The Entry of Major Players into the Comic-Drama Industry Reaches a Critical Juncture: Who Will Prevail?

![]() 01/19 2026

01/19 2026

![]() 537

537

PRODUCED BY | Yiguan Finance

WRITTEN BY | Yecha Baixue

The year 2025 marks a pivotal era for comic-dramas. From their humble beginnings as niche content, they have soared to over 75.7 billion cumulative annual views, with top productions exceeding 1 billion views. This surge underscores their undeniable presence and traffic value within the short video content ecosystem. This year witnessed not only rapid growth in views and content output but also a clearer industry chain structure and the emergence of corporate and systematic approaches.

Standing at the dawn of 2026, comic-dramas have evolved beyond a high-volume sector into a multi-layered, multi-dimensional content ecosystem. Balancing short-term traffic gains, mid-term efficiency improvements, and long-term IP potential will determine who can sustainably accumulate value in this dynamic field.

01

Why Have Comic-Dramas Gained Popularity?

Comic-dramas represent a novel content form that "short-dramatizes and video-izes" comic material. Utilizing comic panels or storyboards as a foundation, they employ AI and lightweight animation technologies to animate scenes, combined with continuous storytelling to craft short video content lasting a few minutes per episode, with regular updates. Compared to live-action short dramas and traditional animations, comic-dramas offer shorter, faster, and more platform-friendly content for frequent consumption on platforms like Douyin, Kuaishou, and Bilibili.

For a more intuitive definition, comic-dramas can be likened to "short dramas encased in an animation shell." In terms of content structure, they inherit the intensity and pacing control of short dramas; in terms of production, they heavily rely on comic assets and AI tools. This synergy precisely addresses several key sensitivities of current content platforms: cost, efficiency, and scalability.

Over the past year, comic-dramas have swiftly transitioned from a niche endeavor to the mainstream, becoming one of the fastest-growing categories in short video content supply. This shift is not because users suddenly "prefer animations more," but because platforms, creators, and toolchains have simultaneously reached a new equilibrium.

The defining characteristics of comic-dramas can be encapsulated in three words: fast, low-cost, and intense.

"Fast" is evident in both production and updates. A significant portion of the process is automated by AI, from storyboard generation, character consistency, scene transitions, to voiceover synthesis, all of which can be processed modularly. The timeline from project initiation to launch can be compressed to a few days or a week, with update frequencies far surpassing traditional animations.

"Low-cost" refers to the transformed cost structure. The cost of a single production is merely a fraction of that of live-action short dramas or heavy animations, enabling creators and platforms to experiment with more content models at minimal trial-and-error costs.

"Intense" pertains to content strategy. Genres such as system-based, fantasy, post-apocalyptic, and comedic reversals frequently emerge, with extremely fast-paced storytelling that filters users within the first few episodes. This "low-cost + fast update" model encourages creators to frequently test and iterate, providing platforms with a stable and scalable content supply.

Behind this trend lie three core driving forces, each with specific companies and practical cases:

First is the maturity of AI technology. Previously, converting comics into animated short dramas was a lengthy and costly process, but AI tools have significantly lowered the barrier. Extensive use of AI for storyboard generation, character animation, and voiceover synthesis has compressed the timeline from weeks or even months to just a few days or a week per drama. This efficiency allows small teams to quickly test genres, reduce trial-and-error costs, and maintain high-frequency updates, forming a continuous supply capability.

