on the application of ICT (Information and Communication Technology) in vehicles, leading to the birth of the Huawei HI mode and the HarmonyOS Intelligent Connectivity mode. Simultaneously, other mobile phone brands like OPPO, VIVO, and Meizu also began collaborating with automakers, introducing NFC keys and comprehensive intelligent in-vehicle solutions.

Caption: In 2021, Xiaomi announced its entry into vehicle manufacturing.

This essentially marked the first wave of profit-seeking by hardware manufacturers, moving from simple hardware (mobile phones) to complex hardware (vehicles). However, it also established a trend in China's new energy vehicle sector centered on vehicle-machine interconnection and intelligent assisted driving, laying the foundation for vehicles to become intelligent agents in the future.

In 2023, with the release of Tesla's FSD V12, the trend of intelligent driving surged. Over the next year, intelligent assisted driving technology rapidly iterated, converging towards end-to-end solutions. A unified, self-learning, evolving, and iteratively performing AI model began to take shape, transforming vehicles into embodied AI portals based on AI models.

By 2025, after fifteen years of development and a concentrated surge from 2019 to 2024, China's new energy vehicle sector witnessed its lowest growth rate in recent years in Q1 2021. Simultaneously, multiple monthly declines in growth occurred in 2024, and a fierce price war at the end of 2024 revealed the harsh reality of industry growth constraints and diminishing profits.

At this critical juncture, the automotive industry must undergo transformation. Leveraging the trend of integrating intelligence into vehicles, shaping vehicles as embodied AI portals through the development of intelligent driving, and combining them with other intelligent agents has become a consensus choice within the industry.

Tesla is advancing the formation of an 'Automobile + AI + Robot' ecosystem, expanding vehicles as part of the AI ecosystem and incorporating the possibilities of robots;

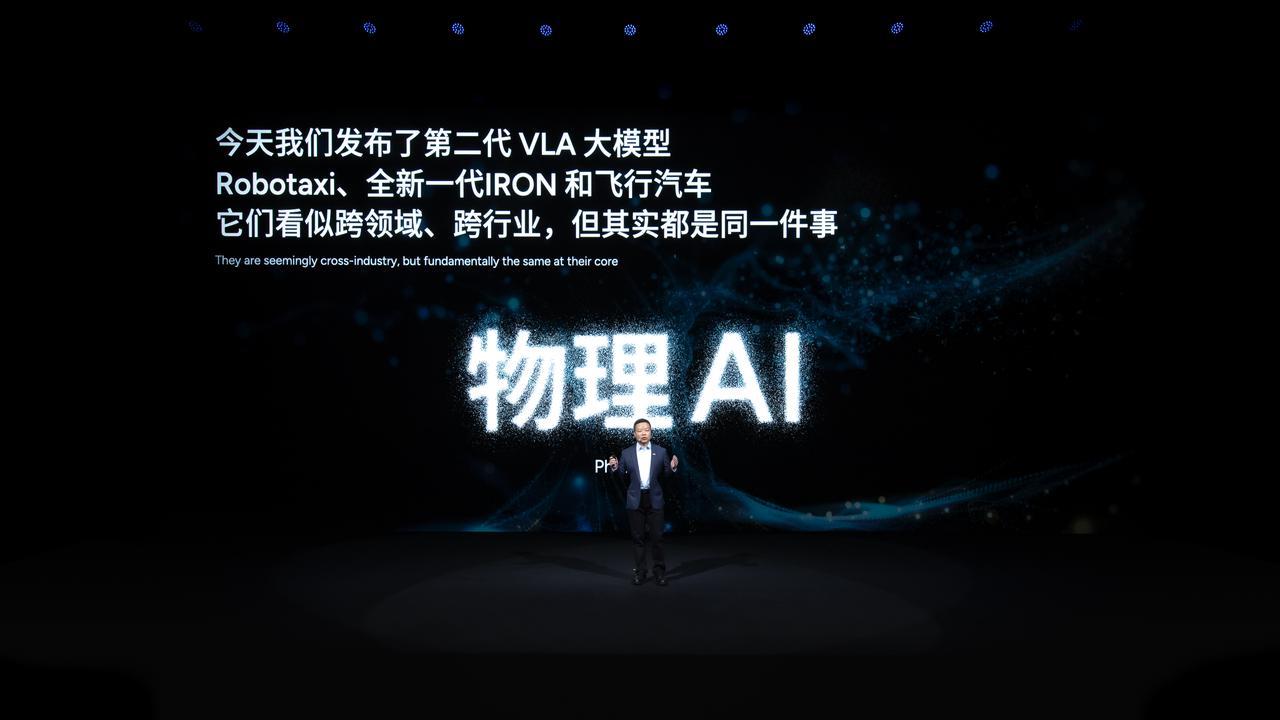

XPENG Motors, with vehicles on the ground, aerial vehicles like the HT Aero Flying Car, and robots like Iron, is learning from Tesla to explore a path of 'general model capabilities + multi-scenario carriers (vehicles/robots/aircraft)';

Caption: XPENG's AI Ecosystem

Volkswagen, collaborating with Microsoft on AR glasses HoloLens, provides vehicle driving information while also applying it to marine scenarios to assist in diagnosing and repairing remote maritime equipment;

BMW, collaborating with Huawei HiCar, promotes the integration of in-vehicle connectivity hardware and intelligent applications;

This trend even includes NIO's launch of the NIO Phone in 2023, an innovation once deemed 'boring' by many consumers. Now, it appears to be an integral part of automakers' transition to smart hardware. However, its timing was unfortunate, as intelligent assisted driving and AI had not yet surged in 2023, leading to its eventual quiet demise.

