Investment in AI Glasses Is Picking Up Steam Once Again | An Industry Report for Everyone

![]() 01/19 2026

01/19 2026

![]() 475

475

I. Core Event: Meta Steps Up Production, Signaling Robust Industry Momentum

At the dawn of 2026, tech behemoth Meta, renowned for its audacious moves, teamed up with EssilorLuxottica, the globe's largest eyewear manufacturer, to unveil a capacity expansion initiative.

This move has once again thrust AI smart glasses into the spotlight of capital attention.

Since the inception of their collaboration, sales of the Ray-Ban Meta glasses have been on a steady upward trajectory, nearing the initial annual target of 10 million units by the end of 2026.

Consequently, the two firms plan to ramp up annual production capacity to 20 million units or more by the end of 2026, with the potential to escalate it further to over 30 million units if market demand remains buoyant.

In 2025, Meta secured roughly a 3% stake in EssilorLuxottica for $3.5 billion, with intentions to boost its ownership to 5% in the foreseeable future.

II. Market Landscape: Technology-Driven Growth + Entry of Major Players, High Potential Emerges

(I) Advancing Technology Maturity Lowers Adoption Barriers

AI smart glasses have transitioned from niche offerings to products with scalable adoption, thanks to continuous breakthroughs in pivotal technologies.

In the realm of AI algorithms, strides in natural language processing and computer vision have facilitated smoother interactions and more precise responses in smart glasses. Enhancements in battery life have alleviated concerns about range, while miniaturization and integration of components have enabled AI glasses to remain lightweight while packing in more features.

(II) Market Structure: Meta Leads with a Significant Edge, Competition Intensifies

The current global AI smart glasses market can be characterized as “one dominant player amidst multiple strong contenders.” Meta commands a leading position through its first-mover advantage and deep collaboration model.

According to Counterpoint, Meta captured a staggering 73% share of the global AI smart glasses market in the first half of 2025. Its Ray-Ban Meta series has emerged as the mainstream choice, leveraging brand influence, product experience, and channel reach.

However, as the market's potential unfolds, competition is heating up.

In May 2025, Google forged a smart glasses partnership with Kering SA’s eyewear division, tapping into Kering’s brand strength and design prowess in the luxury sector to target the high-end smart glasses market. Apple, after scaling back investment in its Vision Pro VR headset project, plans to redirect resources toward the AI glasses segment.

In the future, as more entrants join the fray, market competition will extend beyond product features and technological innovation to encompass brand marketing, ecosystem development, and other facets.

(III) Strong Growth Expectations Position AI Glasses as a New Blue Ocean in Consumer Electronics

