France's Old Friend: Still in Need of Finding Dongfeng

![]() 01/20 2026

01/20 2026

![]() 327

327

Introduction

Introduction

For them, Dongfeng is no longer merely an option; it has become a necessity.

On January 12th, Luca de Meo, the newly appointed CEO of Renault Group, selected Dongfeng Motor's headquarters in Wuhan, Hubei Province, as the inaugural stop on his first visit to China. The journey exuded a sense of rekindling ties with an old acquaintance, yet both sides were acutely aware that the discussions would transcend the simple market and factory talks of yore. Instead, the focus would be on Renault's future survival strategy.

Rewinding thirty years to 1993, Renault, as one of the pioneering foreign automakers to venture into China, established the Sanjiang Renault joint venture. However, due to low localization rates and high costs, it withdrew a decade later. In 2003, Renault resumed negotiations with Dongfeng, but the joint venture only came to fruition in 2013, thus missing out on China's automotive market's golden decade.

In 2017, Dongfeng Renault's sales peaked at 72,000 units before experiencing a sharp decline to less than 20,000 in 2019. Renault was compelled to shut down its joint venture factory in China and exit the internal combustion engine market. Nevertheless, during its retreat, Renault left behind a glimmer of hope: in 2017, it collaborated with Dongfeng and Nissan to form eGT New Energy Automotive Co., Ltd., focusing on new energy vehicle R&D.

Unsurprisingly, eGT emerged as Renault's electrification bridgehead in China. At its factory in Shiyan, Hubei Province, the all-electric Dacia Spring rolled off the production line and became a best-selling affordable electric vehicle in Europe post-export, as well as China's second-largest export model. This validated the viability of the "Made in China, Sold in Europe" model.

Perhaps buoyed by the success of the Dacia Spring, in early 2024, Renault resolved to revive the classic Twingo model as an all-electric vehicle targeting Europe. And once again, Renault placed its production and supply chain bets on China.

It is reported that the French team swiftly finalized key technologies such as the chassis and powertrain in just two months, followed by entrusting the concept car work to the Chinese team. In Shanghai, a research and development team named "ACDC" worked tirelessly around the clock to coordinate procurement and R&D. The results were remarkable: Renault built its first engineering prototype vehicle within nine weeks, with the project progressing from launch to production readiness in just 24 months, a year faster than the conventional European timeline.

Thirty Chinese suppliers contributed 46% of the procurement value for the Twingo, slashing R&D costs by half and mold costs by 40%. In November 2025, the Twingo electric vehicle will make its European debut with a starting price below €20,000, directly competing with BYD's Seagull.

De Meo's visit to Dongfeng Motor, an old friend, was aimed at deepening reliance on China. It is reported that Renault intends to develop new models for Dacia and Nissan through the eGT platform, with the next Dacia A-segment electric vehicle development cycle taking just 16 months.

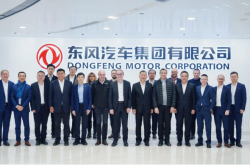

In fact, Dongfeng Motor boasts numerous French old friends. Six months earlier, another automotive behemoth, Stellantis Group CEO Carlos Tavares, led a team of over a dozen executives to Wuhan to inspect Dongfeng Motor and the Wuhan Economic Development Zone. This marked his inaugural visit to China since assuming office.

The accompanying team was a star-studded affair, including the CEOs of the Peugeot and Citroën brands, as well as the President of the China region. Tavares repeatedly underscored the intention to deepen cooperation with Dongfeng to drive industrial transformation and upgrading.

As is widely known, Stellantis' journey in China has been equally tumultuous. French models represented by Peugeot and Citroën gradually found it challenging to adapt, while the Italian brand Alfa Romeo remained a niche player, and the American brand Jeep terminated its cooperation with GAC Group...

After losing its foothold in the Chinese fuel vehicle market, Stellantis turned its attention to the burgeoning new energy vehicle sector. In March 2025, its joint venture with Dongfeng, Dongfeng Peugeot Citroën Automobile (DPCA), launched the new energy brand "HEDMOS Shijie," with the debut model Shijie 06 hitting the market, pioneering a reverse joint venture path.

Integrating Chinese three-electric technologies with French chassis tuning to create a "Chinese electric + French driving experience." It is evident that amidst the global electrification wave, Stellantis has soberly recognized that instead of chasing China's rapid electric vehicle development, it is better to integrate into it. Previously, it took a step by acquiring shares in Chinese automaker Leapmotor; now, it is turning to a closer partner, Dongfeng.

Shortly thereafter, in October 2025, news emerged that Stellantis plans to develop a new Jeep model within the next 18 months, featuring independent design but relying entirely on Dongfeng for the powertrain, cockpit, and autonomous driving technologies.

This vehicle may be based on Dongfeng's Voyah or Mengshi technology, produced in China, and debut as early as 2027, targeting the Chinese market with potential for export. Although both parties have refrained from commenting, the collaboration trajectory is clear. Dongfeng has previously produced some models for Stellantis, and now the technological flow is reversing, reflecting a shift in power dynamics.

It can be said that when French industrial giants like Renault and Stellantis are striving to pivot amidst the electrification wave, they coincidentally turn their gaze to their long-time Eastern partners: Dongfeng Motor.

This is a strategic choice rooted in harsh realities and future considerations. French automakers were once celebrated for their romantic designs and chassis tuning, but on the new track of electrification and intelligence, they face common dilemmas: high manufacturing costs in Europe, relatively sluggish software iteration speeds, and the pressure to catch up in battery and intelligent connected vehicle technologies.

Meanwhile, the Chinese market has not only nurtured the world's most mature and cost-effective electric vehicle supply chain but has also achieved rapid iteration and innovation leadership in "three-electric" technologies, intelligent cockpits, and digital ecosystems. Thus, we witness an intriguing role reversal. In the past, Chinese partners like Dongfeng were students and factories, learning technologies and undertaking manufacturing. Today, Dongfeng has evolved into a crucial enabler.

Their renewed pursuit of Dongfeng Motor is not merely about cost advantages in the supply chain and manufacturing efficiency but also about agility and possibilities in responding to industry upheavals. This marks a fundamental reshaping of the global automotive industry's power structure and innovation flow. China is no longer merely the world's largest sales market but has become a key hub driving technological innovation and model creation.

For French old friends, Dongfeng is no longer merely an option; it has become a critical path at the crossroads of industrial revolution. This path is not just about survival but also about rebirth.

Editor-in-Chief: Shi Ye Editor: Chen Xinnan

THE END