The two rounds of profound transformation in the industry have explored high-margin business possibilities through strategic maneuvers. During this process, two trends have emerged: first, the acceleration of intelligent agent technology extension into in-vehicle scenarios; second, the establishment of vehicles as bridges connecting with diverse smart hardware in their embodied AI form. The continuous development and mutual empowerment of these two trends have, on the one hand, driven the maturation of smart hardware manufacturing processes and, on the other hand, created highly potential scenario extension directions for in-vehicle connectivity.

Vehicle sales, from now on, will gradually transform from a one-time transaction to a continuous paid business embedded in consumers' lifestyles.

Diverse Profit Models for Automakers in the Smart Hardware Era

When examining the specifications of Li Auto's AI glasses, with a frame weight of only 36 grams and a single-charge battery life supporting 1,000 photos, 41 minutes of video recording, 7.6 hours of music, and 6 hours of calls, it's evident that they are designed for all-day use, transcending the limitations of vehicles.

This is also the advantage of smart hardware over vehicles: compact size, portability at any time, affordability, and user willingness to make purchases. Moreover, by being associated with Li Auto, they foster brand loyalty among consumers towards Li Auto as a whole.

More importantly, smart hardware facilitates higher-frequency and more sensor-rich data collection from users. Connected to Li Auto's in-vehicle large model and self-developed chips, it can effectively transmit daily collected data back to Li Auto's AI large model, forming a data closed loop and enhancing the overall capabilities of Li Auto's AI foundational model.

Caption: Li Auto's AI Glasses Livis

When Li Auto's business narrative evolves from merely 'vehicle manufacturing' to a 'consumer intelligent lifestyle platform,' coupled with the advantages of a data closed loop and AI model capabilities, Li Auto can easily extend new business possibilities that attract capital attention and subsequently enhance its valuation. Indeed, there are precedents in the industry. After XPENG Motors announced its 'Physical AI' strategy at the 2025 XPENG Tech Day, including the second-generation VLA large model, Robotaxi, the new IRON humanoid robot, and the HT Aero Flying Car, the company's stock price surged by 13% during the trading session, earning it the title of a 'Physical AI' pioneer in media evaluations.

Why are capital markets so bullish on markets beyond vehicle manufacturing? Apart from the current AI hype, it's also because vehicle manufacturing and creating AI-cored smart hardware are fundamentally two different businesses.

If we consider vehicles as a form of embodied AI, their internal AI foundational model is the core, while the external vehicle is merely the physical manifestation of AI and the portal for interaction with the world, i.e., Software-Defined Vehicles (SDV).

Consequently, the lifecycle of vehicles transforms from the previous logic of purchase, use, maintenance, and second-hand sales to a software platform with repeatable monetization through feature subscriptions, OTA upgrades, and in-cabin services. Such software service revenues often boast higher gross margins than vehicle manufacturing.