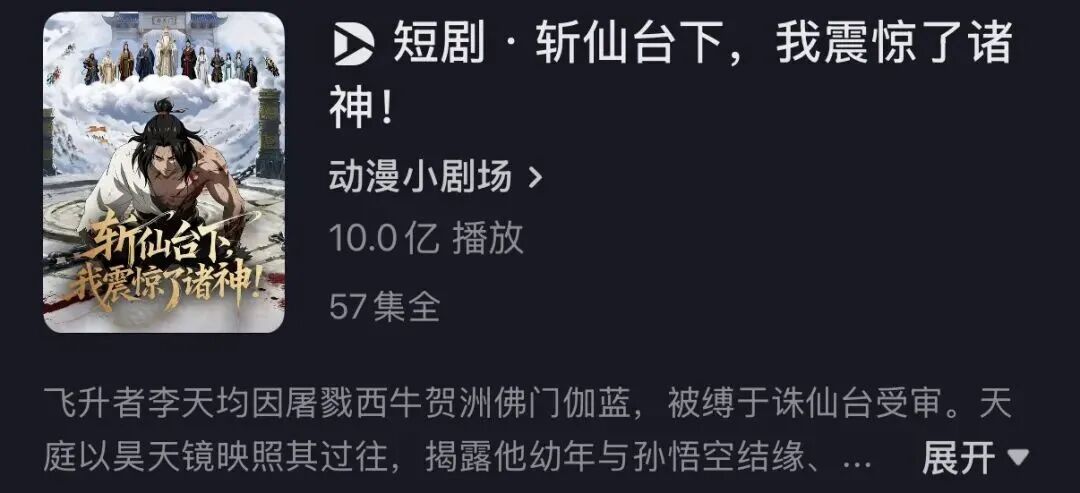

Second is the robust support from streaming platforms. Platforms like Douyin, Kuaishou, and Bilibili offer a vast user base, mature recommendation algorithms, and creator subsidies, enabling rapid high exposure and cash recovery for works. For instance, "Beneath the Immortal-Slaying Stage, I Shocked the Deities" reached 1 billion views on Douyin within a few weeks of its launch, while comic-dramas on Kuaishou achieved over 10 million views on their first day through algorithmic recommendations and promotional support.

Third is the synergy between IP and creators. IP holders like China Literature and ChineseAll open up their copyright resources, allowing top creators to swiftly adapt popular comics and novels into comic-dramas, while also enabling secondary creations or derivative content production. This combination not only accelerates content supply but also diversifies comic-drama genres—ranging from fantasy, martial arts, and post-apocalyptic to comedic, female-oriented, and fan-created works—quickly meeting young users' demand for high-intensity thrills and fast-paced short videos.

In summary, the combination of AI-driven efficiency, streaming platforms providing exposure and monetization opportunities, and the rich content supply formed by IP + creators has enabled comic-dramas to rapidly transition from niche beginnings to the mainstream within just a year, becoming one of the fastest-growing sectors in the short video content ecosystem.

02

The Comic-Drama Boom Reaches a Critical Juncture

If comic-dramas were previously considered a "potential stock" in the content sector, by 2025, they have proven their scale with data.

The cumulative annual play count for comic-dramas exceeds 75.7 billion. Leading companies have begun to show significant scale effects: ManTan Animation and JiangYou Animation surpassed 2.8 billion and 2.2 billion views respectively in a single year; individual productions like "Beneath the Immortal-Slaying Stage, I Shocked the Deities" even exceeded 1 billion views. These figures indicate that comic-dramas are no longer "marginal content" but have truly entered the mainstream traffic pool.

The commercial landscape has also undergone dramatic changes. In the first half of 2025, the daily spending on comic-drama promotions just exceeded 4 million, but the corresponding growth reached 568%; by October, daily spending surged past 10 million, and by December, it exceeded 20 million. Few expected this sector to reach such spending and scale within a year at the beginning of the year.

From a platform perspective, this is a very clear signal: comic-dramas have been validated as a content form capable of supporting substantial commercial budgets, rather than just experimental content surviving on organic traffic.

Notably, in the second half of 2025, the comic-drama sector began to show significant differentiation.

In November, Douyin established a short drama copyright center and simultaneously raised its review standards. The number of comic-drama launches dropped sharply from a peak of 14,726 in October to 6,829 in November. However, overall play counts did not decline; instead, new play counts for the month reached 15.419 billion, with newly launched works contributing 5.682 billion, averaging 3–5 times the play increment of ordinary works.

From an annual perspective, over 30,000 comic-dramas were launched on Douyin, but only 15.7% reached million-level play counts. This means most content was quickly eliminated by the market. Platform attitudes are also becoming clearer: they no longer encourage simple volume stacking but are beginning to screen for content that can truly last.

This indicates that the turning point for comic-dramas has arrived, shifting from "quantity competition" to "quality competition," moving from an early phase of "volume for traffic" to a stage of competition centered on high-quality and differentiated content.

03

Who Will Prevail?

From an industry chain perspective, participants can be mainly divided into three categories: producers, copyright holders, and platforms. Producers are responsible for content production, including storyboard design, character animation, and voiceover synthesis; copyright holders provide IP licenses, determining which works can be adapted; platforms handle work distribution, operations, and commercial monetization.

In terms of commercial revenue-sharing mechanisms, producers typically earn through production fees and a small portion of later-stage revenue, while copyright holders and platforms share major revenue streams such as recharge flows and advertising income. The profit-sharing ratio is usually determined by negotiation, with copyright holders generally taking a larger share due to their investment in production and primary risks. To diversify risks, many copyright holders choose to license the same IP to multiple platforms, creating a unique "multi-platform coexistence" model in the comic-drama sector.

In terms of industry structure, leading participants have begun to take shape. Among producers, companies like JiangYou Animation and ManTan Animation lead with high production capacity and mature processes; among copyright holders, China Literature and ChineseAll dominate with popular IPs and adaptation advantages; platforms are represented by Douyin, Kuaishou, and Bilibili, which leverage vast user bases and mature algorithms for rapid work exposure and commercial monetization. From a market investment perspective, the beneficiaries of the 2026 industry chain will still mainly concentrate among these leading companies and platforms, but the benefit models vary across different segments.