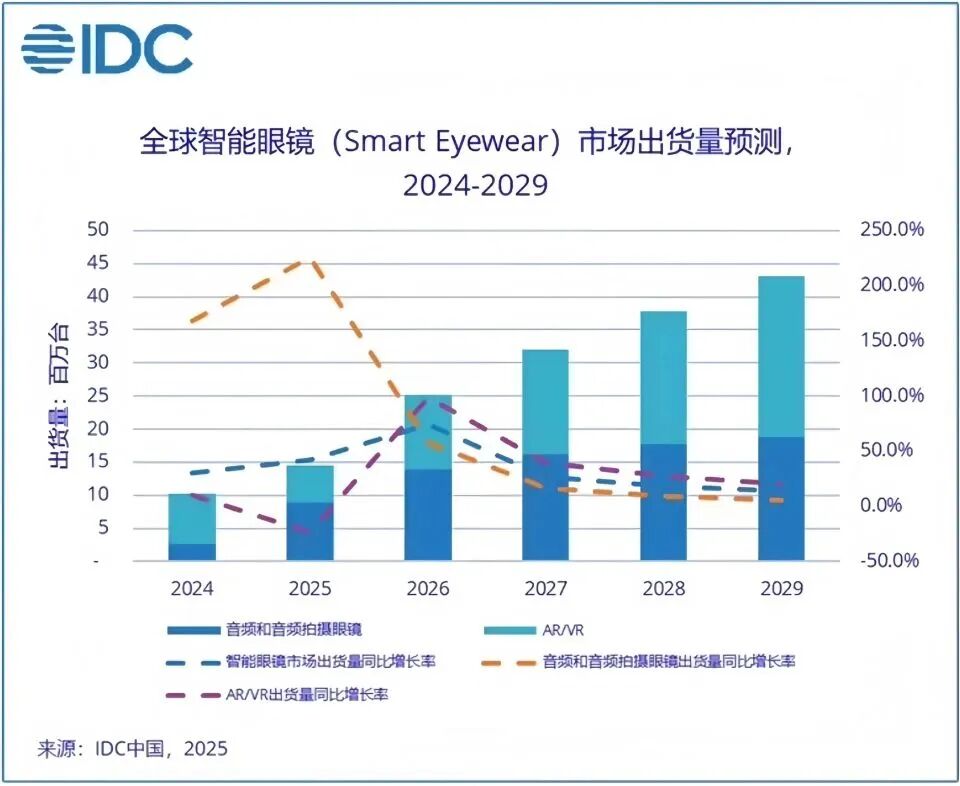

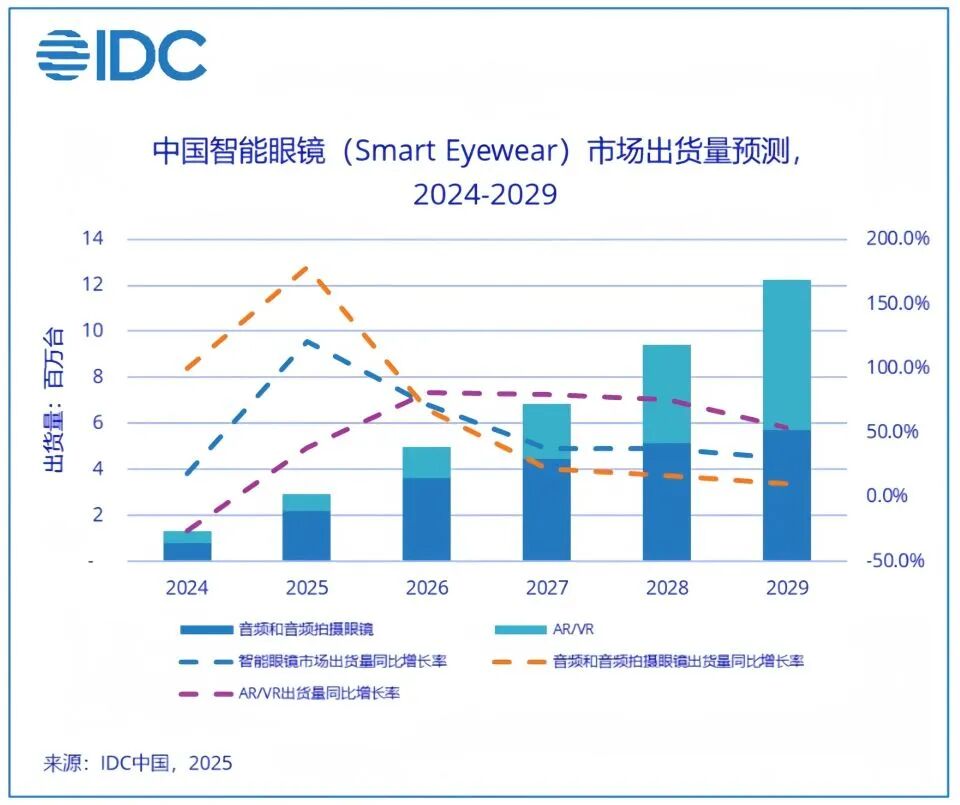

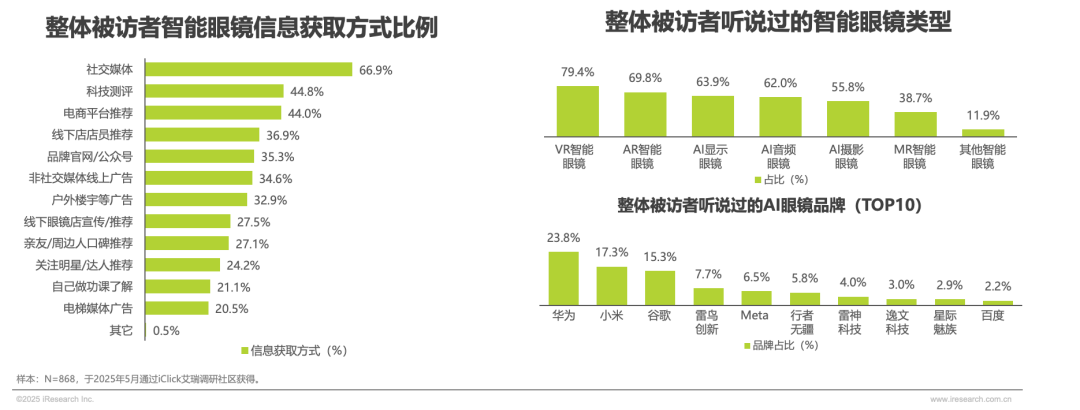

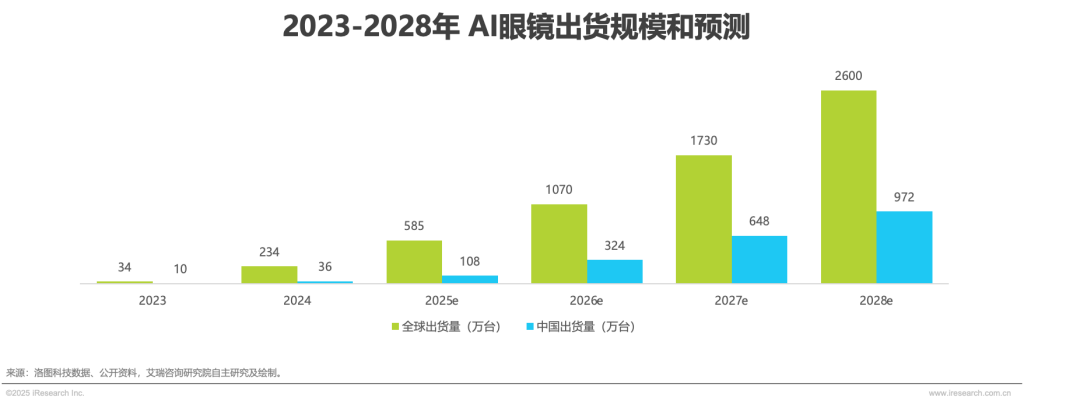

Driven by technological maturity, surging demand, and increased investment from major players, the AI smart glasses market is poised for explosive growth.

Authoritative research firms like Counterpoint forecast that the AI smart glasses category will achieve a compound annual growth rate (CAGR) of over 60% by 2029, emerging as one of the fastest-growing segments in consumer electronics.

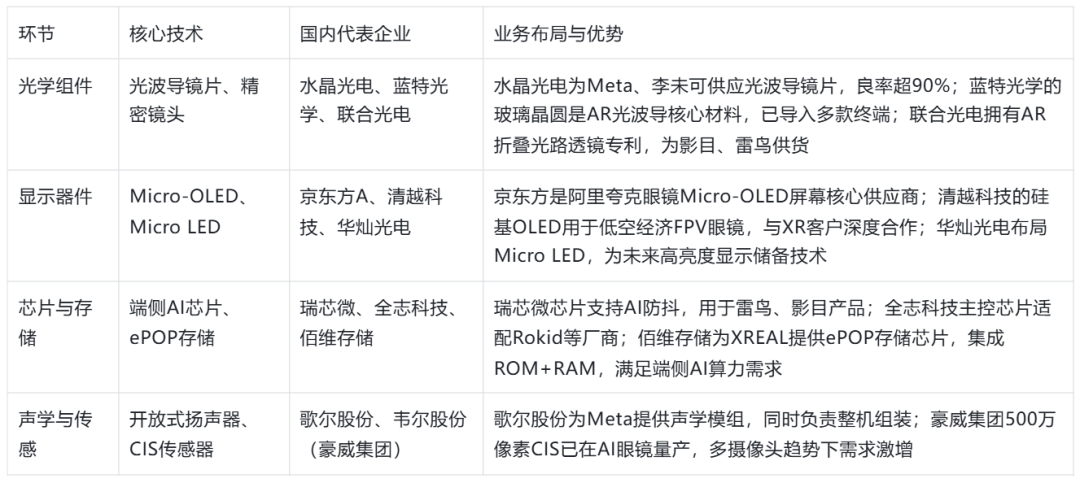

III. Supply Chain Analysis: Chinese Companies Dominate Key Links, Unlocking Growth Potential

The AI glasses supply chain encompasses three major segments: core components, device assembly, and software algorithms. Chinese companies, leveraging technological expertise and cost advantages, have secured dominant positions in several key areas. As global production capacity expands, supply chain enterprises are poised to capture significant growth opportunities.

(I) Core Components: Optics, Displays, and Chips as Critical Bottlenecks, Domestic Leaders Take the Lead

(II) Device Assembly and Manufacturing: Precision Manufacturing Capabilities as the Core, Leading Contract Manufacturers Secure Orders

The device assembly segment demands extreme precision and high production capacity. Domestic contract manufacturers, drawing on years of experience in consumer electronics manufacturing, have become core partners for global mainstream brands:

1. Goertek: The exclusive contract manufacturer for Meta’s Ray-Ban Meta glasses, responsible for supplying optical waveguide modules and device assembly. It also provides manufacturing services for domestic brands like INMO and Rokid, with smart glasses-related revenue accounting for over 15% of its total in 2025.

2. Lens Technology: The exclusive supplier of core structural components for Meta’s new glasses, it also achieved mass production and delivery of Alibaba’s Kuake glasses. With advantages in precision structural components and assembly processes, its order volume is expected to grow by over 80% in 2026.