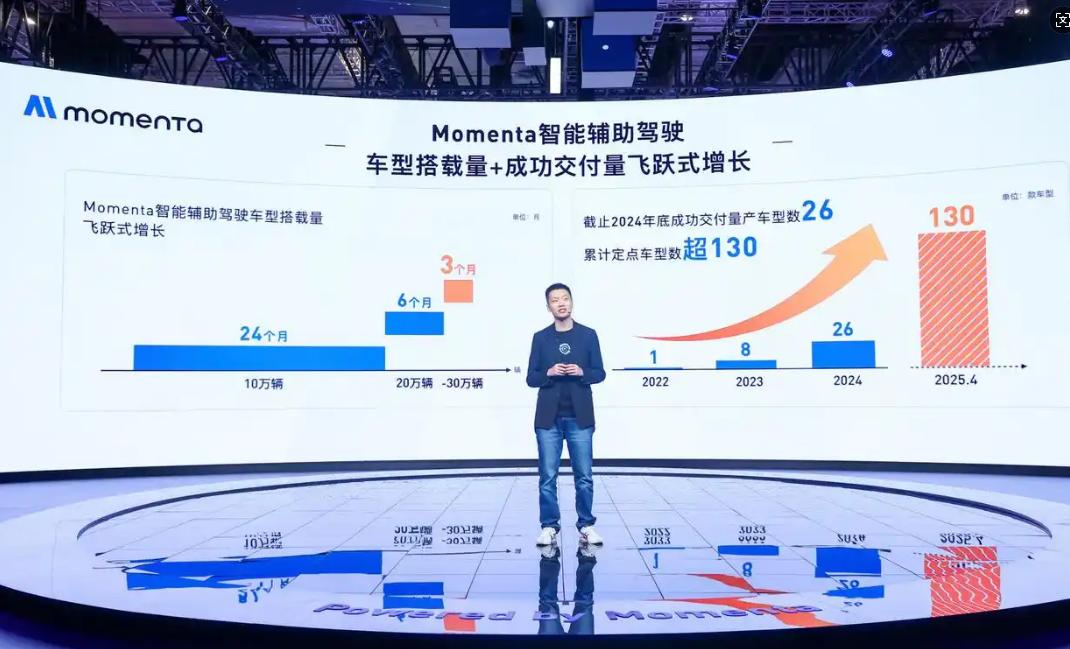

Secondly, the logic of future smart hardware is similar to that of vehicles, both serving as different gateways to embodied AI. Therefore, their AI foundational models can be interconnected, with perception, localization, generative interaction, and OTA platforms made into reusable components, thereby diluting the expensive algorithm, computing power, and data costs. It's worth noting that in the intelligent assisted driving sector, Momenta's rise to the top while maintaining high cost-effectiveness is largely attributed to its end-to-end flywheel model adaptable to different automotive brands and models. Currently, it collaborates with over 130 models across twice as many partnerships, diluting development and service costs through economies of scale.

Caption: Momenta's Triple Increase in Volume, Deliveries, and Designated Models

Thirdly, by leveraging the advantages of industrial chain spillover, AI can transcend the single scenario of vehicles and be applied to enhance industrial production efficiency, such as Siemens' use of AI to optimize production lines, boosting capacity and yield, and further feeding back into cost reduction and delivery speed, making AI a cross-departmental shared capability and enhancing overall efficiency.

Higher-margin service revenues, diluted computing power, algorithm, and data costs, and overall acceleration of company product and operation speeds form a new path for smart hardware development based on its underlying AI models. This will reshape the future capabilities and profit models of vehicles and smart hardware, bringing greater business imagination to enterprises.

The current transition of numerous automakers towards smart hardware is essentially a shift towards AI foundational models and embodied AI agents. However, this transition will not be smooth sailing. In fact, due to the high entry barriers and costs of AI in terms of computing power, algorithms, and data, the winner-takes-all effect in this sector will undoubtedly be more pronounced.

Transformation and the Difficulty in Reshaping Industry Dynamics

Transitioning to AI sounds appealing but is challenging in practice—it's an industry entirely different from traditional manufacturing. Algorithms, computing power, data, supply chain integration, and scalability collectively form its barriers, imposing higher requirements on all entrants.

If vehicles and smart hardware adopt the same AI foundation, the current algorithm approach is end-to-end or an extension thereof, implying that the volume of data fed must be substantial enough for the algorithm to learn autonomously. Correspondingly, this raises the question of how many vehicles or other smart hardware an automaker can sell.

Tesla's rapid establishment of its advantage in intelligent assisted driving is closely linked to the driving data from its global fleet, i.e., the trifecta of 'mileage training/validation/covering edge scenarios.' The logic extends similarly to smart hardware/embodied AI: the more units sold and used by consumers, the smoother the data closed loop can operate. Currently, only a few automakers at the forefront have the capability and rationale to venture into smart hardware, with minimal advantages for those in the middle and lower tiers. However, the possibility of a latecomer overtaking the frontrunners cannot be ruled out.

Purchasing computing power, conducting algorithm research, closing the data loop, iterating algorithms, and configuring technical personnel all require significant financial investment. For instance, Li Auto's 2024 financial report mentioned approximately RMB 11.1 billion in Research and Development (R&D) expenditures. XPENG Motors plans to spend RMB 9.5 billion on R&D in 2025, with around RMB 4.5 billion allocated to AI. Tesla's investment is even more staggering, with its self-built Dojo and AI computing power investment reaching the billion-dollar level, and its 2024 R&D expenditure approximately USD 450-460 million.

These figures are all astonishing, and they represent essentially just one year's investment. The market and capital are highly sensitive to such investments, generally bullish in the short term but focused on delivery capabilities in the long term. If the funds are provided but the technological advancement does not meet expectations, subsequent investments may become difficult to secure.

In summary, enterprises that can successfully traverse the diverse realms of AI, automotive technology, smart hardware, and embodied AI must, at their core, possess robust financial backing, skilled technical personnel, and the scalability to acquire chips or computing power. This enables them to refine algorithms continuously and boost the overall performance of foundational AI systems through economies of scale.

These prerequisites imply that only brands with widespread consumer adoption can meet such demands. Consequently, the industry landscape is likely to remain largely stable or may even become further entrenched.

*All images featured in this article are sourced from the internet.