I. Short-Term Dividends: Traffic Explosion

In the short term, nearly all dividends are concentrated on the traffic side. Streaming platforms, with their vast user bases, mature recommendation algorithms, and creator subsidies, enable rapid high exposure and cash recovery for comic-drama works. Short-term hits can generate significant revenue, even allowing some small teams to earn their first profits within weeks.

However, it is crucial to note that the lifecycle of short-term hits is limited. Severe content homogenization means high play counts do not necessarily translate to long-term value accumulation. Many works only maintain popularity for a few weeks to a month before being replaced by new hits.

Therefore, short-term dividends resemble a "traffic feast" where anyone on stage can quickly enjoy the traffic cake, but this cake will not last forever. The true survivors will be those with long-term content, production, and IP strategies.

II. Mid-Term Dividends: Efficiency-Driven

Mid-term dividends are primarily reflected in production efficiency. AI tools and industrialized processes reduce costs, shorten cycles, and enhance content supply capabilities, indirectly improving work dissemination stability. Efficiency gains not only help streaming platforms maintain active information flows but also allow IP platforms to test content potential or verify adaptations using comic-dramas.

For example, a traditional animation adaptation of a comic might take several months or even half a year, but with comic-drama formats and AI processes, a new episode can be launched within one to two weeks. This speed allows platforms to quickly test genres and creators to identify audience preferences faster.

Recently, Kuaishou launched a one-stop AI comic-drama production and monetization platform—"Comic-Drama Expert." Leveraging AIGC technology, it provides end-to-end capabilities covering script generation, character design, scene rendering, and special effects, completely reconstructing the creative path from text to visuals. According to Kuaishou, the platform can "automatically generate storyboards from a single sentence describing inspiration or directly uploading a script."

The mid-term dividends brought by efficiency are also reflected in the sustainability of traffic and revenue: frequent updates and high volumes enable platforms and creators to maintain long-term user engagement rather than disappearing after a one-time burst.

III. Long-Term Dividends: IP and Potential Value

In the long run, the value accumulation of comic-dramas depends not only on play counts but also on the cross-media development capabilities and market recognition of IPs. Different platforms and participants have distinct understandings and capture methods for value.

IP platforms hold source IPs and adaptation rights, enabling multi-path development and derivative monetization by extending successful short video content into animations, games, merchandise, and more for deeper revenue streams. Streaming platforms, with their vast traffic and ecological connections, may also achieve long-term benefits through advertising revenue sharing, membership fees, and data operations.

Overall, the development of comic-dramas is a multi-faceted game. Short-term traffic dividends, mid-term efficiency gains, and long-term IP potential each play their roles, with streaming platforms, IP platforms, and creators all having opportunities to capture value at different levels. Who can accumulate more sustainable revenue in the future depends on how markets, technologies, and business models align.

For major players, entering the comic-drama sector is a strategic necessity. For example, China Literature leverages its deep IP library and vast online literature ecosystem to provide rich original works for comic-dramas, successfully adapting some IPs into comic-drama works with over 10 million views, significantly reducing promotion costs and compressing production cycles to around 10–13 days. Kuaishou, at the platform level, attempts to convert traffic into broader commercial monetization capabilities through its Kling AI platform and a "comic-drama + live streaming + e-commerce" linkage path.

Hou Xiaonan, CEO of China Literature, stated, "Short dramas and comic-dramas are becoming important engines for IP visualization, not only enhancing the efficiency of converting text to visuals but also bringing new growth poles to the platform."

However, it must be emphasized that popularity and value do not always occur simultaneously.

In truth, even though comic-dramas frequently go viral and keep shattering play count records, for the majority of listed companies, the revenue derived from comic-dramas still remains relatively small in scale. It functions more as a form of content enrichment or a potential strategic move (a way of positioning themselves in the market) rather than representing a clearly established new avenue for growth.

Put simply, comic-dramas have demonstrated their ability to "soar to popularity," yet they haven't comprehensively shown that they can "generate sustained, long-term profits." Whether they will evolve into the next genuine engine for content growth or simply remain a passing fad still hinges on further confirmation from the passage of time, the viability of business models, and the returns on capital investment.

As we stand at the dawn of 2026, the pertinent question is no longer "Should we venture into comic-dramas?" but rather "Who can transform comic-dramas into a viable, long-lasting business?" Once the initial hype fades and online traffic levels out to a more rational state, the ultimate victors may not be those with the highest number of viral hits. Instead, they could be the ones who truly achieve seamless integration in terms of operational efficiency, intellectual property management, and business structure.

The market will ultimately reveal the answer.