3. Luxshare Precision: Leveraging its expertise in magnetic charging and miniature camera modules, it has become a potential contract manufacturer for Meta. It also provides manufacturing services for Huawei and Xiaomi’s ecosystem products, positioning itself to secure more high-profile orders.

4. Longcheer Technology and Wingtech Technology: Longcheer Technology is undertaking R&D projects for leading domestic clients, with mass production scheduled for 2026. Wingtech Technology participates in the manufacturing of the StarV series for Starry Mercury, relying on its ODM model to rapidly respond to customer needs.

(III) Software and Algorithms: AI Empowerment as the Key to Differentiation, Technology Providers Bind to Ecosystems

Software and algorithms are the core determinants of an AI glasses’ “intelligence.” Domestic companies have forged competitiveness in areas such as “operating systems + visual AI + large model adaptation.”

1. Thundersoft: Provides a full-stack solution for AI glasses, ranging from low-level system optimization to upper-level AI applications. It supports brands like Meta and Thunderbird, with its intelligent operating system enhancing device battery life and response speed.

2. ArcSoft: Offers visual AI algorithms covering scene recognition, gesture control, and image optimization. By the first half of 2025, it had signed contracts with multiple AI glasses brands, with an algorithm implementation rate exceeding 80%.

3. Alibaba and Baidu: Empower hardware through large models. Alibaba’s Kuake glasses integrate the Qianwen large model, while Baidu’s Xiaodu AI glasses connect to Wenxin Yiyan, enabling a complete closed loop of “voice interaction - content generation - service integration” and strengthening ecosystem stickiness.

IV. Investment Logic: Hardware as the Carrier of AI Strategy, Long-Term Value Promising

(I) An Inevitable Choice for Major Players’ Strategic Transformation

Take Meta as an example. Its investment in AI smart glasses is not merely an expansion of its hardware business but a step in its broader strategic transformation.

In recent years, Meta has sought to implement its AI strategy through hardware products, creating a new ecosystem entry point independent of smartphones.

As is widely recognized, tech companies are highly reliant on smartphone platforms. AI smart glasses, as the wearable device with (theoretically) the strongest interactivity and broadest scene coverage, are poised to become the next core terminal.

For EssilorLuxottica, as the world’s largest traditional eyewear manufacturer, its collaboration with Meta enables strategic transformation and business expansion.

(II) Market Demand Transitioning from “Novelty” to “Necessity”

The demand for AI smart glasses is evolving from a phase of “tech enthusiasts trying them out” to a period where they become a “must-have for ordinary consumers,” albeit gradually.

Early smart glasses faced challenges due to immature technology, limited functionality, and high prices, appealing only to tech enthusiasts. However, with technological advancements and cost reductions, AI smart glasses now offer intelligent interaction, health monitoring, navigation, real-time translation, and more, with prices gradually declining to levels acceptable to ordinary consumers. For instance, the Ray-Ban Meta series is priced at $459, offering good value for money.

(III) Industry Challenges and Opportunities Coexist, with a Clear Long-Term Growth Logic

From a profitability perspective, RBC Capital Markets analysts note that the gross margin of Ray-Ban Meta smart glasses is expected to be significantly lower than that of EssilorLuxottica’s traditional eyewear products due to high component costs, substantial R&D investment, and the absence of economies of scale.

From a production capacity standpoint, increasing output requires balancing market demand with production costs and supply chain alignment to avoid resource waste and overcapacity caused by excessive expansion.

V. Conclusion: AI Glasses Emerge as the Next Investment Hotspot, Unlocking Sustained Industrial Value

Meta and EssilorLuxottica’s capacity expansion signals a clear acceleration in the AI smart glasses industry.

Currently, the convergence of technological maturity, surging demand, and major player entry positions AI smart glasses as one of the most promising investment sectors in consumer electronics.

In the short term, capacity expansion will directly drive demand growth across the supply chain, benefiting core component suppliers (such as AI chips, sensors, and batteries), as well as manufacturing and distribution sectors, from the expansion of industry scale.

In the medium term, with continued investment from tech giants like Google and Apple, product innovation will accelerate, application scenarios will diversify, and market penetration will steadily increase.

In the long term, AI smart glasses are expected to gradually replace some smartphone functions, becoming new entry points for the mobile internet and fostering a complete ecosystem encompassing hardware, software, content, and services, creating immense industrial value and investment opportunities.

For investors, the current period represents a critical window to enter the AI smart glasses sector. Priority should be given to high-quality companies in core supply chain links, including core component suppliers, technology solution providers, and terminal manufacturers with strong branding and channel advantages.

END